Last week was all about the Federal Reserve (Fed) jump-starting the rate cut cycle with a 0.5%-point cut. But amidst all the commentary around that, it’s easy to forget about what ultimately drives equities: profits.

Note that what the Fed did was important even from this perspective. A Fed that is looking to cap the unemployment rate at around 4.4% is also trying to put a floor on the economy. And the economy is where profits come from. After all, one person’s spending is another person’s income or business’s revenue and profits. And spending is driven by incomes, which is why the labor market is the ballgame.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

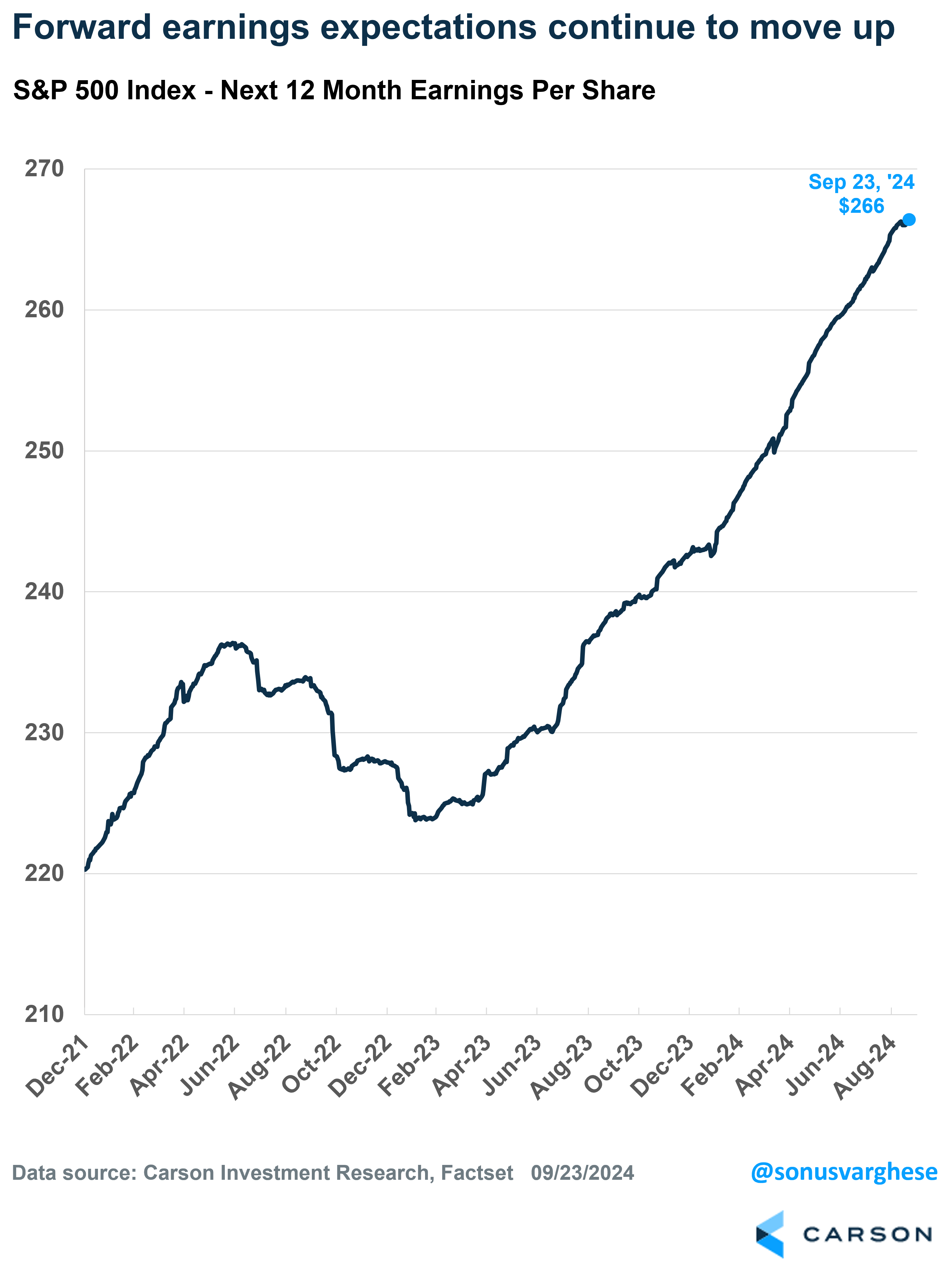

The good news is that profit expectations continue to rise. Expected earnings per share for the S&P 500 over the next 12 months is now at $266, about 10% higher than it was at the end of last year.

