Say goodbye to those 5.5% rates! The Federal Reserve (Fed) jump-started their policy pivot by going big at their September meeting, cutting interest rates by 0.50%-points, taking the federal funds rate to the 4.75-5.50% range. This was not entirely unexpected. Traders put the probability of a 0.5%-point move at 63% just prior to the meeting, staying on the side of a big move ever since a well-timed article in the Wall Street Journal last week reported that the Fed was of two minds as to the size of their first cut (I wrote about this last week). Fed Chair Powell appears to have successfully corralled all but one voting member of the committee to go along with the big cut. Fed governor Michelle Bowman dissented, making her the first Fed governor to dissent since 2005.

In their official statement, the Fed acknowledged that the twin goals of achieving their employment and inflation mandate were in balance — a very different posture from prior meetings when they said that the risks were still tilted toward the inflation side. They’re strongly committed to supporting maximum employment and returning inflation to its 2% objective. Powell reiterated this in his press conference, saying they now have greater confidence that inflation is returning to their target, but labor market risks are rising. The two objectives being in balance implied monetary policy was too tight, and a large cut was justified.

We wrote about rising labor market risks after the August payroll report was released. It looks like Powell and company also saw enough in that report, and other recent labor market data, to spur the large cut.

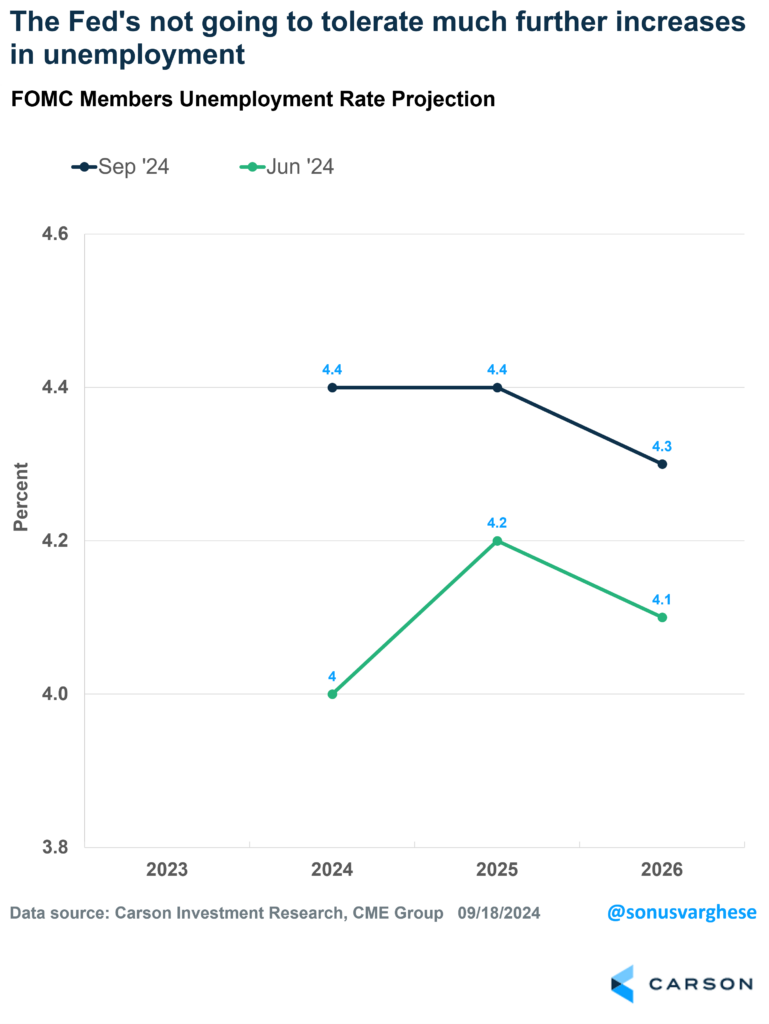

Not Going to Tolerate Much More Unemployment

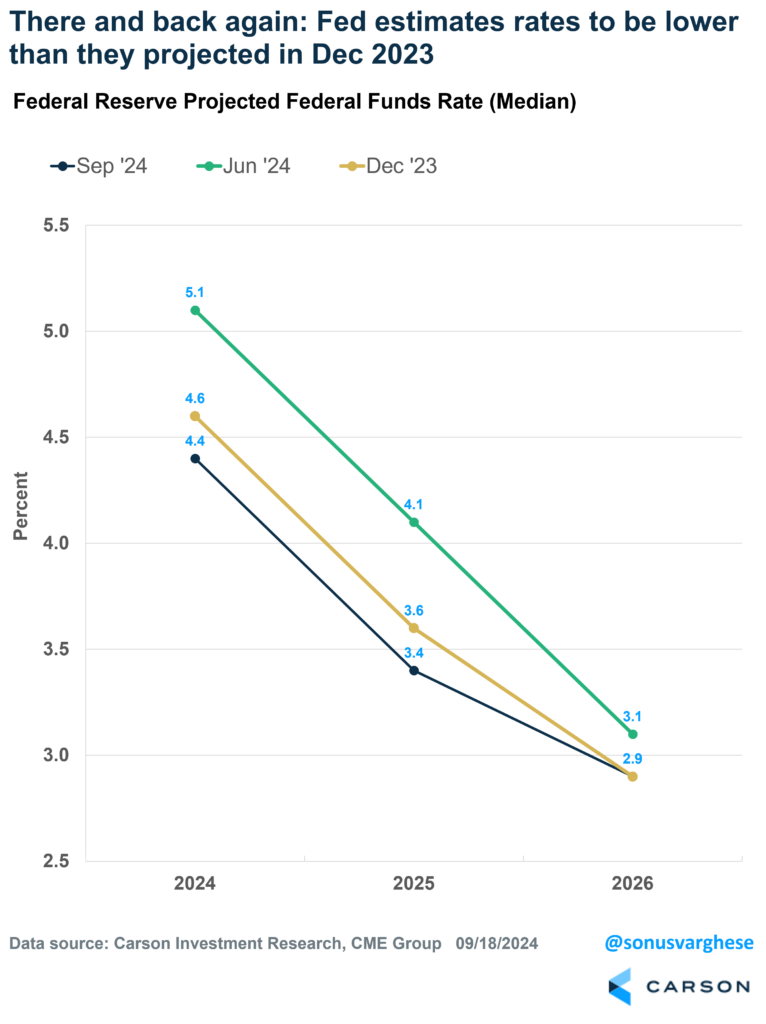

Fed members also updated their estimates of policy rates and other economic variables over the next few years (the “dot plot”). The last update was back in June. Here’s how they shifted their policy rate expectations:

- 2024: Shifted down from 5.1% to 4.4% (implying 1%-point of cuts in 2024, including the 0.5%-points in September)

- 2025: Shifted down from 4.1% to 3.1%

- 2026: Shifted down from 3.1% to 2.9%

What’s interesting is that these updated projections take the policy rates even lower than what they projected way back in December 2023. That’s because the labor market has softened more than they expected — they now project the unemployment rate to hit 4.4% by the end of 2024, up from the 4.1% projection they made last December. The primacy of labor market data in driving policy from here on is highlighted by the fact that the members’ core inflation projection for 2024 increased from 2.4% to 2.6%.

In short, it’s now about fighting unemployment, not inflation. The unemployment rate projections are instructive. They raised 2024 unemployment rate projections from 4% (June update) to 4.4%. They also raised 2025 projections to the same level (up from 4.2%), but the fact that they didn’t raise it even higher is telling. It implies they’ll do what it takes to support the labor market, and make sure the unemployment rate doesn’t rise much further after 2024. Of course, they expect their projected policy rates to keep a lid on unemployment, but Powell did note that all this could change based on how the data shakes out.

