As we noted yesterday, 2023 is off to a great start for stocks, especially when compared with what we saw in 2022. Well, here’s another potentially bullish development that just triggered.

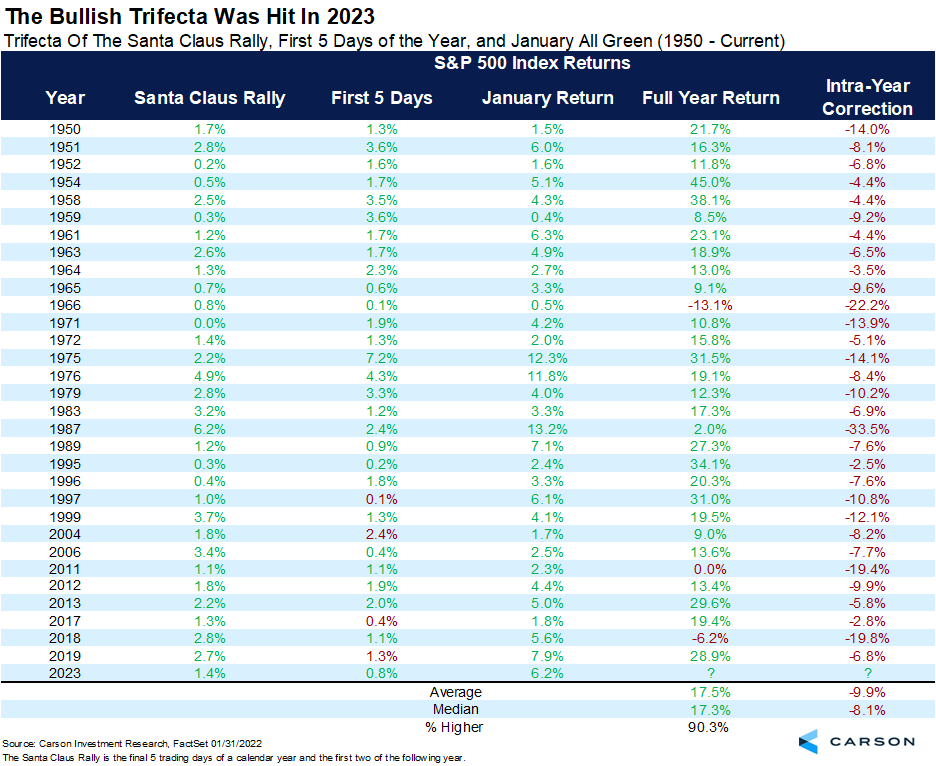

I call it the Trifecta of Bullishness. Yes, I made it up, but I like it. Stocks were up nicely in January, we know that. But the S&P 500 also gained during the normally bullish Santa Claus rally period (the last five days of the year and first two of the new year), along with adding 0.8% the first five days of the year.

It turns out that, historically, when all three of these are hit in the same year, the future returns are quite strong. In fact, the full year has gained 17.5% on average and closed the year higher more than 90% of the time. 1966, 2011, and 2018 were the only years out of 31 that closed in the red. Taking things one step further, the S&P 500 saw a peak-to-trough correction of nearly 10% at some point on average during those years, compared with nearly a 14% peak-to-trough in your average year. So, returns were stronger and there was less volatility; not a bad combo.

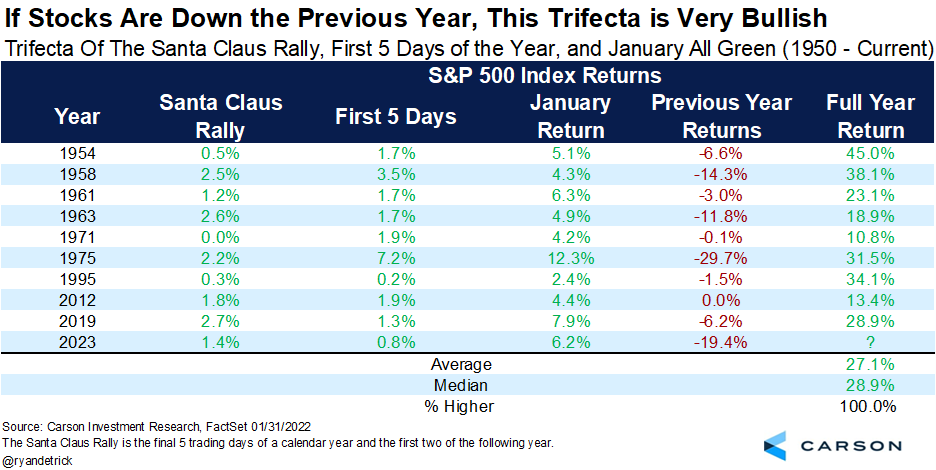

This is just one bullet point, I concede, but when layered on top of the others we’ve noted in the past few months, we continue to think 2023 has the potential to be better for the bulls than most are expecting. What happens after a Trifecta of Bullish on the heels of the previous year in the red, you ask? Incredibly stocks gained the full year every time (9 for 9), and the full year added more than 27% on average. We aren’t expecting stocks to gain that much in 2023, as we are on record of looking for between 12-15% this year, but this study does little to change our optimistic outlook.

