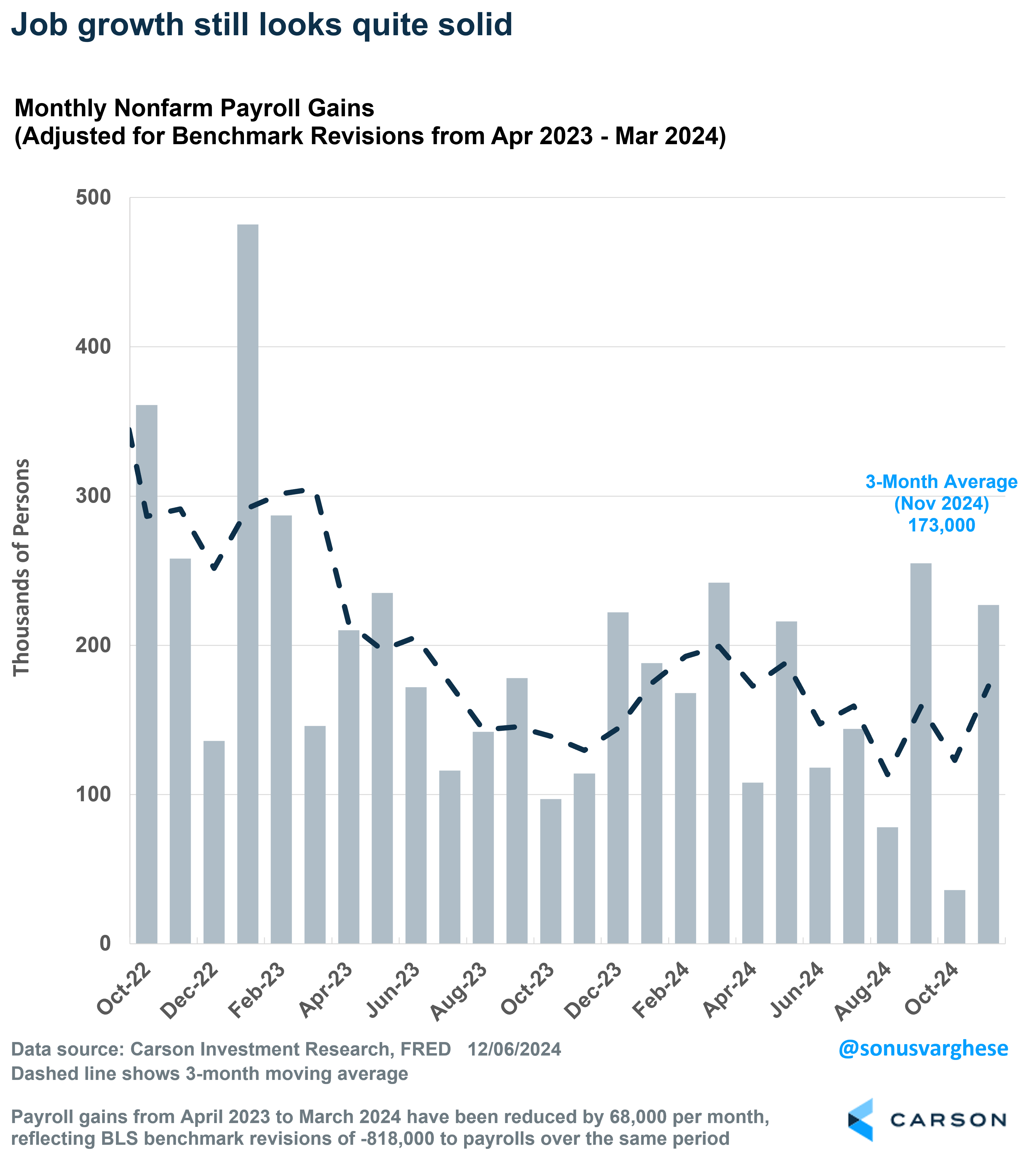

The November payroll report was going to be a tricky one to parse because of a bounce back from hurricane effects (which pulled down October payrolls) and the resolution of the strike at Boeing. The economy created 227,000 jobs in November, close to expectations, which somewhat made up for the low 36,000 number in October (revised up from 12,000). This is why we always recommend taking a 3-month average to get the overall picture, and right now, that’s sitting at a very healthy 173,000. For reference, the 2019 average was 166,000.