Recalibration, as Opposed to Panic

Powell was quite sanguine about labor market conditions. While he did acknowledge that the labor market had cooled, he went on to say that this was still a solid labor market that is close to maximum employment. I personally wouldn’t go that far, but what Powell says is what matters. He’s basing this on the fact that we’ve yet to see rising layoffs and unemployment claims. However, what’s important is that the Fed doesn’t want to wait for layoffs to start rising. This was perhaps the most significant line of Powell’s press conference:

“The time to support the labor market is when it’s strong, and not when you begin to see layoffs.”

In other words, the large cut was about risk management. This is welcome, since you want the Fed to be making policy based on forward-looking risk assessment. Notably, Powell doesn’t think the Fed is behind the curve. Going big in September was just a timely move and the first step of policy recalibration — a sign of their commitment to not fall behind. It does not mean they’ll cut by 0.5%-points every meeting, but they’re going to see how the data shakes out. Again, it comes back to their unwillingness to see the unemployment rate rise above 4.4%.

This is significant even from a historical perspective. In prior rate cutting cycles, the Fed made a large 0.5%-point cut when they were clearly trying to catch up to deteriorating economic conditions, which is what made those “panic cuts.”

We’re in a very different situation now. We’re clearly not in the middle of a recession (nor is one imminent) and the labor market is not weak. The Fed is simply normalizing policy, and by going big, they signaled their intention to stay on top of the data. Ultimately, the message is that the Fed’s got the labor market’s back. This means they also have the economy’s back, since growth depends on consumption and consumption relies on income growth from employment. That’s positive for markets, since profits are likely to grow if the economy continues to hum.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

It’s been a long road from two years ago, when inflation hit 40+ year highs and the Fed took rates to highly restrictive territory in response, cuing widespread calls for a recession (we were one of the lonely exceptions). The good news is that inflation has been tamed and we’ve avoided a recession. And now the Fed has pivoted towards normalizing policy in a big way, cutting rates to hold on to employment gains. So ignore the doomsayers, as my colleague Barry Gilbert, VP, Asset Allocation Strategist, put it in his latest blog.

Ryan Detrick, Chief Market Strategist and I recently celebrated our 100th episode of Facts vs Feelings with Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, who has also been one of the few who have read this market cycle correctly. We recorded the episode live at our annual Excell Conference in Orlando last week, and discussed multiple topics, including what rate cuts mean for stocks over the next year. Take a listen below.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02415737-0924-A