“There are no gains, without pains.” – Benjamin Franklin

Incredibly, many strategists and economists continue to say we are headed for a bear market and a recession in ’24. That’s right, it is Outlook season and some of the forecasts for ’24 have been quite dour. The good news is we’ve been hearing this from the same crowd for well over a year now and things continue to chug right along. Also, I want to make sure you read the amazing blog Sonu Varghese, VP, Global Macro Strategist did yesterday on the consumer. In fact, a few things I discuss today he covered there as well, but his blog is simply amazing.

Here’s a list of things you usually don’t see in a recession.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

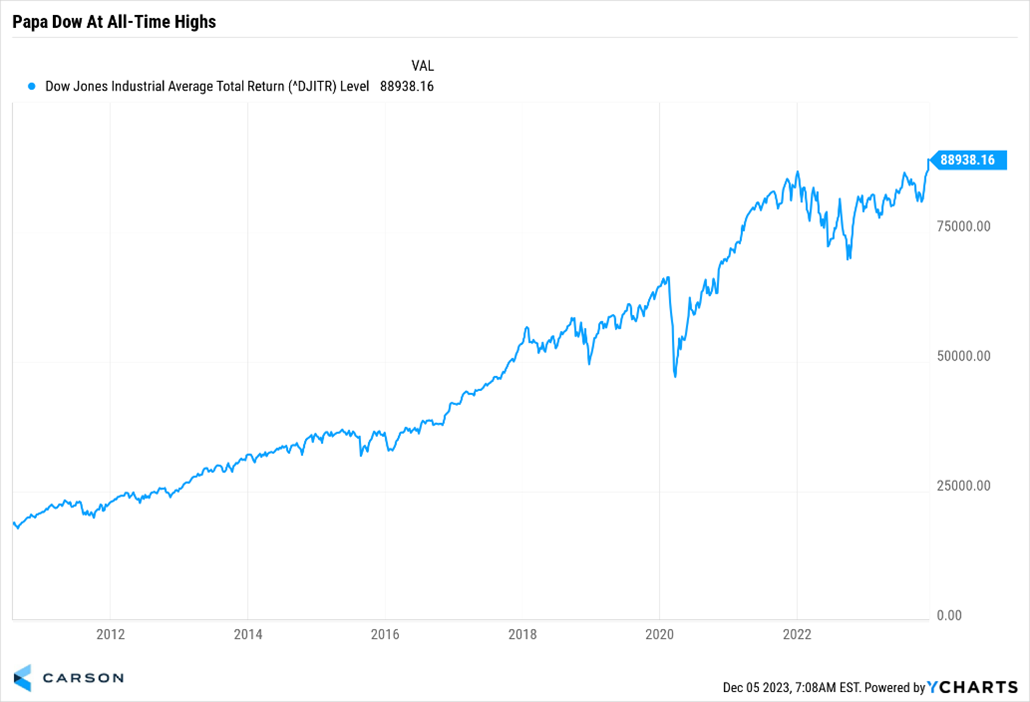

Stocks at All-Time Highs

Stocks lead the economy. It works on the way up and the way down. We have various indexes closing in on new all-time highs, but one of the most important indexes in the world is already at new highs. That’s right, the Dow (on a total return basis) just made a new all-time high. To us, this is the market’s way of saying the economy likely will be much stronger next year.

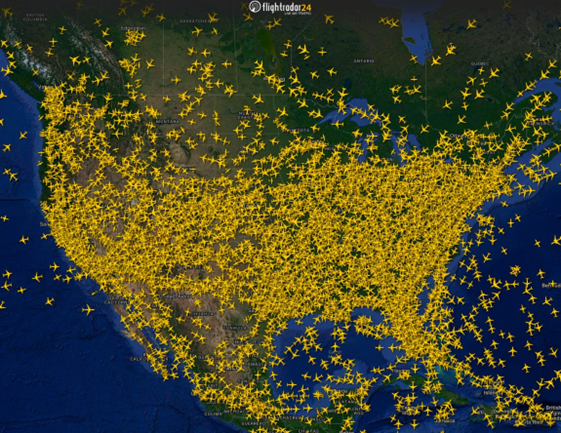

People Traveling and Spending, a Lot

The Sunday after Thanksgiving saw a record number of travelers according to the TSA. In fact, 2.9 million travelers passed through airports. Even more impressive is more than 90% of all flights were on time. It is hard to think consumers are pulling back on spending and worried about the economy starting to slip when they are traveling like never before.

