There’s no question that the inflation data in the first quarter was uncomfortably hot. But as we highlighted over the past several months, there were good reasons not to panic about another sustained upswing in inflation. I wrote about this when the January, February, and March consumer price index (CPI) reports were released. It was reassuring to see that Federal Reserve (Fed) officials took a similar view. As Fed Chair Powell noted after their May meeting, they didn’t think the hot inflation data in Q1 negated the progress made in the second half of 2023. All it did was make them realize that it would take longer to gain confidence that inflation was headed to their target of 2%.

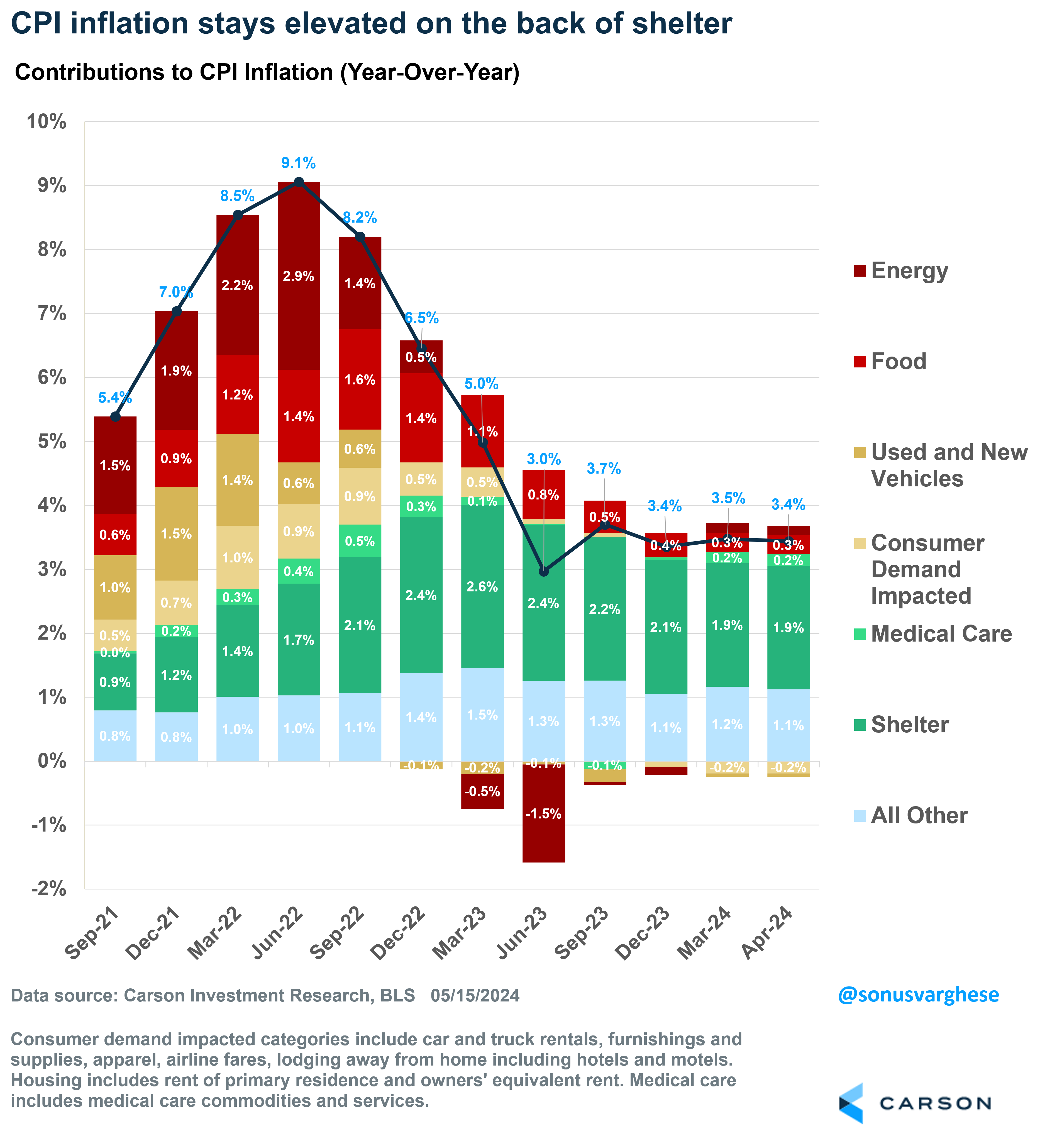

The April CPI report confirmed that there was no need to panic after the hot inflation data in Q1. Headline inflation rose 0.3% in April, below expectations. On a year-over-year basis, CPI eased to 3.4%. That’s still elevated but as you can see below, shelter inflation is the main cause of that (the dark green bars in the chart). If you exclude shelter, headline CPI is up 2.2% since last April.

The heat in the prior inflation reports was mostly due to post-pandemic catch-up effects, rather than renewed demand or supply-side side pressures.