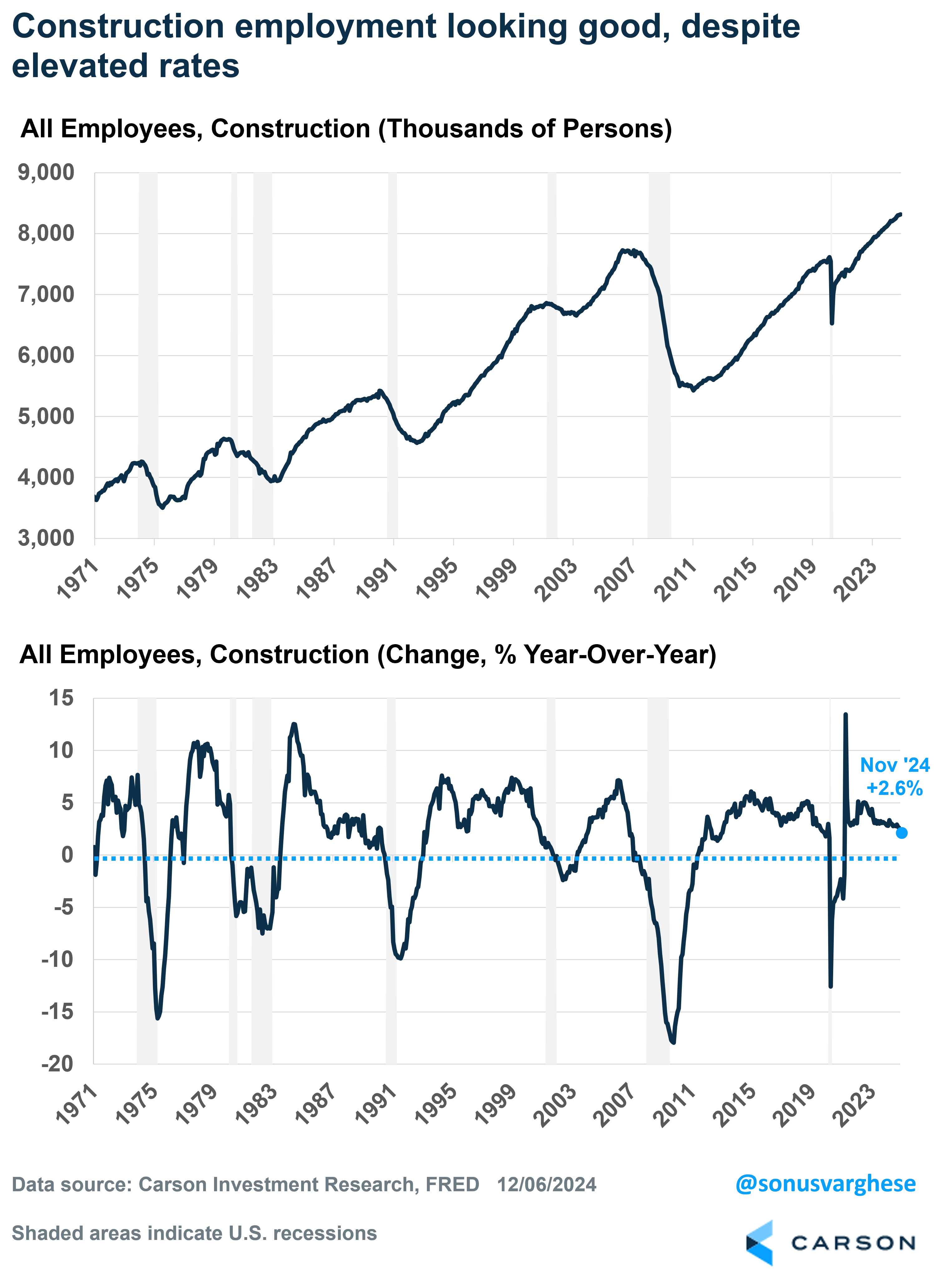

One of the more encouraging parts of the labor market, and really for the economy, is that construction employment is running solid. It was strong even in 2022 and 2023, which was another clue that a recession wasn’t imminent. Historically, construction employment has foreshadowed further weakness across the labor market (and recessions), which makes sense because elevated interest rates (and tight monetary policy) has preceded past recessions. If housing remains weak due to elevated rates, we could see construction employment start to pull back. For now, construction employment is rising at a very healthy 2.6% year-over-year pace, spurred by building construction (residential, but also non-residential like manufacturing facilities) and even home improvements. However, this is something we’re going to be watching very carefully as 2025 progresses.

