It’s been a tough year, both for stocks and bonds. Perhaps the bonds piece of it has been tougher, mostly because you typically expect bonds to zag when stocks zag. Instead, they’ve gone down together.

And as stocks and bonds have gone down, negativity has increased. Don’t get me wrong – there’s enough to be negative on, e.g. a bear market for stocks that hit another low in October, the Federal Reserve raising rates and so far giving no hint of pausing, yield curve inversion (which has historically foreshadowed recessions), recession predictions, high gas prices, high food prices and more recently, higher mortgage rates and crashing home sales activity.

And that by no means is an exhaustive list.

A Different Lens 🔎 🙃

More than a decade ago I was backpacking in Argentinean Patagonia (which I highly recommend) and the last leg of my trip took me to the southernmost tip of South America, to a town called Ushuaia and nicknamed “fin del Mundo” or “end of the world”. It’s a town that sits along the ocean (technically, the “Beagle Channel”) and has forests, glacial landscapes, as well as tours to Antarctica (which I didn’t do, unfortunately).

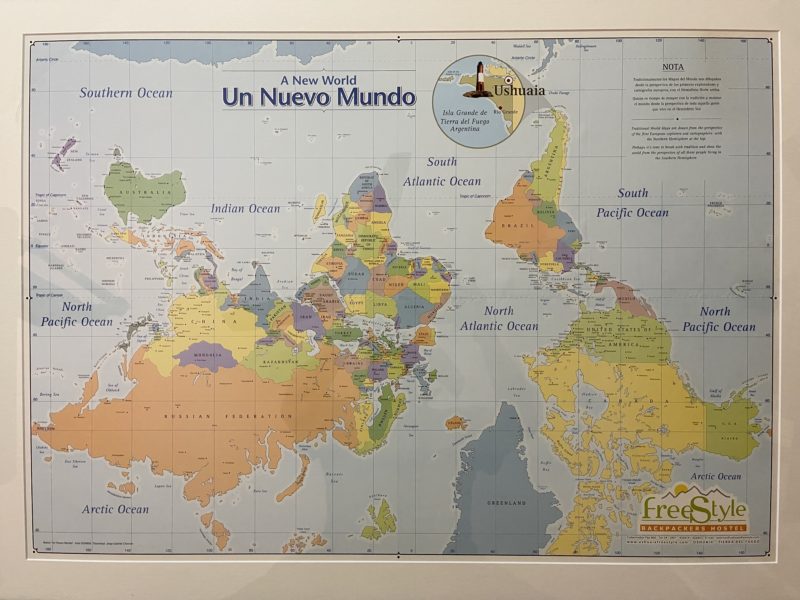

One thing about being in Argentina is that the seasons are upside down relative to America. I was traveling in what would be Fall up here but was the heart of Spring down there. It takes getting used to. Anyway, I was staying at a hostel when I came across a most interesting map. I usually love staring at maps, old and new, but this was totally different. It was an upside-down view of the world – North was South and South was North. As you can see below, it completely changes your perspective. For one thing, look at how big Canada and Alaska are, not to mention Africa – all of which completely dwarf Europe. Even Brazil looks bigger than all of Europe ex Russia.

The map is titled “Un Nuevo Mundo” or “A New World”. But not really, right? It’s the same world. Just upside down.

I framed the map, and it now sits behind my seat. I love the memory of that trip, but it serves as a reminder that there are different ways to look at the world.

Which gets us to the title of this blog.

There are things that could go and are going, right 👍

My colleague, Ryan Detrick, and I just recorded the 10th episode of our new podcast, Facts vs Feelings and we chatted about a few things we’re thankful for (within the realm of markets and the economy). Without giving too much of our conversation away, we nailed down three things.

One, Positive seasonality. Markets are rallying again and we just started what’s historically been the best six-month period of the four-year presidential cycle. Ryan’s written a lot about this and we even talked about this in episode 9 of our podcast – stocks have been higher every single time from November through April during midterm years. Will it be positive again? I don’t know but I like the odds of a tailwind from positive seasonality.

