Amidst all the election news, the Federal Reserve’s (Fed) November meeting almost went under the radar. The good news is that the Fed didn’t give us any surprises. As widely expected, they cut the federal funds rate by another 0.25%-points, taking it down to the 4.5-4.75% range. Fed Chair Powell pointed out that this is simply ongoing recalibration of interest rate policy – policy is still restrictive even as inflation continues to move to their target of 2%. The labor market has cooled off quite a bit, but they don’t want to see any more softening. They believe the employment situation is solid and want to keep it that way. All of which is very positive.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

At the same time, they’re in no hurry to “normalize” policy. They’re going to take a gradual approach as more data comes in, i.e. no big moves like the 0.50%-point cut in September. Economic growth is solid, as recent data has highlighted. Quoting Powell:

If you look at the U.S. economy, its performance has been very good. And that’s what we hear from businesspeople, and expectation that that will continue. If anything, people feel next year—I’ve heard this from several people—that next year could even be stronger than this year.

This is a telling outlook and worth unpacking as we look toward 2025. Real GDP growth has clocked in at an annualized pace of 2.9% over the last two years (through Q3). That’s above the 2017-2019 pace of 2.8%. There’re questions about whether the Fed should even be easing under this scenario, but as Skanda Amarnath pointed out when Ryan and I spoke to him on our recent Facts vs Feelings podcast episode, the Fed does not have a GDP target. They have an inflation target and maximum employment mandate.

Note that Powell was quick to add that they haven’t accounted for any impact of the new administration’s proposed policies. We’re not quite sure what policies will actually be passed, and to what extent. It’s going to take some time for things to come into focus, and even more time for it all to play out. Given that uncertainty, I thought it would be useful to do a SWOT analysis for the US economy in 2025, i.e. considering its strength, weaknesses, opportunities, and threats. In this piece, I’ll cover strengths and weaknesses. I’ll save the discussion of potential opportunities and threats in part 2 of this blog.

