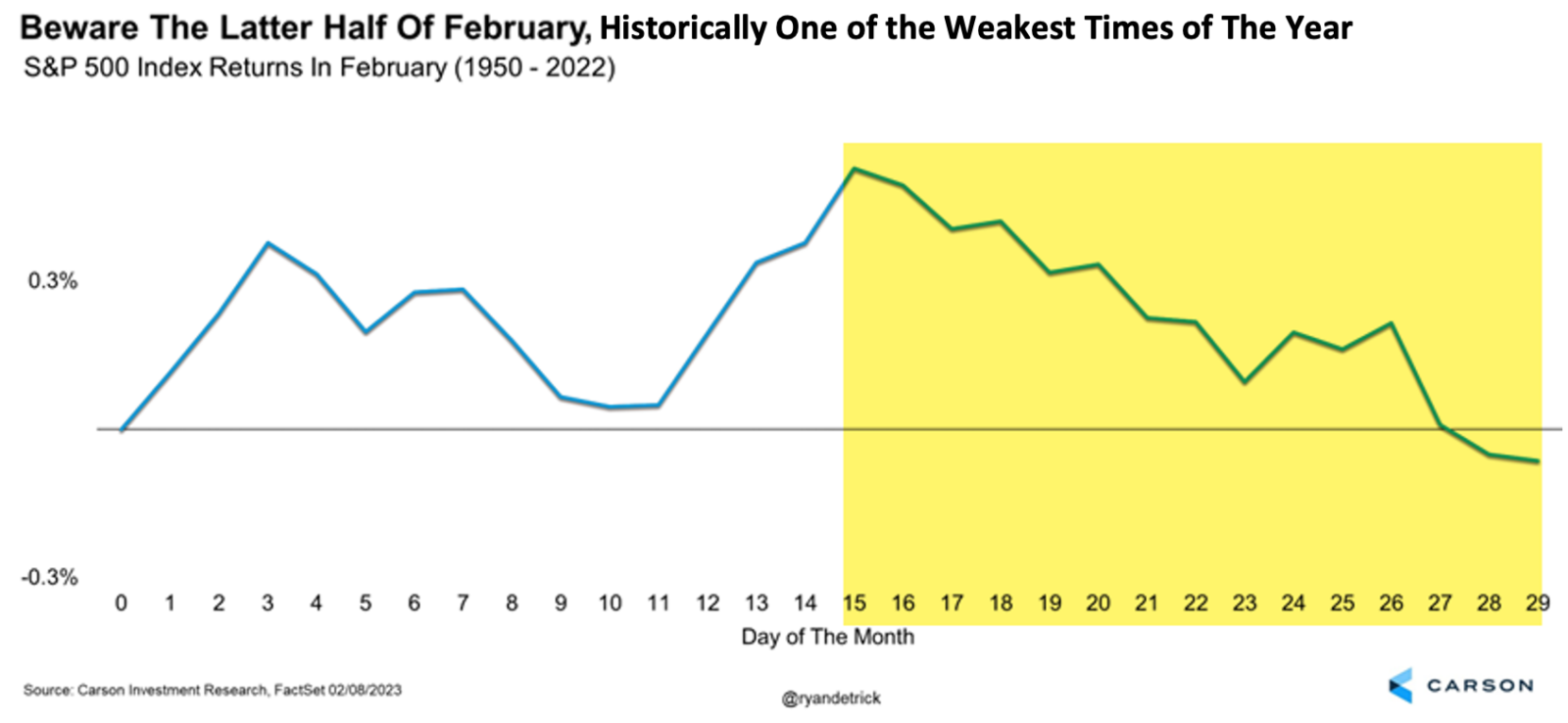

After the 11th best start to a year ever for the S&P 500 as of Valentine’s Day, stocks have pulled back the second part of the month in what we would classify as perfectly normal price action. Here’s a chart we started sharing at the beginning of the month and sure enough, the later part of February was trouble once again.

