This, friends, is where I actually started my blog post series before it expanded to a full week. This is where the rubber meets the road. Today, we’re going to chat about hiring, compensating, training and developing new talent in our industry.

As a reminder, when I’m talking about “new talent,” I’m referring to recent graduates or career-changers who don’t have experience in the financial services industry. We’ve been awfully exclusive for a long time, and we’ve found ourselves in quite the conundrum – not enough experienced people for all of the roles we need to fill, and a pretty homogenous talent pool that’s leading to a lack of diversity in important roles and leadership positions. This ends up hurting our industry, since diversity tends to lead to better outcomes.

How to Hire New Talent

We already focused on who can be successful in our industry, and how we might go about finding people with potential. But now we’re going to talk about what it looks like to hire them.

You might have more applicants than you’re used to. The worry some leaders have is that posting entry-level positions will lead to a flood of resumes you don’t have the time to sort through. It shouldn’t feel like an overwhelming task for someone to apply to your open position, but you also want to focus on people who are truly interested.

You might consider adding a short questionnaire (one that takes only a few minutes to complete) for people to fill out as part of the application process. This will lead those who aren’t serious to quit before submitting. Think about asking questions like:

- “Where did you hear about this position?”

- “What are three of your biggest strengths?”

- “What interests you about this position?”

- “If you are selected for an interview, what days and times tend to work best for you?”

If you do this, remember that job seekers are going to put in a lot of effort, so make the questions fairly easy to answer. Assure them upfront that you’re not looking for an essay response.

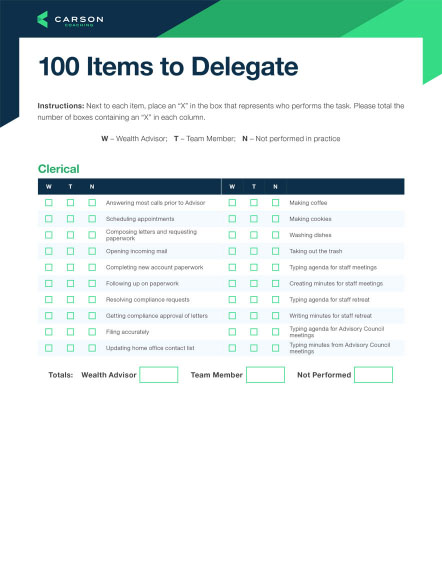

Next, enlist help screening resumes. Delegate this to someone on your team or hire a recruiter to assist. Then, get away from the old model where every first interview is an hourlong in-person interview. Set up short 30-minute interviews via phone or web conference.

They might not match the picture of how you think they “should” look/act/speak. When we get beyond our typical M.O. of hiring a young college grad named “John” whose father works in our industry, things might feel different. You see, John had a leg up. His dad taught him our industry norms – how to dress, how to interview, what industry jargon to drop in conversation and what compensation to expect.

I’m not knocking John – I’ve had some lucky breaks, too! My dad taught me the value of dollar cost averaging early on. I had an uncle who was a financial advisor, and my parents attended church with a very successful RIA owner who took the time to chat with me about the industry while I was still in college.

Read more: Building Key Stakeholder Plans for Team Members You Can’t Live Without

There are so many people who didn’t have these advantages who would be phenomenal hires – they just haven’t been taught the norms yet. So if our candidate shows up to interview in attire that isn’t a nice suit, or they’ve never heard of The Wall Street Journal, or they don’t know industry jargon, or they commit some other minor faux pas, be willing to look deeper.

You might need to work harder identifying what’s important. Your job is to determine whether the person you’re interviewing has the personal characteristics/traits that you think make someone successful in a role. Get some practice with behavioral questions like: “Tell me about times where you were really challenged personally or professionally and how you responded.” When listening to their answers, actively look for examples of those qualities you’re looking for.

How to Compensate New Talent

The best advice I can give you comes from Daniel Pink, author of Drive: The Surprising Truth About What Motivates Us: “The best use of money as a motivator is to pay people enough to take the issue of money off the table.”

Translation: Pay people enough so that they don’t have to worry about feeding or housing their family. Pay a base salary that allows your employees to live comfortably. For recent graduates, you need to pay a living wage. For career changers, you might need to pay a little more.

Carson is paying new graduates who are part of our NextGen program a $50,000 base salary plus 6% bonus potential and full benefits (which include health insurance, life insurance, paid time off, professional development reimbursement, student loan assistance, paid holidays, 401(k) with match, paid sabbaticals, wellness reimbursements and more). That’s in Omaha, Nebraska. According to NerdWallet’s cost of living calculator, the equivalent base salary in San Francisco is $109,464. In Denver, it’s $61,707. In New York City, it’s $139,333. How do you stack up when it comes to compensating entry-level positions?

If we’re underpaying or using models heavily weighted toward “results-based compensation,” we’re missing out on groups of people who don’t have the personal savings or family support to take that financial risk.

Don’t discount the role that comprehensive benefits play, either. There are many options to offer a solid benefit package to your employees. You might just need to do some research.

Finally, think about how you can offer equity to key members of your team at some point in their career with you. This doesn’t mean that you need to give away a majority position, but even small amounts of equity can be an incredible retention and motivation tool. I’d caution against making equity a part of your initial offer to a candidate, but it’s very powerful to be able to speak about the opportunity they have for future equity ownership and share specific metrics they’ll need to meet to be eligible.

Training

A training program is an investment in your firm’s future. Don’t worry about “getting value” from your new hire in the first few weeks or months. Plan on meeting with them daily for the first two weeks. Then you can begin backing it down to every other day, then once per week, then once every two weeks.

