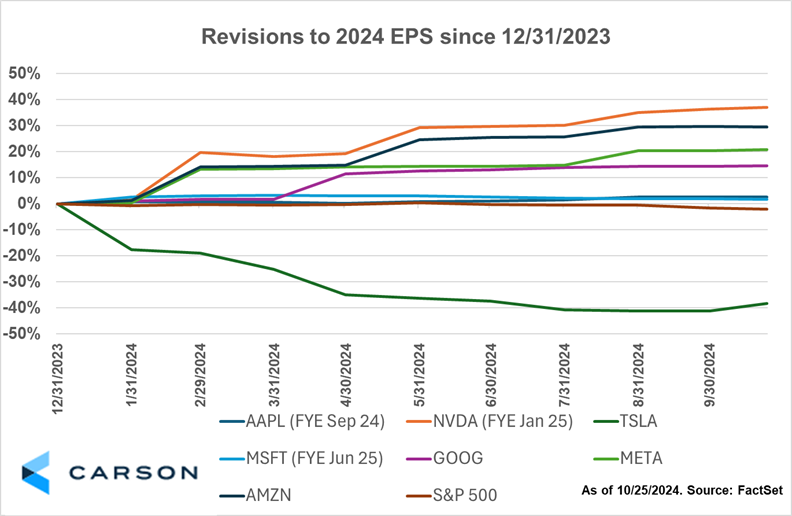

The ‘Magnificent 7’ group of stocks enters this earnings season with meaningfully different expectations. As represented by earnings estimate revisions thus far in 2024, investors are beginning to distinguish between perceived leaders and laggards amongst this group. Below is a chart of 2024’s earnings estimate revisions for each of the seven in this group since the beginning of this year. Nvidia investors expect the company’s earnings per share (“EPS”) for this fiscal year to be 37% higher than what was expected at the beginning of the year (all data according to FactSet consensus estimates). It’s worth noting that the average revision among this group is +10% (+18% excluding Tesla), while earnings estimates for the S&P 500 for 2024 have changed by -2.1%.

Tesla reported earnings after the close on October 23rd and gave investors plenty to cheer about, with the stock trading more than +20% the following day. It’s a welcome change of narrative for investors as Tesla had the most negative revisions to 2024 EPS of the Mag7 group, with a -41% revision in expectations heading into the release. Tesla CEO Elon Musk spoke clearly that investors should expect initial production of a next generation vehicle to begin in the first half of next year, and to expect Full Self Driving to be used for paid rides in 2025 as well. I recently wrote about Tesla’s Bold Vision and give more detail on their technological capabilities in that blog. Since news broke on June 13, 2024 that Mr. Musk’s pay package would be reinstated, Tesla stock has returned +47% compared to the S&P 500’s +7% return over the same time (FactSet data). Clearly, investors are eager for Mr. Musk to continue leading the company with his innovative designs.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

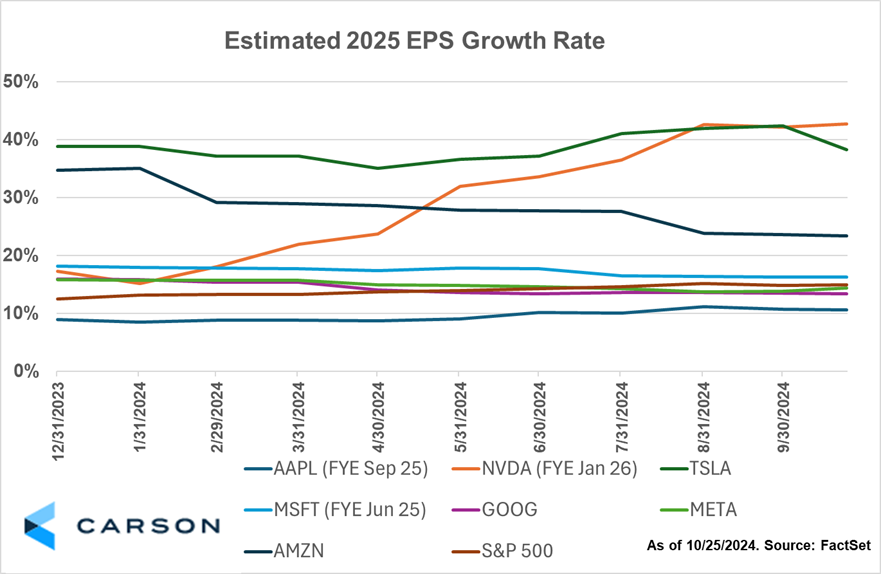

Investors are tasked with forecasting future profitability for each company. While revisions to 2024 EPS are important, the spotlight may begin to turn to a company’s 2025 growth prospects as an indicator of sustainable growth in the future. Below is a chart of each company’s implied EPS growth rate in 2025 throughout this year, based on FactSet consensus estimates. Nvidia’s combination of strong 2024 revisions (shown above) and increasing 2025 implied growth rate (shown below) may tell the story of why the stock has returned above 180% so far this year.

Amazon, however, stands out in the chart as the company which has seen the sharpest 2025 growth estimate reductions. Amazon’s implied 2025 EPS growth rate has declined from 35% at the beginning of the year, to 24% as of the latest estimates. On the company’s last earnings call, CEO Andy Jassy discussed that Project Kuiper, Amazon’s constellation of satellites designed to deliver broadband internet, is a center of higher costs and is decreasing company profitability in the near term. Project Kuiper received FCC approval in 2020 to operate a constellation of 3,200 satellites, with requirements that half of those would be in service by July 2026. Should Amazon aim to complete these requirements, it would mean higher costs over the coming quarters to manufacture and launch the fleet. However, Project Kuiper propels Amazon into a new market of broadband subscription services. With a robust base of Amazon Prime subscribers, the company may see a path to profitability in the coming years and boost future earnings.

The ’Magnificent 7’ group of stocks have posted remarkable stock price returns in 2024, with the returns being fueled by positive earnings estimate revisions. This group continues to grow faster than the broader market. Investors this earnings season will likely focus on next year’s estimated earnings growth as the company’s results come in. With such dispersion among estimated growth rates – with Apple’s 11% at the bottom of the range, and Nvidia’s 43% at the top of the range – investors are distinguishing even within the group.

For more content by Blake Anderson, Senior Analyst, Investments click here.

02480291-1024-A