It’s hard to get away from continued recession calls, even as several data points suggest the opposite. For example:

- Employment: running strong

- Retail sales: rebounded in April

- Manufacturing: signs point to a turnaround, especially vehicle production

- Housing: a turnaround seems to be happening

I want to focus on housing in this blog.

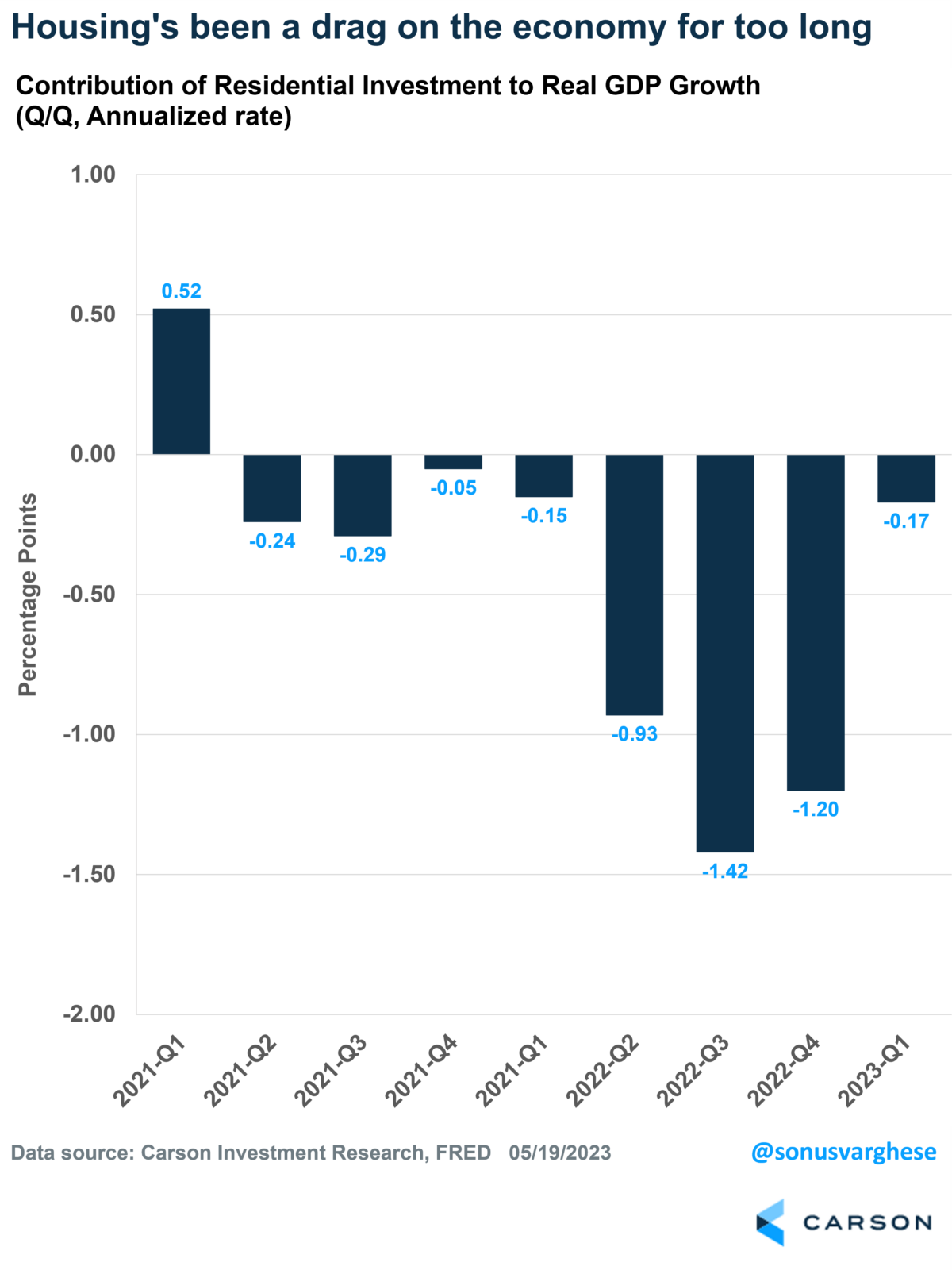

Residential investment makes up under 5% of the economy, but it’s been a drag on economic growth for eight straight quarters.

