November inflation data, as measured by the Consumer Price Index (CPI) landed right along expectations. Headline CPI rose 0.3% and is up 2.7% from last year. Core CPI, which excludes food and energy, also rose 0.3%, and is up 3.3% year over year. These numbers are clearly over the Fed’s 2% target. Cue the cries that “inflation is sticky” and that the Federal Reserve (Fed) is erring by cutting rates. This couldn’t be further from the truth.

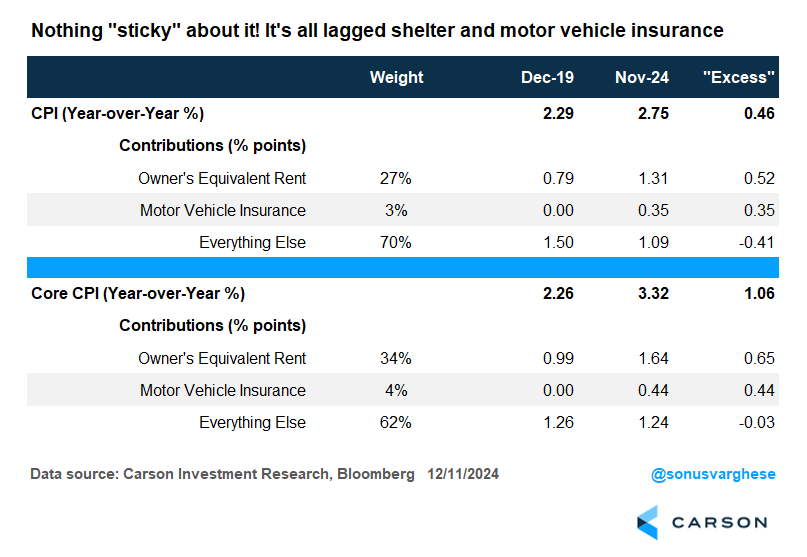

Note that the Fed targets the personal consumption expenditure (PCE) inflation metric, and I recently wrote a blog on why this metric (both headline and core PCE) shows no signs of concern if you look under the hood. Still, let’s focus on where “excess inflation” is coming from for CPI and compare the November data to December 2019 (when headline and core CPI were up 2.3% year over year). There are two main drivers of excess inflation: shelter and motor vehicle insurance.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Within shelter, it’s really “owner’s equivalent rent” (OER), which is the “implied rent” homeowners pay, and is based on market rents as opposed to home prices. OER makes up 27% of the headline CPI basket, and a whopping 34% of core CPI. It’s now up 4.9% year over year (y/y), versus 3.3% in December 2019. That’s adding 0.52%-points to “excess” headline CPI relative to December 2019, and 0.65%-points to “excess” core CPI.

The other component is motor vehicle insurance, which makes up 3% of the CPI basket (and about 4% of core CPI). Motor vehicle insurance is adding 0.35%-points to excess headline CPI and 0.44%-points to excess core CPI (relative to December 2019).

Together, OER and auto insurance fully account for the entirety of excess CPI inflation, both for headline and core. Everything else put together is making a negative contribution.

Another important point here: the December 2019 levels of CPI actually coincided with PCE and core PCE (the Fed’s preferred metrics), running below their target of 2% — at 1.5% and 1.6% y/y, respectively.

All this is year-over-year data, which is impacted by what happened last year to a degree. But things are looking up when you look at more near-term data.

For one thing, motor vehicle insurance inflation is pulling back in a hurry. Car insurance costs surged in 2023 due to lagged effects of higher car prices post-pandemic (and more car crashes), rising 26% y/y at its peak in August 2023. But the pace has eased to about 13% y/y, and just under 5% annualized over the last three months (through November).

There’s better news on the docket that is key for the inflation outlook.

