The Federal Reserve (Fed) opted to keep their policy rate unchanged, leaving it at the 4.25-4.5% target range. This was not unexpected, but all eyes were on the Fed’s “dot plot,” which is their Summary of Economic Projections. It’s updated every three months and contains individual member estimates of the federal funds rate over the next few years, and estimates of economic variables (unemployment rate, inflation, GDP growth). The last update was in December, which was viewed as hawkish (I wrote about it at the time). This time around, there was a big question around what they would do with their inflation projection (using the core Personal Consumption Expenditures Index), especially in the face of tariffs, and consequently, how they would shift their policy rate projections. It was interesting to say the least, with the projections moving in a “stagflationary” direction—members projected higher inflation, higher unemployment, and slower growth:

- Their 2025 core PCE projection rose from 2.5% to 2.8%

- The 2025 unemployment rate projection rose from 4.3% to 4.4%

- Real GDP projection for 2025 fell from 2.1% to 1.7%

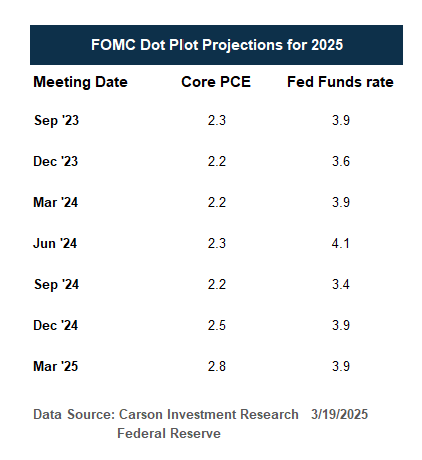

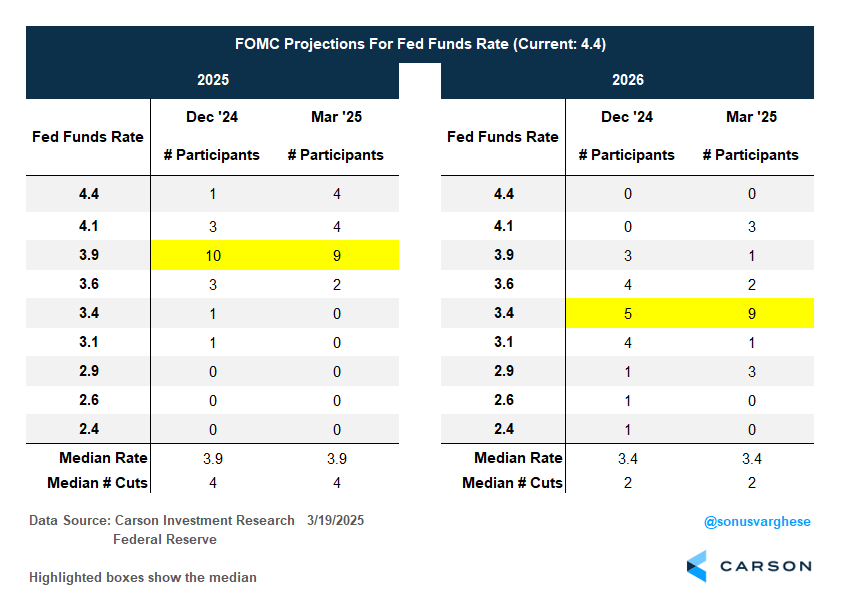

To be clear, these levels are nothing close to stagflationary. It was more the direction of travel, with inflation expectations moving further away from their inflation target of 2%. Instead, the median member projected a policy rate of 3.9% in 2025, implying two rate cuts this year, unchanged from December. In fact, their core PCE projections for 2025 have decidedly moved away from their target over the past year and half, even as their policy rate projection has stayed put. By itself, this is quite dovish, and it’s not a big surprise why equity markets rallied and bond gained as interest rates pulled back.

“Transitory” Makes an Unexpected Comeback

It was three years ago at the March 2022 Fed meeting that Fed Chair Jerome Powell said inflation was likely transitory. Of course, Powell, and the Fed, have been haunted by that ever since. However, “transitory” is back, at least going by the dot plot.