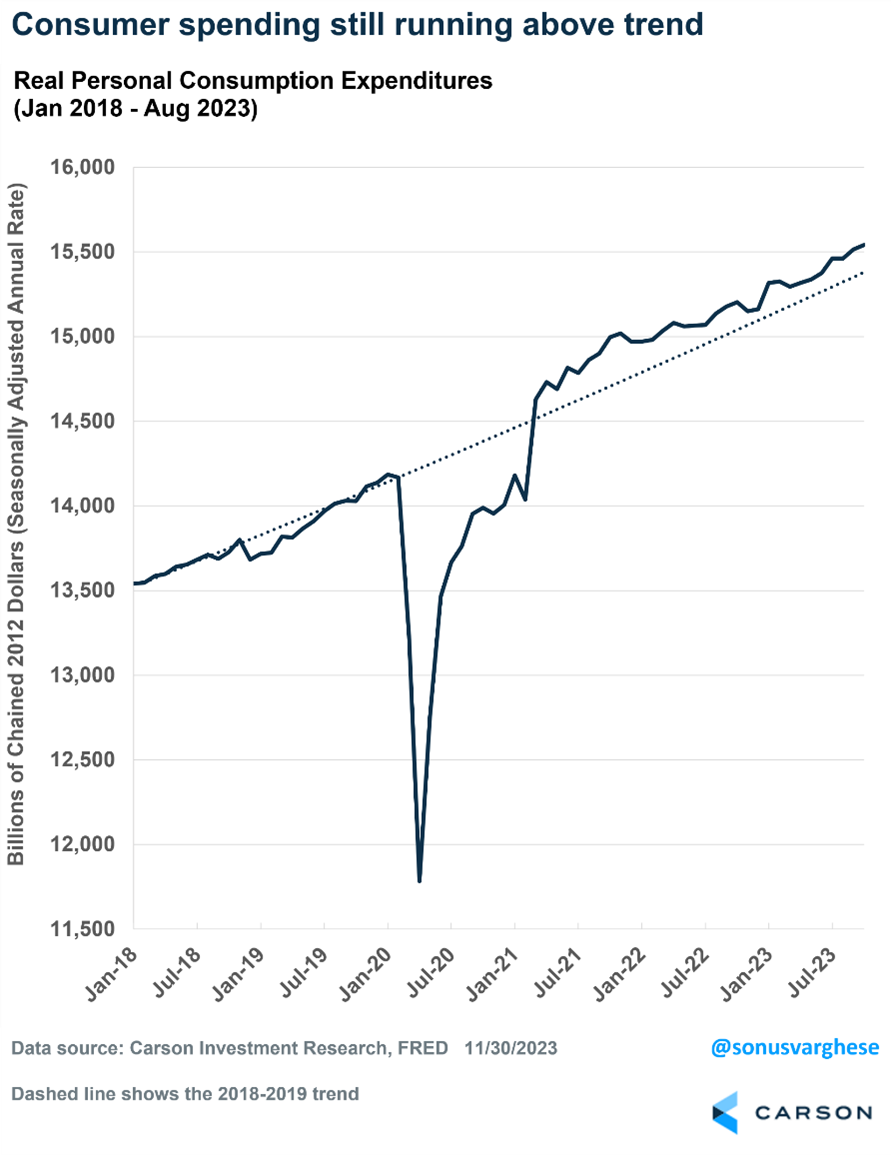

But consumers aren’t just buying airplane tickets, they are spending on many other things. People might complain about things, but that isn’t stopping them from taking that trip, driving their new $80,000 SUV, or updating their house. Here’s a nice chart that shows consumption is still running above the pre-COVID trend. That doesn’t look like a recession to me.