It’s Not All Rosy

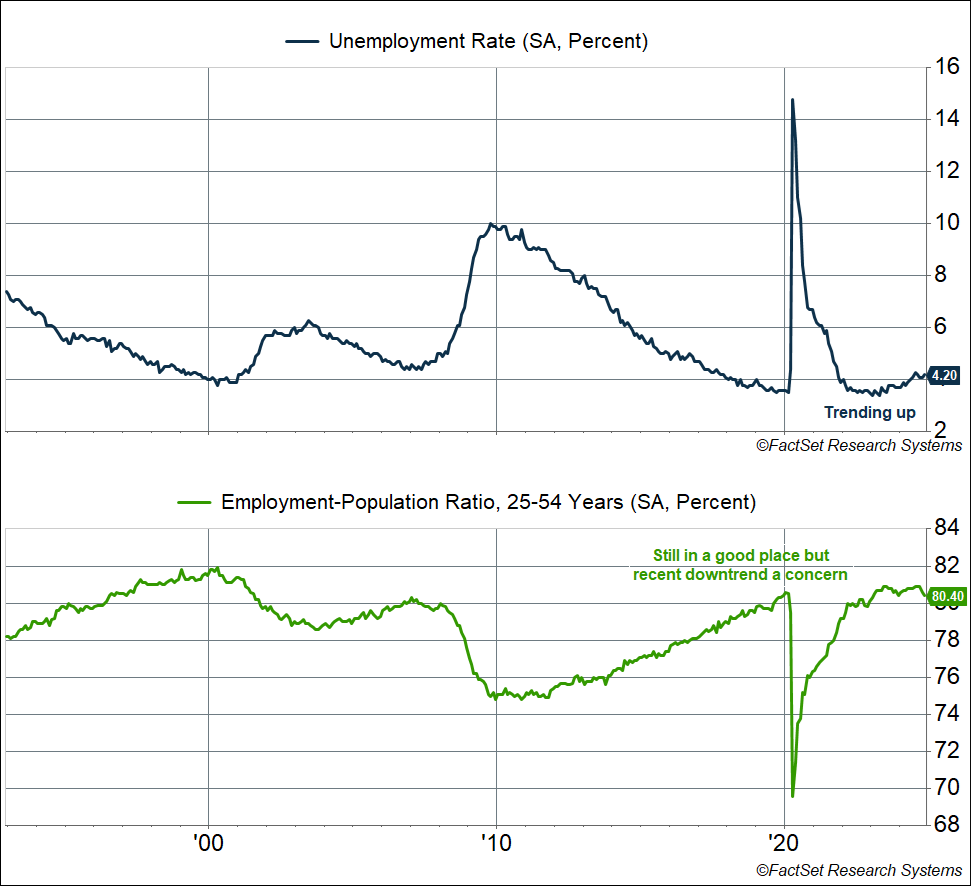

Despite the healthy look on the payroll side, which comes from the government’s survey of businesses, things are less than picture perfect when you look at the household survey. For one thing the unemployment rate rose to 4.2%, just shy of the highest rate we’ve seen over the last two years. A year ago, it was 3.7%. The prime-age (25-54) employment-population ratio, which is a way of controlling for demographic effects and labor force participation issues, has fallen to 80.4%. That’s still close to the highest we saw during the 2010s expansion, and above anything we saw in the mid-2000s, but it’s fallen quite a bit from the recent peak of 80.9%. These levels are not a bad place to be at if things can hold at this level, but it’s the trend that’s concerning.

