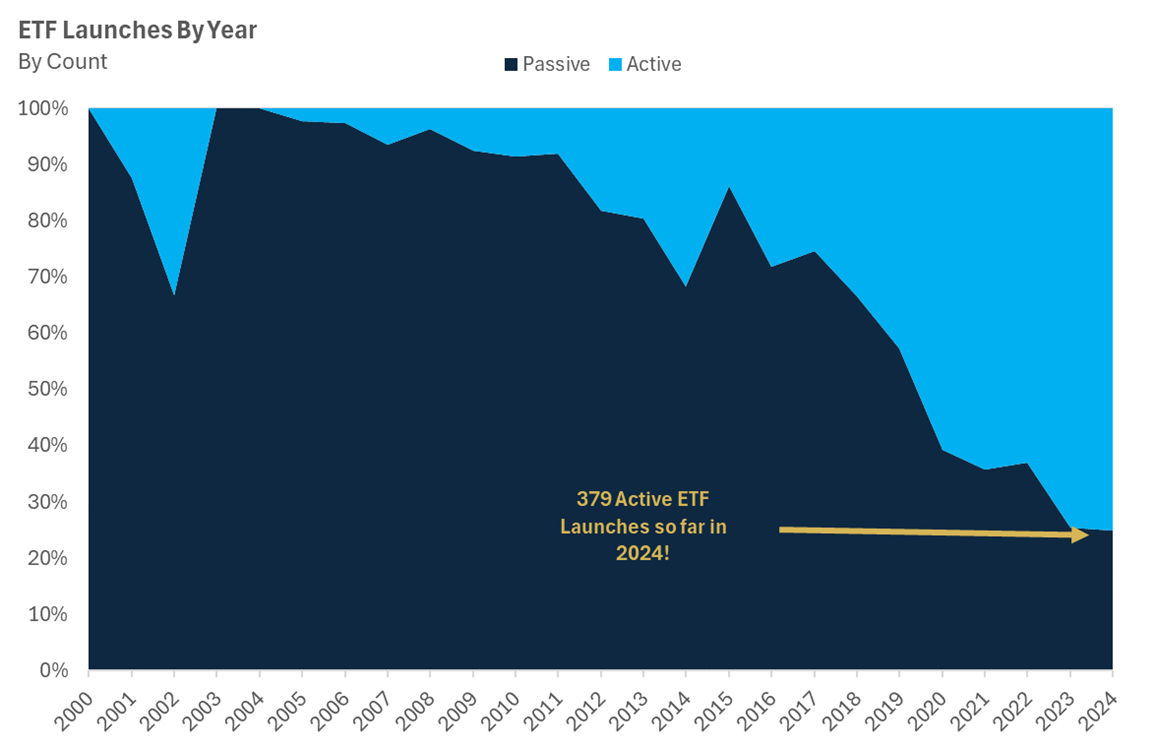

United States Exchange-Traded Fund (ETF) assets just hit $10 Trillion for the first time. That is still around half of the assets in traditional open-end mutual funds but the gap is closing quickly. An increasingly larger part of this growth is coming from active ETFs, which have accounted for roughly a third of ETF inflows year to date. More so, ETF launches have become increasingly dominated by actively managed products — since 2020, the number of active ETF launches have averaged over 2/3 of all ETF launches. 75% of the more than 500 ETF launches in 2024 have been active so far, the most on record in any given calendar year.

Sources: Morningstar, Carson Investment Research 9/30/2024

No Longer Just Passive Indexes

The recent surge in active ETF launches comes for a variety of likely reasons. First is the ability to launch active ETFs more easily and create custom creation/redemption baskets due to updated regulations in recent years. Additionally, the asset-gathering success of several large active ETFs in fixed income, US equity, and derivative strategies has likely led other asset managers to attempt to duplicate their success, or at least re-think their approach to product launches. I also do believe that investor thinking regarding active vs passive has changed. ETFs are no longer viewed solely as passive index tracking instruments, but are widely being accepted as the more efficient investment vehicle.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

