“I’ve had 36 orthopedic operations, have two fused ankles, my knees, hands and wrists don’t work, I now have a fused spine, other than that, everything is great.” -Hall of Fame basketball player Bill Walton

First off, RIP to Bill Walton. He was one of a kind and his glass-is-half-full attitude on life is something many investors could learn from. Things can get pretty dark pretty fast, but if you are willing to wait long enough, brighter times will come.

Here are some things that caught my attention recently and all support the bullish thesis.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

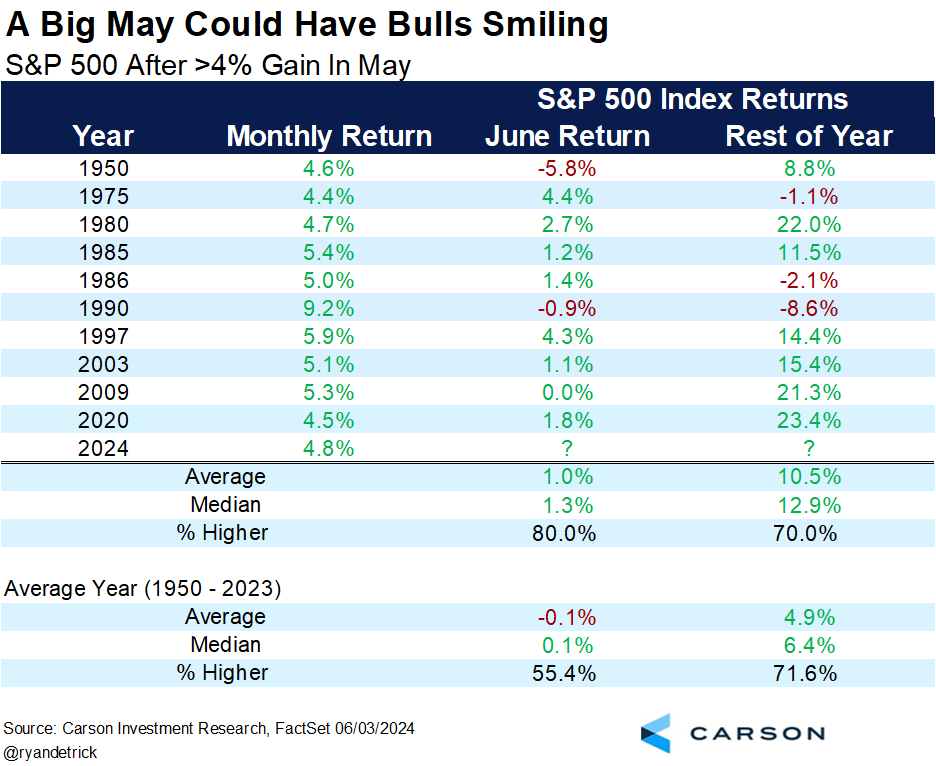

The S&P 500 just missed a 5% gain in May, but 4.8% is pretty darn good, especially considering April lost 4.2%. So what tends to happen after a big May you ask? June, which is historically not a good month, gained eight out of 10 times for a very solid 1.0% average, while the rest of the year was up more than 10% on average, more than double the average final seven months of the year. Even more impressive though is the past four times this happened (1997, 2003, 2009, and 2020) all saw at least double-digit returns. “MAY”be we have a positive signal from the strong May. Did you see what I did there 😉