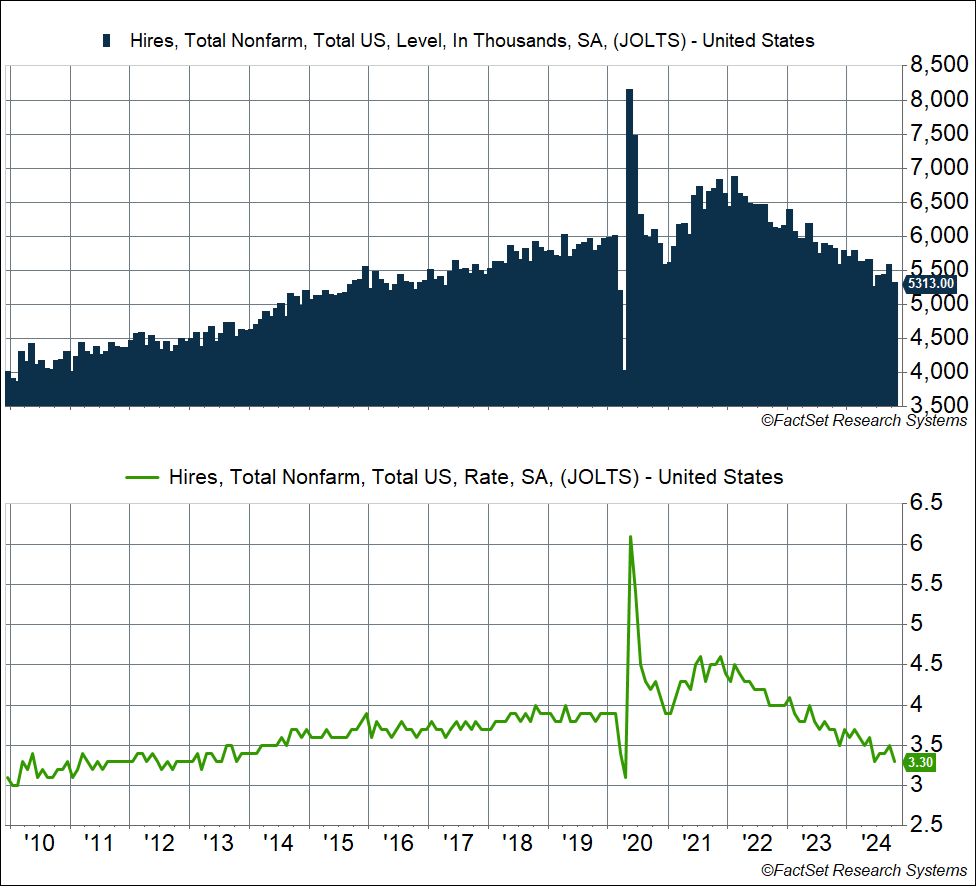

The other aspect that is concerning is that overall hiring has slowed, a lot. Hires fell to 5.3 million in October, well below the 5.5-6 million level we saw in 2018-2019. Keep in mind that the labor force is also larger. The hiring rate, which normalizes hires by the size of the labor force, has fallen to 3.3%. That’s the lowest pace since early 2013 (outside of the Covid months). Again, it’s the trend that’s a concern here.