Consumers Are in Much Better Shape Than the Media Claims

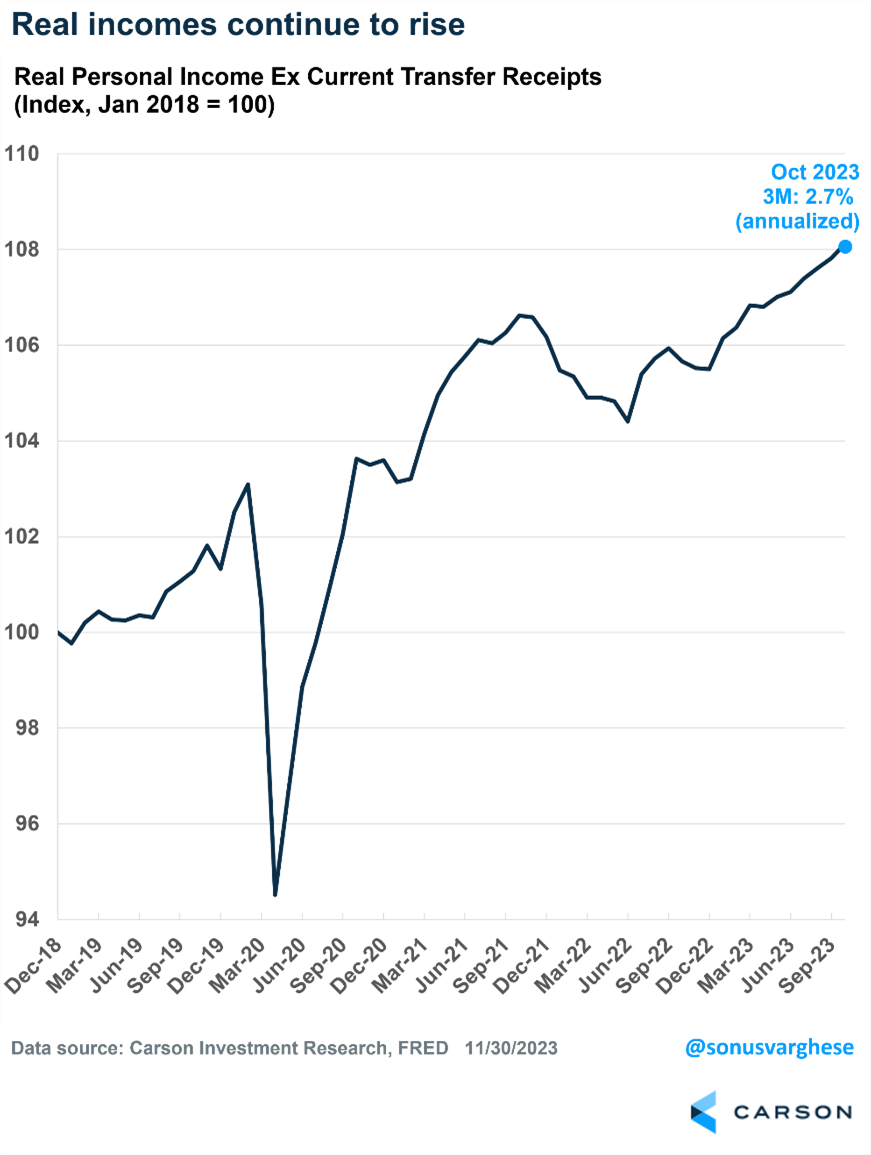

All we hear about is how bad the consumer is doing and they will be tapped out soon. Fortunately, if you take the time to look at the actual data that isn’t the case. Would you believe real incomes are at an all-time high? Given consumers make up close to 70% of the economy, this bodes well for continued spending.

