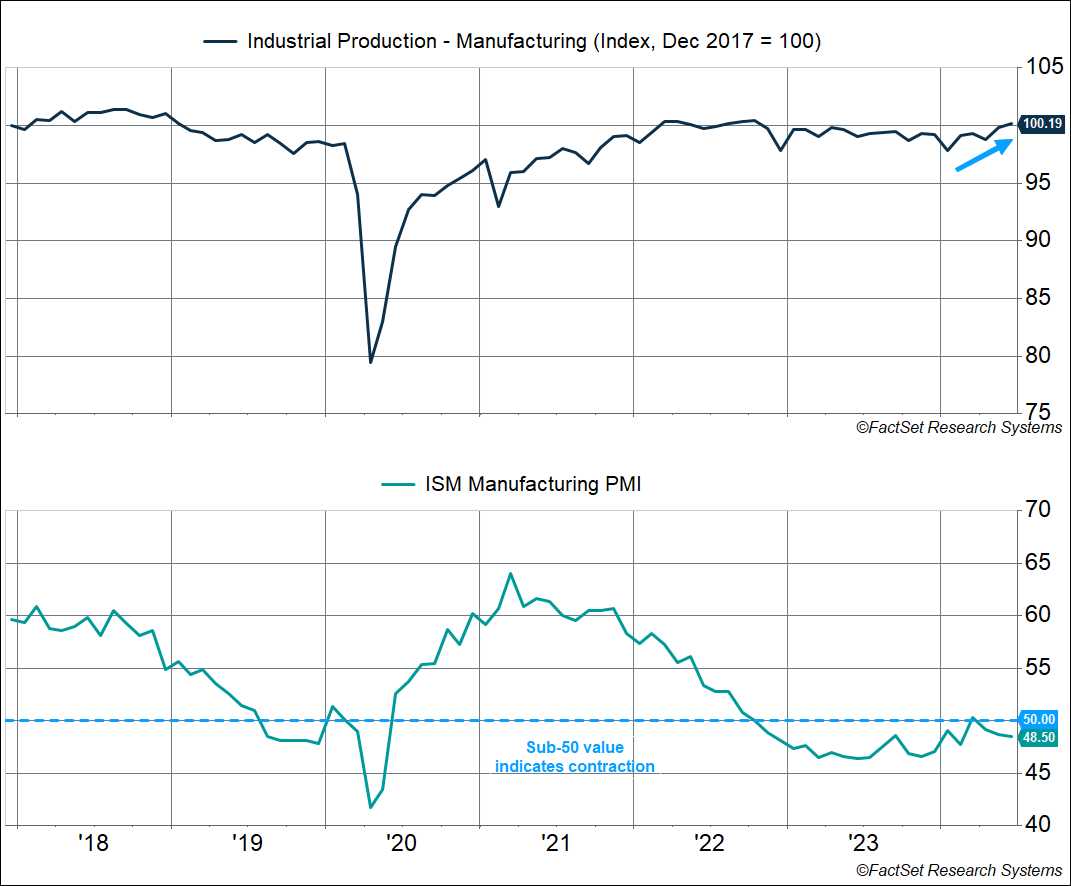

The US economy mostly runs on the back of household consumption, and so the manufacturing sector is usually bit of an afterthought. Though its salience has increased recently amid the 2024 presidential election campaign, and especially former President’s Trump’s preference for a weaker dollar to boost the export sector. Still, the headline news from the manufacturing sector has been pessimistic, thanks to poor survey data. The ISM Purchasing Managers’ Index (PMI) — which is one of the most popular leading economic indicators amongst investors, economists, and financial publications — has been below 50 for 19 out of the last 20 months, indicating that the manufacturing sector is contracting.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Well, there’s the survey data (of about 300 purchasing managers) and there’s the “hard” data that is collected from thousands of manufacturing establishments published by the Federal Reserve. This hard data has surprised on the upside recently. Manufacturing production ran at an annualized pace of 4% over the last quarter (Q2), upending the narrative from PMIs. While manufacturing production would ideally run faster, it’s far from in a slowdown, let alone in contraction. Note that production declined in 2019 amid the trade war, and despite that the economy was doing quite well. The good news is that production is now 2% higher than where it was in December 2019 and running near early-2018 levels.

But there are some notable things happening behind the headline too. Here are three areas people aren’t really talking about that I want to highlight.

