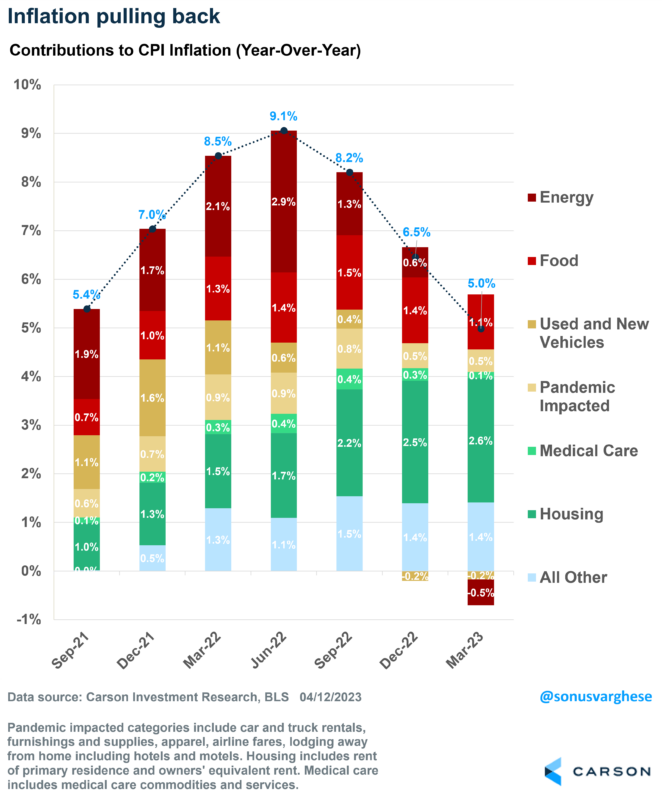

The March inflation report showed that CPI inflation rose only 0.1%, slightly below expectations. Over the past year, inflation is now up 5%, well off the peak 9% from June 2022. As you can see below, the big driver of lower inflation has been energy and food.

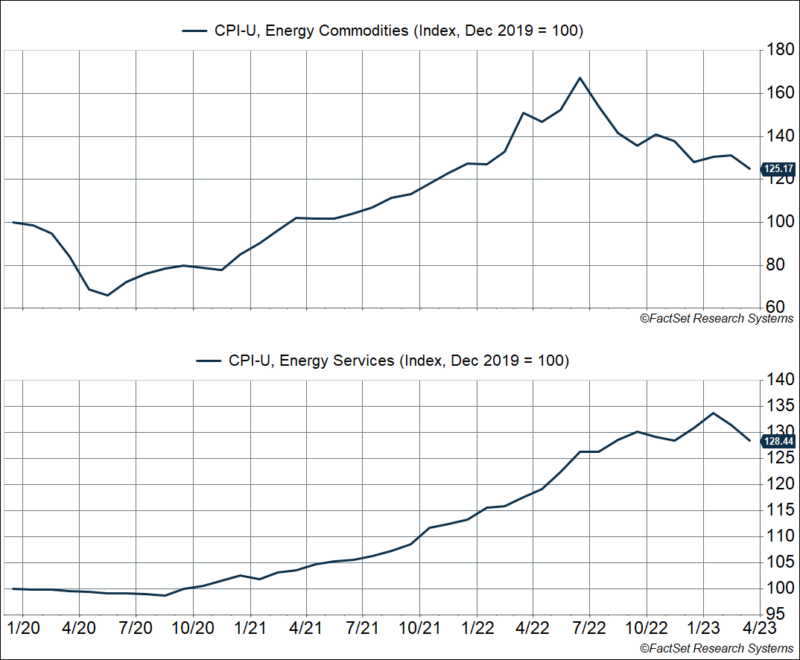

Energy makes up about 7% of the “inflation basket”, split almost equally into commodities (like gasoline) and services (like electricity and piped gas). Thanks to the pullback in oil prices, energy commodity prices are now below where they were in December 2021. The recent drop in natural gas prices has also sent services prices lower over the past couple of months.

Further good news: prices for “food at home”, i.e. groceries, fell 0.3% in March. This is the first price decline since September 2020, and bodes well even for prices and restaurants and such (which are still elevated).

