If you’re wondering what the investment is, I’m referring to stocks. More specifically, US stocks. At Carson Investment Research, we just moved our longer-term strategic asset allocations to their maximum equity overweight. Stocks may very likely gain 75-100% cumulatively over the next 5 years, which is 12-15% annualized.

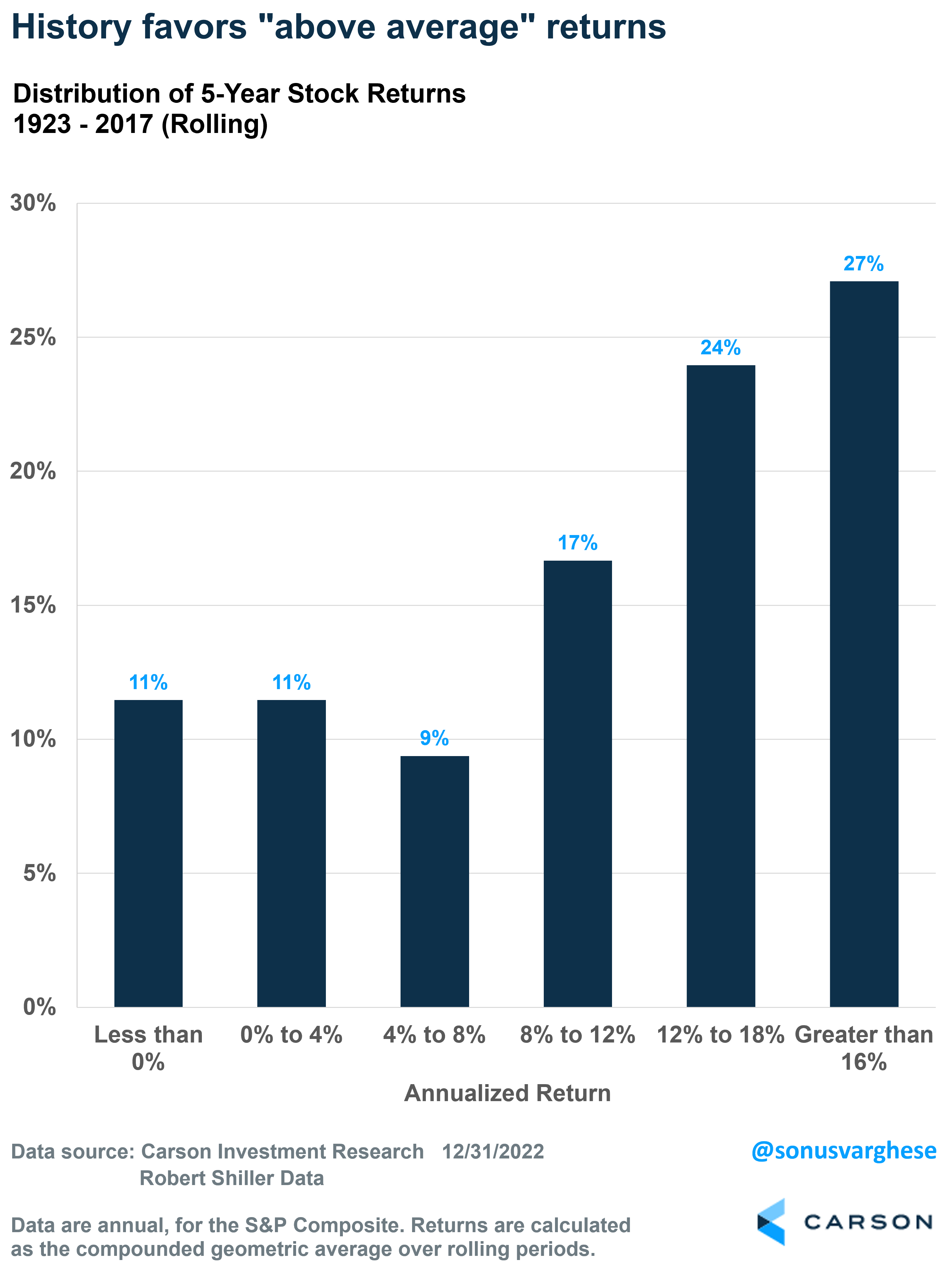

If you look back at history, the average return over rolling five-year periods from 1923 through 2017 is about 11% (before inflation). However, in 49 out of the 96 five-year periods (51%), returns were higher than 12% annualized, i.e. greater than 75% overall for the entire 5-year period through the power of compounding. In fact, returns were under 8% in only 31 periods (32%).