Strengths

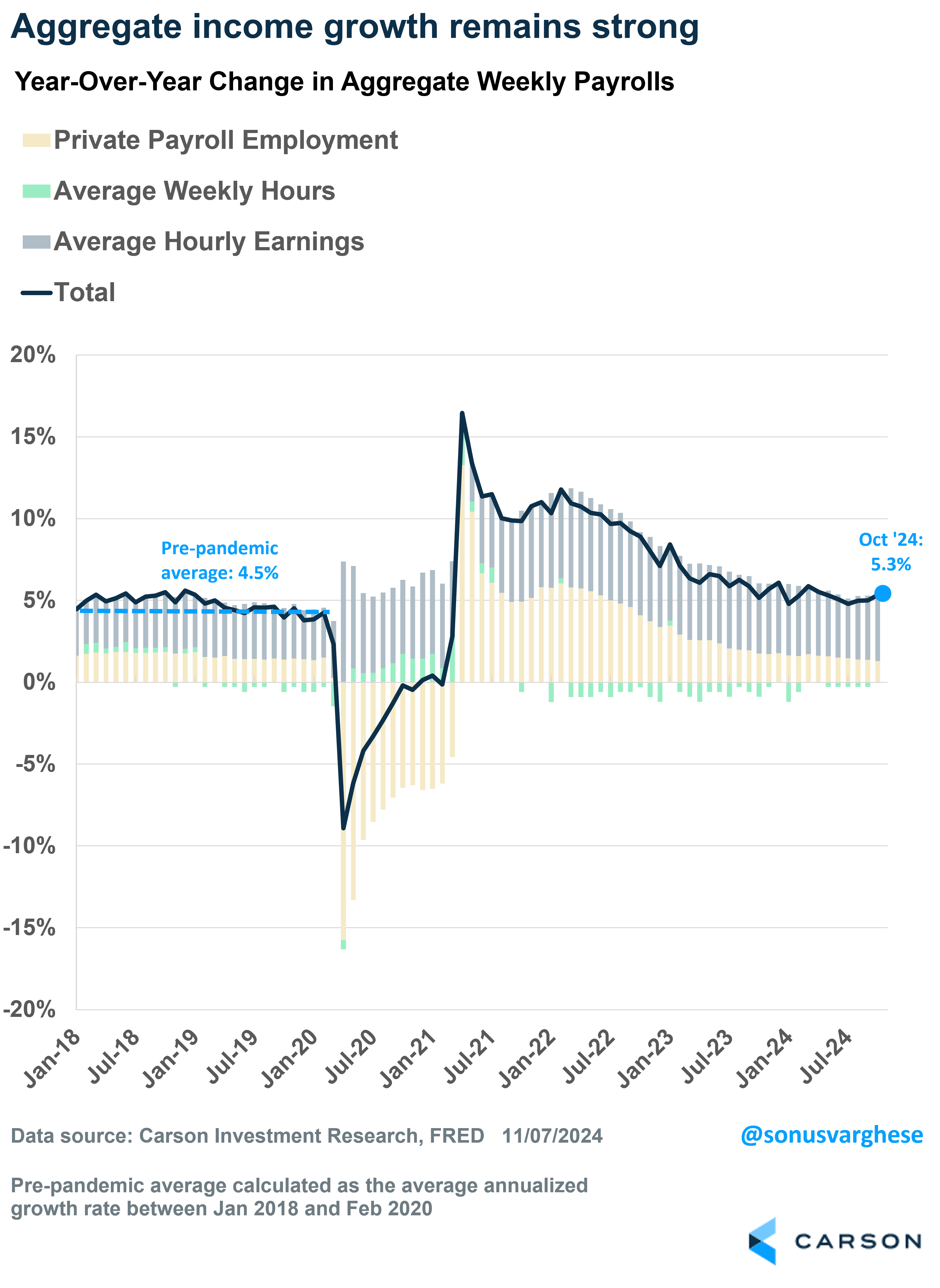

To start with, it’s useful to recall that consumption accounts for just under 70% of the economy. Consumption has been driven by income growth this cycle, and right now aggregate income growth (across all workers in the economy) is running at a 5.3% year-over-year pace. That’s above the strong pre-pandemic pace of 4.5%. There’s no reason to expect this to pull back significantly, but we may see a shift in dynamics. Aggregate income growth is the sum of employment growth, wage growth, and change in hours worked. Going forward, aggregate income growth is more likely to be powered by strong wage growth, even as employment growth slows to a 150,000-175,000 average monthly pace.

