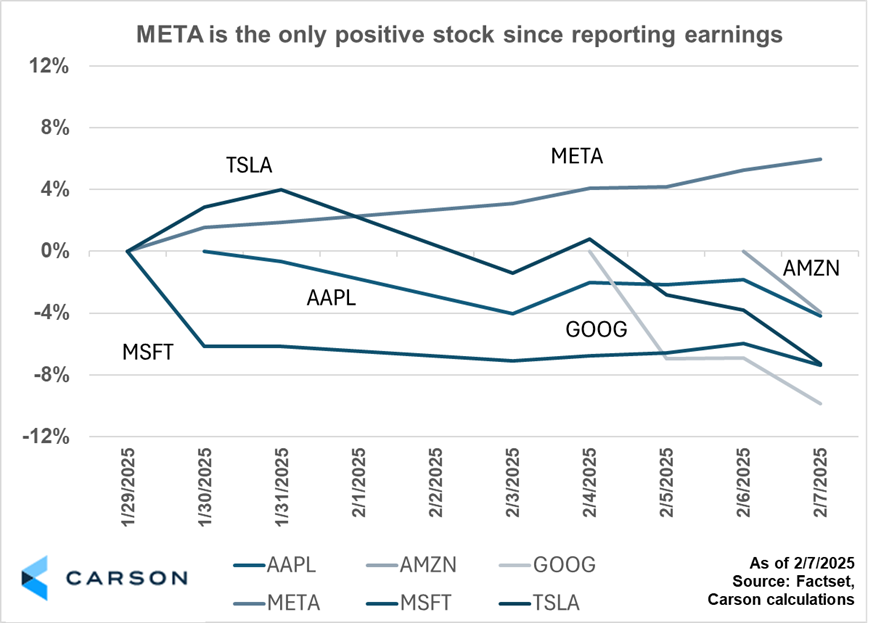

Investors digested results from six of the ‘Magnificent 7’ in the past two weeks. After A Magnificent Year, it is time for the companies to deliver the rise in earnings to support their lofty stock prices. Unfortunately, only one company, Meta Platforms, shows positive performance since reporting. This stock price performance for the group reflects that earnings results compared to estimates have largely come in-line, a marked slowdown from the typical earnings beats.

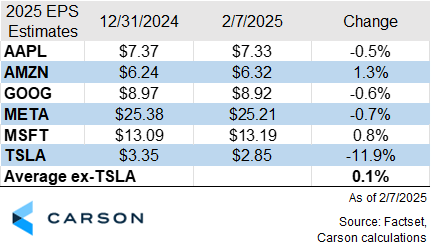

Earnings estimates for the six of the Magnificent 7 only slightly increased after their report, according to FactSet. In fact, four of the six saw their earnings per share (“EPS”) estimates decline compared to the beginning of the year as shown in the table below. Amazon is the notable standout, with the company’s EPS estimates for 2025 increasing by 1.3%, while Tesla saw the largest decrease at 11.9%. Excluding Tesla’s large negative revision, the average estimate revision to the remaining five was only 0.1%.

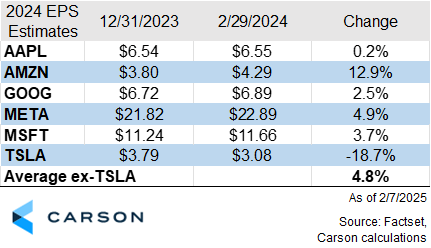

This 0.1% increase in estimates is a sharp slowdown compared to the year ago period. During the last fourth quarter reporting period (in the first calendar quarter of 2024) EPS estimates for those same five companies were revised upward by 4.8%, as shown below. The fourth quarter reporting period (which just concluded) is one of the most important of the four reporting seasons all year, as many management teams issue preliminary full year-guidance for the first time to help analysts refine their models. This dynamic often results in large changes to full year earnings estimates because of the forward guidance provided. Having such a muted upward revision may portend that expectations are already too high for these companies.

The latest earnings season for the Magnificent 7 has largely delivered results that were in-line with expectations. Despite this, only one of the six has seen their stock price rise since reporting. Earnings forecasts for the group saw minimal upward revisions, with some even declining, highlighting a slowdown in growth momentum. The contrast is stark compared to last year’s fourth-quarter results, when estimates rose significantly. The muted earnings revisions and stock reactions may signal that current expectations have already been priced in. Though, of course, estimates can be catalyzed to move higher or lower. Investors should weigh whether the current valuations still justify the growth outlook ahead.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Blake Anderson, Senior Analyst, Investment click here.

7620371-0225-A