“The stock market is a giant distraction to the business of investing.” Jack Bogle, Founder of Vanguard

With stocks up five months in a row, we’ve hit some weakness so far in August, which is fairly normal as we discussed in Stocks Don’t Like August, Now What? Here’s the truth, investors have been rather spoiled this year, with stocks having one of their best starts to a year ever. Yet it is important to remember that while stocks usually go up, they can also go down. Even in some of the best years ever, stocks tend to see double digit corrections at some point during the year.

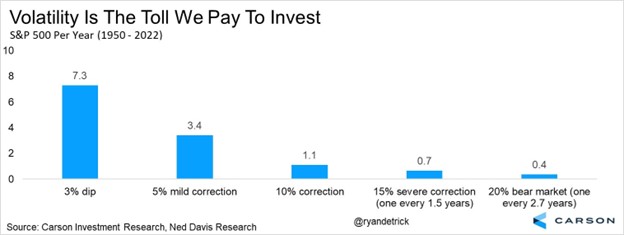

The S&P 500 pulled back nearly 8% back in March during the regional banking crisis and recently was down nearly 5% from the late July peak. Here’s the thing, volatility is normal (even in bull markets) and around here we like to say volatility is the toll we pay to invest. Or as the great Jack Bogle put it in the quote above, stock market volatility can make you take your eyes off the prize of longer-term investing.

With help from our friends at Ned Davis Research, here is a great chart that shows just how often you can expect said volatility.

A few takeaways:

- More than three 5% mild corrections a year, which puts the only one we’ve seen so far this year in perspective.

- There tends to be one 10% correction a year, while a bear market happens close to every three years on average.

- Then the real interesting one to me is each year sees an average of seven separate 3% dips. That isn’t much of a dip, sure, but when they happen they can cause quite a bit of worry and angst.

I’m out in Denver right now for a client event and a conference, so I wanted today’s blog to be short and sweet. Plus, the chart above is one of those charts that investors need to always remember, as when volatility hits (and it will) you need to be prepared for it. Print it off, save it, put it on the fridge, just don’t forget it. As Dwight Eisenhower said, “Plans are useless, but planning is everything.” Plan for each year to have scary headlines and volatility.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more of our views on the sudden strength of the economy, me breaking my laptop, stock market weakness in August, and the upcoming Jackson Hole meeting for the Fed, here’s our latest Facts vs. Feelings podcast titled “Recession? Guess the Economy Didn’t Get the Memo”.