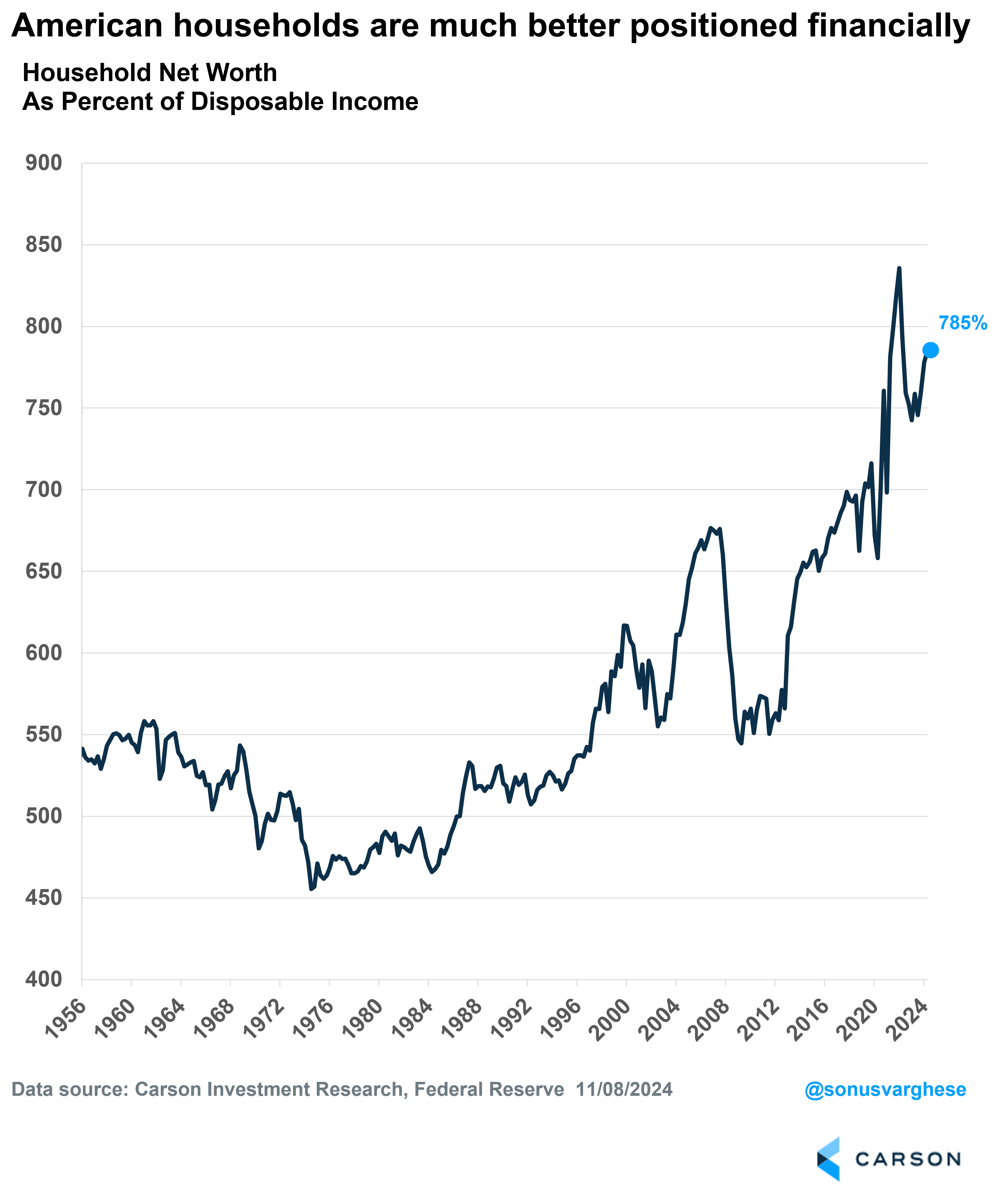

Household balance sheets are also in really good shape. Household net worth is 785% of disposable income, close to all-time records. Mostly thanks to rising home prices and stock prices. Even if income growth pulls back further, strong balance sheets give households room to maintain consumption (by reducing the amount they save each month).