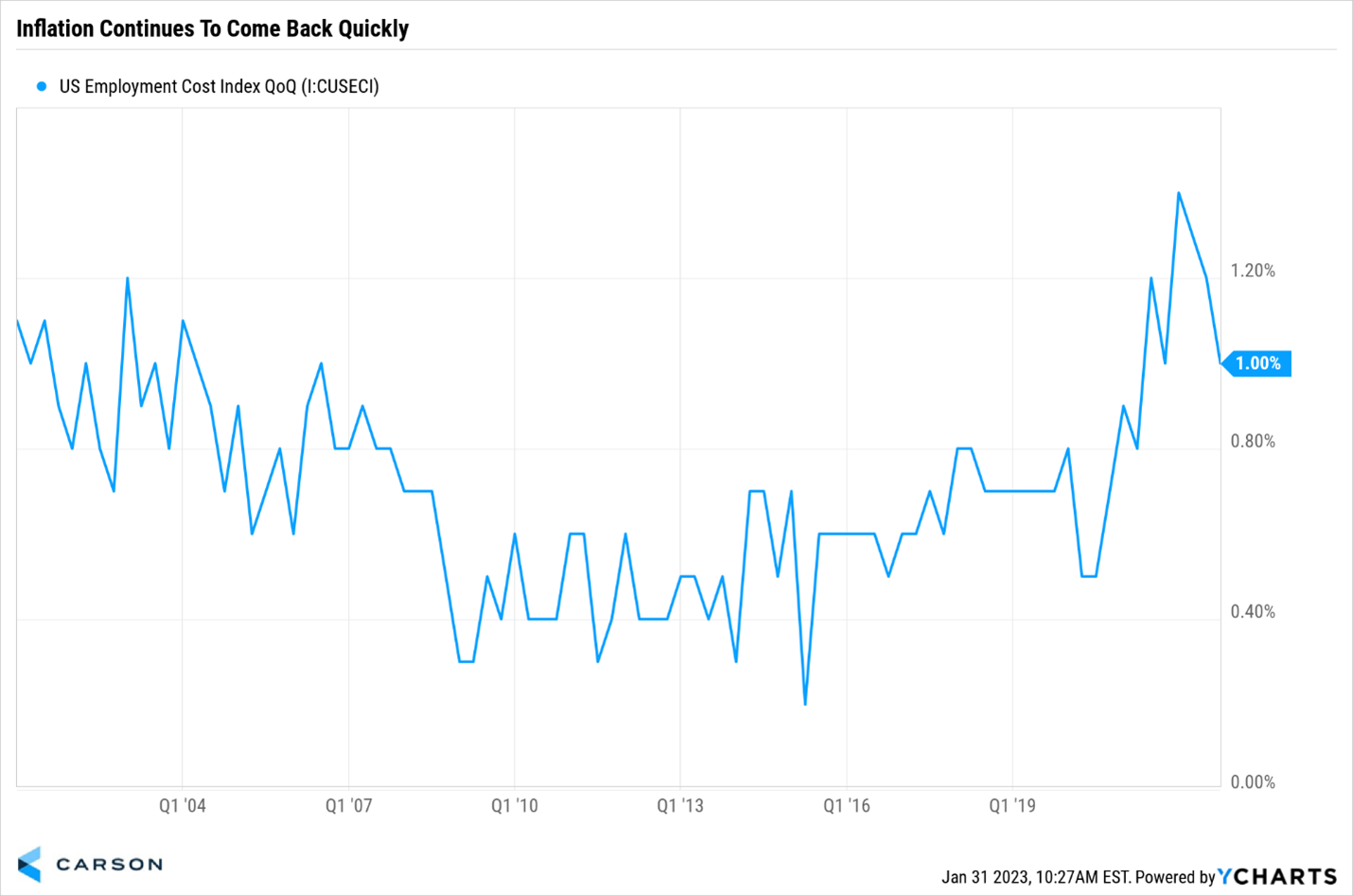

I will leave on this, one of the big worries from the Fed has been wages. If wages stay high, we could be looking at a 1970s style of higher for longer inflation. Yesterday, the Employment Cost Index (ECI) fell to only an increase of 1% in Q4. This was lower than expected, and now three consecutive quarters of declines (the longest quarterly decline streak since late 2004).

Why does this all matter? It shows inflation is indeed showing signs of being under control, which means the Fed is increasingly likely to end its historically aggressive series of rate hikes sooner. Fed Chair Jerome Powell was on record as wanting to see the ECI trend lower and that is exactly what we are seeing now. The Carson Investment Research team increased our view on equities to overweight in late December for a myriad of reasons, but one of the main ones being lower inflation could be a bullish catalyst in 2023.

For more of our thoughts on the strong start to the year, inflation, the economy, the Fed, NFL referees, and more, please be sure to listen to our latest Facts vs. Feelings podcast. In case you aren’t listening, I do this fun weekly podcast with Sonu Varghese and you can listen wherever you get your podcasts.