Over the four quarters through Q1 2023, real GDP grew about 1.6%. But that’s after accounting for a 0.6-0.7%-point drag from residential investment. That’s a lot!

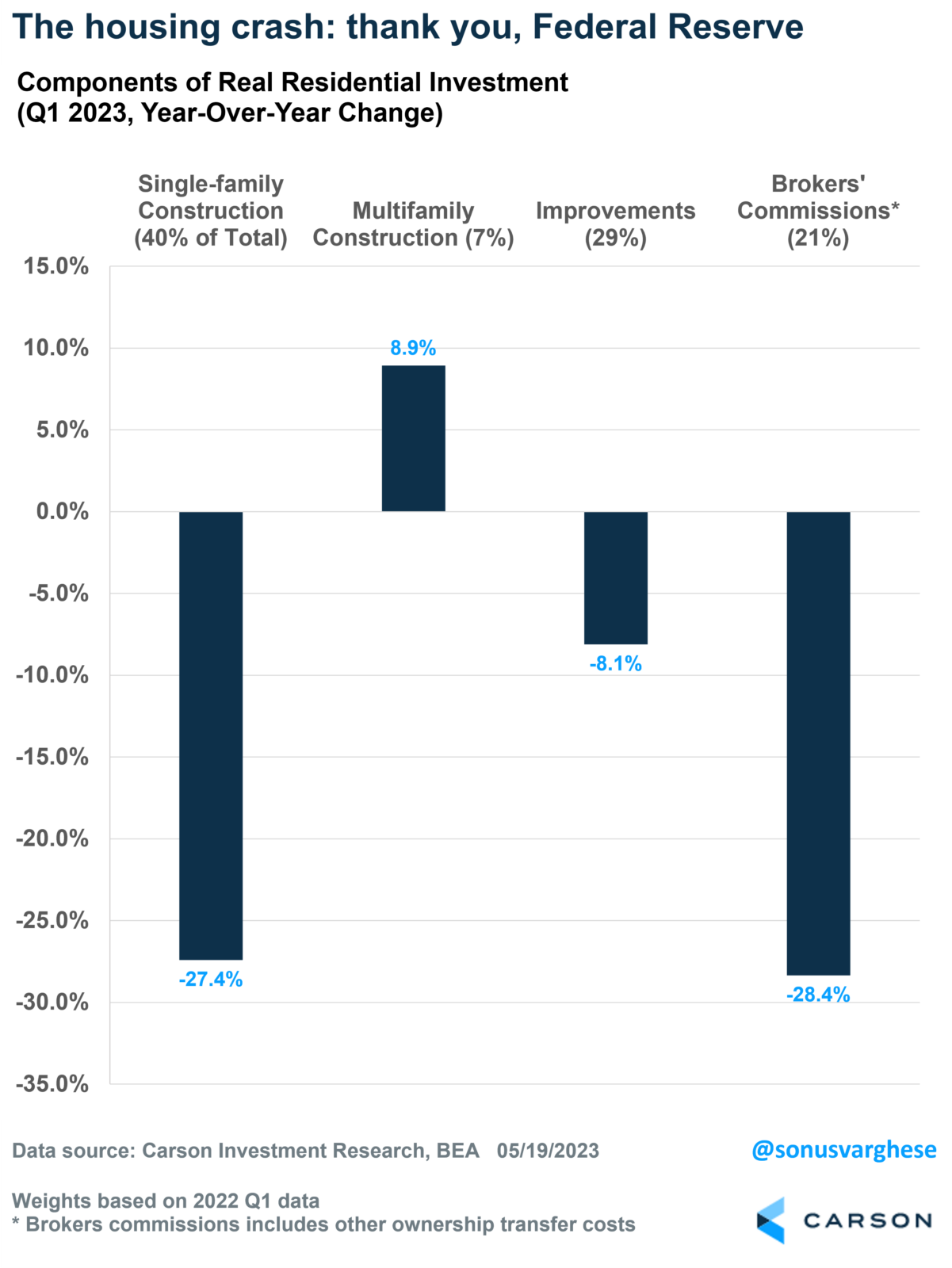

The cause shouldn’t be a surprise. The Federal Reserve (Fed) began its most aggressive policy tightening cycle in 40+ years as they looked to get on top of inflation. That sent mortgage rates from 3% to 7% in less than a year, freezing the housing market. Affordability collapsed due to higher rates and elevated home prices.

Amid decreasing demand, builders reduced their involvement in new construction projects. As a result, there was a notable 27% decline in single-family construction, which comprises approximately 40% of residential investment in GDP. Brokers’ commissions, accounting for just over 20% of residential investment, experienced a 28% decrease due to a significant drop in sales activity. Home improvements also fell, primarily because many households had already completed their projects during the 2020-2021 pandemic period. The sole positive aspect within the housing sector was the continued strength in multi-family construction.