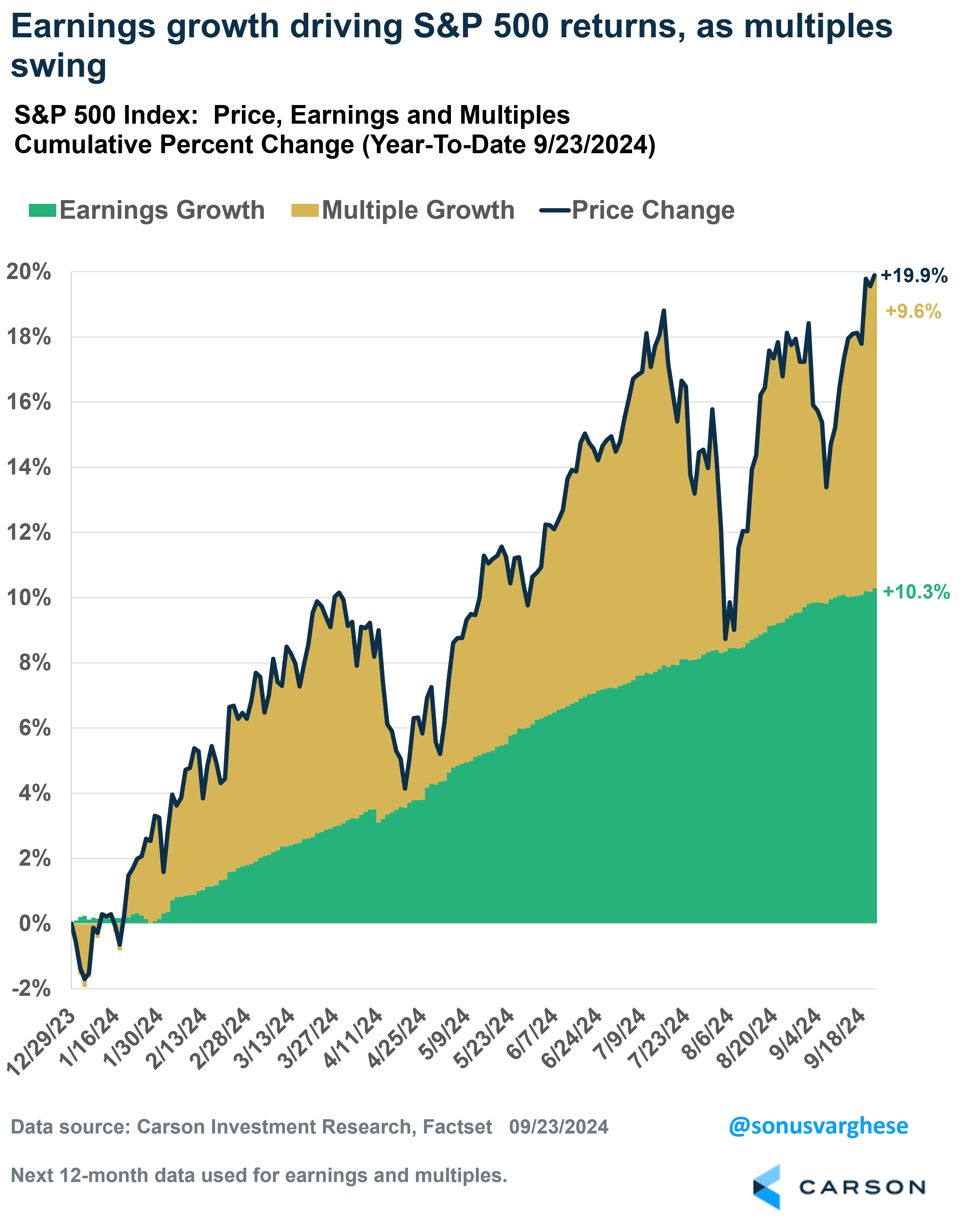

I’ve pointed out in past blogs that we can break apart the price return of a stock (or index) into two components: earnings growth and valuation multiple growth (forward P/E). Note: I use forward expectations here because markets look ahead.