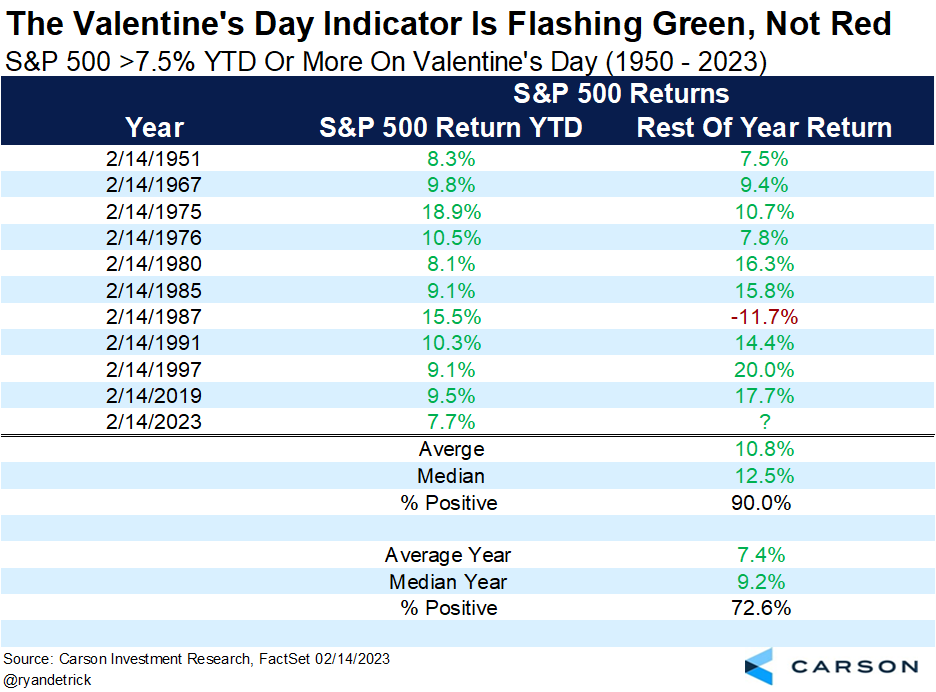

Speaking of Valentine’s Day, as we shared two weeks ago, historically strong starts to a year for stocks as of the day of love tend to resolve higher by year-end. That doesn’t mean it’ll be a straight line up, of course, but this puts the recent weakness in perspective for investors who are deciding whether this could be the right opportunity to add to positions.

It is what it is; the best three months of the year for stocks have historically been November, December, and January. Which means February tends to be the hangover month. Think about it; too much fun means you likely will have to pay for it. I’m 44, and I still remember my 40th birthday…And the tequila… I blamed my friends, but my wife reminded me that I’m old enough to make my own decisions. Let’s just say that my productivity for about a week after that really fun night was quite low. Action, meet my friend, consequence.

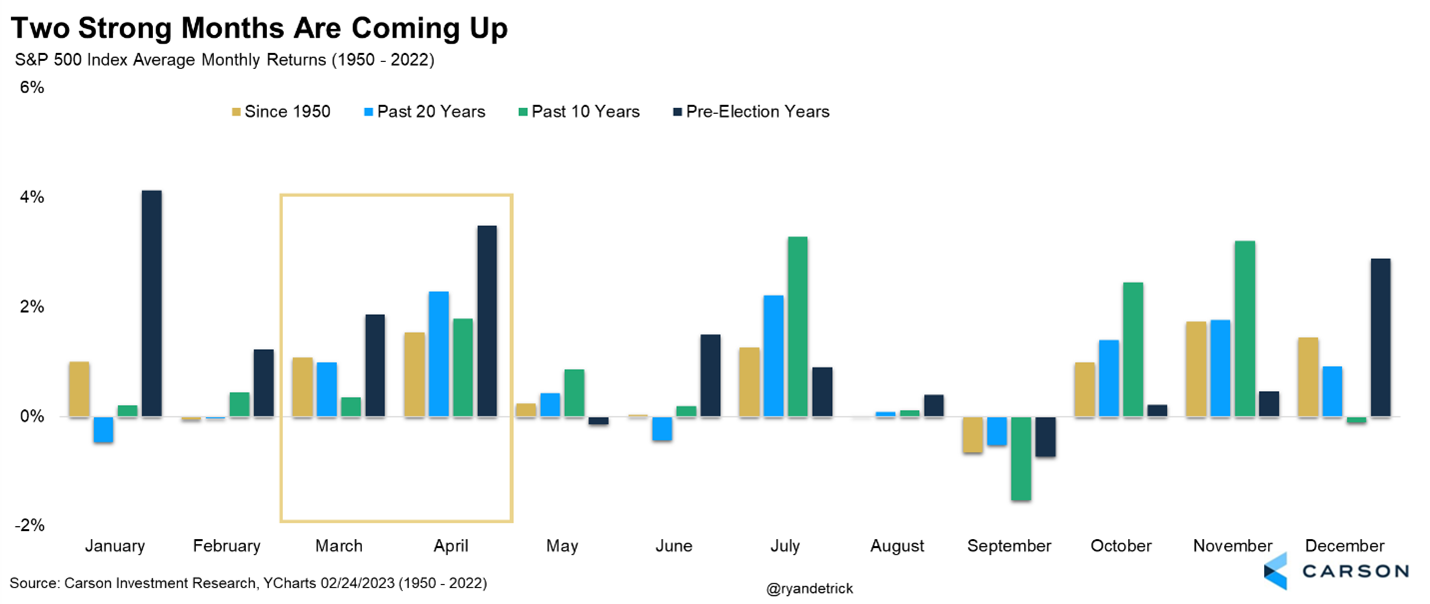

After the nearly 17% rally off the October lows into mid-February, some type of hangover or indigestion made sense. The good news is that we don’t expect this weakness to last much longer. March and April are historically two of the strongest months of the year, but they have done even better in pre-election years. Since 1950, the S&P 500 gained 1.1% in March, while April was up 1.5%, but in a pre-election year, those returns went to 1.9% and 3.5%, respectively.

