“No amount of evidence will ever persuade an idiot.” -Mark Twain

We been pointing out signs of an early cycle revival in the economy and many bullish signals that indeed suggest the upward trend in stocks since October is alive and well. Well, here’s a blog on two more things that recently triggered and both could be nice signs for both the economy and stocks going forward.

First up, this past earnings season was really good relative to expectations. According to Factset, about 95% of S&P 500 companies have reported first-quarter earnings and a very impressive 78% beat expectations. Yes, earnings are set to come in down 2.2% versus the first quarter last year, but this is much better than the 6.6% drop that was expected this time seven weeks ago. Also, all 11 sectors came in better than expected, with tech (the largest component) really impressing. Lastly, the average company beat earnings by 6.5%, one of the best beats in years, while the average small cap stock beat by an even wider margin.

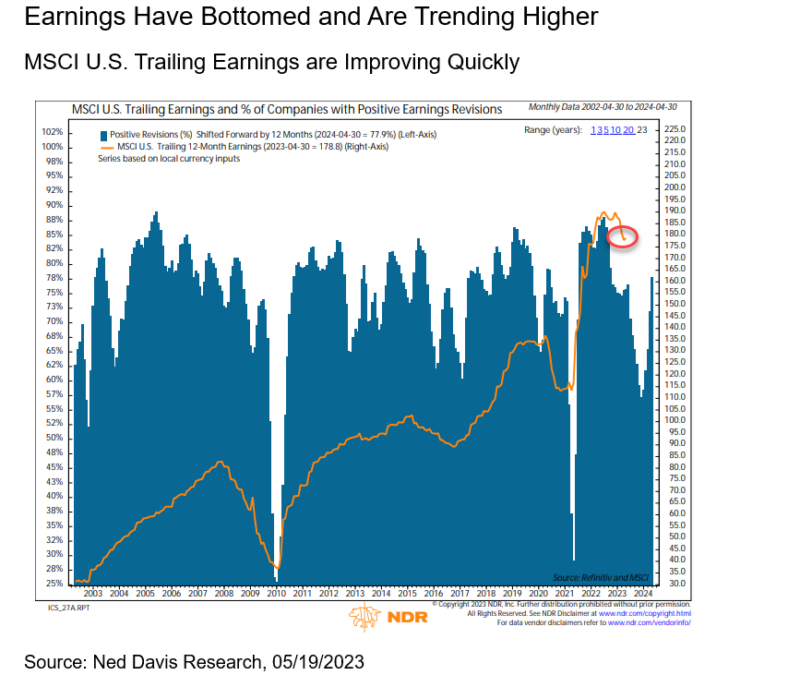

Thanks to data from our friends at Ned Davis Research, MSCI U.S. trailing 12-month earnings have officially bottomed and are now heading higher. Given nearly 80% issued increased revisions (the left side of the chart below), this makes sense that this would stop going down and start going up. All in all, this is a very strong signal that all the worries about the impending recession have been greatly exaggerated and corporate America likely sees better times coming.

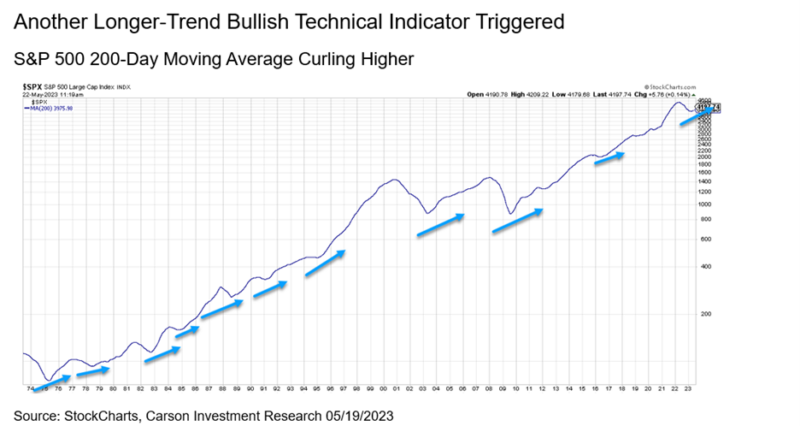

The other thing that no one is pointing out is the S&P 500’s 200-day moving average has officially turned higher. This is a longer-term trendline and it tends to catch significant trends. Right now, it’s rebounding off a bottom and that is another feather in the cap for bulls.

Some previous times the 200-day turned higher after trending lower for an extended period were July 2016, August 2009, June 2003, and March 1991. For those who remember their stock market history, all of those times indeed took place after significant lows were already formed (in other words, no new lows took place) and continued strong gains occurred. I eyeballed 10 times this turned higher and all 10 were nice times to own stocks.

Our friends at Bespoke looked at this and they found 20 times the 200-day moving average made a new 52-week low and then moved at least 1% off that level within three months, so a clear signal that the lower trend in stocks had ended. Sure enough, going back to 1928, they found the S&P 500 was higher a year later 20 out of 20 times, with a solid average gain of 18.2%. 20 out of 20!

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

One thing I’ve seen the past few months though is many of the perma-bears have really dug their heels in, likely costing many investors a good deal of gains and future gains. Take another look at the Mark Twain quote at the beginning. We’ve been sharing a lot of evidenced-based investment data this year showing better times could be coming and fortunately, it has been taking place for investors. The vast majority of what we see continues to look quite positive and we expect more solid gains from stocks the rest of this year, with an economy that will avoid a recession and surprise to the upside.