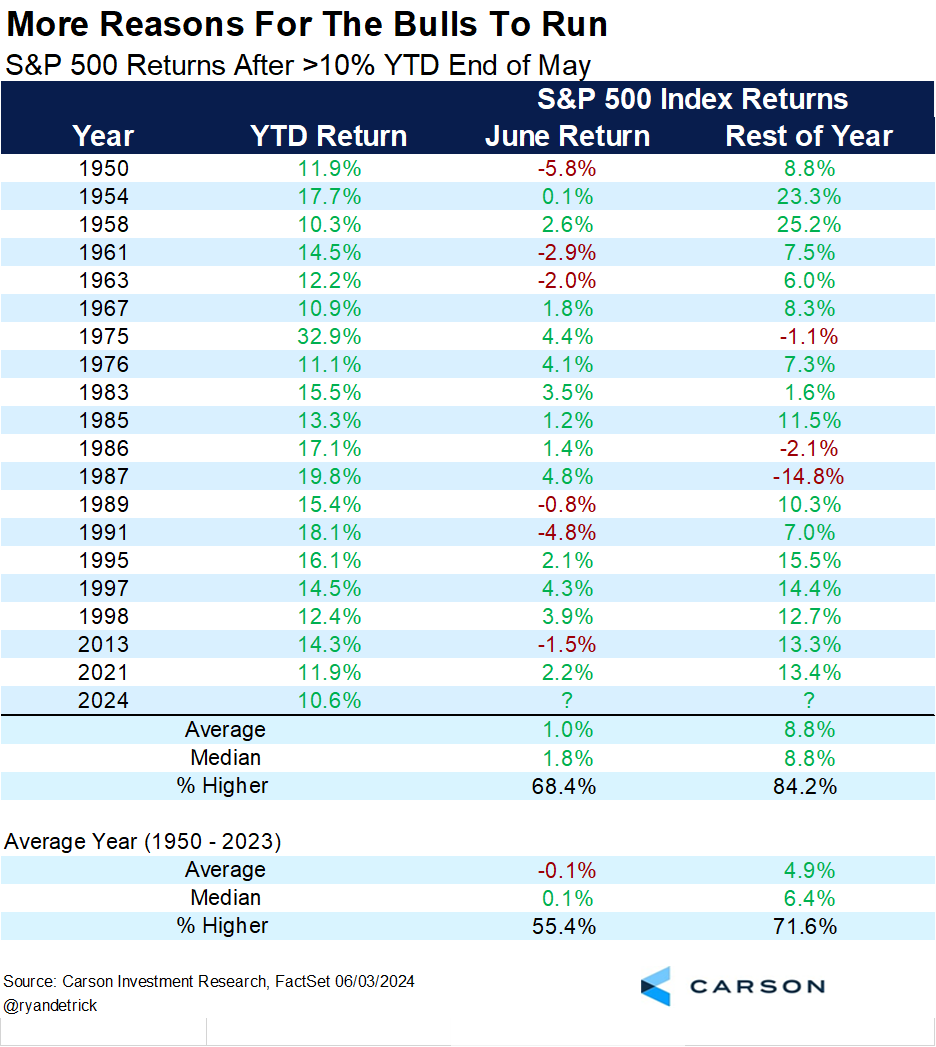

2024 is one of the better starts to a year ever, but you’d never know it if all you looked at were the headlines. All we hear about is how bad things are, how the consumer is tapped out, the economy is headed for a recession, only a few stocks are going up, and so on endlessly. Well, investors should be smiling through all the dour calls and outlooks, as stocks have gained double digits after the first five months this year and the good news is more green could be coming.

We found the returns after previous 10% or more year-to-date gains after May tended to be quite impressive, with June up 1.0% on average (and even more for the median), with the rest of the year up 16 out of 19 times (84.2%) with a solid 8.8% gain on average. 💪🔥

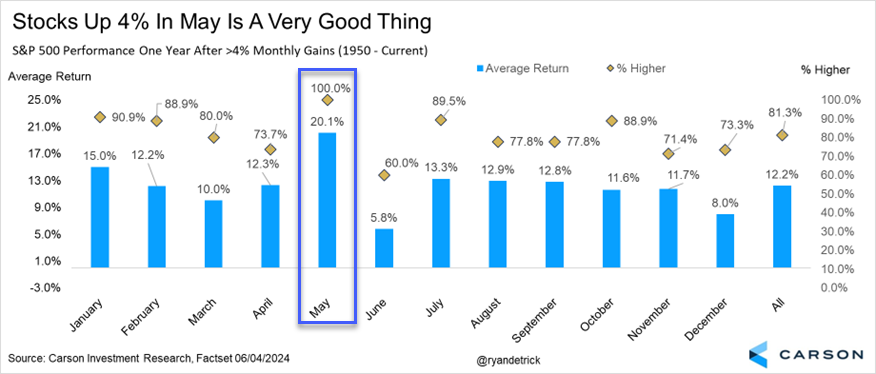

The last bullet point for the bulls is a 4% or greater monthly gain has tended to suggest continued strength, with the S&P 500 up a year later 81.3% of the time and up a very solid 12.2% on average. This compares to the average year higher 73.0% of the time and up 9.0%. But it doesn’t end there, as I looked at all 12 months and would you believe that, historically, the very best returns after a 4% or greater monthly return take place after a big gain in May? A year later stocks have never been lower (10 out of 10) and are up more than 20% on average.

Lastly, please be sure to watch (or listen) to our latest Facts vs Feelings Podcast below, as VP, Global Macro Strategist Sonu Varghese and I discuss the recent slowdown in economic data, why the bull market alive and well, the latest on inflation and so much more!

For more content by Ryan Detrick, Chief Market Strategist click here.

02268600-0624-A