Probably the top fixed income question we’ve received in 2023 is when it’s appropriate to begin moving bond allocations from ultra-short-maturity bonds and money market funds back into core bonds. Gauging by 2024 rate hike expectations, the answer is probably sometime around now.

The “perfect” time, assuming rates have peaked, was October 19 of this year, when the 10-year Treasury yield peaked at just under 5%, while the Bloomberg US Aggregate Bond Index (“Agg”) yield hit a high of 5.74%. The Agg still has a lot of ground to make up for 2021-2023 losses, but since October 19 it’s up 6.9% on a total return basis as of yesterday’s close.

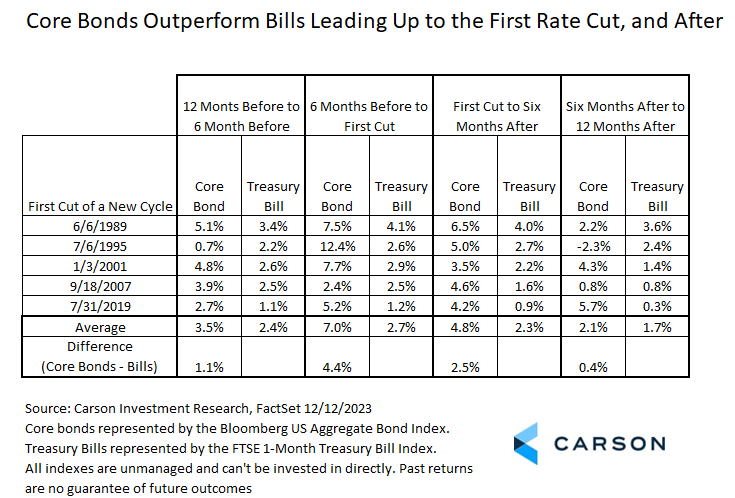

While yields may have fallen a little too far too fast, the timing of the rally is entirely normal and we believe it’s likely to continue, even if there may be some volatility along the way. As shown in the table below, historically, in the period from 12 months to 6 months before the first rate cut, core bonds (the Bloomberg US Aggregate Bond Index) outperform short maturity Treasuries (the FTSE 1-month Treasury Bill Index) by 1.1%, on average. It gets even better as you get closer to the cut, core bonds outperforming bills by an average of 4.4%. Outperformance slows down a little after the cut but continues in the year following the first cut.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Right now, market-implied odds signal the first rate cut is most likely to come at the May 2024 regular Federal Reserve policy meeting, with expectations of 4-5 rate cuts in 2024 overall. If expectations are right, or even a little aggressive, we are in that historical sweet spot of the six-month period prior to the first cut now. We would take market-implied expectations with a grain of salt and believe they may be a little aggressive but are still right in principle. We’ll find out more when the Fed’s December policy meeting concludes tomorrow, when we expect the Fed to push back at current expectations but only causing a moderate shift.

Carson Investment Research recently extended the maturity profile of our fixed income recommendation, moving it closer to the duration (a measure of interest rate sensitivity) of the broad Bloomberg US Aggregate Bond Index, which is a market-capped weighted index of investment-grade US Treasuries, mortgage-backed securities, and corporates. We do continue to prefer stocks to bonds based on our positive outlook for the US economy in 2024. But as inflation continues to decline, we think core bonds will increasingly return to their traditional role as a portfolio diversifier and ballast against potential stock losses while still offering an attractive yield.

For more of Barry’s thoughts click here.

02020671-1223-A