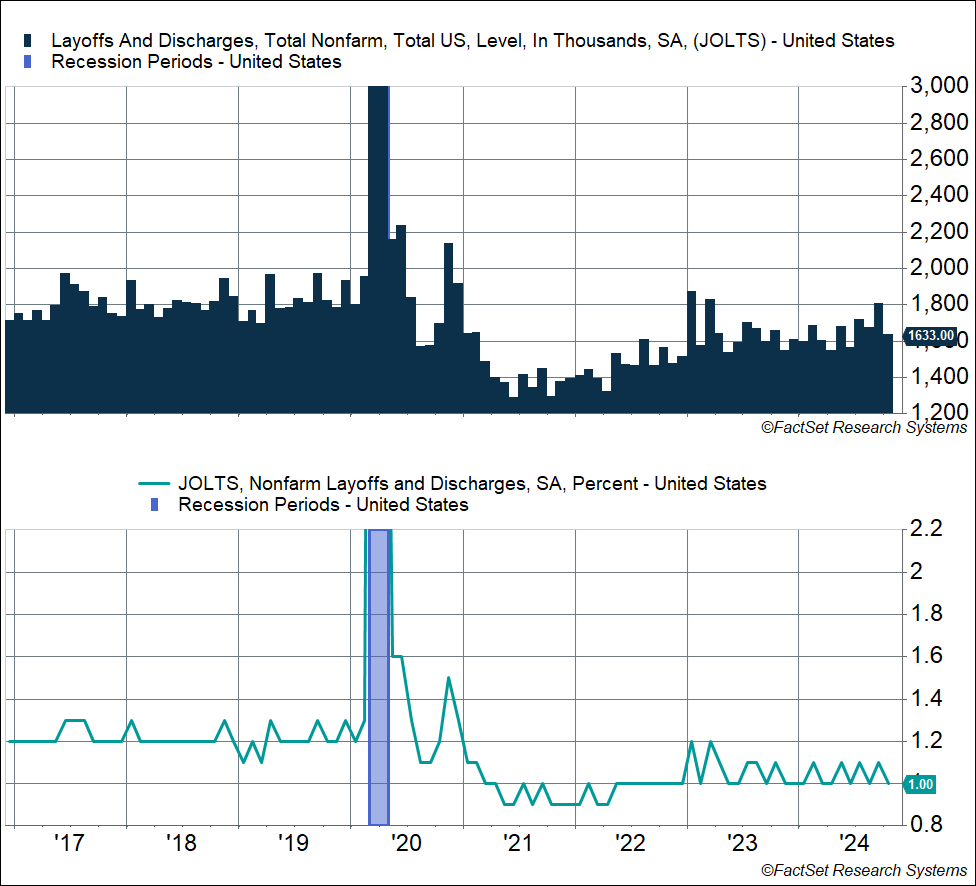

You may be wondering, “Wait, if hiring is weak, why are monthly payrolls growing at a healthy pace?” The answer is that hires measure “gross hiring,” whereas payrolls measure hires net of separations (including quits and layoffs). Quits have been in a general downtrend, which also highlights the fact that hiring has slowed (people tend to quit their jobs at a higher rate only if it’s easy to find a job). At the same time, layoffs remain really low, and that’s been the datapoint that’s been consistently positive as far as the labor market is concerned. Overall layoffs are clocking in around 1.6 million a month, well below the 1.8-2.0 million level we saw in 2018-2019. Again, the labor force is much larger, and if you normalize for that, the layoff rate is currently at 1%. That’s well below the pre-pandemic range of 1.2-1.3%.

The big picture is that the employers are very reluctant to lay off workers right now, but hiring has slowed. So if you have a job, or are casually looking for a better opportunity (while being employed), it’s not a bad labor market environment. But if you’re unemployed, it’s harder to find a job than it was a year ago (let alone two years ago).

