“It’s not what you look at that matters; it’s what you see.” Henry David Thoreau

I’ve done this for more than two decades, and I have to say, the general consensus remains that the first half of next year will be rough for stocks, while the second half of the year should be better. But let’s be clear, overall, the general consensus is that next year will be rough for investors (as we explained here).

The last time I can recall everyone agreeing on something like this was in 2012 and the fiscal cliff drama. Seriously, it is all anyone talked about in the second half of 2012, and the big worry was that it would wreak havoc on stocks and the economy in the first half of 2013 and beyond. Guess what happened? Stocks soared nearly 30% in 2013, and the economy did just fine.

You see, the stock market is always pricing things in, and if everyone is talking about it, you better believe the stock market is aware. As Lou Holtz once said, “Life is 10% what happens to you and 90% how you respond to it.” We are in the midst of one of the worst years ever for investors, and the general consensus is that next year will be bad, also. So the question is, how are we supposed to respond to this?

What amazes me is how bearish everyone is. Yet, we have inflation coming down very quickly, an economy (while notably slowing, for sure) that we believe is not likely to be headed to a recession (in part, thanks to a very strong consumer), and some of the historically best times to invest based on the calendar.

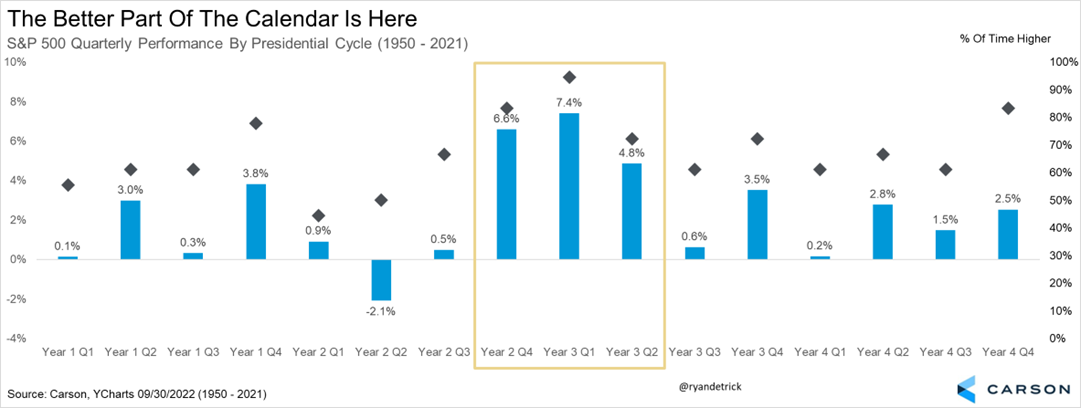

That’s right, the first quarter in a pre-election year has been positive an incredible 17 out of 18 times going back to 1950. Oh, it was also up 7.4% on average (the very best quarter out of the entire four-year Presidential cycle). On top of that, the second quarter has also performed quite well, too. So, we potentially have an interesting situation brewing here, and I sure don’t hear too many people pointing out any of the more optimistic news or perspectives.

Now go back to the quote at the very beginning about what you look at versus what you see. To me, I look at all the worries and concerns as everyone else, but what I see is the potential for a surprise rally that not many are expecting.