“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” – Peter Lynch, Magellan Fund Manager

The first quarter earnings season brought mostly positive news for investors, including the fastest earnings growth in five of the last six quarters. Many companies have seemingly recovered from pandemic-induced turmoil, and with inflation pressures easing, the outlook for growth is optimistic. Excitement is palpable as AI adoption spreads, with investment accelerating across every sector. Here are our top five takeaways:

- Earnings Growth Acceleration: The S&P 500 delivered an earnings growth rate above 5%, marking an acceleration compared to the prior quarter. Projections for the second quarter are even more optimistic, with expectations of more than 8% growth. Recall, earnings for the index declined in late 2022 and early 2023. This reacceleration in business fundamentals underpins the upward move we’ve witnessed in markets so far this year. Analysts anticipate a further acceleration of earnings growth in 2025, which bodes well for equities.

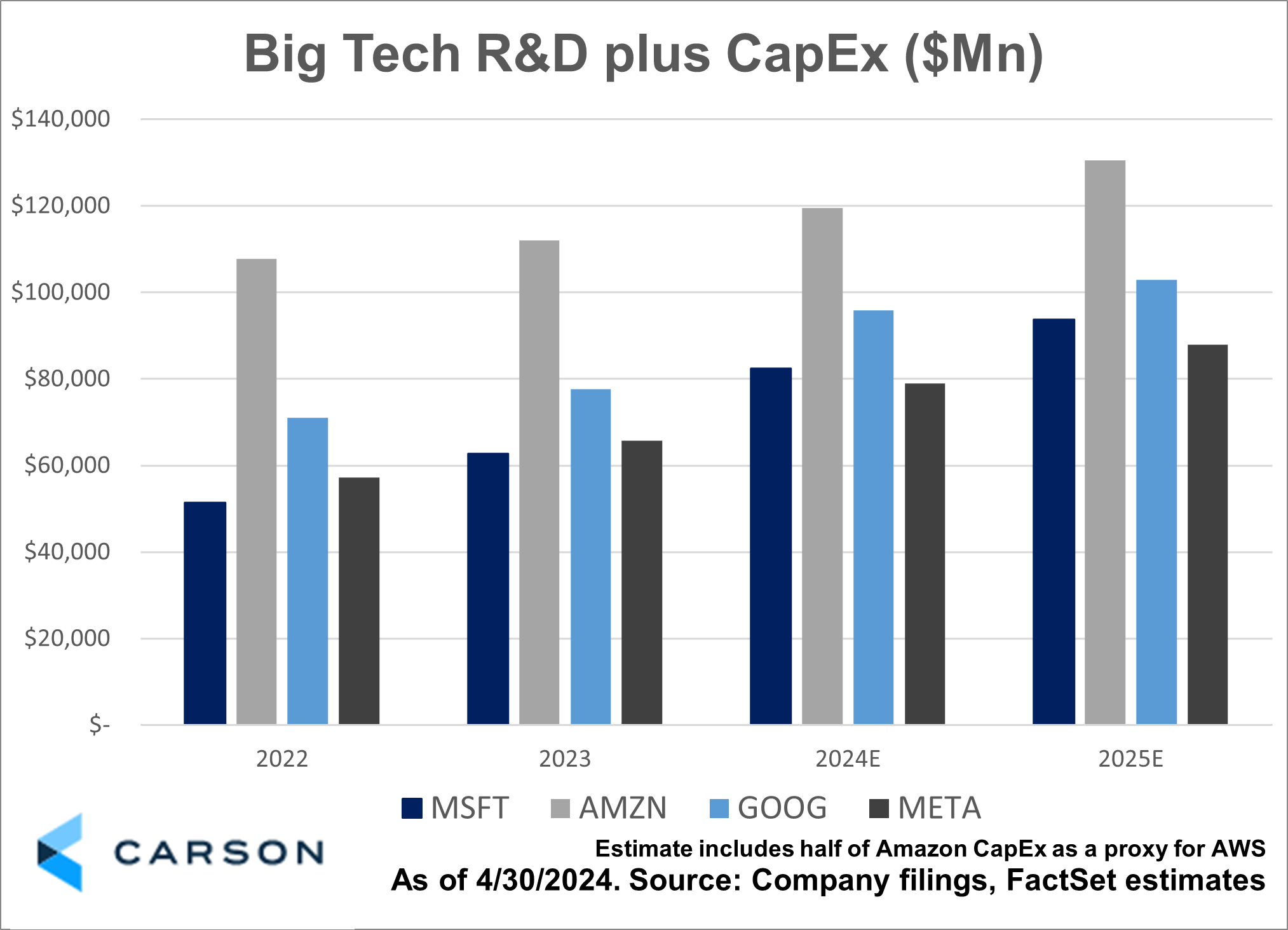

- Tech Investment in AI: One of the standout themes this season is the heavy investment by tech giants in artificial intelligence. These companies are allocating substantial capital to bolster their AI capabilities, sparking investor curiosity regarding the costs and expected returns of these investments. There’s a scramble among companies to acquire Nvidia’s chips, specifically the GPUs that enable the complex computing needs of AI. Nvidia’s recent earnings report exceeded expectations, reassuring investors about the robust demand for AI. Anticipation is building as they prepare to release their Blackwell Chip, touted to be 150% more powerful, later this year.

- Inflation and Consumer Spending: Companies are showing less concern about inflation, referencing it only half as much on earnings calls compared to two years ago when inflation rates were considerably higher. This shift is a net positive for both companies and consumers; however, it does constrain the pricing power of consumer-facing businesses. While customers continue to make purchases, they are becoming more discerning and seeking out bargains. This shift may present challenges for retailers like Target and Lululemon. However, it presents an ideal environment for Walmart whose solid earnings report propelled its shares to record highs.

- Cash Flow and Shareholder Returns: Mega-cap tech companies like Meta and Alphabet are leveraging their robust and rapidly growing cash flows to invest in AI initiatives while simultaneously returning capital to shareholders. Meta led the charge by initiating a dividend earlier in the year, with Alphabet following suit by launching its own dividend program this quarter. Additionally, Nvidia increased its dividend by 150% in conjunction with its 10-for-1 stock split. These strategic moves indicate a maturation within the trillion-dollar businesses. Though, given their substantial ongoing investments, these companies still anticipate strong growth into the future. This dual strategy not only reinforces investor confidence in their financial stability but also underscores their commitment to delivering value to shareholders.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

- Market Valuations: Despite market indices reaching record highs, the strong growth in earnings has led to a slight decrease in the forward price-to-earnings (P/E) ratio, from 21x at the end of the first quarter to 20.7x currently. While the phrase “record highs” invokes caution regarding future investment prospects, it’s worth noting that the market currently sits only 8% above its 5-year average P/E multiple of 19.2x. P/E ratios are a shortcut to determine valuation that are based upon a series of discounted cash flows, and this equation depends heavily on growth. While I believe the market dictates the multiple and we shouldn’t predict where that multiple will go, there are no glaring red flags concerning valuation, especially with earnings growth accelerating, in my opinion.

For more content by Jake Bleicher, Portfolio Manager click here.

02261341-0624-A