Markets received their first round of company earnings this week following unprecedented uncertainty. Several key companies offered a lens into the current state of consumer behavior, capital markets, and global demand. While strong quarterly results demonstrated these companies’ abilities to thrive in stable markets, executive commentary reflected growing concerns about a potential slowdown ahead.

JPMorgan reported robust earnings results. Non-GAAP earnings per share (“EPS”) of $5.07 beat the FactSet consensus estimate of $4.63, with revenues rising 8.0% year-over-year. The company’s Markets segment – which includes equity, fixed income, and derivatives trading, as well as their capital markets operations – was a standout this quarter, benefiting from a healthy IPO environment. The lending and consumer segment also largely met expectations. These results underscore JPMorgan’s ability to perform well in a stable market environment. But all ears were tuned to the company’s timely comments on underlying business trends.

Unfortunately, those stable conditions may be behind us, at least at the time of the report. Jamie Dimon, JPMorgan’s CEO, spoke candidly about emerging risks tied to trade tensions. Dimon commented “the economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and “trade wars,” ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility. As always, we hope for the best but prepare the Firm for a wide range of scenarios.” Dimon’s comments strike a balance between signaling cautious optimism paired with prudent risk management.

One key forward-looking metric that changed was the bank’s ‘weighted average expected unemployment,’ which increased from 5.5% last quarter to 5.8%. This input feeds into many of JPMorgan’s risks controls and profit levers, and even a modest uptick of this size may affect the firm’s ability to release net income from reserves. Importantly though, JPMorgan’s CFO noted “cash levels, spending and debt ratios are all in-line with our expectations. Consumers and small businesses remain healthy.” The rise in expected unemployment may simply reflect a conservative approach to credit positioning rather than an outright deterioration in fundamentals.

Jamie Dimon also reiterated his long-term view of managing the firm through cycles. “Our economists think it’s about a 50/50 [chance] for recession. Anecdotally, a lot of people are not doing things because of this [uncertainty]. Hiring, M&A, a lot of that is being paused. [If we do enter a recession], earnings won’t be great, the stock will likely go down, but I see it as an opportunity to buy back more stock.” His comments suggest the company is bracing for near-term volatility but is positioning for long-term opportunity.

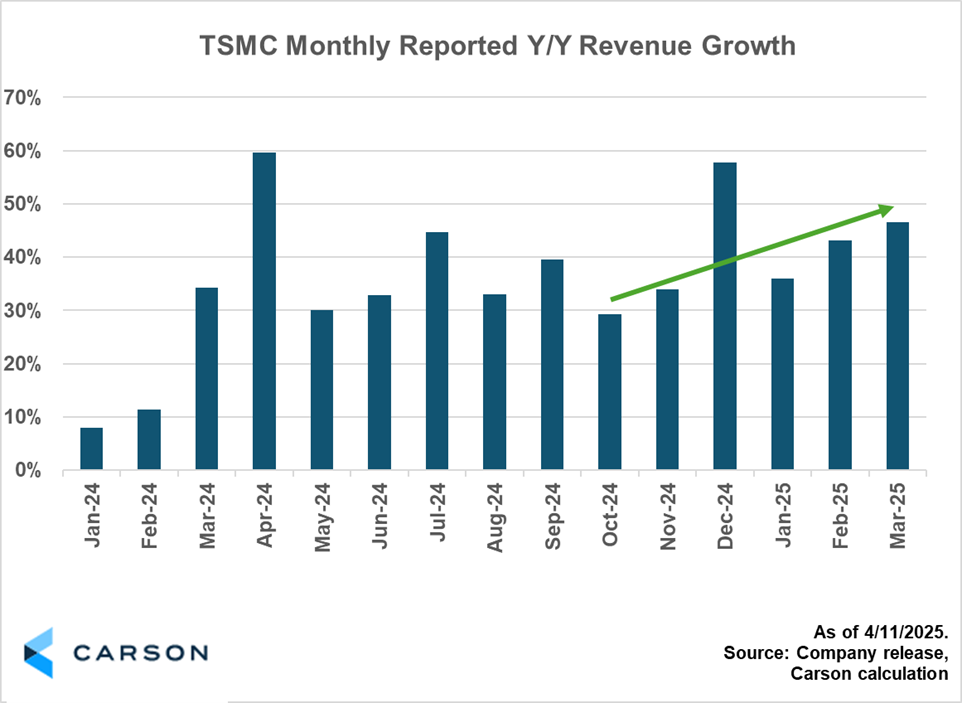

Investors also received upbeat monthly sales data from Costco and Taiwan Semiconductor, two bellwethers in their respective industries. The data suggest that business execution remained strong leading up to the end of the month.

Costco ($COST) released monthly sales data ahead of their formal earnings announcement. It revealed March adjusted year-over-year sales growth accelerated to 9.1% from 8.3% in February, as shown below. This result builds on months of recently heightened sales growth and may tell investors that Costco’s value proposition is resonating. The company is expected to formally announce their earnings report on May 6th.

Taiwan Semiconductor ($TSM) reported monthly sales figures that also speak to positive and accelerating underlying demand for their chip making business. TSM reported that March revenues grew an astounding 46% year-over-year, accelerating 3 percentage points from February, as shown below. With global demand for semiconductors showing no signs of slowing, investors are eagerly anticipating TSM’s April 17 earnings report to gain deeper insights into the company’s forward outlook.

This week’s results reflect a market at a crossroads—where strong company fundamentals coexist with rising macroeconomic headwinds. JPMorgan’s conservative tone and cautious adjustments stand in contrast to the growth momentum still visible in consumer and tech bellwethers like Costco and TSM. While no single narrative dominates, these reports collectively offer investors a balanced mix of resilience, realism, and potential opportunity in an increasingly complex economic landscape.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.

7850510.1-0425-A