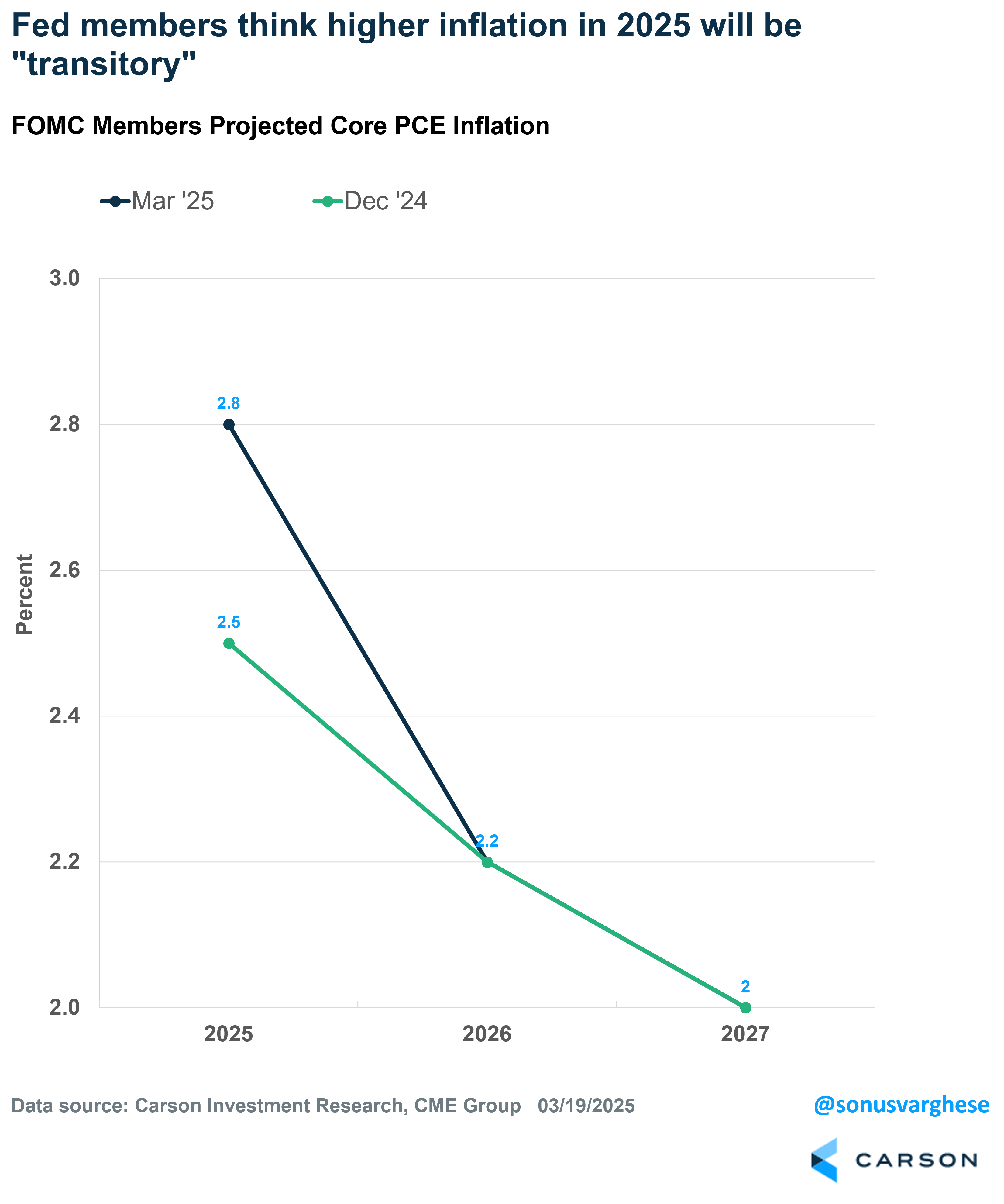

Even as Fed members increase the 2025 core PCE projection to 2.8%, they left the projection for 2026 at 2.2% and for 2027 at 2%. In other words, they think tariffs may simply cause a one-time shift upwards in the price level, boosting inflation temporarily, after which it’ll revert back to the expected trend. There’s some irony in that a lot of people who mocked Powell and Co for saying inflation was transitory a few years ago are now in the administration and saying the same thing.

This kind of explains why the median policy rate projection didn’t shift. Why move policy rate projections if higher inflation is expected to be transitory? Powell also mentioned that long-term inflation expectations remain stable, downplaying the popular University of Michigan survey, which showed 1-year inflation expectations surging to 4.9% and 5-year ahead expectations jumping to 3.9%, the highest we’ve seen over the past decade. This is likely colored by politics (though not all of it), and Powell was quick to dismiss it as an outlier.

BUT the Fed Is Not in a Hurry to Cut, Amid a Lot of Uncertainty

Powell: “I don’t know anyone who is confident of their forecast.”

Powell rationalized the apparent dovishness of the dot plot by saying the risk of slower growth balances out the risk of higher inflation. However, he said there’s a lot of uncertainty here, and the dot plot illustrated this quite nicely.

The median dot, which is where the projections come from, hides a lot of varied thinking across Fed members. Back in December, four members (out of nineteen) projected less than 1 cut in 2025, with three projecting one cut and one projecting none. In March, eight members now project less than two cuts, with four projecting one cut and four projecting none. On the other end, back in December, five members projected three or more cuts in 2025. That’s fallen to just two members now.