In those first few months, build a training program that includes these areas:

Training Area #1: Basic Onboarding. You need to give your new hire a lay of the land, which includes everything you teach new employees, like:

- Email setup

- Answering the phone

- Where the printers, copiers, etc., are located

- Benefits and paperwork

- Employee manual items

Training Area #2: Financial Literacy. If the person you hired doesn’t have a background in the industry, they may need some foundational education on the things we take for granted, like how to budget, how savings accounts work and definitions of things like IRA, mutual fund, ETF, net worth, etc. Whether your new hire needs this education depends on the person. If they do, pick your favorite financial literacy program and pay for your new hire to go through it.

Training Area #3: Your Firm. In this area, you’ll want to cover things like:

- What are your company values?

- What is the company’s history?

- Who is on the team?

- Who are your clients?

- What technology do you use?

- What are your client service standards?

Training Area #4: The Value You Bring to Clients. In this area, we want to help new employees connect with the importance of what we do. Include things like:

- Why does financial planning and investment management matter?

- How do firms make money?

- Share testimonials and “thank you” notes you’ve received from your clients.

- Allow your new hire to experience the power of planning by having them go through the financial planning process for themselves. Note that some people aren’t comfortable sharing this intimate information with their employer, so consider offering a “voucher” or “trade” with another firm that you trust.

Training Area #5: How You Work With Clients. Once you’ve explained why financial planning is important, now you get to the “nitty gritty” of how you do this for your clients. Cover things like:

- What services do you offer to clients?

- How do you charge your clients for your services?

- What is your new client onboarding process?

- What is your review process?

- What is your planning process?

- What is your investment methodology?

- What does a client statement look like?

Training Area #6: Industry Foundations. It helps to know how your firm fits into the broader ecosystem. Train your new hire on things like:

- Who are related financial professionals that your clients work with?

- Who are the players in the space – B/Ds, RIAs, custodians, regulatory agencies, etc. – and how do they work together?

- What are your important vendors, and who are the contacts at those vendors?

- What is “compliance” and why does it matter? What things are typically reviewed in an audit?

Training Area #7: Role Foundations. Now it’s time to get into the specifics of their specific role:

- What technology systems will they be using?

- What are the specific processes they need to follow, and where are those located?

- How do you fill out paperwork?

- Have them shadow someone doing the tasks they’ll be expected to handle and take copious notes.

Training Area #8: Downtime – Self Study. You and your team can’t possibly be actively training someone all of the time – there’s a good chance they’ll have downtime as well. So give them a list of self-guided learning they can be working on:

- Books like Atomic Habits by James Clear, Proven in the Trenches by Ron Carson, Storytelling for Advisors by Mitch Anthony and Scott West, The Richest Man in Babylon by George Samuel Clason, The Success Cycle by Marques Ogden, 12: The Elements of Great Managing by James K. Harter and Rodd Wagner, The Slight Edge by Jeff Olson, or any of your other favorite industry or personal development books.

- Podcasts like Conversations for Financial Professionals, Framework, So You’re A Financial Planner…Now What?, The Financial Advisor Success Podcast or any other of your favorite industry podcasts.

- Online courses like the ones we offer through Carson Coaching Online.

Ongoing Development

Somewhere in between Months 3 and 6, your new hire will get a good handle on the basics of your firm, the industry and their role. At this point, we need to transition to deepening their understanding of what we do, our industry and how everything fits together. This stage includes:

Certifications and credentialing. Whatever their role, determine which license, certification or credential they should get started on. It may be a Series 65 license, it may be a CFP® or CFA® education program, or it might be something else unique to the role. Get them enrolled in the program that makes sense for them – and help them pay for it! This may come earlier in the process – just make sure they have enough bandwidth to be successful at this while they’re learning their new role.

Read more: The Process of Creating Great Processes

Mentoring. Schedule a standing time at least a couple of times per month to sit down with your new hire and teach them. Things to consider teaching:

- Lessons you’ve learned – what works and what hasn’t worked.

- How you develop strategy for your firm.

- How you set goals.

- How you manage your team.

- How you evaluate vendors.

- How you connect with clients and prospects.

- How you make decisions as a firm owner.

- Your thoughts on the future of the industry.

Expanding perspectives. Support them getting out of their bubble and seeing the bigger picture. This helps them learn to evaluate new ideas, make connections that can help you innovate at your firm and bring fresh perspective to everything they do. You can do this by:

- Paying for them to attend industry conferences.

- Introducing them to industry leaders.

- Sharing important industry publications and thought leaders they should be following.

- Encouraging them to join industry associations and study groups of their peers.

Supporting personal and professional development. Let’s help everyone become successful human beings. We can do this through:

- Hiring a one-on-one coach to help them grow and improve.

- Sending them to group coaching programs like our Emerging Advisor Growth Accelerator Program.

- Sharing books and podcasts that have made a difference in our own lives.

- Providing a generous professional development reimbursement amount.

- Enrolling them in a program to learn about the power of mindset.

- Expanding our idea of what “personal development” we support – it could also be relationships, mental health, physical health, hobbies and more.

We’ve Got This

What I’ve outlined here feels like a lot of work. But let’s remember why we’re doing it: We need to hire talented people from outside of our industry because (1) everyone wants to hire someone with experience, and there’s just not enough of those people; and (2) it’s one of the best ways to bring in new perspectives and increase the diversity in our industry.

We dug a hole for ourselves, and it’s up to us to build the ladder to get out of it. If we put in some effort now, our firms, and our industry, will be THE place to be for amazing, talented professionals. Let’s do this.