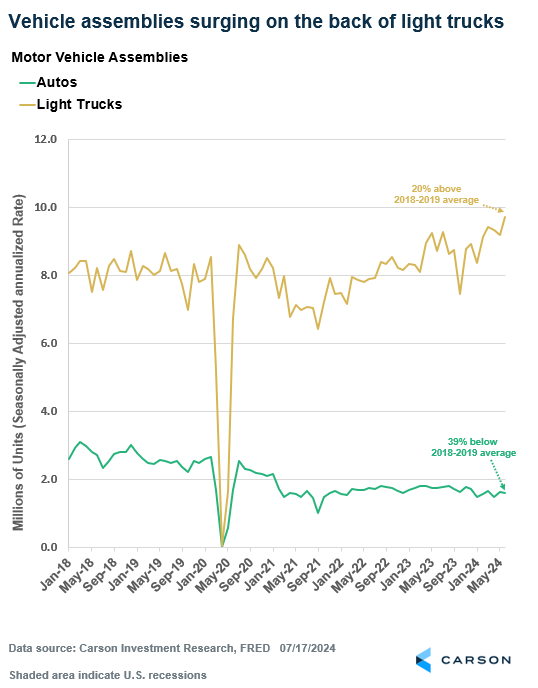

Motor Vehicle Production Is Rocking

Motor vehicle assemblies rose to a seasonally adjusted annualized pace of 11.6 million in June. That is well above the pre-pandemic pace of 11.1 million and the fastest pace in four years. The boost in vehicle assemblies has mostly come on the back of light truck assemblies, i.e. SUVs and minivans (Americans can’t get enough of these). Light truck assemblies are running a whopping 20% above the average 2018-2019 pace, whereas assemblies in the less preferred auto segment are running 39% below the pre-pandemic average.

Vehicle assemblies have come back strong since the auto industry strike last fall. This is a big deal for the economy as production came to a halt after the pandemic hit. It’s taken a long time to come back, especially as supply chain issues hampered the recovery. That’s also what sent vehicle prices higher. The good news is that the current pace should boost inventories, and sales, while pushing prices lower. Due to the production falloff amid the pandemic, we still have a massive deficit of 5-6 million vehicles. That will need to be made up, and so production is likely to continue running strong for a while, which will be a nice tailwind for the economy.

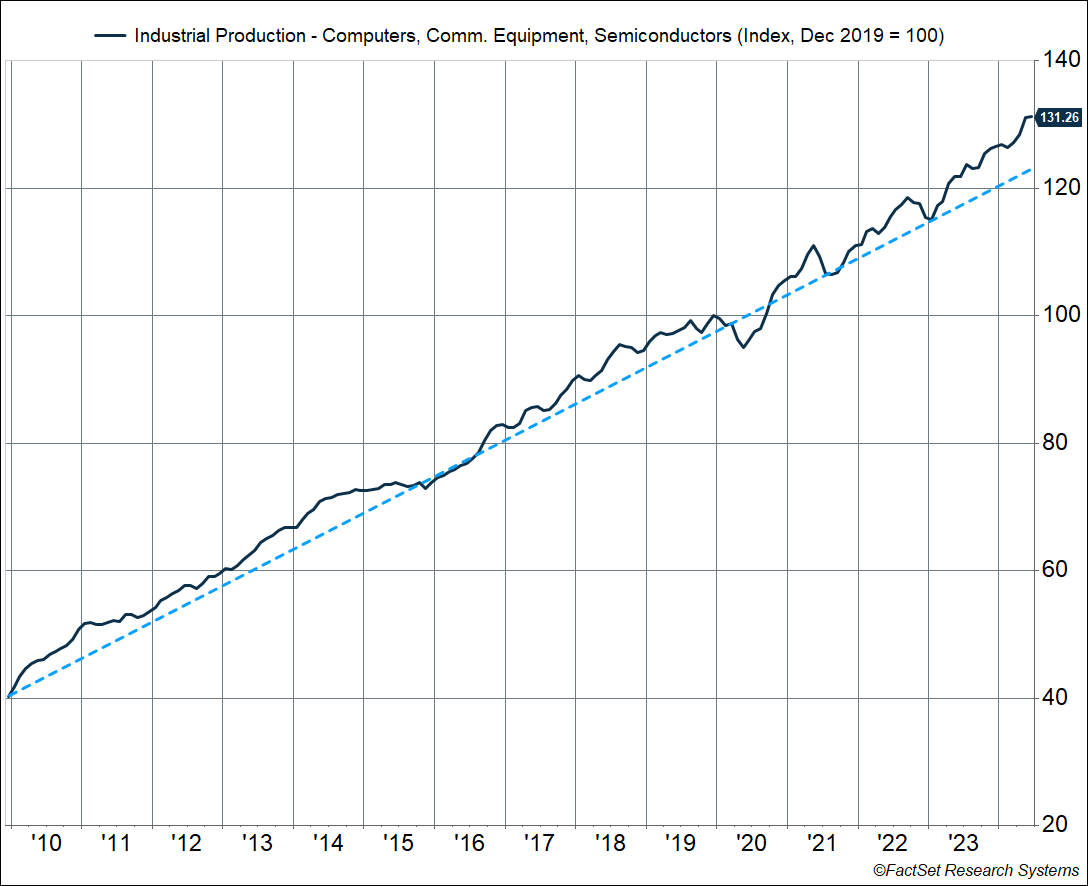

High-Tech Equipment Production Is Also Surging

High tech equipment production (computers, communication equipment, semiconductor chips) rose at an annualized pace of 13% in Q2. Production is now running a whopping 31% above December 2019 levels. This is likely a function of demand coming from artificial intelligence-related investment and the CHIPS/IRA Act. You can see the surge starting in early 2023, taking production well above the 2010-2019 trend.