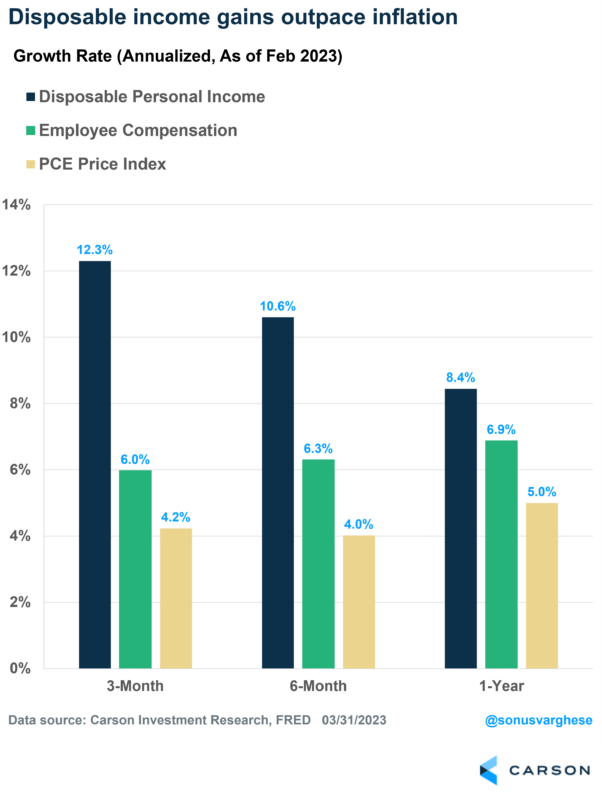

Lower energy and food prices are a big deal, for consumption

Lower inflation, by way of lower energy and food prices, means “real” incomes, i.e. incomes adjusted for inflation, remain strong. More so if the labor market remains healthy, which looks to be the case as we wrote the other day.

The chart below shows annualized growth rates of disposable income, employee compensation (across all workers in the economy), and inflation. Over the past 3, 6 and 12 months, disposable income has run ahead of inflation. Part of this is because social security incomes got a big inflation-adjusted boost in January. But even employee compensation is running ahead of inflation. That’s really positive for consumer spending, which makes up 70% of the economy.

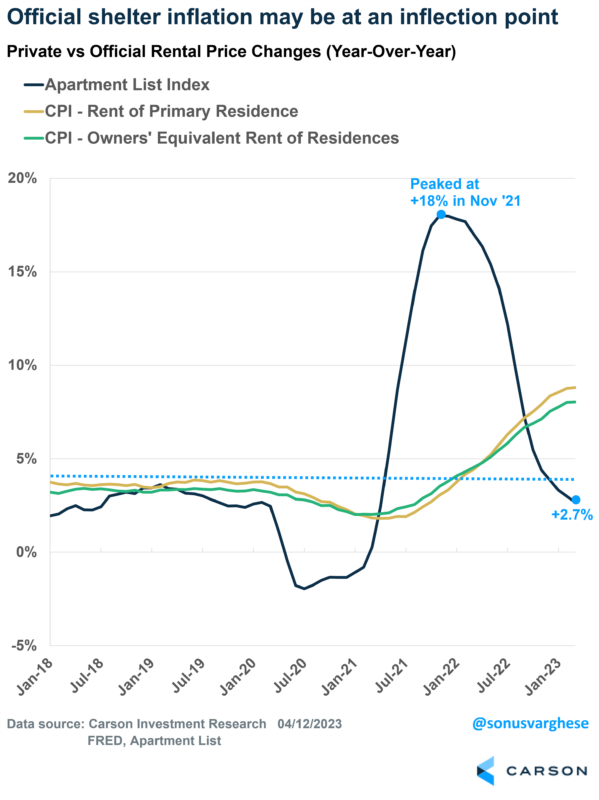

The big story: Housing inflation may finally be turning (lower)

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Core inflation, excluding food and energy, rose 0.4% in March. Over the past 3 months, core inflation is up 5.1% (annualized pace) and its up 5.6% over the past year. So, not much of a slowdown.

Part of the reason is that housing inflation has been running high.