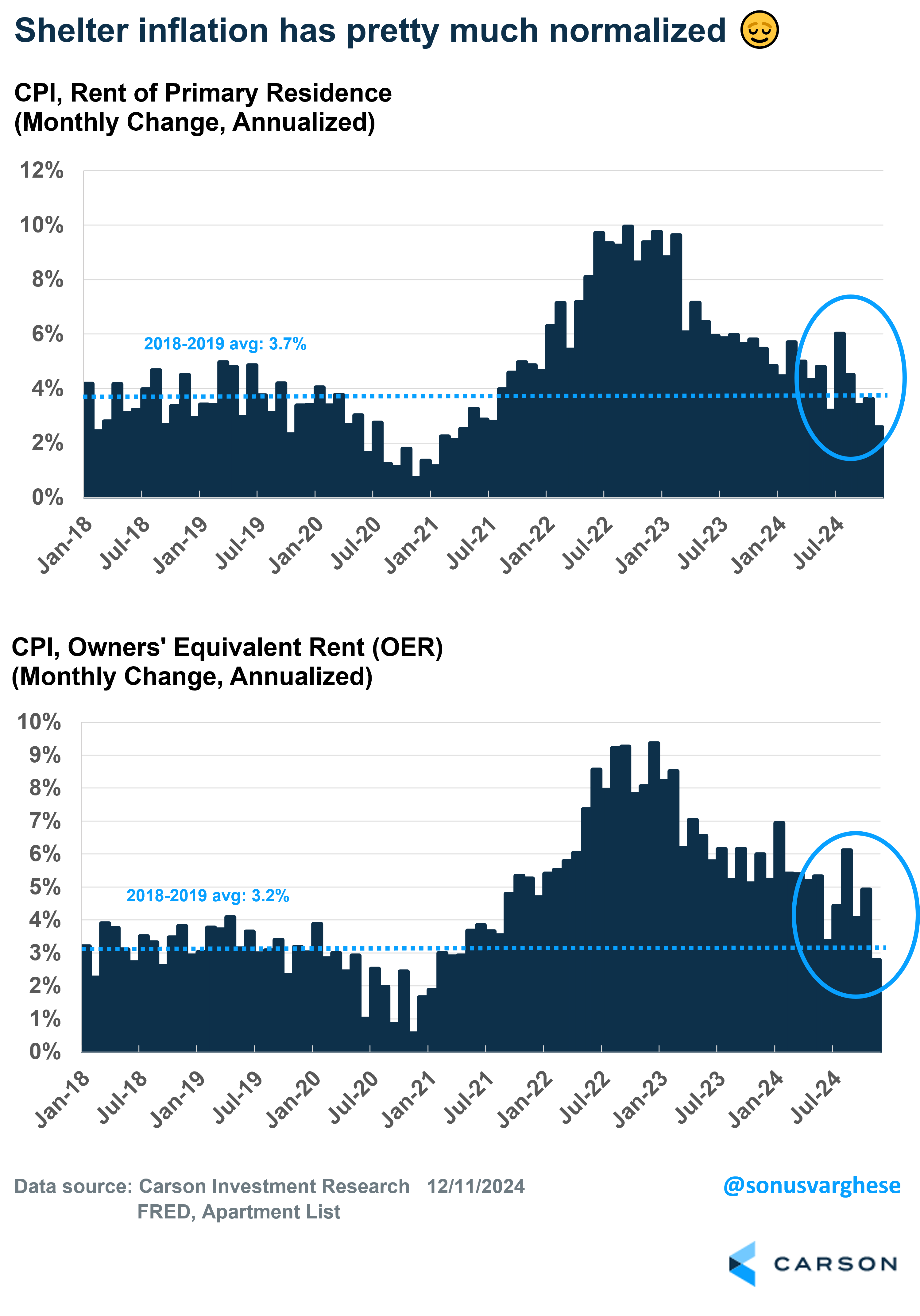

Shelter Inflation Has Normalized

Shelter inflation is made up of two components, rents of primary residences and OER. On a year-over-year basis these are still elevated:

- Rents are up 4.4% y/y versus the 2018-2019 average of 3.7%.

- OER is up 4.9% y/y versus the 2018-2019 average of 3.3%.

Here’s the good news from the November CPI report: Rents were up 2.6% (annualized) and OER was up 2.8% (annualized) — both clocking in below their respective 2018-2019 averages.