However, that’s the past, and while it’s a reasonable guide for what could happen in the future, we believe there are few things that tilt the odds further towards above average returns in the future.

The 2020s – America Rising

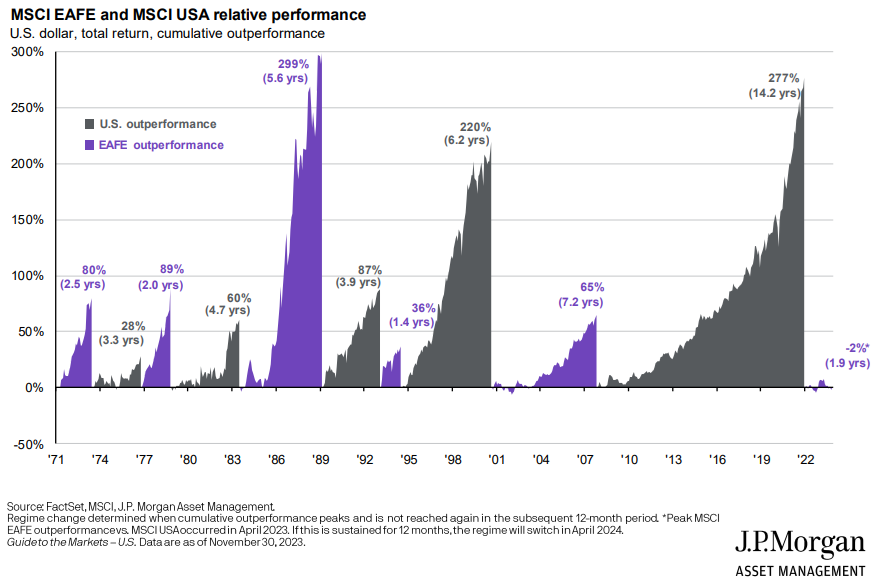

It may sound weird to suggest that the 2020s will likely be the American decade, especially from the perspective of the stock market. U.S. stocks vastly outperformed international stocks over the prior decade, and as this chart from J.P. Morgan illustrates, these periods of outperformance tend to go back and forth. So, it wouldn’t be unusual to expect a reversion. But we’re going against the grain here.

Over the last year and a half, the economy has defied multiple forecasts of a recession, overcoming an aggressive Federal Reserve tightening cycle amid the highest inflation in 40+ years. Ryan and I have written a lot about this, with economic resilience coming on the back of strong household balance sheets and solid income growth.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