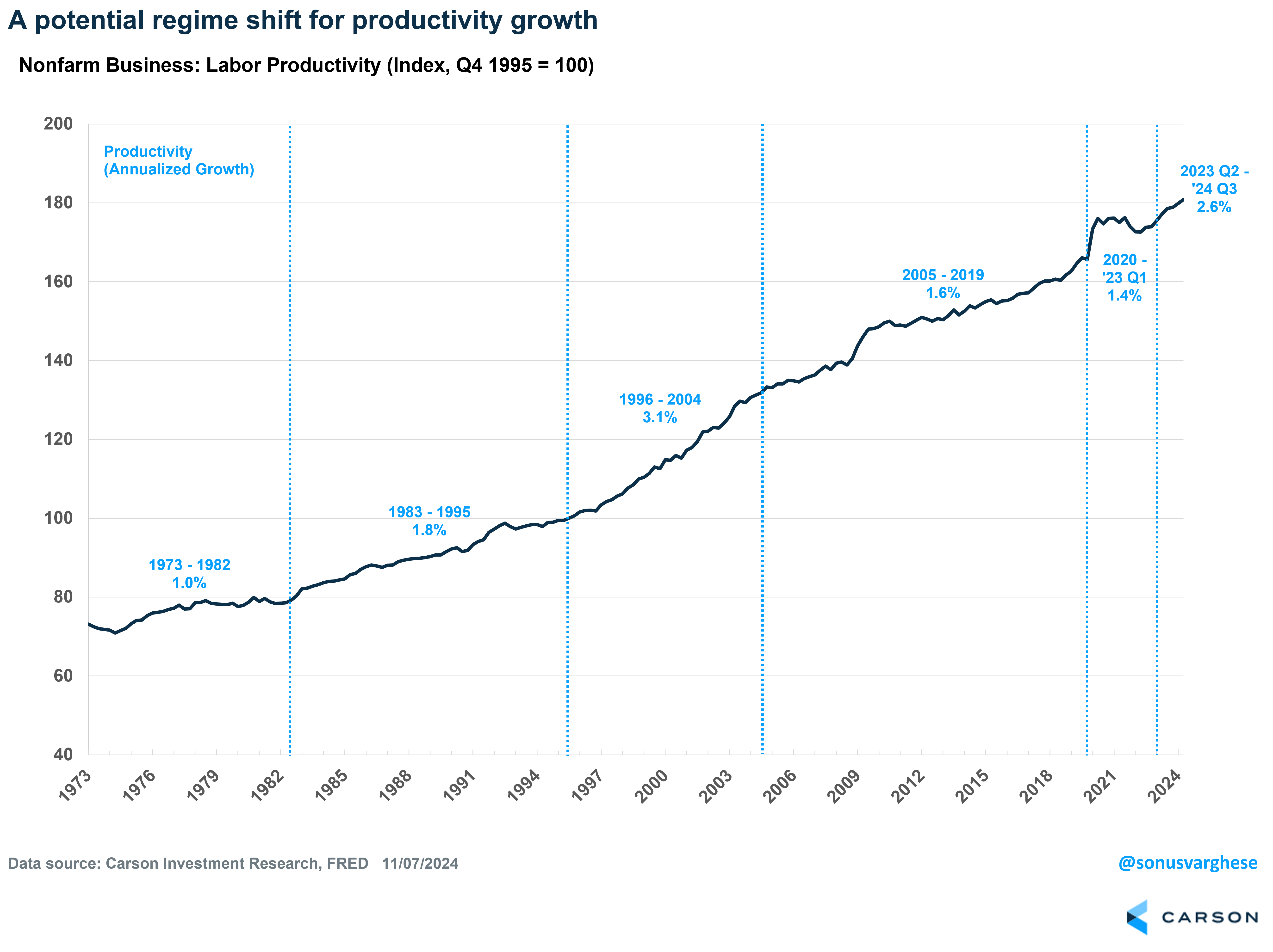

Productivity growth is also running strong – over the last six quarters, productivity growth has clocked in at a 2.6% annualized pace. That’s well above the 1.6% annual pace we saw between 2005 and 2019. This productivity boost is something we talked about a year ago, including in our 2024 outlook. As we discussed back then, a key factor here is a strong labor market. Workers who were hired back in 2021 and 2022 have gotten a lot more productive as they got trained and stay in their jobs (with relatively higher pay). Entrepreneurship is another likely factor boosting productivity, with new business formations running well ahead of what we saw in the last decade. New business creation also provides employees opportunities to switch jobs for higher pay. The good news is that strong productivity gains allow wage growth to remain strong, without creating inflationary pressures – this dynamic has been playing out over the past year and half and we expect it to continue into 2025.