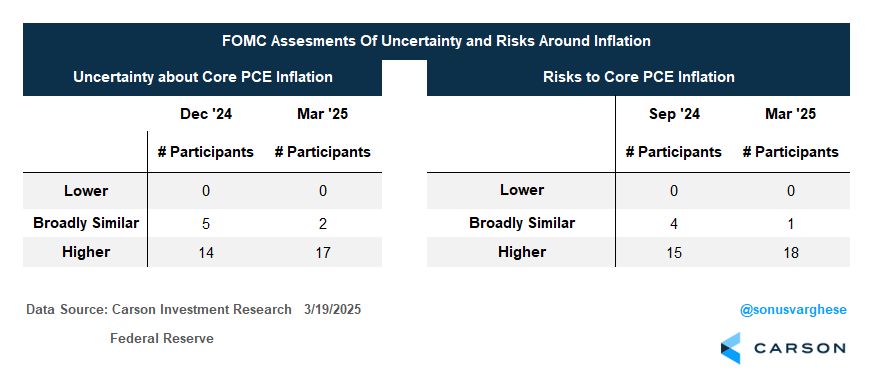

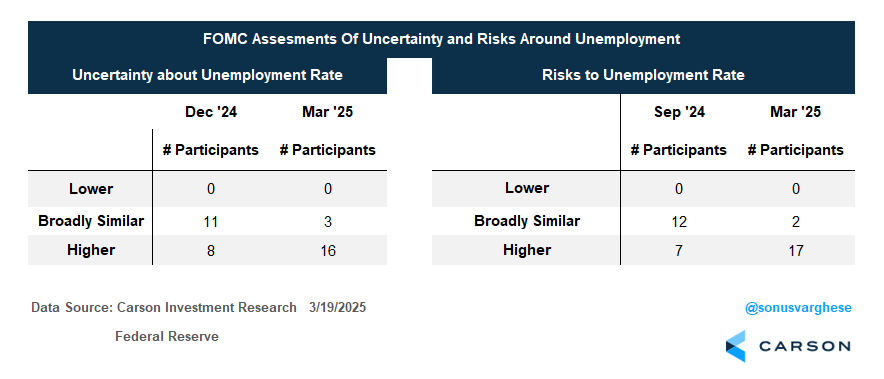

Along with their dot plot, Fed members also put out their expectations for uncertainty and risks around economic variables like inflation and unemployment, assessing whether it was lower, broadly similar, or higher. This got a lot of play in December, as there was a big jump in members who viewed uncertainty and risks around inflation to be higher. Even more members think this as of March.

- 17 of 19 members now say inflation uncertainty is higher, versus 14 in December

- 18 members say inflation risks are higher, versus 15 in December

At the same time, members are a lot more worried about a slowing economy and rising unemployment.

- 16 of 19 members say uncertainty about the unemployment rate is higher, versus just 8 in December

- 17 members say risks to the unemployment rate are higher, versus 7 in December

The data above highlights the Fed’s quandary. Policy rates are clearly restrictive. The policy rate is 4.4% right now, well above the “neutral” rate of 3% (the rate that is neither too accommodative nor too tight). Under normal circumstances, they’d likely be easing rates already, especially since they’ve repeatedly made clear that they want to hold on to labor market gains, even as the inflation outlook looks good. Powell once again noted that the labor market isn’t a source of inflationary pressure, which is important because that’s usually where the Fed can apply pressure to rein in inflation.

However, Powell’s been explicit that Trump administration policies across four dimensions have created a lot of uncertainty for them. Tariffs are the main cause, but also immigration, fiscal policy, and deregulation. Tariffs have created enormous uncertainty about short-run inflation, preventing them from easing rates further. Powell was clear:

“We now have inflation coming from an exogenous source.”

On the other hand, there’s uncertainty around growth and employment too. For now, the hard data suggests the economy is doing fine, but sentiment is weak (though that doesn’t mean it has to translate to a weaker economy). At the same time, hiring is clearly weak, with the hire rate running close to 2013 levels—by no means terrible, but much lower than it was in 2018-2019 or even 2022-2024. The good news is that the unemployment rate remains low because layoffs are low. This balance has held for 6-8 months now, but there’s uncertainty around whether that continues, or breaks one way or the other. It’s an important question. Do hires pick up from here, or do layoffs increase?

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

All this means the Fed is on hold, as they maintain that they’re not in a hurry to cut rates. They’re going to wait for more data to come in and then react to it. This is a big difference from last year. The unemployment rate climbed from 3.9% to 4.2% from April to July, which was still historically low. But they decided to “go big” with a 0.5%-point cut in September to preempt further weakness. Contrast to today. They’re essentially going to wait until things really break before acting. In fact, Powell admitted that members were uncertain and as a result inertia took over, and most members stayed in place with respect to their rate cut projections.

The problem is the economy may not be able to handle the Fed sitting on their hands while rates remain restrictive. As we wrote in our Outlook 2025, elevated rates are still a big risk to the economy, especially for cyclical areas like housing. Looks like that’s going to continue for now, on top of policies from the other side of DC.

Carson’s Chief Market Strategist, Ryan Detrick and I talked about the recent market pullback and how worried we should, or shouldn’t be, on our most recent episode of Facts vs Feelings. Take a listen.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

7765436-0325-A