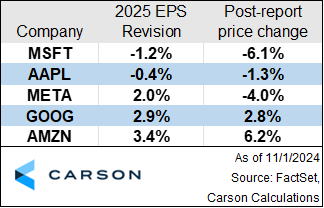

Investors this week digested results from some of the world’s largest companies. Both fundamental results and price return the day after the reports were mixed, but generally positive. As I wrote about last week in my Technology Earnings Preview, I noted that investors may shift their focus away from this year’s results and concentrate on how the companies speak about their prospects for 2025. It appears that was largely the case, as the table below shows a strong correlation between analysts’ change in 2025 expected earnings per share (“EPS”) and post-report price return.

The development of Artificial Intelligence (“AI”) products continued to be highlighted on many of the conference calls as a driver of strong revenue growth. In specific, Microsoft CEO Satya Nadella noted that their Microsoft 365 Co-Pilot is now being used “by nearly 70% of the Fortune 500” companies, with many existing customers returning to buy more seats.” Nadella added that “Microsoft 365 Co-Pilot [is being] adopted at a faster rate than any other new Microsoft 365 Suite.” As a result, Microsoft’s Azure cloud computing segment reported results above street estimates. Analysts left the call a bit more skeptical, however, with Microsoft expected to earn slightly less in their next fiscal year than before the release.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Amazon CEO Andy Jassy noted that “AWS’s AI business is a multibillion-dollar revenue run rate business that continues to grow at a triple-digit year-over-year percentage and is growing more than three times faster at this stage of its evolution than AWS itself grew.” AWS has been one of the largest beneficiaries of the AI-age, with that segment’s revenue accruing $102.9 billion in the last twelve months, the only cloud company to be a member of the 12-digit club. Amazon’s exceptional revenue growth paired with expanding margins resulted in the largest positive EPS revision and price change out of the group.

Meta, Google, and Apple are also telling their own AI-powered growth stories. Investors may be well served to remember just how large of captive user bases each of these companies cater to – Meta AI sees 500 million monthly users, Apple’s device install base hit new highs, and Google commands 90%+ market share of internet search traffic. The ‘Magnificent 7’ group of stocks continue to have rosy growth outlooks as they can layer on the latest and greatest technology – in this case AI services – to customers who already know the brand.

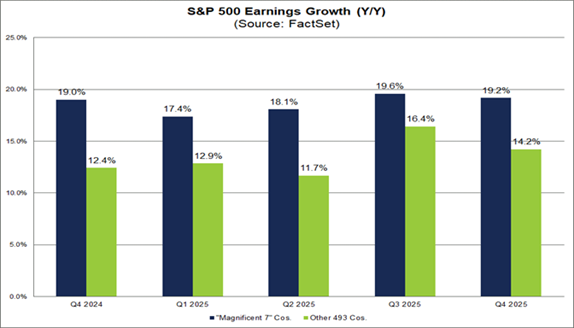

With strong competitive advantages and an innovative culture to quickly roll out new products, these companies are again proving why they are among the largest in the world. And estimates show they’re likely to continue growing faster than the rest of the market. FactSet compiled consensus estimates still show that quarterly EPS through the end of 2025 may grow at a faster rate than the rest of the market, as shown in the chart below1. The Magnificent 7 group of stocks continues to deliver magnificent earnings.

For more content by Blake Anderson, Senior Analyst, Investments click here.

02490926-1124-A