Note that none of this commentary constitutes buy/sell/hold recommendations.

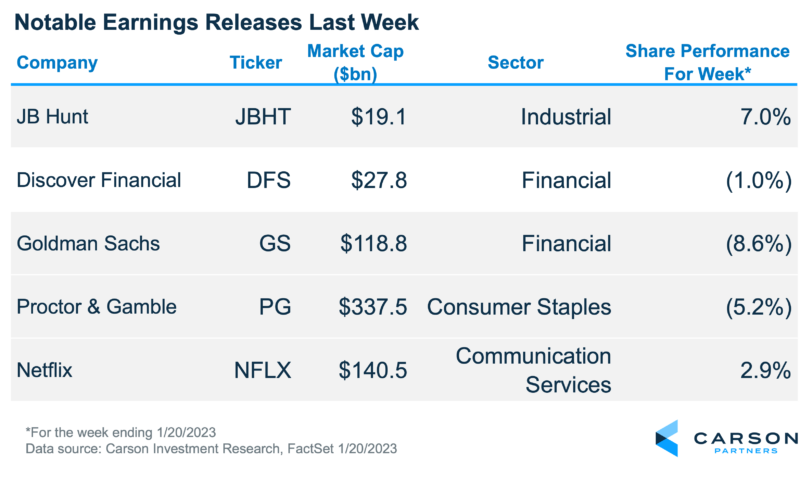

We selected Tom Petty’s “The Waiting” as our theme song for this reporting season in our recent Earnings Preview. We feel that it captures investors’ sentiment as we await to see if this sideways market can find direction, either through evidence of an incoming recession or a soft landing. Quarterly earnings calls from public companies can give a ground-level perspective into the state of our economy, industries, and equity market. Here, we’ve selected a handful of firms from various sectors that reported results last week to see where we stand, but more importantly, where we might be going.

Every day we see one more card.

Our overall take from last week’s earnings reports is that many firms are seeing near-term weakness. However, comments about an improving second-half environment helped investors look through this soft patch and anticipate brighter days ahead.

J.B.Hunt (JBHT) – Management sees a 2H rebound

J.B. Hunt is one of the nation’s largest trucking companies. It gave investors what they needed to hear; results are weak near-term, but there’s hope for an improved second half. In fact, management said most of this freight recession is an inventory correction based on customer data and feedback. If true, this is encouraging for the broader economy because end demand remains fairly healthy.

This was enough to send the stock nearly 5% higher on Wednesday after its report while broader markets were weak, which is encouraging for such a cyclically-sensitive firm.

Discover Financial (DFS) – Scary credit headlines put into perspective during earnings call

Discover Financial is a large issuer of credit cards. Its stock initially sold off sharply as the firm reported an acceleration in “net charge offs,” or bad loans, and said that these losses would be higher than analysts expected for the year. However, the stock recovered after management made the case that the increase was due to normalization from unusually strong credit conditions in recent years. Also, it said credit losses are to peak in 2024 at levels below what some had feared, and this is a management team with a reputation for being conservative.

In short, the company sees higher stress on consumer credit, but when planning for various economic scenarios, it is not forecasting this alarming reaching levels.

Goldman Sachs (GS) – Stock hit hard but appears to be mostly company-specific

Goldman posted its biggest earnings miss in over five years, which sent shares tumbling. However, much of this seems to be company-specific, as other US banks managed the difficult environment in capital markets much better. So we’ll set aside these factors since our focus is what earnings reports mean for the broader economy.

Here, Goldman notes that balance sheets and corporate fundamentals are relatively healthy but that the 2023 outlook remains uncertain. It added that CEOs are cautious for the near term and would like to see some stability before committing to longer-term plans.

Equity investors can relate.

Proctor & Gamble (PG) – Inflation-fueled growth but cost pressures are improving

Proctor & Gamble is the leading provider of consumer staples with such brands as Pampers, Bounce, Tide, Charmin, etc. The stock was soft on its report, which was probably due to a combination of elevated expectations/valuation. Also, most of its quarterly growth came from price instead of volume, considered lower quality/less durable. As a result, price increases accelerated to 10% compared to just 3% a year ago. Volumes fell 6%, but about half of this was from end demand. Currency and cost increases remain a large headwind, but it is seeing modest improvements, which left the door open for potential EPS upside later this year.

We note that Consumer Staples stocks were down nearly 3% last week, which we find interesting considering that these are highly-defensive stocks that investors flock to in times of economic stress. A shift away from defensive positioning bodes well for broader markets.

Netflix (NFLX) – Investors cheer outlook for accelerating growth in revenue and profit

Netflix is the leading provider of video streaming. It isn’t the best read for the broader economy, considering the secular adoption of its service and relatively inexpensive price. However, we think it’s relevant for why the stock has begun performing well, which may foretell what’s to come from other growth-minded firms that are now beginning to find religion in profitable growth. On this front, Netflix is about a year ahead of most as it went through its post-pandemic slowdown last year. Now the firm is calling for accelerating revenue growth, and profit expansion, and is expecting free cash flow to nearly double in 2023.

To be clear, the stock is still well off its all-time highs but has doubled from last year’s lows. Perhaps other “fallen angels” are poised to follow.

Note that none of this commentary constitutes buy/sell/hold recommendations.