What Ultimately Matters Is Income Growth and That’s Looking Good

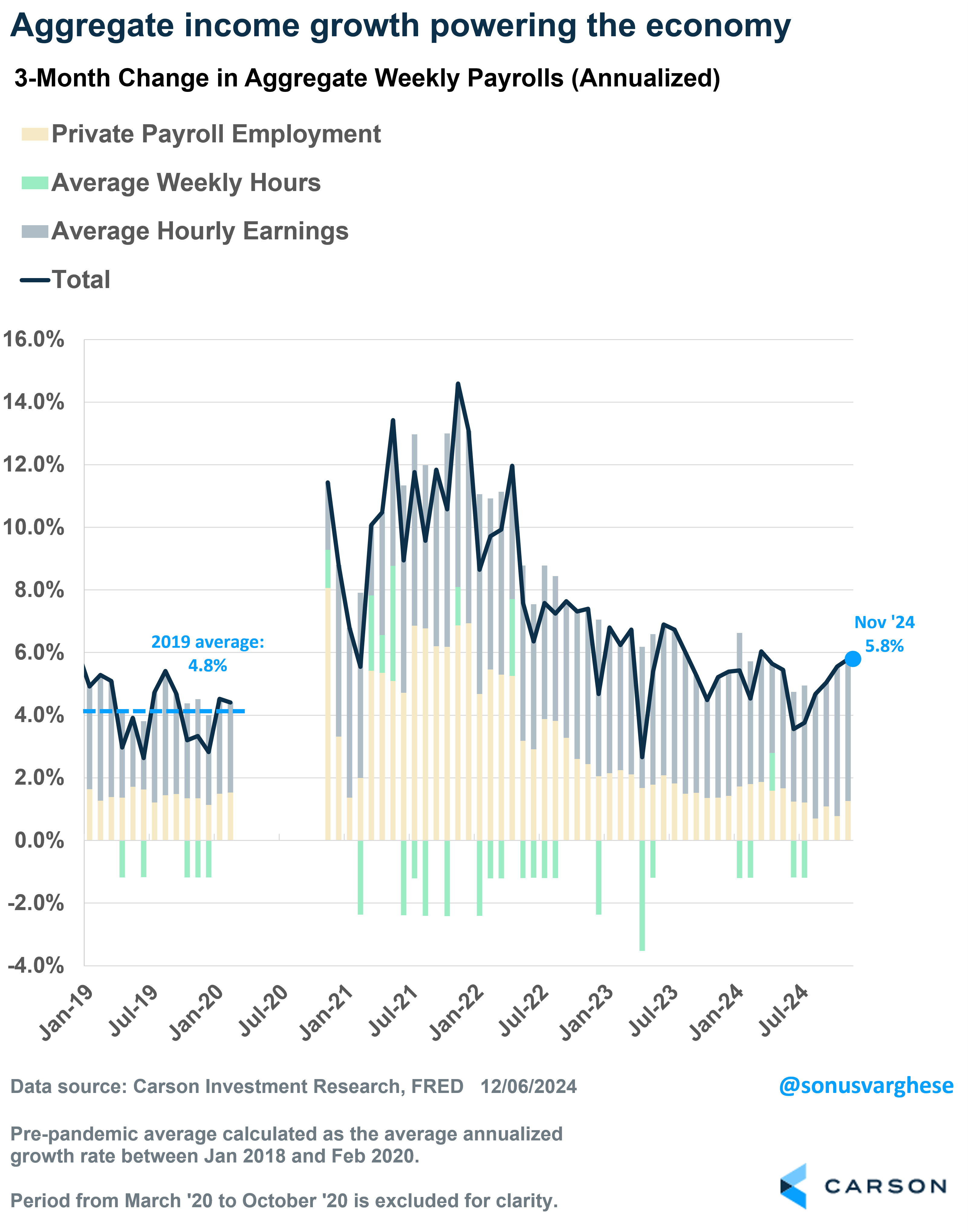

it’s useful to recall that consumption accounts for close to 70% of the economy. Consumption has been driven by income growth this cycle, and right now aggregate income growth (across all workers in the economy) is running at a 5.8% annualized pace over the last three months. That’s above the strong pre-pandemic pace of 4.8%. There’s no reason to expect this to pull back significantly, but we may see a shift in dynamics. Aggregate income growth is the sum of employment growth, wage growth, and change in hours worked. Going forward, aggregate income growth is more likely to be powered by strong wage growth, even as employment growth slows to a 150,000-175,000 average monthly pace. Over the last three months, wage growth has run at an annualized pace of 4.5%.

Another reason for optimism is that we expect headline inflation to remain muted (close to the Fed’s target of 2%), in no small part due to easing energy and food prices. That means real wage growth is likely to remain strong, supporting consumption.

The Big Question: What Does the Fed Do?

Given the current picture of the labor market — a healthy level overall, with some worrying downtrends — the Fed is likely on track to cut rates at their December meeting. Investors are currently pricing an 87% probability on that outcome.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

But we’re going to face some uncertainty in 2025, for two reasons. As long as the unemployment rate doesn’t move much higher and stays below the Fed’s own projection of 4.4% (for 2024 and 2025), they’re going to take that as a positive, i.e. less risk to their employment mandate. However, for idiosyncratic reasons (housing and stock prices), inflation could stay elevated over the next few months, pushing the Fed to pause on rate cuts. I wrote about this in my previous blog.

The risk is that the Fed takes an extended pause, even as rates stay on the higher side and adversely impact cyclical areas of the economy like housing, manufacturing, and business investment. As I wrote in my prior piece, that doesn’t mean a recession is likely, but it’s a scenario where we get more volatility as the economy navigates monetary policy that is tighter than it needs to be. We talked about all this, and more, on our latest Facts vs Feelings podcast. Take a listen …

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02541145-1224-A