The close of the calendar quarter means the opening of earnings season. Investors this week will parse results from some of the largest financial institutions in the world including JPMorgan, Wells Fargo, and Bank of America, among others.

Assessing the big picture, the financials sector (as proxied by XLF, the Financial Select Sector SPDR ETF) has largely followed the moves of the broader S&P 500 (as proxied by SPY, the SPDR S&P 500 ETF) in recent years, albeit with volatile periods of outperformance and underperformance. Even accounting for the ‘banking crisis’ witnessed in the first quarter of 2023, the financials sector has outperformed the market by a measly 0.6% since 3/31/2023, as detailed in the chart below.

What gives? Shouldn’t financials be a beneficiary of a growing economy and outperform as a result? Investors may be well served to look past the noise of daily market movements and assess the fundamentals under the hood.

Investors in financial stocks, in my opinion, likely focus on two important metrics: average loans outstanding, and net interest margins generated. These are two of the biggest levers that financial institutions can pull in order to grow income. Results and commentary indicating better than expected levels in either, or both metrics, may lead to outperformance in the sector.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Average loans outstanding at many financial institutions continue to grow at a healthy pace. According to Federal Reserve data, total bank credit in the economy has recently inflected back to positive territory, growing 3.1% in September compared to last year’s levels1. While slightly lower than the average 4-5% growth range of the 2010’s expansion, it’s a sign that results may improve.

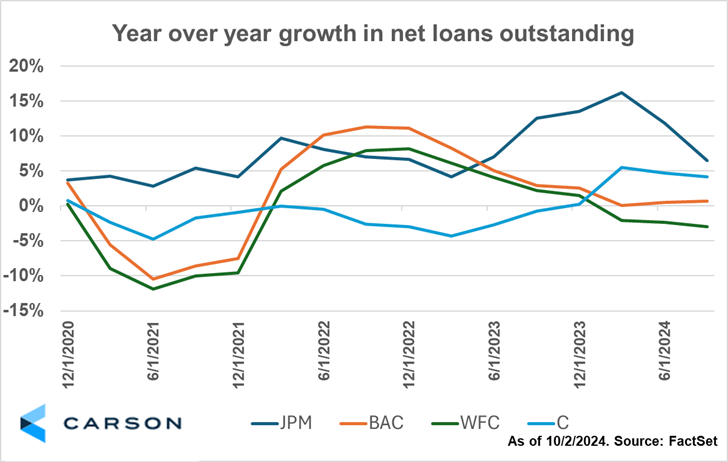

Major banks continue to grow net loans outstanding as well. The chart below shows year over year growth in net loans outstanding for four of the largest financials. While Wells Fargo is in negative territory, it is largely due to regulatory constraints. Should the economy continue to remain on stable or even healthy footing, investors may very well think loan growth is on the horizon and perhaps provide a tailwind to financial stocks.

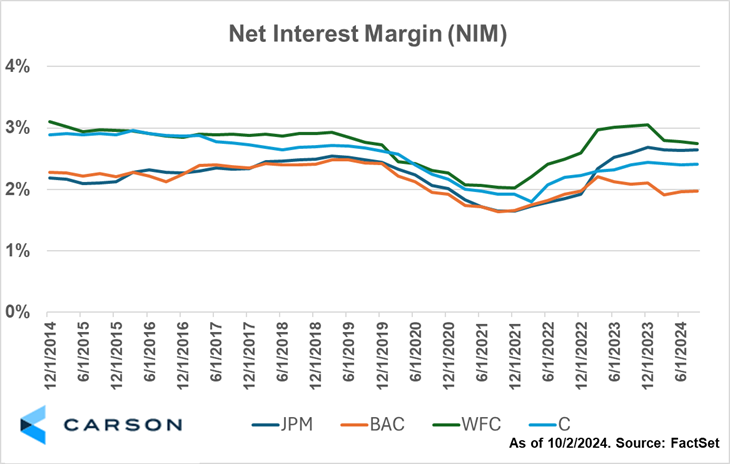

Net interest margin (NIM) represents the spread between how much the bank is earning on loans it issued to customers minus how much it owes on its own debt outstanding and what it pays on deposits. It’s an important gauge for investors to judge both how opportunistic the bank is in its lending practices and helps assess which banks have lower cost of capital, which typically is a boon to equity investors. I find it shocking that NIMs for 3 of the 4 selected institutions remain below pre-pandemic averages, shown in the chart below. Only JPMorgan has recorded a NIM above their pre-pandemic average.

Did these banks issue too many lower interest rate loans during the 2021 growth period and stifle their returns as a result? Are they not taking enough risk in their lending book? Are bank depositors demanding a higher deposit rate? The exact answer is unknowable, but in my opinion all the above factors may be playing into this outcome.

Tasked with forecasting the future, investors in financials will be keen to hear if these headwinds are abating. Nearly 18 months after the deposit flight caused by the banking crisis, consumers are perhaps more comfortable about which bank they’ve chosen, with these so called ‘sticky’ deposits acting as a tailwind to banks. And the first interest rate cut since 2020 by the Federal Reserve also eases the demands of depositors. Both factors may lead to higher NIMs. Should the economy remain in a stable growth environment, investors may also see loan growth accelerating. With tailwinds perhaps coming to two of the largest income levers for banks, it may soon be the time for financials to shine.

For more content by Blake Anderson, Senior Analyst, Investments click here.

02444526-1001-A