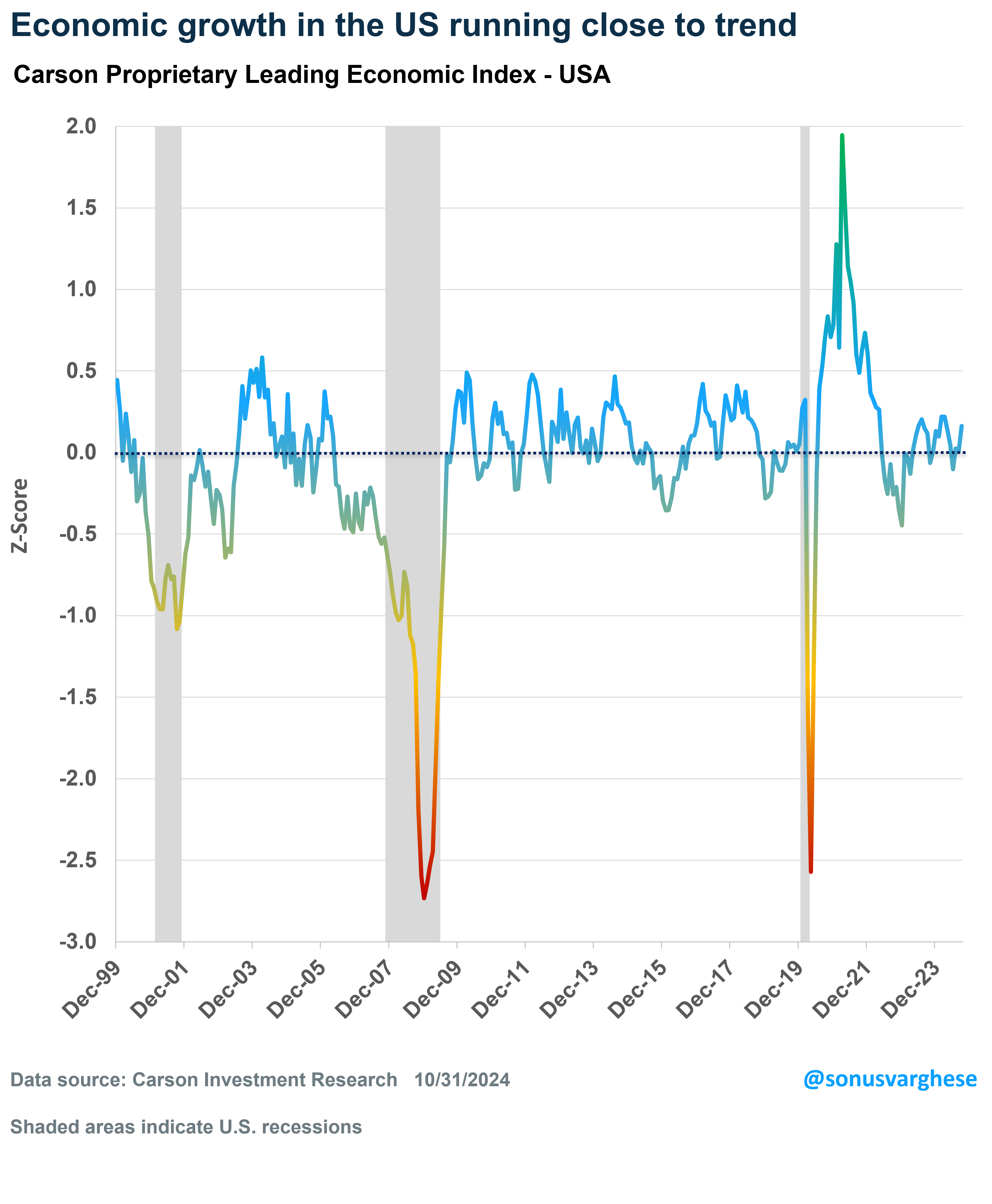

The main risk to this productivity boom is a recession, which can really harm the labor market. However, we don’t think that’s on the cards for 2025. Our own proprietary leading economic indicator has consistently said that the US economy is not close to a recession for over two years now (including in 2022 and 2023, when everyone was calling for one). It continues to tell us that the US economy is growing on trend, or slightly above it. Moreover, the Fed has pointed out that they don’t want the employment situation to soften any further. That’s crucial support.

Weaknesses

Interest rates have risen sharply since the Fed meeting in September, despite rate cuts. The 10-year treasury yield jumped from 3.64% on September 17th (the day prior to the Fed’s September meeting) to 4.33% as of November 7th. We did see a big jump on the day after the election, but yields pulled back the following day. These are big moves, but for the most part it reflects lower recession fears thanks to strong economic data in recent weeks.

Normally I’d put higher interest rates as a “Threat” but it’s already hurting and causing weakness in certain sectors of the economy. For one thing, higher interest rates can adversely impact investment spending that is dependent on borrowing, and we’re already seeing signs of that. Business equipment spending has picked up over the last two quarters, coinciding with a big drop in interest rates. However, with rates reverting higher now, there’s some risk that equipment investment flatlines (as it did in 2023). Investment in structures has boomed over the last couple of years, but this has been driven by the CHIPS Act and IRA (Inflation Reduction Act) crowding in investments in manufacturing structures, specifically high-tech manufacturing. However, investment in structures outside of manufacturing has been weak. This is unlikely to rebound unless interest rates ease.

High interest rates also hinder consumers from tapping into credit, such as auto loans or even home equity that’s built up over the last few years. Overall consumer credit growth is running at just over 2% year-over-year, well below the 4.5-5% pace we saw back in 2019.

