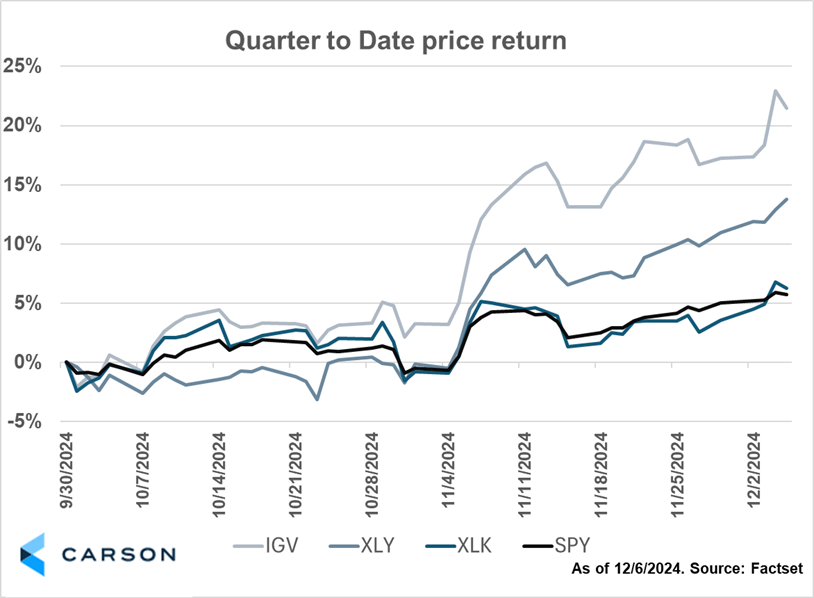

The iShares Expanded Technology Software Sector ETF (trading under IGV) has recorded a quarter-to-date gain of +21.5% as of Thursday’s close (FactSet data). The software-focused ETF is trouncing other broader ETFs over this period. It’s a welcome relief for software and technology-focused investors compared to earlier in the year, with the ETF seeing a gain of ‘only’ +10.1% year-to-date through the end of the third quarter (FactSet data). With announcements of new products and the earnings growth to back it up, software companies this quarter have led the charge higher since earnings season.

CrowdStrike’s Comeback

After suffering a -44% price drawdown this summer due to a software malfunction, CrowdStrike has gained +67% from its closing low price on August 2nd to now sit only 7% below its previous all-time high price (FactSet data as of 12/5/2024 close). While the stock has traded relatively flat since their November 26th earnings report, management’s commentary reveals why the stock may have seen such a strong comeback. CEO George Kurtz noted on the earnings call that CrowdStrike “maintained stable gross retention rates…at over 97%.” Customers, largely, aren’t abandoning the cybersecurity platform after their misstep. Mr. Kurtz continued by highlighting key wins in healthcare customers who are being targeted by cyber threats and illustrates the growing attack surface across industries. CrowdStrike has been a leader in AI-based cybersecurity, and its recent release of Charlotte, an agentic AI offering, helps strengthen their competitive advantage. In all, these factors have led to CrowdStrike’s comeback.