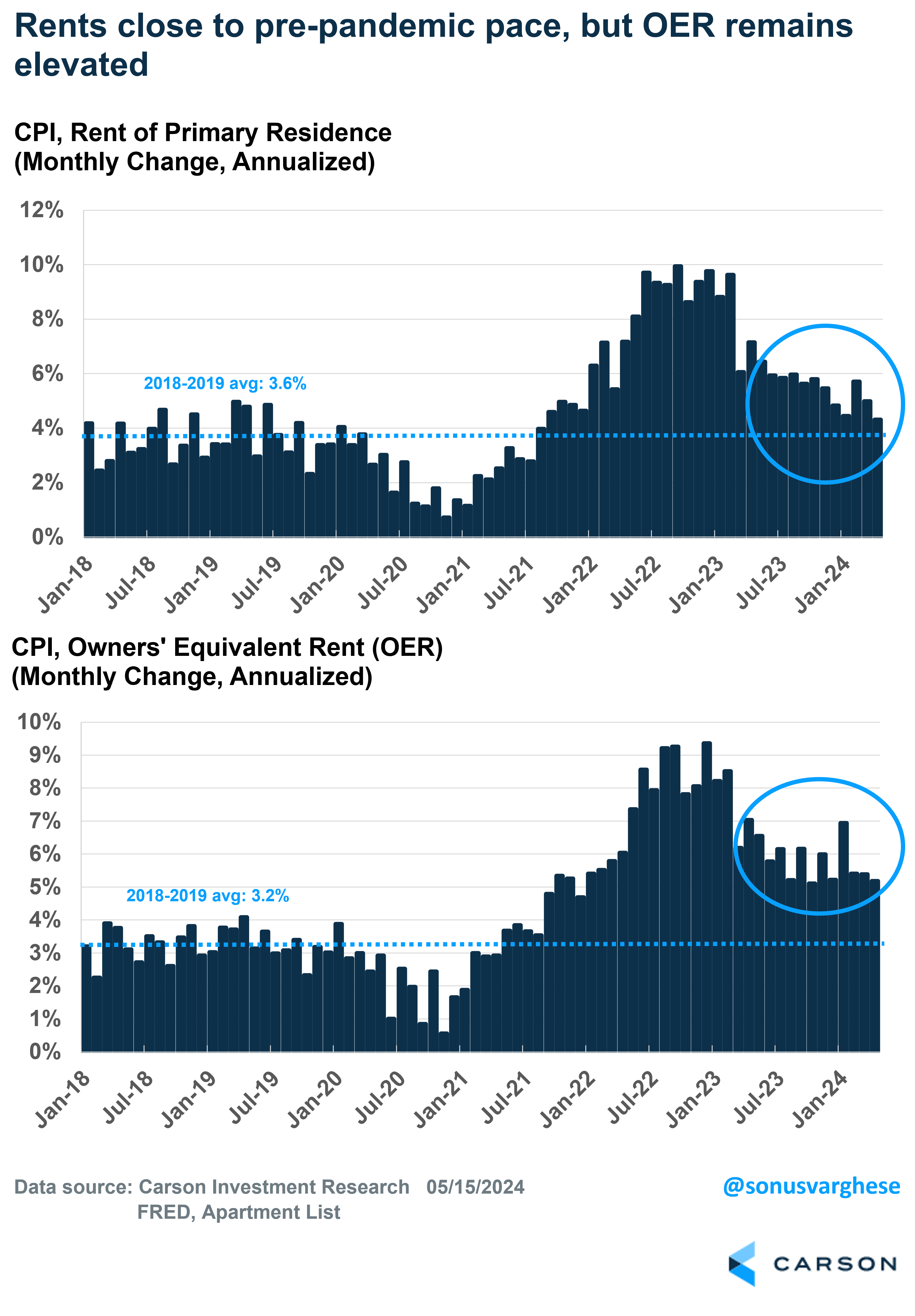

Shelter is a classic case in point. As we’ve written and talked about on Facts vs Feelings, the podcast Ryan Detrick and I host, official shelter inflation runs with significant lags to what we see in actual rental markets. Shelter inflation matters a lot for CPI, as it makes up 35% of the basket. Rents of primary residence account for 8% of that, while “owners’ equivalent rent” (OER) accounts for 27%. OER is the “implied rent” homeowners pay, and it’s based on market rents as opposed to home prices.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

However, there’s good news with respect to shelter. Rents of primary residences rose at an annualized pace of 4.3% in April. That’s the slowest pace since August 2021 and not far above the 2018-2019 average of 3.6%. OER remains elevated but it’s easing (albeit slowly). It rose at an annualized pace of 5.2% in April, below the Q1 average of 5.9% but well above the 2018-2019 average of 3.2%. You can see why OER is keeping CPI elevated.

Another example of post-pandemic catch-up effects is auto insurance. Core CPI inflation, which excludes food and energy, was up 3.6% year over year in April. Of that, auto insurance accounted for 0.73%-points. What’s amazing is this: auto insurance makes up just over 3% of the core inflation basket of goods but accounted for about 20% of the year-over-year increase. That’s because vehicle prices and repair costs surged after the pandemic and insurance premiums rose as a result. Official data is just about catching up to that, even as actual real-time vehicle prices are now easing.

Combine the contribution from auto insurance (0.73%-points) to that from rents and OER (2.37%-points), and the three categories account for about 85% of the year-over-year increase in core inflation. Of course, that’s all backward looking because none of this is really capturing what’s happening in real time, and what’s likely to happen going forward.

The good news is that several forward-looking indicators of underlying inflation don’t give us any cause for concern.

- Wage growth for workers is running at the pre-pandemic pace of around 3%, which means there’s no underlying demand-side pressure on inflation.

- Broad commodity prices are not surging like they did in 2022 (in fact, oil prices have fallen close to 10% since early April), which means a commodity-driven supply shock is not on the cards for now.

- Market-implied expectations for future inflation are consistent with the Fed’s 2% target, and well off their 2022 peak.

- Consumer expectations for inflation are not far above what we saw before the pandemic, and this should ease further as gas prices pull back (which has happened recently).

- Business expectations for inflation in the year ahead are running at 2.3%, which is also close to pre-pandemic levels.