As of September 23, the S&P 500 price index was up 19.9% year to date, of which

- Earnings growth contributed +10.3%-points

- Multiple growth contributed +9.6%-points

As you can see in the chart below, the volatility in the S&P 500 has come from multiples swinging wildly back and forth. Meanwhile, earnings expectations have moved steadily higher. Right now, profit growth makes up just over half the S&P 500’s year-to-date return. Contrast to two months ago, when valuations contributed the majority of the return.

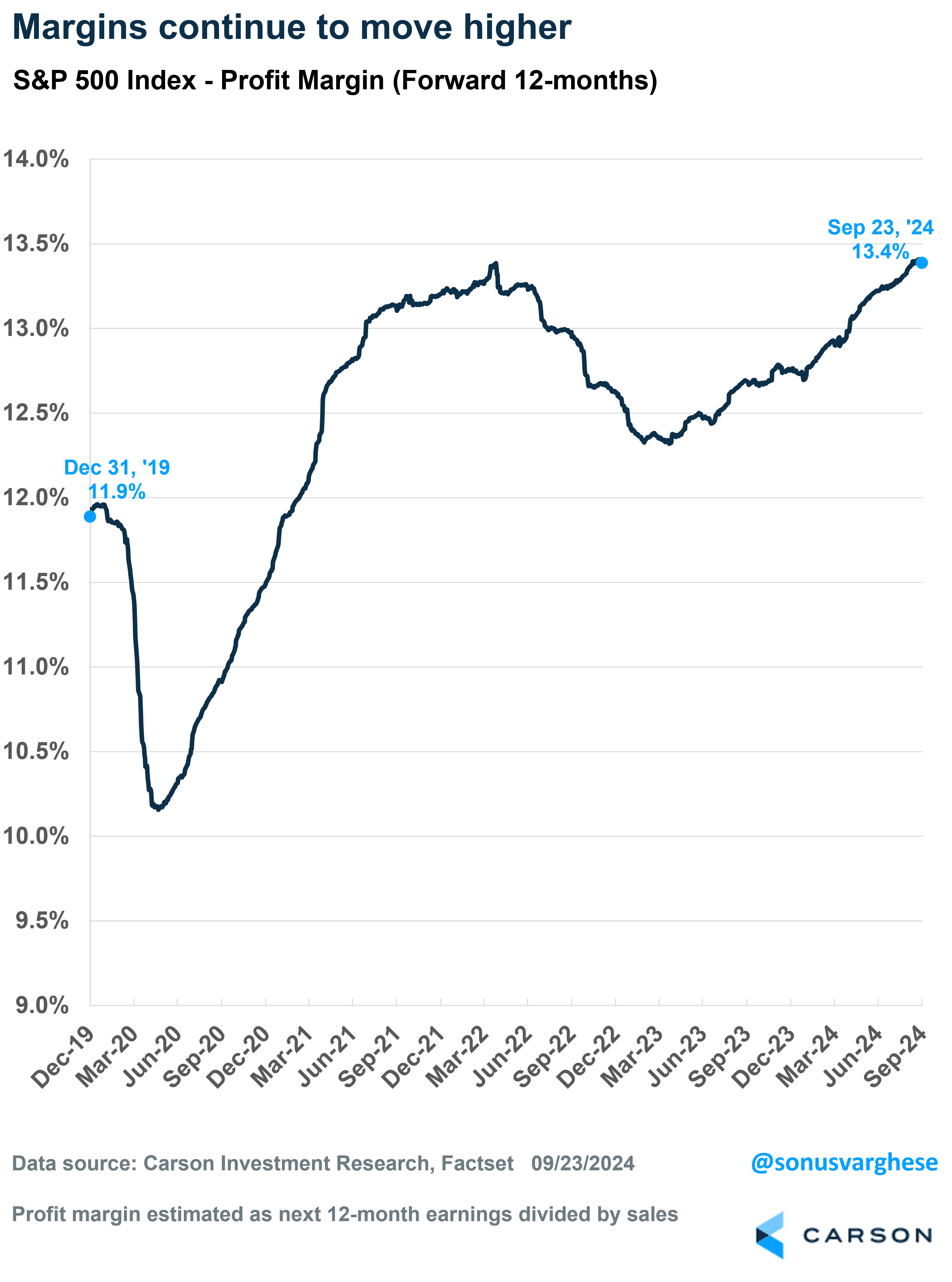

A More Important Story: Margin Expansion

“Operating leverage” allows firms to expand margins as sales grow (even modestly). And corporate America now has a lot more operating leverage thanks to a lot of cost cutting in 2022, especially variable costs. 2022 was a year of low productivity, as firms felt the blowback of over-hiring and over-spending in 2020-2021. Sales grew but margins fell. So corporate America pulled back. However, getting more conservative bore fruit in 2023. Sales grew amid strong nominal GDP growth, and margins expanded. That’s a result of more operating leverage. This also showed up in rising economy-wide productivity, which has continued into 2024 and is positive for earnings/margins going forward as the economy continues to grow. S&P 500 margins are now at a new high of 13.4%.

