Last week I argued that the Federal Reserve (Fed) needs to “go big” sooner rather than later by starting their rate cut cycle in September with a 0.5%-point cut. Labor market risks are rising, and the August payroll data wasn’t really comforting from that standpoint. At the same time, the latest inflation data showed that the inflation fight was over. In short, risks to the Fed’s employment mandate are a lot higher than the risk of not achieving their “low and stable inflation” inflation mandate. Even if these risks were perceived to be “balanced,” policy rates are well above normal and so the case for normalizing sooner rather later seems clear. However, it looked like the Fed was poised to start cutting rates gradually, with markets penciling in a 0.25%-point cut at their September meeting with close to 85% probability as of Wednesday, September 11.

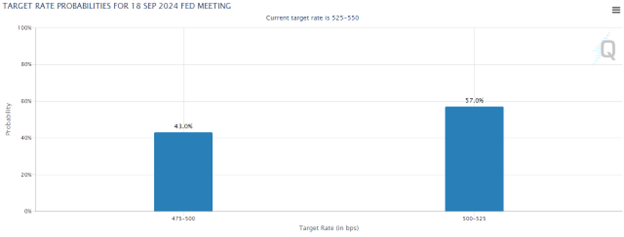

This was upended on Thursday, September 12. Famed “Fed Whisperer” Nick Timiraos (a reporter at the Wall Street Journal), wrote a piece laying out various arguments for a large cut by former Fed officials and even a former senior advisor to Fed Chair Powell. The signal was clear as mud: there’s no internal consensus at the Fed. It’s likely going to come down to Powell, who was the one Fed official who has not used language like “gradual” or “careful” in describing the path for policy. Instead, he’d said that the Fed wouldn’t tolerate further labor market weakening in his speech at Jackson Hole three weeks ago. As a result, the probability of a 0.50%-point cut jumped to over 40%, which is where it sits as of this writing.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

Does a Large Cut Signal Recession, and Hit Stocks?

There’s been a lot of handwringing over whether a large cut up front is risky and would adversely hit stocks. The argument is that it signals panic, and perhaps signals that the Fed knows something that the rest of us don’t. However, if anything has been clear over the last few years, it’s been that the Fed doesn’t have more information than the rest of us. Instead, a Fed that falls increasingly behind the curve as labor market indicators remain in a downtrend is likely to be more detrimental for stocks.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

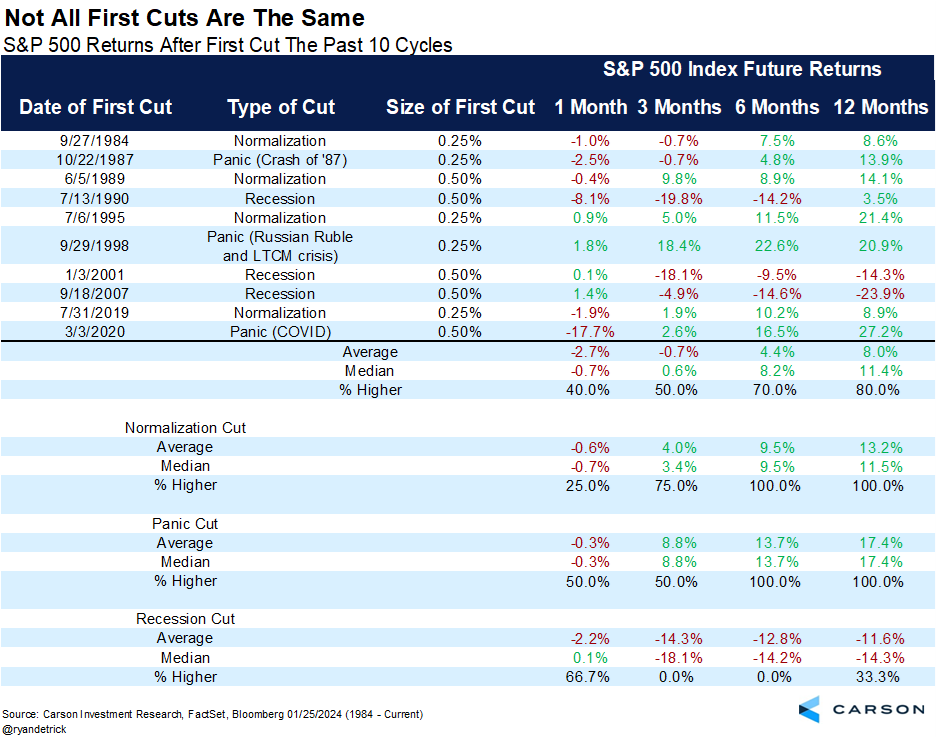

There’s also a concern that Fed “panic cuts” have historically signaled a recession ahead. My colleague, Carson’s Chief Market Strategist Ryan Detrick, put a chart together showing what stocks did after historical rate cut cycles began. Except for 1989, the 0.50%-point cuts all coincide with recessions – 1990, 2001, 2007, and 2020 – and stocks were hit over the next 3-6 months. But here’s the thing: in each of these cases, the Fed was well behind the curve and was playing catch-up. The economy was already in a recession, or close to one, by the time they began cutting rates.