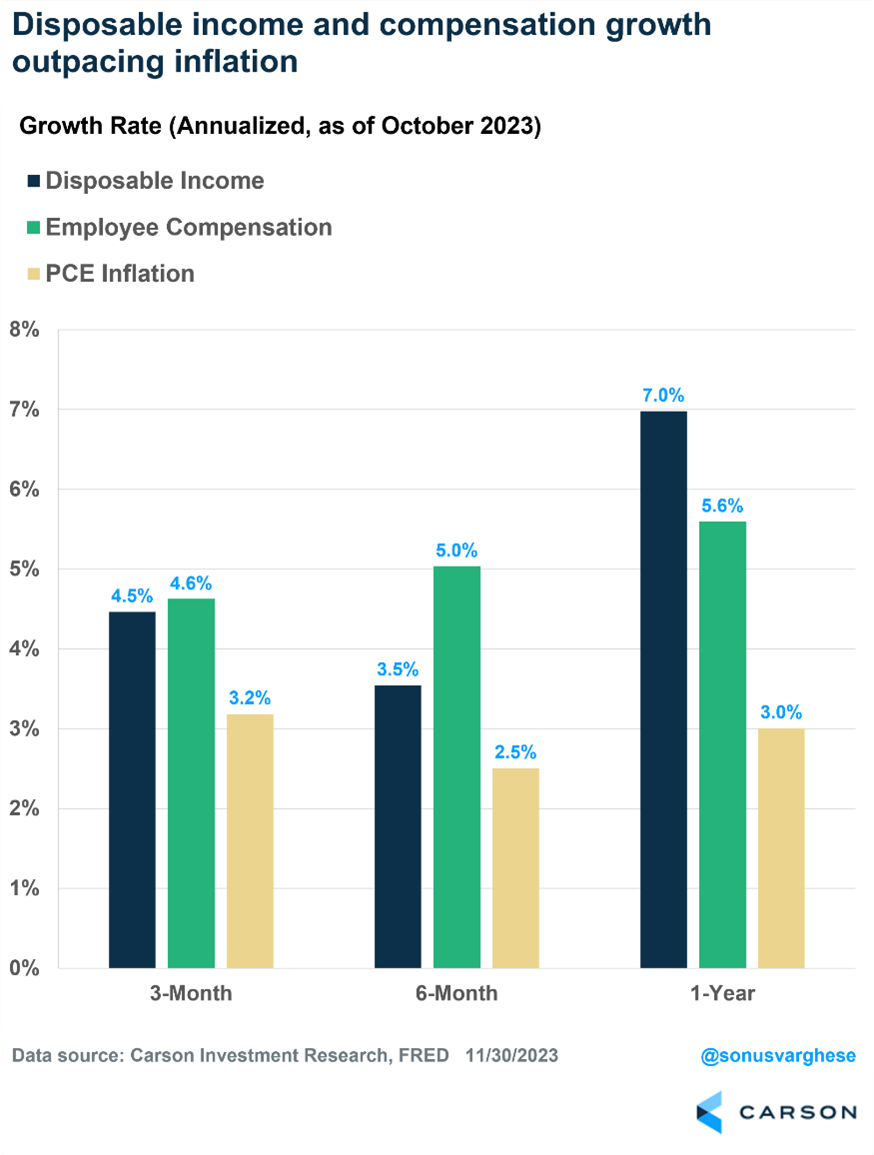

We hear every day that things cost more and this is absolutely true, most products and services cost more than they did a few years ago (in many cases, a lot more). But what we rarely hear about is incomes are up a lot too, in fact, more in most cases. Even if prices might be higher, here’s a great table that shows that most people are making more over the past few years as well.

Manufacturing Is Much Better Than the Headlines

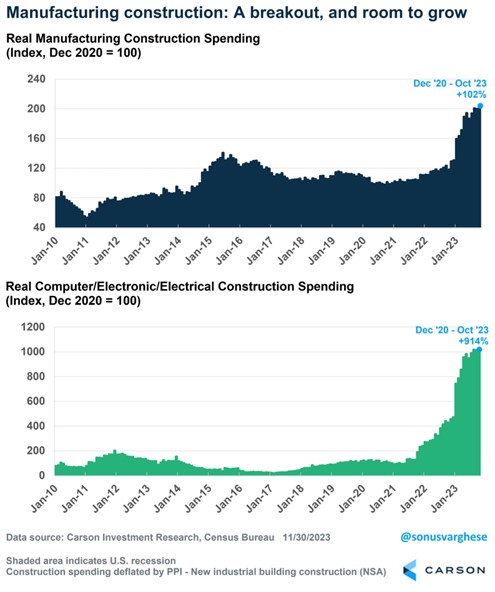

We continue to see manufacturing surveys tell one story, while the hard data tells a much different story. It is so impressive how strong parts of manufacturing have been, with real manufacturing construction at an all-time high and up more than 100% (on an inflation adjusted basis) the past three years and high tech construction spending soaring, up more than 900% the past three years.