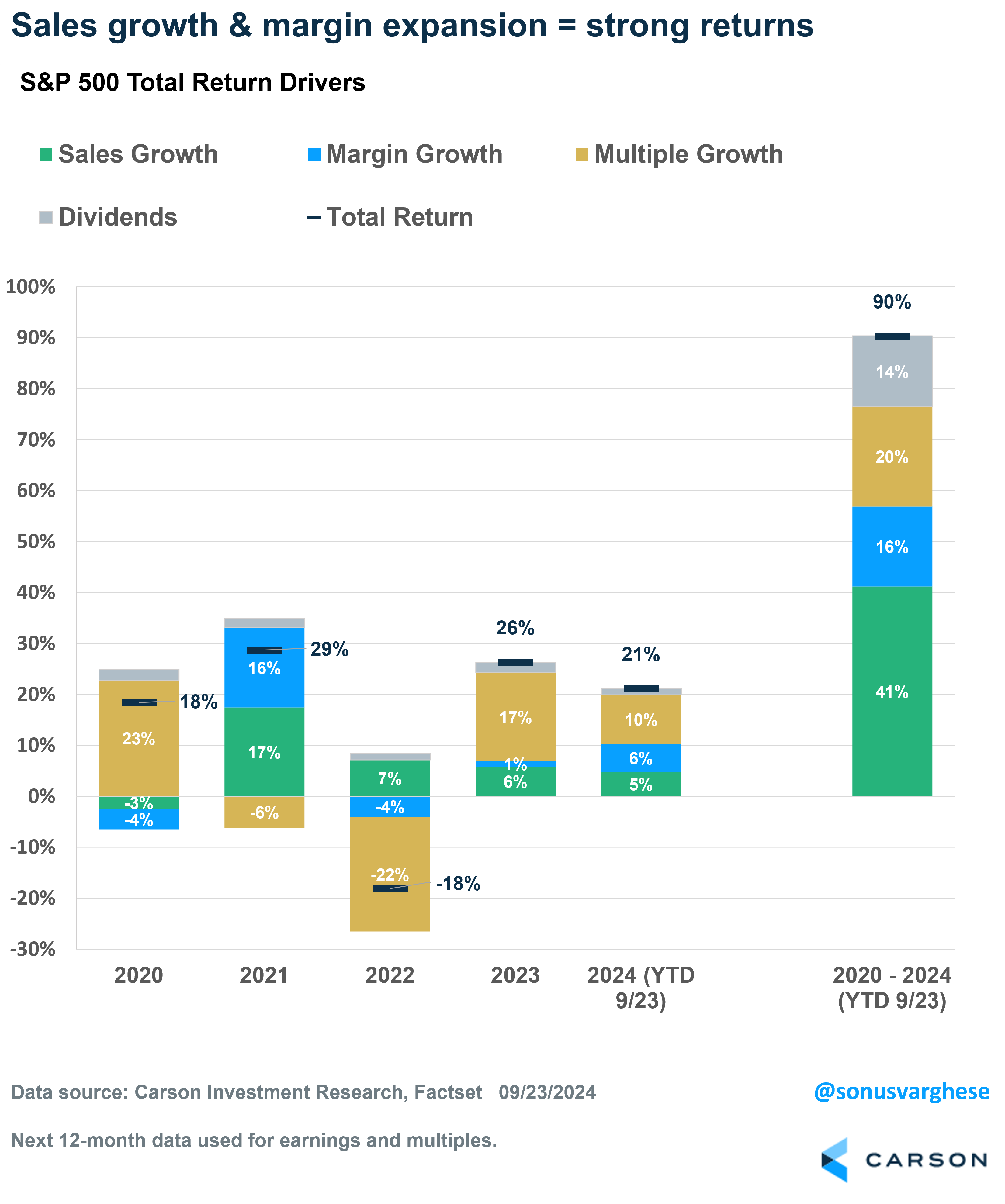

Diving back into attribution of S&P 500 returns, we can separate earnings growth into sales growth and margin expansion. I’m going to include dividends as well, to get to “total return.” Looking back at the prior record high for the S&P 500 on July 16, it was up 19.7% year to date back then, of which the contributions broke down as

- Sales growth: +3.8 %-points (pp)

- Margin expansion: +4.2 pp

- Multiple growth: +10.8 pp

- Dividends: +0.9 pp

Fast forward to this week, and the S&P 500 was up 21.1% year to date as of September 23. Here’s how the components added to that total return:

- Sales growth: + 4.8 pp

- Margin expansion: +5.5 pp

- Multiple growth: +9.6 pp

- Dividends: +1.2 pp

My colleague, Carson’s Chief Market Strategist Ryan Detrick, was on CNBC last week talking about how the Fed going with a big cut was actually positive for markets (so far that’s borne out). However, the anchor wondered if these were “sugar highs.” I’m not sure you can call these new record highs sugar highs, especially since they’ve come on the back of sales growth and even more so, margin expansion. In other words, strong fundamentals in the corporate sector are driving returns more than just positive sentiment. (They’re obviously correlated, but sentiment can swing wildly as we saw last month.)

Even the Last 5 Years Haven’t Been a “Bubble”

New record highs for equity indices always raises concerns, and we typically see questions or comments in the form “Is this it?”, or “Should we reduce exposure?”, or “Things look stretched!”. Ryan’s done some great work showing that new highs lead to more new highs, as momentum begets momentum.

But let’s broaden out the horizon. From the end of 2019 through September 23, 2024 (a quarter shy of 5 years), the S&P 500 is up 90%. Here’s how the various components contributed to that massive total return:

- Sales growth: +41 pp

- Margin expansion: +16 pp

- Multiple growth: +19 pp

- Dividends: +14 pp

The big takeaway is that 71%-points of the total return came from “fundamentals,” i.e. profit growth (sales + margin expansion) and dividends. Another lesson is that you shouldn’t ignore dividends — its contribution is almost as strong as multiple growth.