Two, no crypto-contagion. I should qualify this with “yet”. Over the past 10 days, we’ve seen one of the largest cryptocurrency exchanges blow up. Stocks did fall on the day after the election – but it was unclear whether markets were falling because we didn’t have midterm election results yet or whether it was due to the crypto implosion. Anyway, markets more than made up lost ground from that day and had a massive rally last Thursday that continued into Friday. Technology stocks have been relatively correlated with the crypto complex this year, but they outperformed over the past week even as cryptocurrencies pulled back.

Three, soft inflation numbers. The October CPI report was positive for several reasons (as I wrote about previously) and was the catalyst for a massive stock market rally. While one month is not a trend, it certainly corroborated (or caught up to) all the other price indicators showing that inflation was coming down.

More good news on the inflation front 📰

We just got the producer price index data for October, and that was much softer than expected, and in some ways just as positive as the CPI report. Core PPI, ex-food and energy, was flat last month, which is the slowest monthly pace we’ve seen in 2 years. PPI is essentially a measure of prices producers receive for their output, both goods, and services.

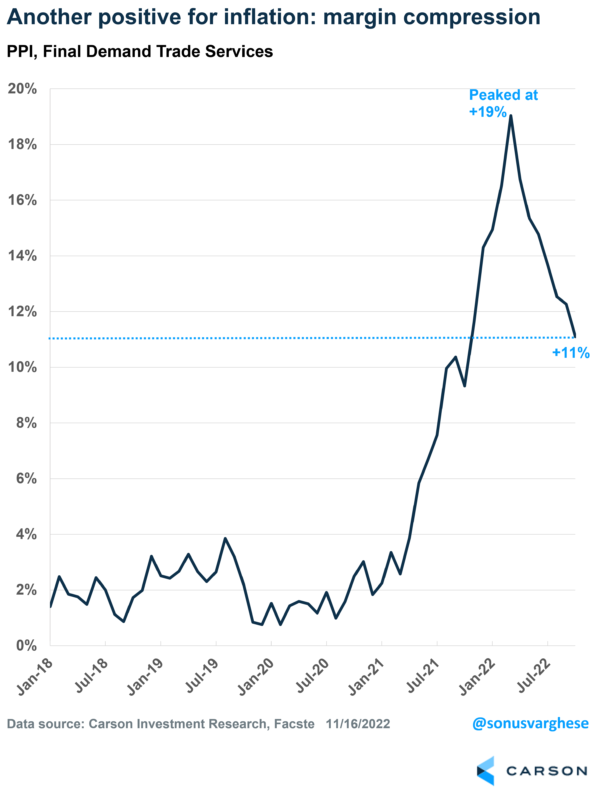

However, there’s an entire category of PPI, for wholesale and retail services, where it’s not measuring output prices – these businesses don’t alter products, and instead add value to finished products through services that help sell more products (warehousing, marketing, display, sales, and promotions, etc). Without getting into the weeds of it, PPI for these “distributive services” actually measure margin prices, i.e. the retailer or wholesaler’s selling price minus the current price of acquiring that good. And these retail margins have surged since April 2021, contributing to high prices.

But the good news is that they’ve been decelerating recently, and quite sharply over the last couple of months, including a 0.5% decline in October. The year-over-year pace is now about 11%, having decelerated from a peak of 19% in March 2022. It still has some ways to go to get back to the pre-pandemic pace of about 2%, but the trend is very encouraging.

This “margin compression” bodes very well for a further downshift in inflation, and we could even see a rapid fall in prices as we get into the first half of 2023. That would certainly qualify as something that could go right, not to mention the fact that it would ease a lot of pressure on the Fed. I don’t think a lot of people, including the Fed, are prepared for the possibility that inflation could fall even as economic growth picks up and financial markets rally.

Of course, this is not meant to be pollyannaish. I recognize that things could also go wrong. We got a glimpse of that today with the Russia-Ukraine situation, as missiles landed in Poland, killing two people and raising the possibility of escalation. Markets sold off immediately, before recovering. And then news broke that it was Ukrainian air defense.

Nevertheless, it’s always useful to ask, “what could go right”, more so when everyone’s focused on “what could, or what else, could go wrong”. Sometimes turning the map upside down and looking at things from a different perspective reveals new insights into the world. 🌎