Declining housing activity has foreshadowed past recessions

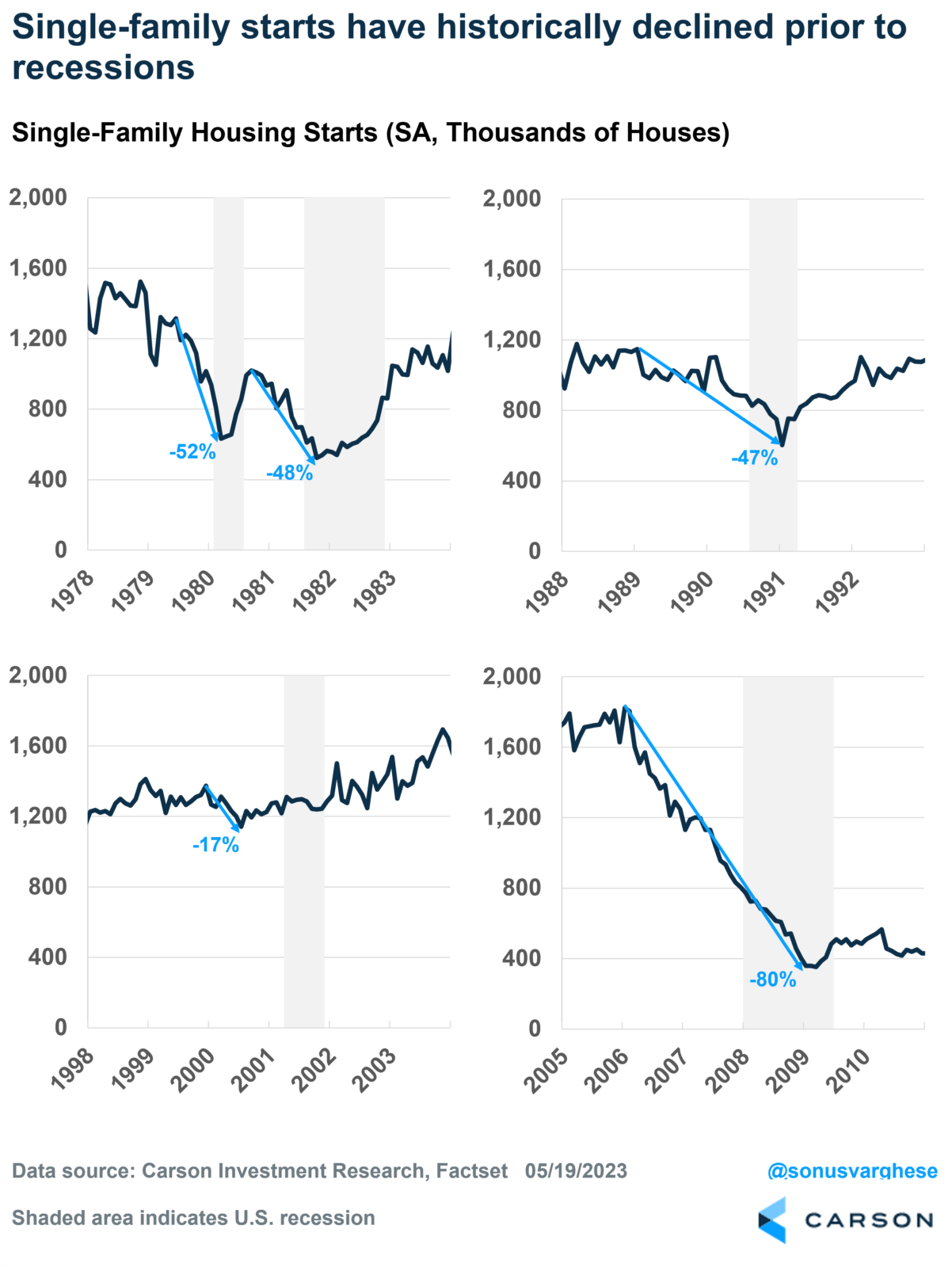

Between 1980 and 2010, we had five recessions, and each one was preceded by a huge decline in single-family housing starts.

Housing starts measure the start of construction on a new residential unit. This precedes sales of new homes as well as spending on appliances, furniture, and other home goods. It tells you a lot about builders’ sentiment for investing in new projects and how consumers view their personal financial situation (since buying a house is a big deal).

You can see why it’s an important metric for gauging where the economy is going.

I looked at single-family housing starts across the five recessions that preceded the pandemic-led 2020 recession, including 1980, 1981-’82, 1990-’91, 2001, and 2007-’09. As you can see in the chart below, single-family starts declined significantly prior to each of those recessions. And these were typically preceded by aggressive Fed tightening.

The mildest decline was in 2000 when starts declined “only” 17%. The 1999-2000 period saw the Fed raise the federal funds rate by about 1.75%-points. The other periods saw rates go up by 4.0%-points or more.

Here’s what’s interesting, however. The chart also shows that housing historically bottomed prior to the end of a recession and has typically led the economy out of one. It typically coincided with the Fed reducing interest rates in response to a slowing economy.

This brings us to the current cycle.