An Inflation Bellwether Is Cause for Optimism

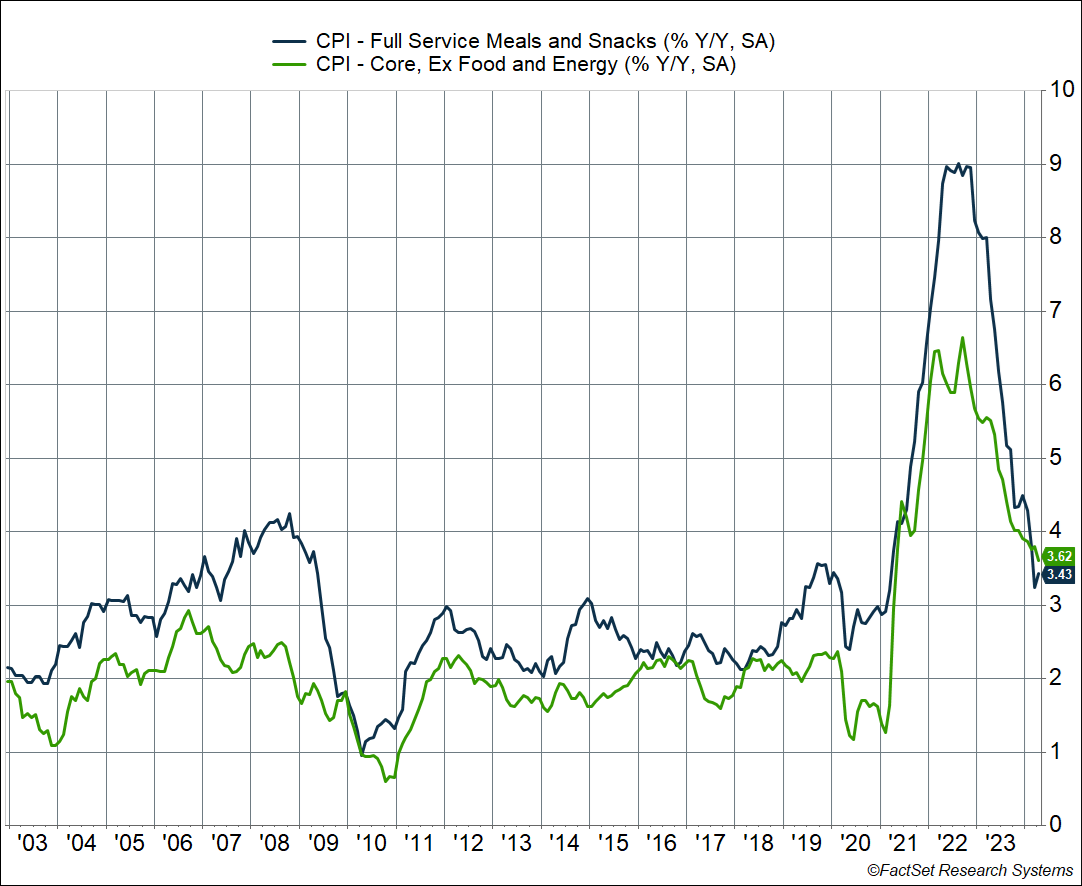

As I’ve written previously, one category I like to keep a close eye on is inflation at full-service seated restaurants (the official category is “full service meals and snacks”). It’s technically not in the core CPI basket, but interestingly, it’s historically tracked core inflation fairly closely. I find it useful because full-services restaurant meals combine several demand- and supply-side elements that drive inflation, including:

- Commodity prices – food, but also energy (since food has to be transported across the country)

- Wages – for restaurant workers

- Rents – for restaurant premises

Inflation for restaurant meals has eased significantly over the past year and half. It peaked at 9% year over year in August 2022, but is now running at 3.4%. That’s similar to the pace we saw in 2019. The message is that underlying inflationary pressures are quite benign. If you look at the chart below, you can see that it’s quite unusual for inflation of full services meals (blue line) to run below core CPI inflation (green line), as is the case now. But that’s only because shelter inflation is elevated, going back to what I discussed earlier.

Still On Track for Interest Rate Cuts in 2024

As Fed Chair Powell recently reiterated, recent inflation data has yet to give them confidence that inflation is headed back to their 2% target, which means they’re unlikely to cut rates at their June, or even July, meeting. The April inflation data was a step in the right direction, and the forward-looking data suggests we should continue to see disinflation ahead. That means we may still be on track for at least a couple of 0.25%-points of interest rate cuts in 2024.

Markets clearly read optimism in the April CPI data – the one-year Treasury yield, which is a close proxy for policy rates over the following year, fell from 5.16% to 5.09% over the day, and the S&P 500 rose more than 1% to a new record high. We could see more of this if the inflation picture evolves as we expect it will over the next several months, keeping the bull market alive and well (as Ryan Detrick, Carson’s Chief Market Strategist recently wrote).

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02242367-0524-A