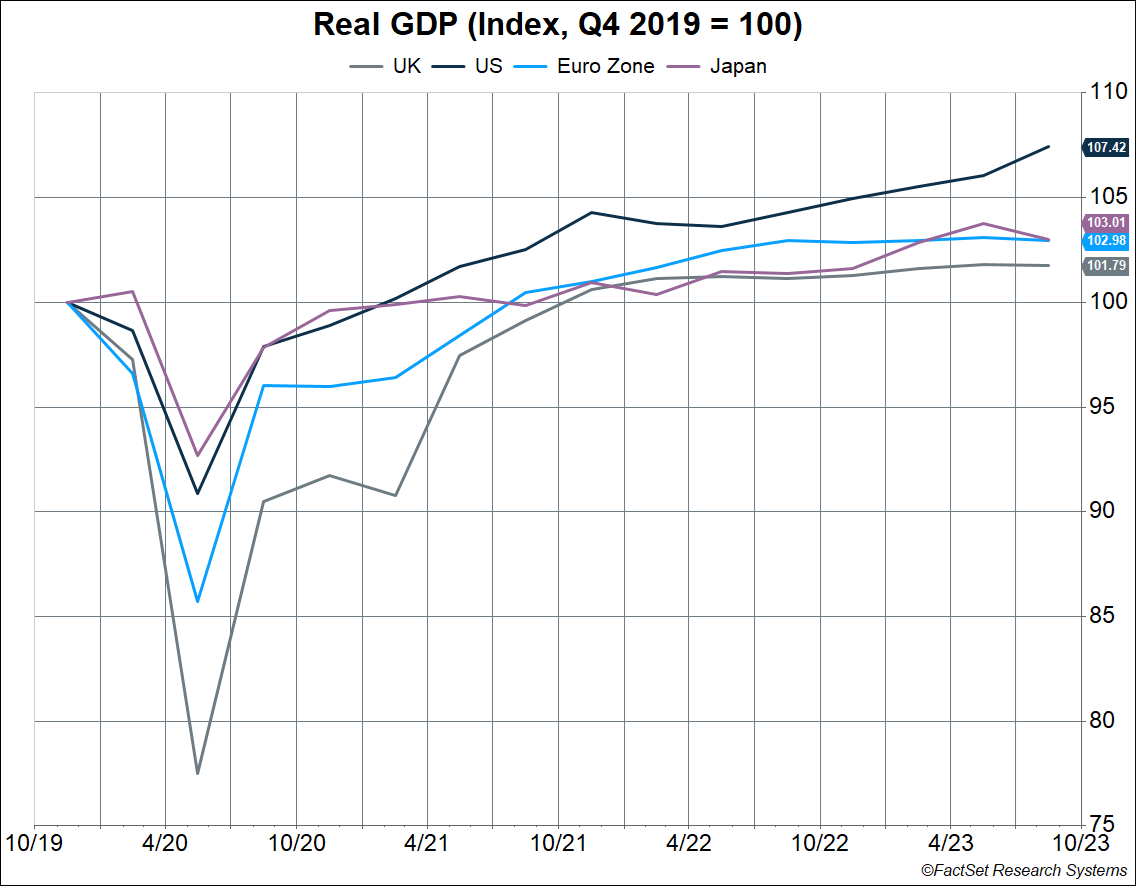

The economy seems poised to grow around 2.5-3% in 2023 after adjusting for inflation, which would be above the trend we saw between 2010 and 2019. That is remarkable, especially given the massive headwind of surging interest rates. No wonder the consensus has shifted away from recession calls, though several outlooks from other shops suggest middling growth in 2024. The US has now raced ahead of other developed markets when looking at economic growth since the pandemic – the economy is 7% larger in real terms, versus 3% or less for its peers.

We remain in the camp that the economy will avoid a recession but take a different view on what the drivers of economic growth will be, emphasizing the upside from productivity growth. That view makes us optimistic on the expansion continuing in 2024, and even beyond. There’s been a lot of buzz around generative artificial intelligence (AI) this year. Our view is that the watershed moment for this technology is not about what it can do for us right now, even if it has the power to unlock enormous potential down the road, but the environment that allows generative AI and other transformative innovations to flourish. Part of this also involves a reshoring shift to the US, boosting domestic investment, which is why we believe America will outperform its developed market peers.

Productivity growth can’t be created on demand, and there are environments that foster it — for example, by incentivizing investment, encouraging competition, and protecting property rights. That’s what’s created the environment that has given us generative AI, which itself can then seed additional productivity growth in the future.

2023 was the year of normalization, and all the investment over the last couple of years (including labor, which is businesses’ largest investment) is bearing fruit, and productivity is accelerating. Over the last two quarters, productivity growth rose at an annual pace of over 4.4% — the fastest two-quarter pace since the late 1990s outside of recessions and immediate post-recession periods.