- The 1990 recession started in July 1990 (the Fed went 0.50%-points in July)

- The 2001 recession started in March 2001 (the Fed went in January)

- The 2007 recession started in December 2007 (the Fed went in September)

- The 2020 recession started in March 2020 (the Fed went in March amid the Covid panic)

Take the “recession cuts” out, and stocks actually did quite well over the following 3-12 months.

The good news is that we’re not in the middle of a recession now, nor is one imminent over the next three months or so. It’s just that a Fed that falls behind the curve leads to rising recession risks 6-12 months from now. Subjectively, I’d say the odds of a recession are about 25%, certainly far from the base case, but it really depends on the Fed getting ahead of the labor market data.

Ironically, despite more uncertainty now about how the Fed will start this rate cut cycle, markets have responded well to the possibility of the Fed going big. Since the release of the Wall Street Journal article, the S&P 500 has risen over 1.2% (top panel in the chart below, via Bloomberg) and the Russell 2000 is up over 2.5% (bottom panel).

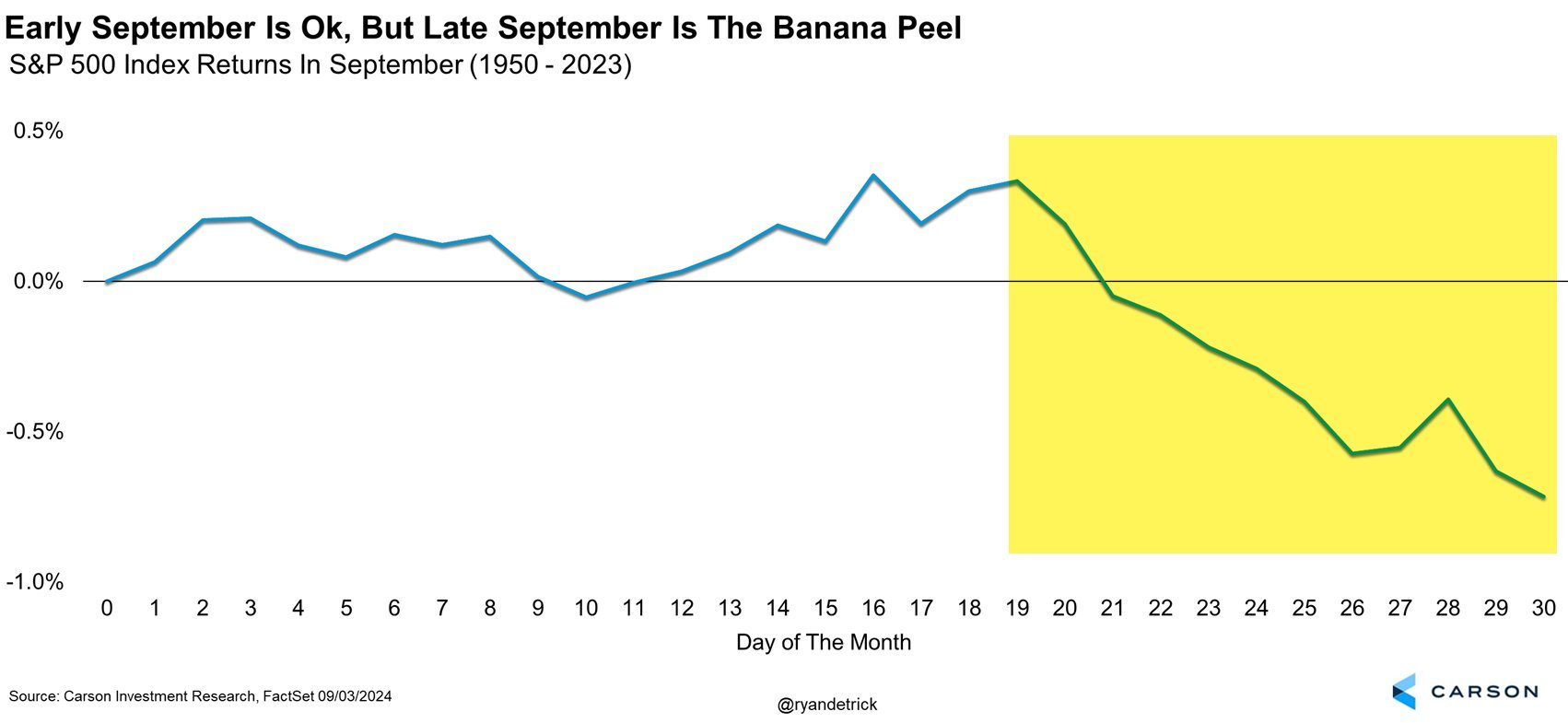

It’s early days yet, but the market doesn’t seem to be thinking about a 0.5%-point cut as a recessionary panic cut. Note that the second half of September can be volatile and is typically the weakest period for stocks. As Ryan likes to say, it’s the banana peel period for stocks. So, we could see some near-term volatility irrespective of what the Fed does, but that was always the case.