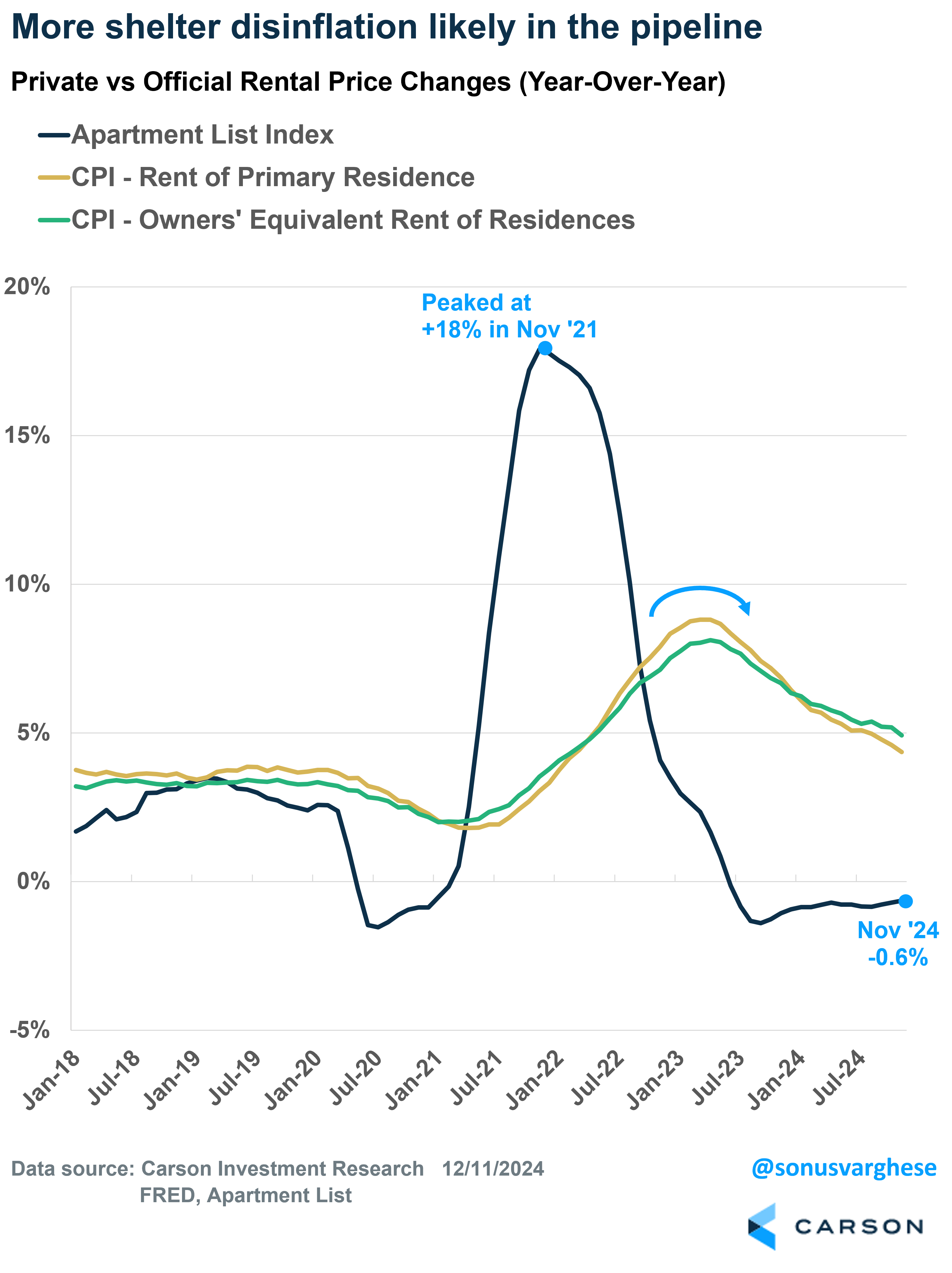

Even better news is that there’s likely more disinflation in the pipeline. Apartment List reports that median rents are down 0.7% y/y, the 18th straight month with a negative y/y reading. Our friend Neil Dutta, Head of Economics at Renaissance Macro Research, flagged another report from Redfin that tells the same story: November median asking rent price per square foot was down 2.2% y/y to $1.79. That’s the 19th straight month where this reading fell y/y, and the first time it’s fallen below $1.80 since November 2021.

