Technology stocks find themselves at a pivotal crossroads ahead of this earnings season. Price action and fundamentals are beginning to send mixed signals. Active equity investors are likely to scrutinize both the quarter’s results and full-year outlook for the sector’s constituents to assess whether forward estimates are attainable.

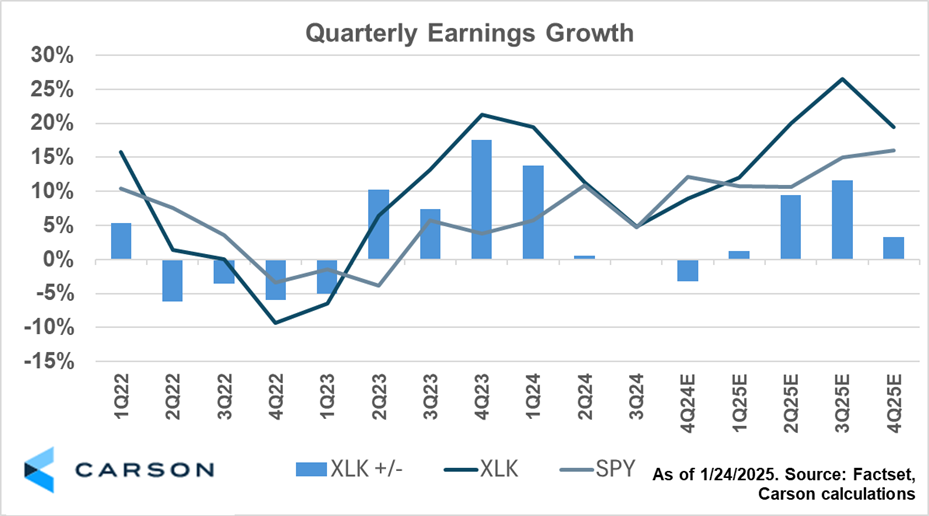

The technology sector, as proxied by XLK (the iShares Technology Select Sector Fund), has historically experienced earnings per share (“EPS”) growth that outpaces the broader S&P 500, as represented by SPY. As shown below, EPS growth outperformance for XLK peaked in the fourth quarter of 2023, with tech earnings growing 21.3% year over year compared to the S&P 500’s 3.7% growth – a notable 17.6% outperformance for tech stocks (FactSet data). However, during this reporting period, tech stocks are projected to have their weakest quarter of relative EPS growth since the first quarter of 2023, estimated at -3.2%. The fundamental driver of tech stock outperformance appears to be pausing, at least for now.

What may be most critical for technology investors, however, are the current FactSet consensus estimates for future EPS growth. Technology stocks are expected to resume outgrowing the broader market soon, with earnings expected to outgrow the market by as much as 11.6% in the third quarter of 2025 (FactSet data, as of 1/24/2025).

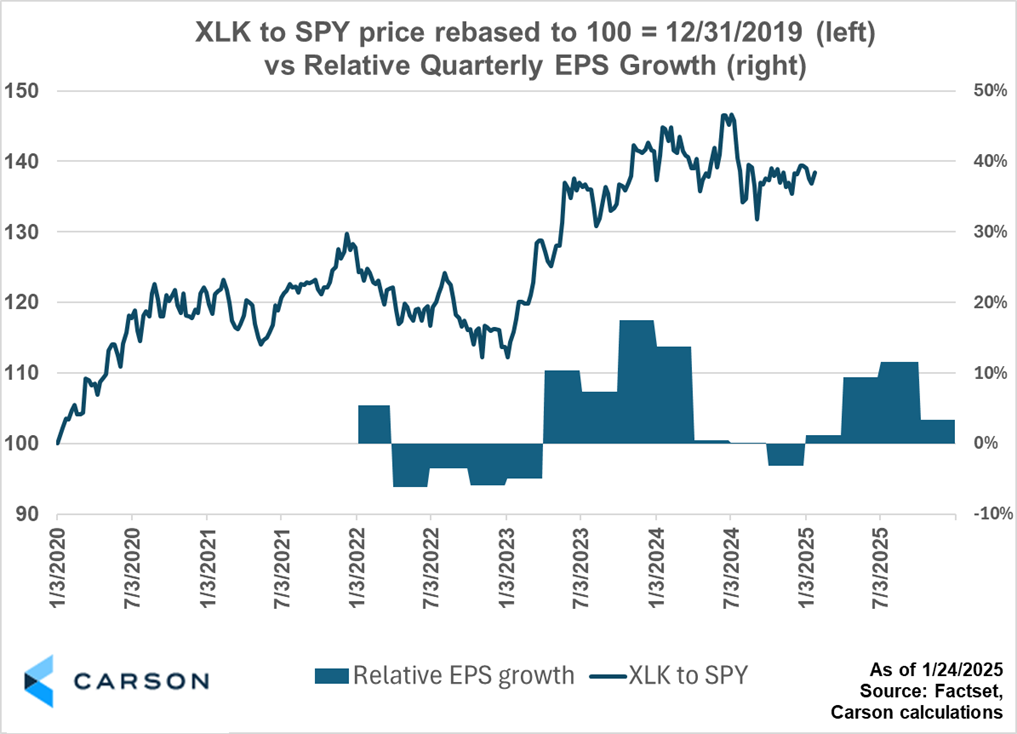

This pause in EPS growth outperformance has also coincided with a pause in price outperformance. As shown below, when comparing the price of XLK to SPY and rebasing the ratio to 100 as of December 31, 2019, tech stocks have materially outperformed over the past five-plus years by roughly 38%. However, the ratio chart currently sits at the same level as in November 2023. Said differently, XLK hasn’t outperformed SPY for a little over a year.

Investors aiming to outperform the market may consider overweighting the tech sector if they anticipate the ratio chart will rise again. Appending relative EPS growth to the chart reveals a loose and lagged correlation between price outperformance and EPS growth outperformance, with price movements often leading earnings growth differential by 3-6 months. Future projections of earnings growth outperformance may loosely imply that tech stocks may be poised to once again outperform the broader market, but of course these estimates are subject to change. Investors will need to sharpen their pencils as forward guidance rolls in.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Technology stocks have outperformed the broader market in recent years, perhaps owing to their ability to deliver higher EPS growth than the overall market. However, the sector’s earnings growth outperformance has stalled recently, and price outperformance has paused as well. Robust forward growth expectations set a high bar for guidance during this earnings season, offering both the potential for sector outperformance and a test of whether expectations align with reality.

For more content by Blake Anderson, Senior Analyst, Investment click here.

7569957-0125-A