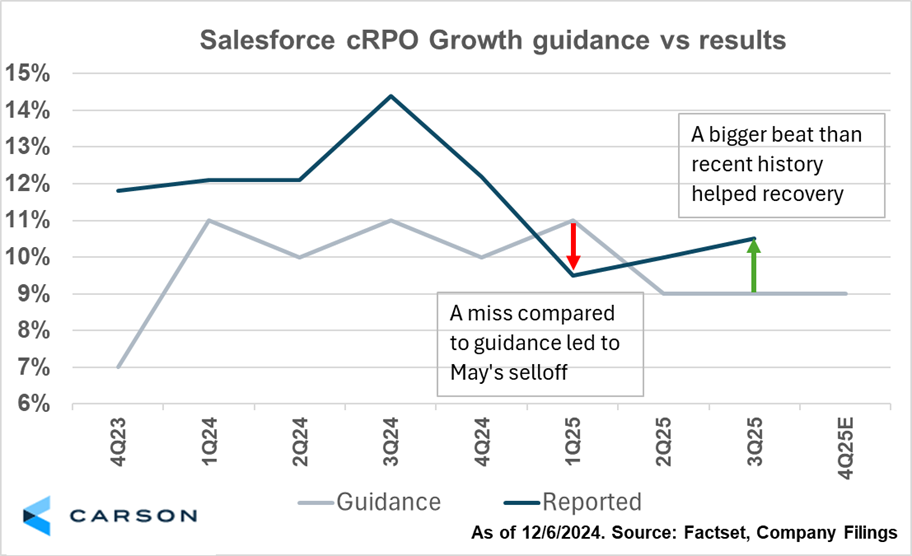

Salesforce Surprises

Salesforce has had a similar resurgence to CrowdStrike, with the company’s stock appreciating by +66% since its yearly closing low on May 30th (FactSet data as of 12/5/2024 close). This quarter showed the largest beat compared to guidance for the company’s current remaining performance obligation (“cRPO”) metric this year and may be a factor why the stock has performed so well. cRPO is a closely tracked metric by investors as it is seen to have a high correlation to near term revenue growth. Salesforce CEO Marc Benioff noted that the company has seen such strong demand for its products because of the introduction of its agentic AI offering, noting “Agentforce became available on October 24, and we’re already seeing incredible deal velocity. [We closed] more than 200 Agentforce deals just in Q3…and the pipeline is in the thousands of potential transactions.” With hopes of a brighter future, and results indicating an acceleration, the investor base is buying in to Salesforce’s future.

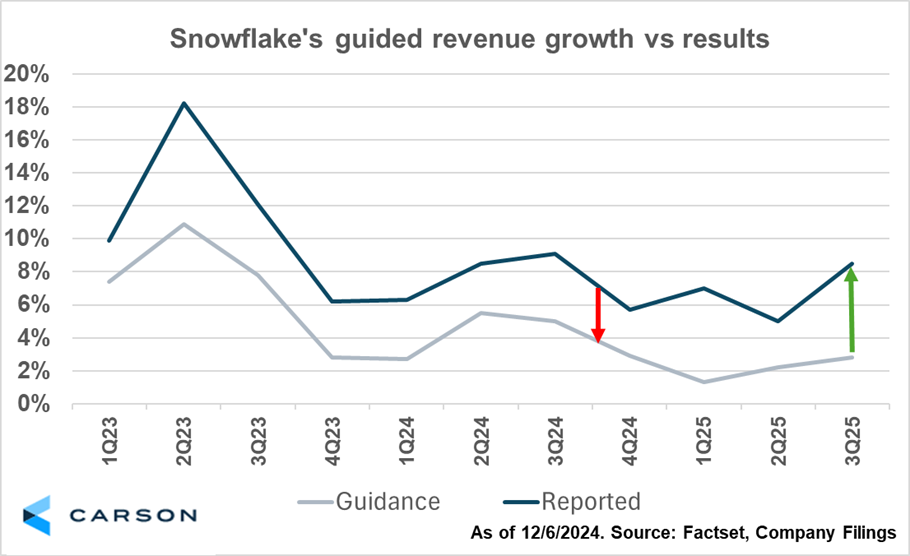

Snowflake Stuns

Snowflake has been one of the top gainers this quarter with the stock rising +59%, including a +32.7% return the day after its earnings report (as of 12/5/2024 close, FactSet data). The company’s stock price had been under pressure for much of the year as it was rumored that Databricks, a private competitor, was growing faster than Snowflake and was introducing more innovative offerings to win over customers. Snowflake’s recently appointed CEO, Sridhar Ramaswamy, put product innovation at the top of his priority list since accepting the role. The results are beginning to show. Mr. Ramaswamy noted that “[Snowflake’s] product development engine continues to accelerate as we launched the same number of Tier 1 features to general availability [this quarter] as we did in all of fiscal 2024.” If investors wanted Snowflake to increase innovation, it appears the company is doing just that. Like Salesforce, Snowflake’s revenue results compared to their guidance is showing larger beats than recent history. Investors are cheering the results.

CrowdStrike has comeback, Salesforce surprised, and Snowflake stunned. Each of these companies, and many others in software, are just beginning to rollout next generation AI-powered features. Their innovation flywheels are developing new products to possibly power another leg of revenue and earnings growth. And the prices of the company’s stocks reflect a brighter future may be coming with the industry ETF outperforming the broader market. Software is surging and is giving investors a positive year-end gift in an otherwise rocky year.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Blake Anderson, Senior Analyst, Investment click here.

02542791-1224-A