But we got very good news on that front. Rents of primary residences and owners’ equivalent rent (rental equivalent of owner-occupied homes) rose “only” 0.5%. While still high, that pace is the slowest monthly increase in a year. Over the past 9 months, housing inflation averaged about +0.7% per month, which translates to a whopping 9% annualized rate!

So, the slowdown in March is significant, and most welcome.

Of course, as we’ve written about in the past, we’ve already seen a sharp deceleration in market rents. It’s just that the official inflation data has been really slow to catch up to that reality. But that may be changing now and bodes well for core inflation to slow down across the rest of this year.

The bad news: Core inflation ex housing remains elevated

That was the good news, i.e. a slowdown in energy, food and housing inflation. However, the rest of it still looks to be elevated.

For one thing, vehicle prices are no longer falling as fast as they were. Vehicle prices, especially for used cars, was another big factor in pulling inflation lower over the last few months. Used car prices fell 0.9% in March, but that’s the smallest decline in 7 months. Private data suggests that used car prices are rising again. New vehicle prices also rose 0.4%, breaking a recent downward trend.

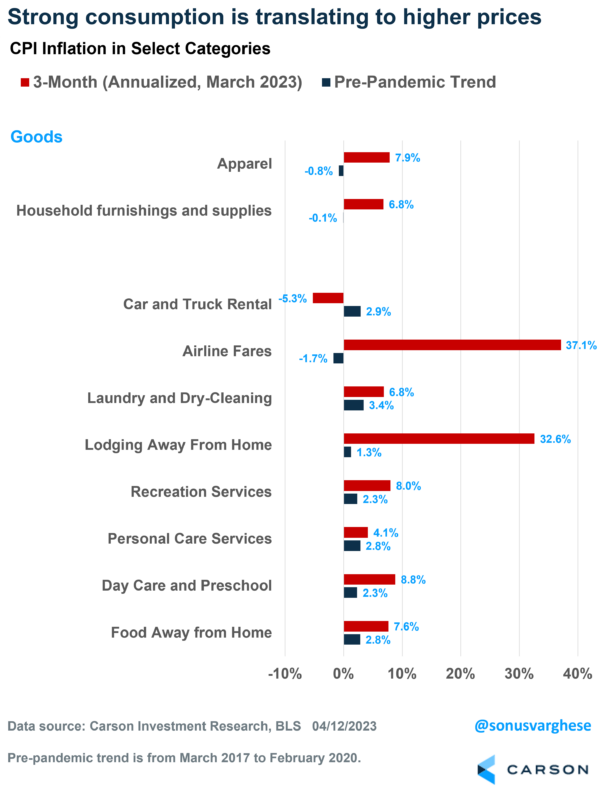

Outside of vehicles, a lot of goods and services that were initially hit by the pandemic are still seeing significant price increases. These include goods like household furnishings and apparel, and services like hotels and airlines fares.

Even beyond that, services such as day care, personal care, and recreation, are seeing inflation running well above what we saw before the pandemic.

All of which is a sign that demand for these goods and services remains strong.

What does this mean for the Fed?

Fed officials have explicitly said that they want to see core services ex housing decelerate. In short, they’re looking at inflation excluding energy, food and housing, the three categories where we’ve had positive news. Unfortunately, there’s not much evidence that this slice of the inflation basket is decelerating, yet. The good news is that it tends to be correlated to wage growth, and there’s strong evidence that wage growth is moving closer to what we saw pre-pandemic.

Now, the Fed is unlikely to continue raising interest rates much further from here, especially since we had a banking crisis, and they may want to play cautious. Plus, as we wrote a few weeks ago, banks tightening credit in response to the crisis is akin to rate increases.

At the same time, they are likely to keep rates where they are until they see convincing evidence of inflation falling, especially core services ex housing inflation.

This is not what investors expect. Instead, investors expect the Fed to start cutting rates in late summer, pricing in at least 3 rate cuts by the end of 2023. Indicating that bond investors believe a crisis or recession is likely in the near-term. That’s clearly not where Fed officials are right now. We’re not there either, for now.

Eventually, market pricing and Fed officials’ views must converge. In the meantime, expect volatility, especially in the bond market.

Apple Podcast | Google Podcast | Spotify