A turnaround begins

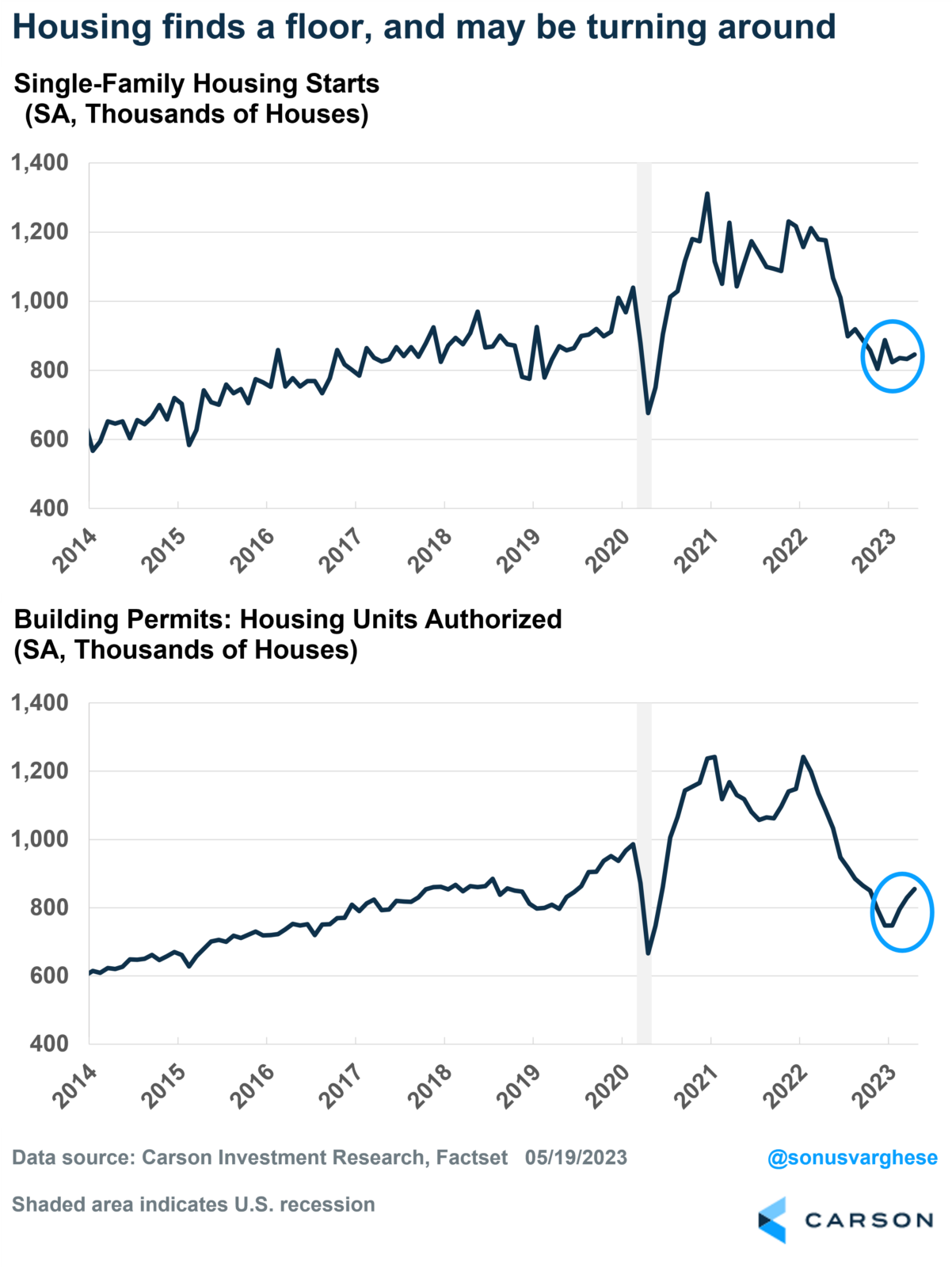

The chart below shows single-family housing starts and permits. Permits count authorized permits to build new housing units and are a leading indicator of future supply.

Thanks to aggressive Fed rate hikes, single-family starts crashed 35% over the 12 months through November 2022. Permits plunged 40% over the 11 months through December 2022. No wonder residential investment was such a big drag on economic growth. However, unlike what we saw in the past, the economy was able to avoid a recession.

And now there’s good news. Starts and permits appear to be turning around. Starts are up 5% since November 2022, while permits have already increased 14% over the three months through April.

Builders are feeling a lot better about the housing market

Builders’ confidence in the housing market is growing. Since the start of 2023, the NAHB Housing Market Index, a gauge of builders’ confidence, has been steadily recovering. It’s still got a long way to go to get back to pre-crash levels, but the upward trend is encouraging.

In fact, earnings and revenues for the nation’s largest builders have been beating estimates by a big margin in the most recent quarter. More importantly, they’ve been very positive about what lies ahead. This comment from the Chairman of D.R. Horton, the nation’s largest homebuilder, best captures it:

” Although higher interest rates and economic uncertainty may persist for some time, the supply of both new and existing homes at affordable price points remains limited, and demographics supporting housing demand remain favorable.”

Here’s a summary of what’s happening:

- Due to high mortgage rates, most homeowners (who probably bought their homes or refinanced at low rates) are “locked in.”

- So, there’s not much inventory in the existing home sales market.

- However, there’s a lot of pent-up demand due to a record number of people in the 25-34 year age cohort, which is the prime home-buying age.

- These potential homebuyers are being pushed into the new homes market.

- That is very positive for builders and the economy since new home demand matters a lot for economic growth.