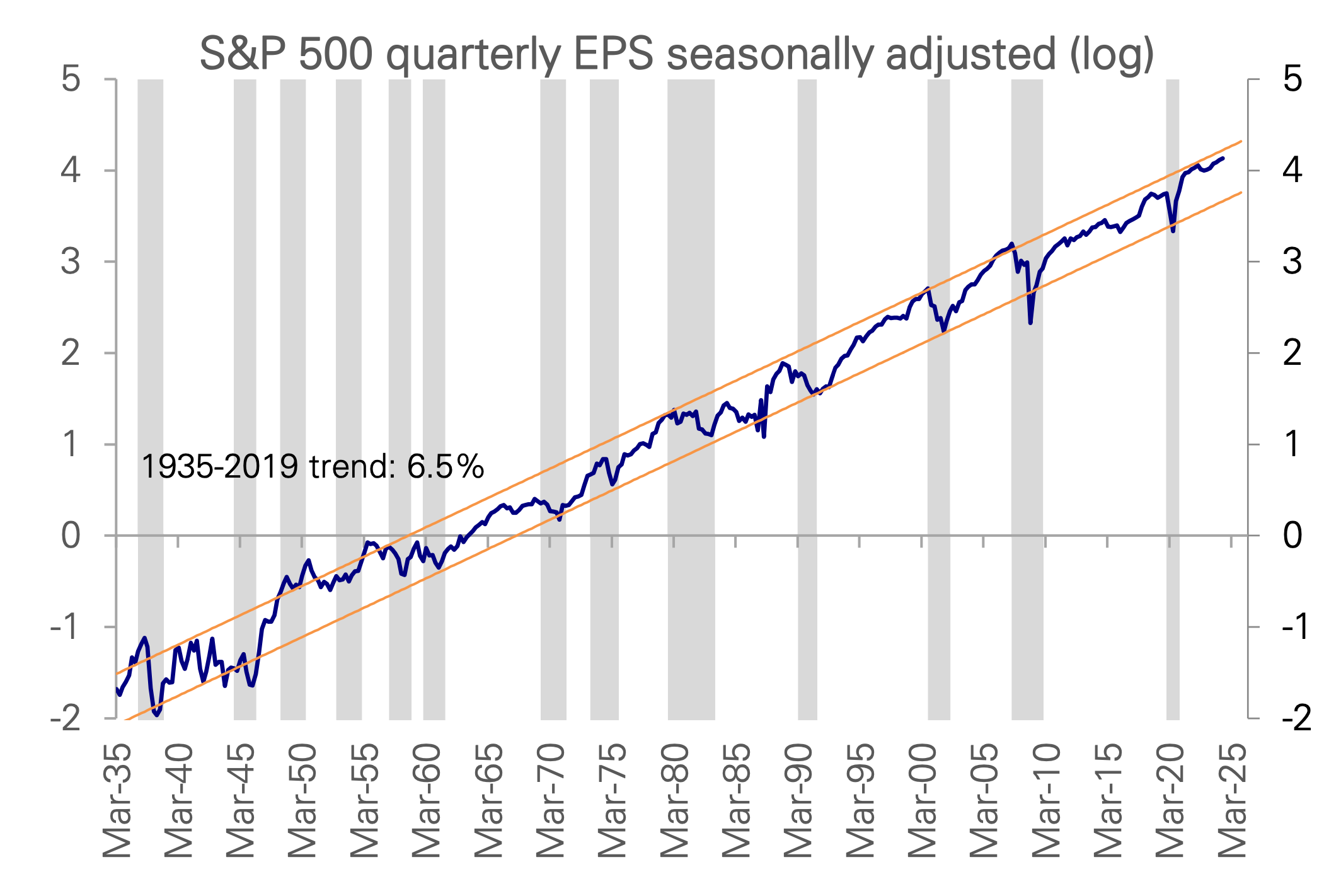

Now, as you can see in the chart below, in individual years we can see wild swings, especially if valuations pull far ahead (like 2020) or revert back (2022). But ultimately over the long run, it’s usually earnings growth that drives returns (and dividends). As our friend Sam Ro (who writes the Tker substack), says, earnings are the most important driver of stock prices. And earnings for US companies have been going up for a very long time, which explains why stocks have gone up. The main pullbacks in profits have occurred during recessions.

(Source: Deutsche Bank)

The good news is that we’re not in the middle of a recession now, nor is one imminent. And it looks like the Fed has cut the risk of one occurring over the next 6-12 months as well by signaling its intention to backstop the labor market. That’s a tailwind for profit growth, and markets. Ryan and I talked about the Fed, the economy, and therefore the outlook for stocks over the next several months, in our latest Facts vs Feelings episode. Take a listen.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02424995-0924-A