One other thing we are encouraged by is how quickly everyone has become bearish again. After the great start to the year, many bulls were getting loud and some longtime bears were starting to sound bullish. This increased the odds of a pullback. Well, we’re in the middle of the pullback, and nearly just as quickly, investors have turned extremely worried and the sentiment is showing signs of pessimism. From a contrarian point of view, we like to see this type of skepticism. The one thing we wouldn’t want to see is weakening price action but more bulls, and that sure isn’t happening today.

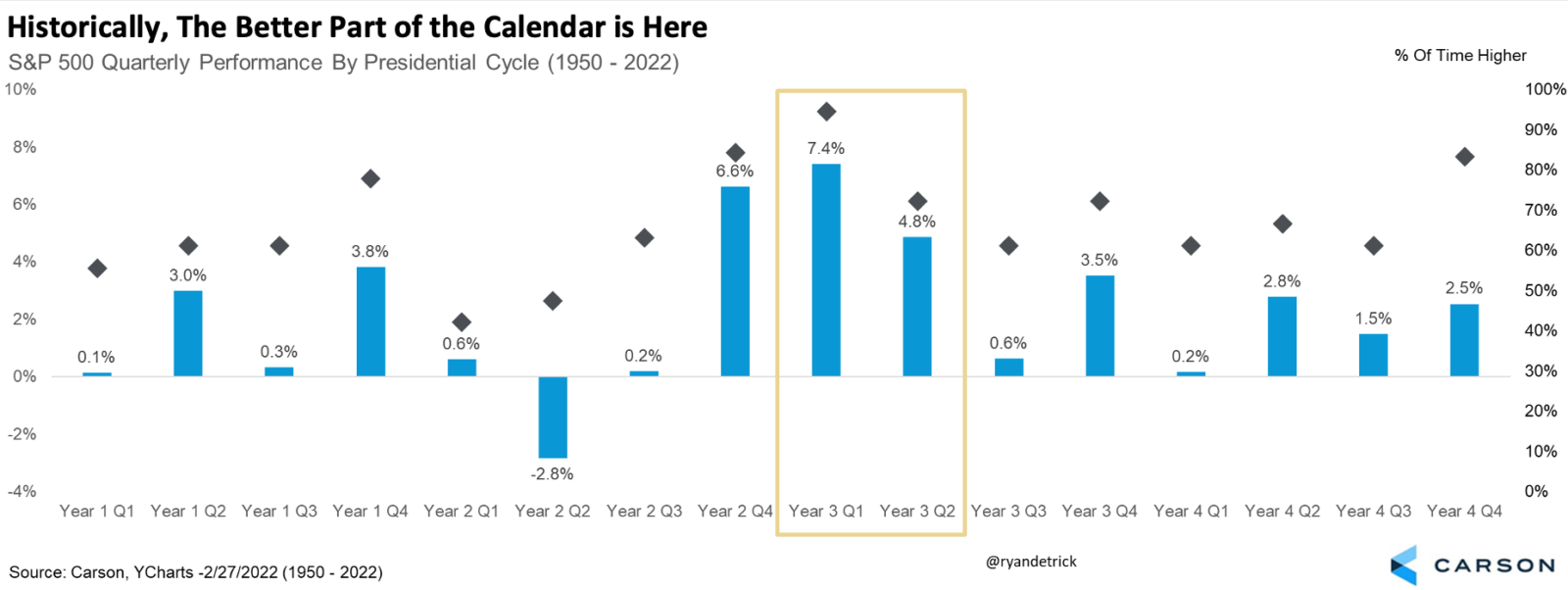

Lastly, here’s a chart we’ve shared a lot over the past few months but looking at the entire four-year Presidential cycle showed that the current quarter was the best out of 16 total quarters of the four-year cycle. Adding to the fun, the next quarter has been quite strong as well, only adding to why we expect any weakness to be well-contained potentially.

I was honored to join Charles Payne on Fox Business yesterday to discuss many of these concepts. You can watch the full interview below.