An offshoot of this story is what we’re seeing in the electrical equipment space. Production has risen at an annualized pace of 20% over the past quarter and is running 18% above December 2019 levels (credit to our friends at Employ America for first flagging this data back in 2023). As you can see in the chart below, production looks to have broken out of a decade-long period of stagnation that began after the Great Financial Crisis in 2008. The current surge looks like what we saw back in the mid-1990s. This is another sign that there are major shifts happening under the hood of the economy, including the less talked about industrial side.

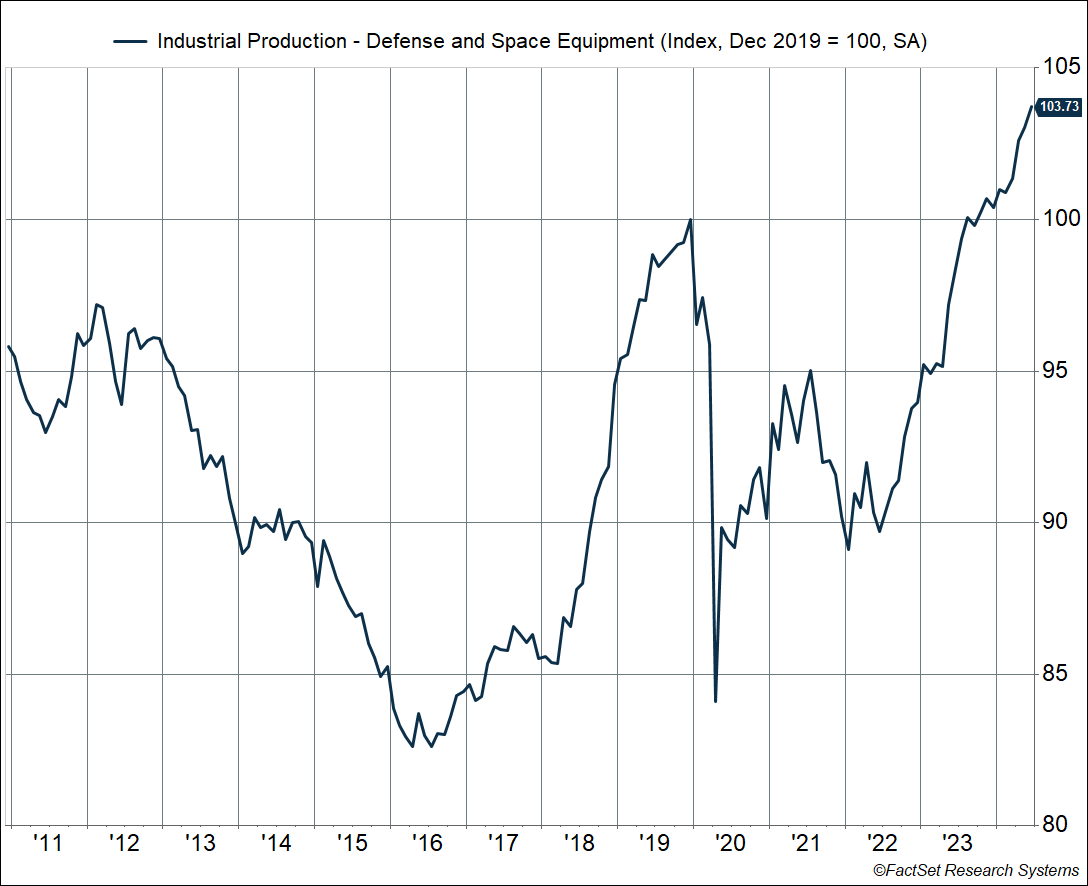

An Unexpected Boom: Defense Production

In some respects, this is more of a surprise than what we see on the high-tech equipment production side, given political constraints. Defense equipment production rose at an annualized pace of 10% over the last quarter and is currently running 4% above December 2019 levels. But as you can see in the chart below, the real surge has occurred over the past year. This is another area where government spending is boosting the economy, especially from the federal government. And as I’ve noted in a prior blog, this is likely to continue even after November, irrespective of who is elected president. Contrast that to what happened after 2010, when defense equipment production fell amid budget cuts.

Together, all these pieces make up a significant portion of the US economy. It’s much smaller than the contribution from consumption, but it can provide an important cyclical boost, perhaps one that will continue as the Fed starts cutting interest rates. What we’re seeing in industrial production is very different from the experience of the last decade. Something has been changing in the economy.

The supply-side recovery (including vehicle production) is a big reason why inflation is now yesterday’s problem. Chief Market Strategist Ryan Detrick and I talked about this in our latest Facts vs Feelings episode, including what it all means for Fed policy. Take a listen below.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02327589-0724-A