“You can learn a lot by looking.” Yogi Berra

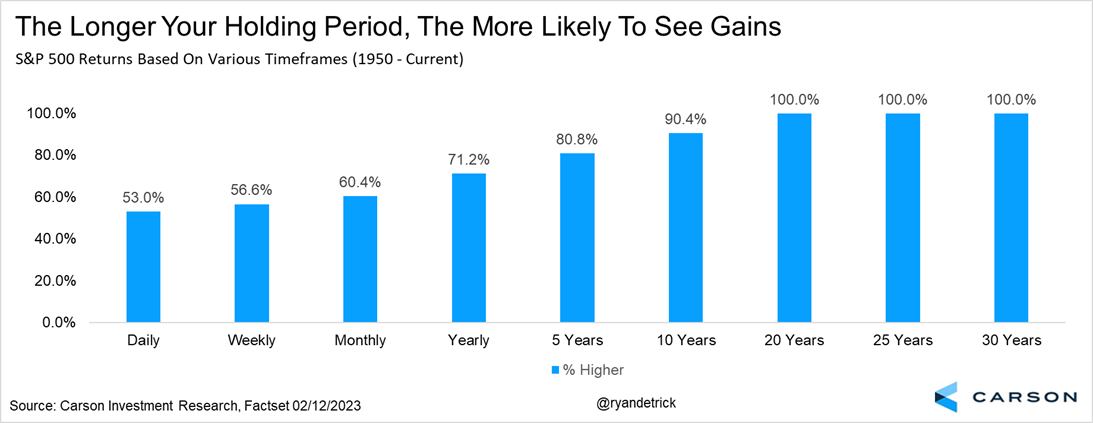

Did you know that the S&P 500 is up about a coinflip of the time on any one day? That’s right, since 1950, the S&P 500 has closed green 53.0% of the time. So the secret that nearly everyone knows but few uses to their advantage is that time is on your side when it comes to investing.

As Brett noted yesterday, one of our principles is that long-term stock gains are simply one of the best ways to create wealth and beat inflation. And if you have a long enough time horizon, history shows the odds favor that you’ll be in the green over time, potentially by a lot. Or, as Yogi told us in the quote above, you don’t always have to do much other than be patient and look around.

So, let’s do that; let’s take a longer-term look at things. If your average day is up 53% of the time, the good news is that the average week is up 56.6% of the time, the average month is up 60.4% of the time, and the average year since 1950 has been higher 71.4% of the time. So, the longer you hold, the more likely it is to sport gains.

What about taking it out even longer? This is where it really pays to have patience, as the S&P 500 was higher 80.8% of the time every five years, 90.4% every decade, and it has never been lower if your holding period was 20, 25, or 30 years.

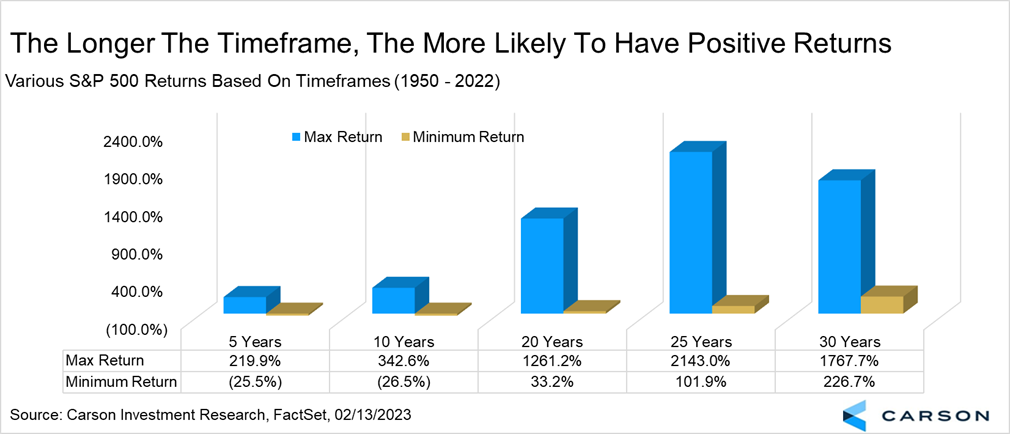

Here are some other important stats to know. The worst 30-year return for the S&P 500 was 226.7% in 1958. That shouldn’t be surprising; if you bought 30 years earlier, you’d be buying right near the peak before the Great Depression. In other words, you could have bought in front of the worst stock market and economy in U.S. history, yet 30 years later, you’d still be up more than 200%. Think about that. Oh, and the best 30-year period? From the end of 1974 to the end of 2004, the S&P 500 added 1767.7%, on the heels of the huge ‘80s and ‘90s bull run.

Here is a chart breaking down the best and worst returns based on how long you are willing to hold things.

Jack Bogle once said, “The stock market is a giant distraction to the business of investing.” I like that, and when you think about how strong these long-term returns are, it sure makes you want to think twice the next time we have a worry du jour. Trust us, there are always worries and reasons to be concerned. But for most investors, especially those with a potential multi-decade time horizon in a retirement account, any pullback or weakness should be viewed as an opportunity, not a time to panic.

Let’s think about that great 30-year run one more time. It would mean you’d have the fortitude to buy in 1974, which was on the heels of one of the worst bear markets ever in ‘73/’74 when stocks were cut in half. They say the stock market is the only place things go on sale, yet people run out of the store screaming. I agree, and we need to remember this the next time stocks are in a vicious bear market. If you can buy (or not panic and sell) during those scary times and hold for a few decades, the market gods might just grant you some spectacular gains for going against the masses telling you to sell.

Over the past 25 years, we’ve seen the tech bubble implode, 9/11, the financial crisis, multiple flash crashes, the worst global pandemic in 100 years, generational inflation, numerous economists touting deflation, multiple major global wars, horrible NFL ref calls in big games (ok, this might not fit the others, but it is true), yet those investors who used two 50% bear markets and a 25% bear market as an opportunity to add, and not panic, are the ones that are simply smiling right now.

I’ll leave you with this. Warren Buffet once said, “It is not necessary to do extraordinary things to get extraordinary results.” I get to work with Advisors and their clients every single day. Some of the happiest investors I ever see are the ones that continued to put money into their 401(k) and savings accounts like clockwork over the past 25 years. They simply ignored the news, trusted their advisor’s advice, and stuck with their long-term financial plan. Many others got cute and sold at poor times or went all-in on gold, crypto, or some other latest fad. Almost like they have some superpower… In reality, all they are doing is just looking … like Yogi told us.