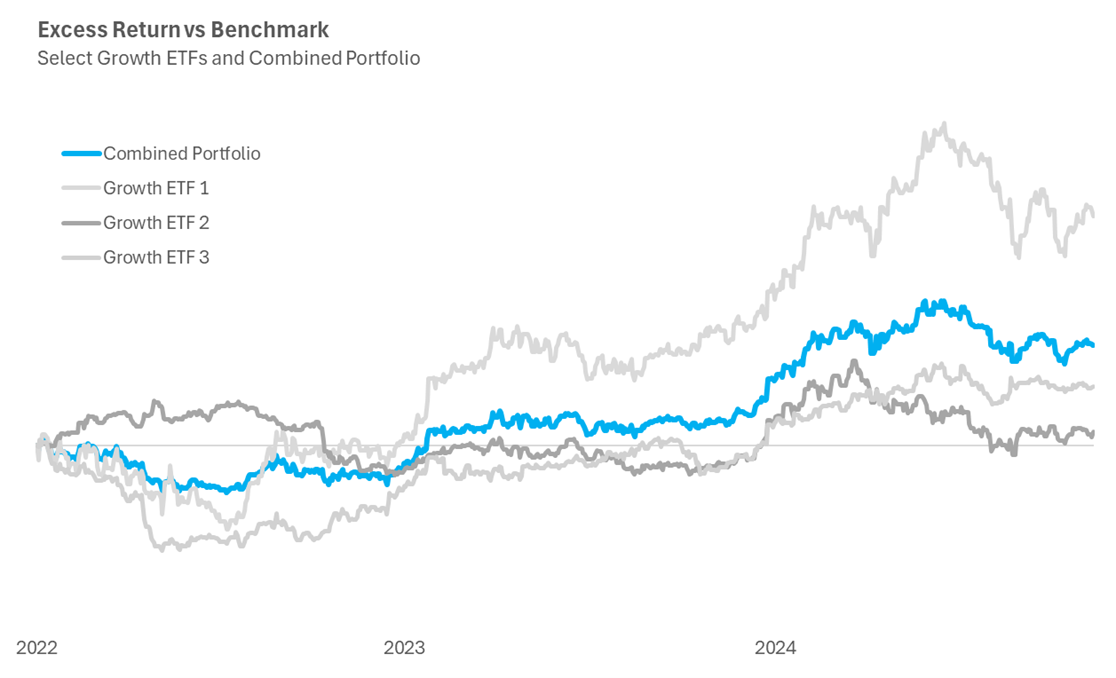

Perhaps most importantly, ETF issuers are increasingly bringing their best ideas and managers into the ETF wrapper. Traditional mutual fund managers are opening up to the efficiencies of the ETF wrapper and getting comfortable with the operational processes and holdings transparency options (whether fully or semi-transparent). This originally occurred in fixed income, as many active strategies have come to market and done quite well in aggregate relative to their applicable benchmark, as can be seen in the chart below.

Sources: Morningstar 9/30/2024

More and more active equity strategies are coming to market and showing promise. While there is limited history for many, we are seeing portfolio managers adapt to the structure and take advantage of the lower fee structure and tax efficiency of the ETF wrapper to deliver exceptional value for investors. While in aggregate only about a third of active US Equity ETF managers have outperformed benchmarks over the past couple of years, the top performing fund (ETF or traditional mutual fund) has been an active ETF in the massive Large Blend, Large Value, and Mid-Cap Growth categories. Proper due diligence is just as key in the ETF wrapper as it is in a traditional mutual fund to find the best actively managed strategies.

The Carson ETF platform has a higher percentage of active outperformers than the broad universe over all time frames covered here.

Combining Manager Alpha does NOT Give You the Benchmark

One additional consideration when thinking about active ETFs resides in the allocation decision. Taxes aside (yes, I know that is a big thing to set aside), allocation costs in ETFs can come with less friction than mutual funds — no transaction costs, intraday tradability, low investment minimums (cost per share), and just one share class. While always choosing the best active ETF would be a great outcome, no level of due diligence can give that kind of information in advance. When combining strong active ETFs together, they each can bring their own less-correlated levels of alpha, and instead of diluting your portfolio and getting an index return, you can actually take advantage of each manager’s expertise and deliver a smoother ride with a strong result. The chart below shows exactly this for select growth ETFs (all on the Carson platform) in recent years.

Source: Carson Investment Research, Morningstar 10/2/2024

Returns are shown above or below the category benchmark. The underperforming ETFs in 2022 become outperformers over the entire period. The end result of the combined portfolio is outperformance of all but one of the ETFs, and a smoother ride through the process. This is something we consider in our Mission Asset Class Models and can be applied to a variety of asset classes. Fixed income, for example, will generally have a tighter range of excess returns, but focusing on combinations of managers with different areas of asset class or management expertise (duration, credit, mortgages, etc.) can be additive. The key is to find complementary alpha that has relatively low correlation with the other strategies.

With tens of trillions of dollars still in actively managed mutual funds, it is hard to see the growth of actively managed ETFs slowing down any time soon. As we approach the end of the year, capital gains payouts — notoriously high in active mutual funds due to the structure — will likely precipitate this process for both investors and asset managers alike. A nuanced proposal by 30 different active managers to add an ETF as a separate share class of an existing mutual fund (a patent previously owned by Vanguard) bears close watching and could potentially change the makeup of the industry if approved. The fourth quarter will likely send 2024 to a record year for ETF launches, active launches, and ETF inflows.

For more content by Grant Engelbart, VP, Investment Strategist click here.

02441205-1001-A