Yes, a good deal of this is due to the CHIPS Act and other fiscal policy decisions, but that doesn’t mean it has to be bad or can’t work. Just imagine what productivity might do over the coming years as the benefits for all this manufacturing construction is felt. We think this is a huge story going into the future and this isn’t something you’d expect to see if a recession was near.

Lastly, let’s say the consumer slows some in ’24. We could see a scenario where manufacturing improves significantly next year, along with a big bounce in housing should rates pull back. Clearly housing has been a headwind to economic growth and manufacturing overall hasn’t added to growth much. Strength in these areas could potentially help offset any mild slowdown from consumers.

Consumer Balance Sheets Appear to Be the Best They’ve Ever Been

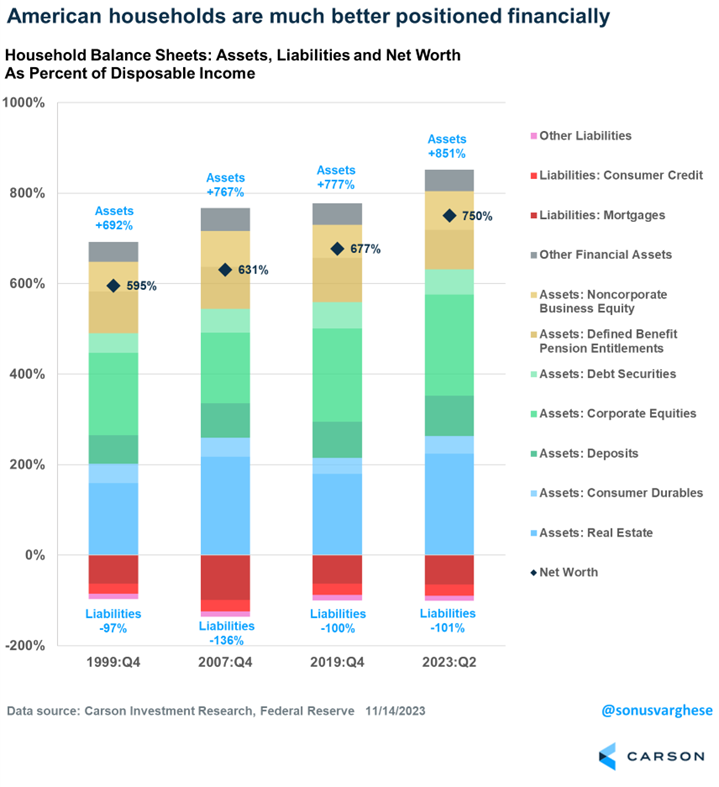

This take will upset many people, but balance sheets for households are much better than they were before the pandemic in many cases and very well could be in the best shape ever. Yes, debt is higher in places, but what is conveniently left out is net wealth. The improvement in housing prices has quietly created enormous wealth, while stocks have had a tremendous run as well. If someone owned a house and some stocks the past few years, they’ve likely substantially increased their overall net worth.

Here’s a great table that shows just that. Assets are as high as they’ve ever been, while liabilities are near the same levels they’ve been for decades. We broke this down as a percent of disposable income to keep it consistent, but it tells a story you won’t hear on the nightly news and likely says no recession is coming in ’24.

I was honored to join my friend Brian Sullivan last Friday night on CNBC’s Last Call to discuss why we’ve been bullish, still are bullish, and why we don’t believe a recession is likely in ’24 (hint – many of the same things I just wrote in this blog).

For more of Ryan’s thoughts click here.

2012894-1223-A