Another Big Positive: Sit-Down Restaurant Price Inflation

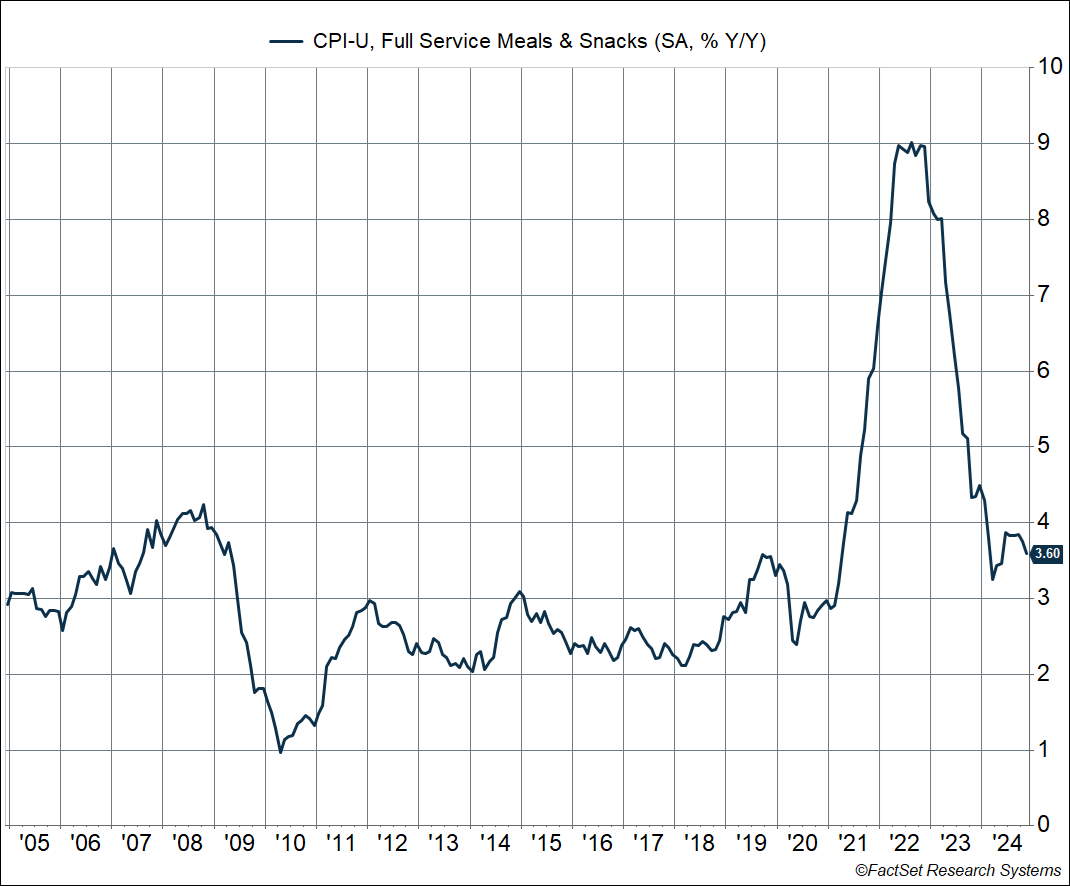

I’ve noted in the past how one of my favorite inflation indicators is “full service meals (and snacks),” i.e. sit-down restaurant prices. It’s historically tracked core inflation very closely, despite it not being in the core CPI basket, and in fact, tracks core CPI better than OER (despite OER’s huge weight in the basket). Restaurant prices make up about 8% of core PCE, and so it does matter for the Fed’s preferred inflation metric.

Full-service restaurant meals combine several elements that go into inflation, including:

- Commodity prices – obviously food, but also energy prices to an extent (for things like crop fertilizers and diesel for transportation)

- Wages – for workers in restaurants

- Rents – of the restaurant premises

We’ve seen all of the above ease considerably over the last year, and that’s starting to show up in the inflation data. CPI for restaurant prices is up 3.6% y/y, down from a peak of 9% in 2022. The current pace is only slightly above what we saw in late 2019.

Looking at the chart above, it may look like restaurant prices are still elevated relative to what we saw over the last decade. But as I pointed out earlier, CPI inflation in late 2019 was consistent with PCE inflation running below the Fed’s target of 2%. In fact, core PCE ran below 2% across the 2010s.

All this tells me that underlying inflation is running close to the Fed’s target of 2%. Never mind lagged shelter inflation (and motor vehicle insurance).

A December Rate Cut — Signed, Sealed, And Will Be Delivered

Markets clearly took the inflation data as a positive with respect to Fed rate cut expectations, with the probability of another cut at their meeting next week jumping from 89% to 98%. In fact, the November Producer Price Index report suggests that core PCE (which takes inputs from CPI and PPI) will clock in around 0.1% (via our friends at Employ America). That’s a big positive, and likely seals the deal for a cut next week.

Yet, the outlook for 2025 remains uncertain. The November CPI report generated a lot of commentary that “inflation is sticky” and that the Fed has an “inflation problem.” And that cutting as much as they have is going to be viewed as a mistake. I clearly disagree with all of this. As you saw from the numbers above, inflation really isn’t a problem anymore.

In fact, the risk is that the Fed falls into the trap of believing that they do have a problem, based on lagged data, and taking an extended pause in 2025. (I wrote about this last week.) That would increase the odds of having a bigger problem on our hands, in the form of continued weakness in housing, a pullback in investment, and most important, a weaker labor market. The labor market is the whole games right now, since consumption is being driven by income growth, and that’s coming on the back of a fairly solid labor market. Keeping policy on the tighter side risks breaking that.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02549794-1224-A