The Real “Dry Powder” (for the Economy)

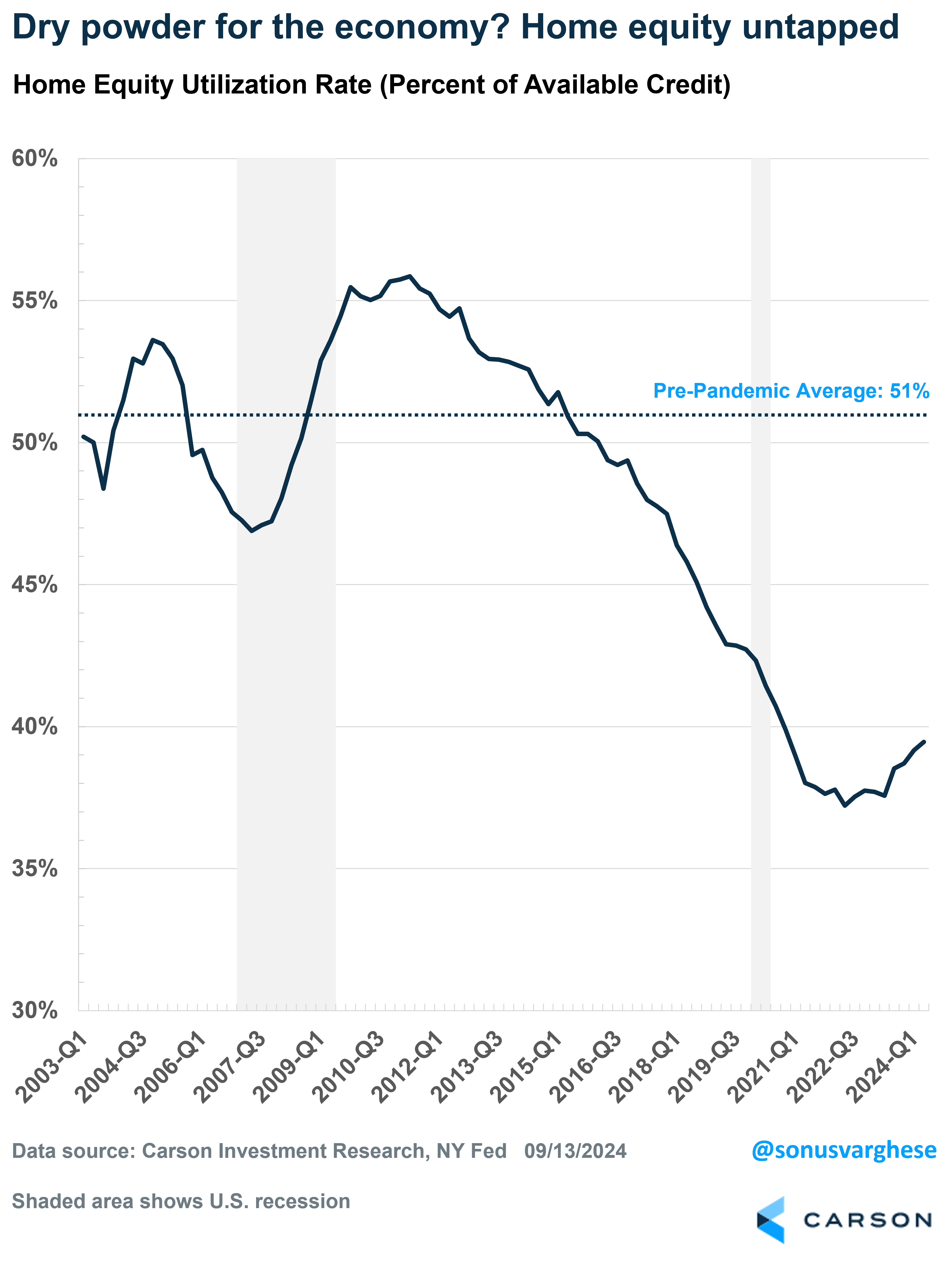

Another common notion is that markets price in rate cuts before they actually happen, and that’s true. For example, mortgage rates key off of 10-year Treasury yields, which in turn are impacted by rate cut expectations. However, the actual cut itself matters because it impacts the “prime rate” that goes into interest rate calculations for auto loans, home equity loans, and small business loans – which is why whether the Fed goes big or small matters.

Households are barely tapping into their home equity lines of credit right now – understandably, because while home prices have risen, interest rates are really high. Home equity “utilization rates” (which is the percent of home equity lines that have been accessed) are below 40%, well below the pre-pandemic average of 51%.

Even for those homeowners that currently have a home equity loan, their rates will immediately see a drop when the Fed begins to cut, which means more of their monthly payments will be going towards paying off principal, thereby improving their household balance sheets.

In a sense, this becomes real dry powder for the economy if lower rates prompt homeowners to start tapping into their home equity and increase spending as a result. And that’s going to be good for markets, because ultimately, profit expectations drive market returns, and profits come from the economy, which is primarily driven by household spending.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02408371-0924-A