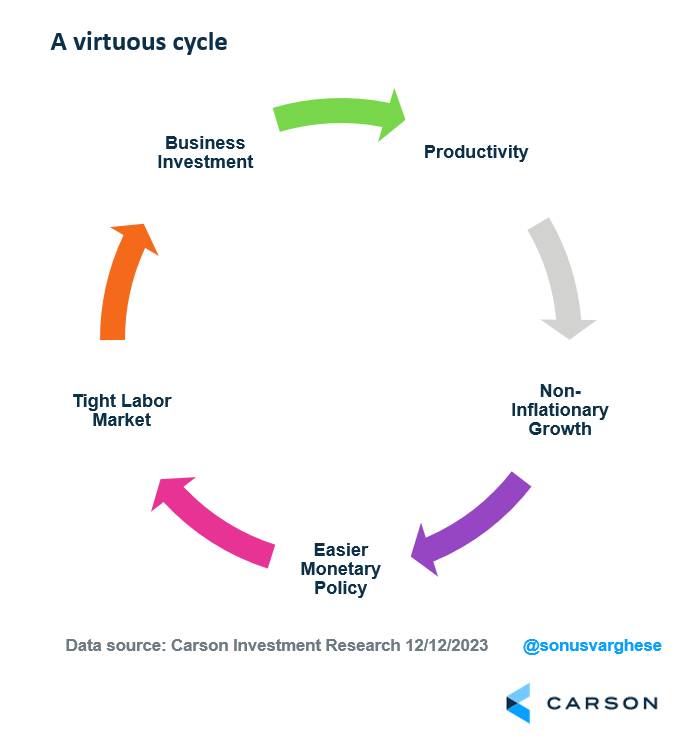

In a previous blog, I discussed why this is a big deal for the economy, inflation, and monetary policy. Long story short, if you have higher productivity, you can have strong wage growth with relatively low inflation. This can create a positive feedback loop between monetary policy and productivity. Strong productivity growth that is accompanied by low inflation could lead to more expansionary monetary policy. That could lead to greater investment and a “tighter” labor market with low unemployment and faster wage growth. This could in turn fuel further productivity growth, and signal to the central bank that it can keep rates low.

This is essentially what happened in 1995, with then Fed Chair Alan Greenspan choosing to reduce interest rates despite strong wage growth. He bet that productivity would increase due to technological breakthroughs and prior breakthroughs gaining traction, and he was right. Part of it was also because expansionary policy led to tight labor markets that boosted productivity further.

We could be in a similar situation right now, with tight labor markets leading to productivity gains rather than inflation. Increased business investment could also push profits higher, boosting equity market returns above the historical average.

What’s the Risk?

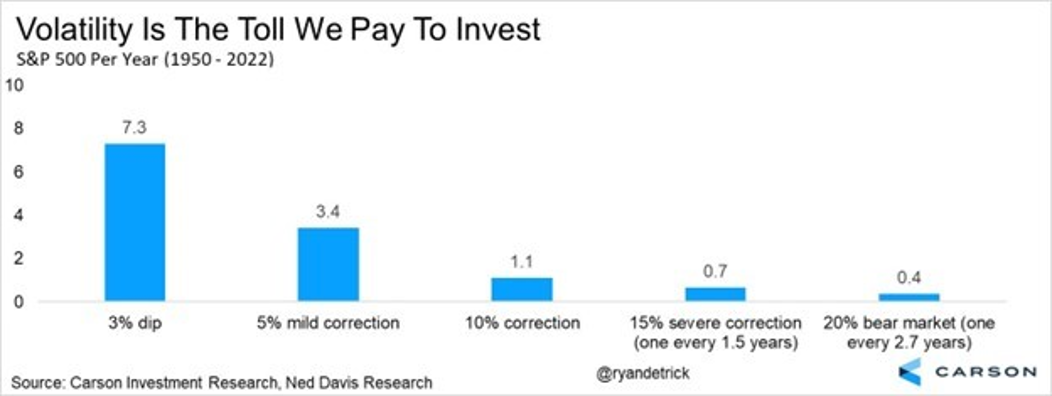

By no means do I want to suggest that stocks will go up in a straight line – we’ll continue to see volatility, with pullbacks and corrections along the way. As Carson’s Chief Market Strategist Ryan Detrick likes to say, volatility is the toll we pay to invest. Expect to see pullbacks, corrections, severe corrections, and perhaps even a bear market where stocks fall 20%.

But here’s some perspective: from December 31t, 2018, through December 12th, 2023 (just shy of 5 years), the S&P 500 has gained 102%. That includes 2 bear markets along the way, in 2020 and again in 2022. Yes, you’re reading that right — stocks have doubled over the last 5 years, amidst a worldwide pandemic, high inflation, an aggressive Fed, and surging interest rates.

The other big risk, which could upend our views, is that the Fed could keep rates too tight for too long, which in turn would lead to falling investment, more unemployment, and slower wage growth, and ultimately weaker productivity growth.

This is why we seek to control risk in our portfolios. As my colleague, Barry Gilbert, recently wrote, we also extended the maturity profile of our fixed income holdings. While we are overweight stocks versus bonds, we do think core bonds will increasingly return to their traditional role as a portfolio diversifier. At the same time, we’ve also chosen to diversify our diversifiers, with some allocation to managed futures, which is a hedge against inflation volatility.

The good news is that the Powell-led Fed now view the risk of not doing enough to fight inflation as balanced against the risk of doing too much, and potentially breaking the labor market. That’s a big deal, since it means we could see policy easing if inflation heads down in a sustainable way – which it could if productivity runs strong.

Ryan and I are going to talk about all this in our upcoming webinar. Outlook ’24: Seeing Eye to AI. Join us by registering at the link below:

For more of Sonu’s thoughts click here.

2022657-1223-A