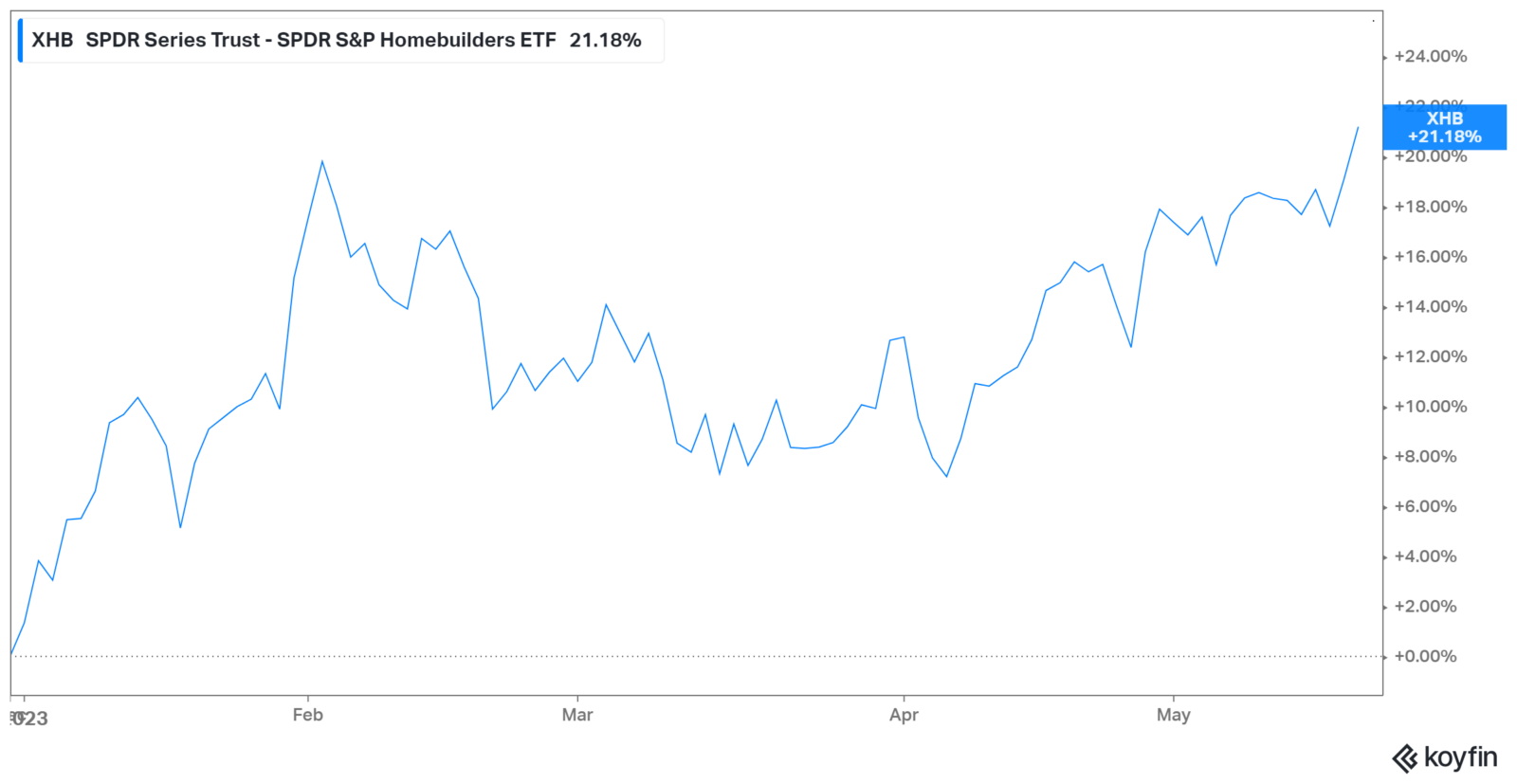

The final chart to underline all this: the SPDR S&P Homebuilders ETF, which is a basket of homebuilder stocks, just hit a new 52-week high, and is at the highest level since February 2022. The ETF is up more than 21% this year through May 18th.

Investors are starting to treat the housing market as an early cycle recovery story, even as several commentators call for a cycle-ending recession. Not us, though. We’ve been saying the economy can avoid a recession since last year.

Ryan and I discussed a lot of this in our most recent podcast, which was taped live at Carson’s Partner Summit. Take a listen.