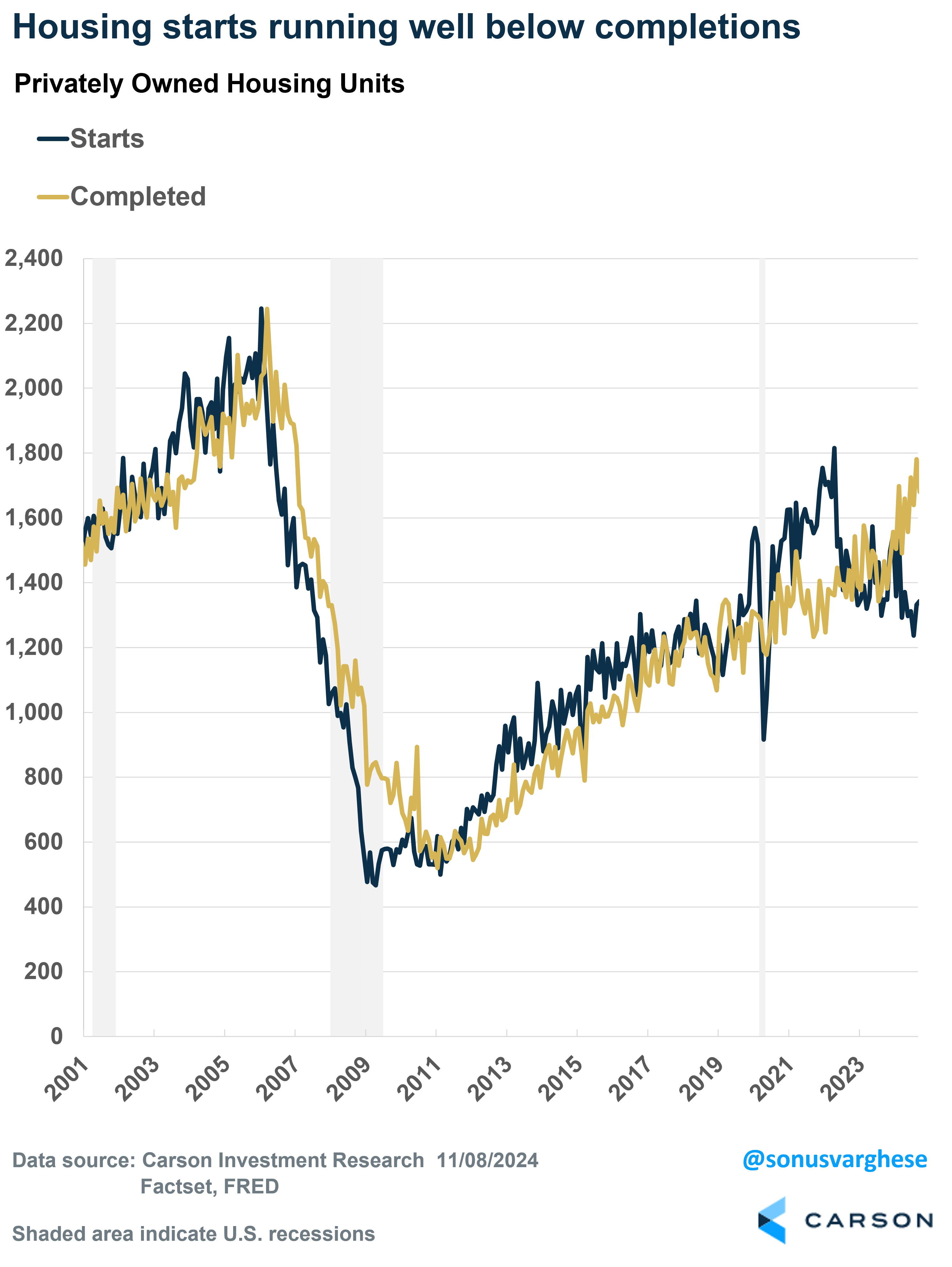

The weakest area of the economy is housing, which is a critical cyclical sector of the economy. And no surprise, it’s highly dependent on interest rates. 30-year mortgage rates closely track 10-year treasury yields, and they’re back over 7% now. That’s not conducive for housing activity. Both single-family and multi-family segments are getting hit. Completions are running 25% above starts, which indicates that builders are not confident about the outlook and are more focused on just completing homes already in the pipeline. Instead of starting new ones.

Housing by itself may not be pull the economy into a recession, but it’s a drag. Residential investment has already dragged from GDP growth for two quarters in a row. This is likely to continue into the beginning of 2025, unless mortgage rates pull back. Construction employment has been running solid until now, but if housing remains weak, we could see that start to pull back as well. Historically, construction employment has foreshadowed further weakness across the labor market. This is something we’re going to be watching very carefully over the next few months.

Overall, I think it’s fair to say the strengths currently outweigh the weaknesses, especially because the latter are isolated in smaller areas of the economy. Still, it’s something to be aware of as we move into next year. In my next piece, I’ll discuss potential opportunities and threats for the 2025 macroeconomic outlook.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02500514-1124-A