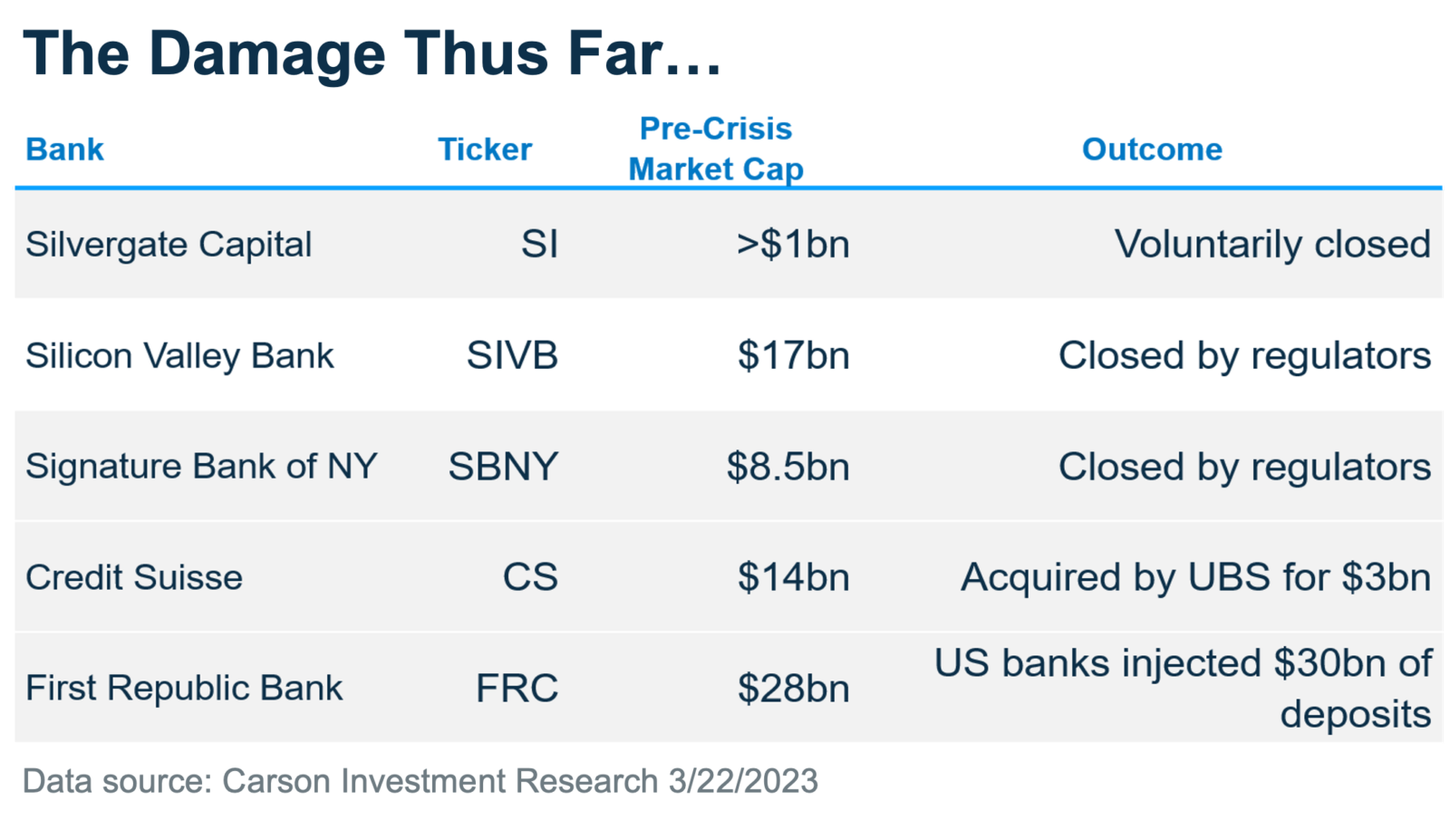

It’s been less than 2 weeks since Silicon Valley Bank’s stunning 48-hour collapse, and a few more banks have been caught in the fray. New York regulators closed the doors on Signature Bank on Sunday, March 12. A week later, US banks injected $30 billion into First Republic Bank to keep it afloat, and UBS acquired rival Swiss bank Credit Suisse in a government-brokered deal. In the midst of the chaos, your Carson Investment Research team was there for you with client-facing content, professional advice, and investment solutions. In fact, we think this event presents an opportunity to invest in the more stable large-cap financial companies and recently upgraded the sector to overweight in our House Views Advice.

Why is this happening?

The rapid hike in interest rates caused an asset and liability mismatch for banks. Due to many years of low-interest rates, banks invested assets in interest-earning loans and bonds that would be repaid over the next five-plus years, which at the time was a logical way to earn a higher yield. Regulators considered government bonds to be among the safest ways a bank could invest its capital. As interest rates rose, bond values dropped. Interest rates rose at the fastest pace in history, and the safe assets that banks invested in lost value to the tune of more than $620 billion in unrealized losses as of the end of last year. This decline in value left weaker banks underwater and, when coupled with depositors pulling money out, caused them to collapse or seek costly capital raises.

Why this matters to investors?

The weakness in the banking sector will likely lead to tighter lending standards, potentially slowing economic growth. The reason we’re in this mess, to begin with, is that the Fed hiked interest rates to slow the economy because inflation was rising too quickly. Perhaps the 16% drop in oil prices over the past two weeks reflected this slower growth and bodes well for continued falling inflation. Thus, the Fed is closer to achieving its goal.

Maybe it’s an overreaction as “banking crisis” headlines stir painful memories of 2008. Either way, an environment with slower growth and lower inflation isn’t a bad time to invest. Bonds and stocks could both perform well, especially stocks of companies with the ability to grow earnings. We also reiterate our House Views Advice overweight on the large-cap Financials sector. The largest US banks are well-capitalized and are gaining market share from the smaller regional banks. We believe this calamity provides an opportunity for stronger banks and investors to capitalize on.

Thanks to Portfolio Manager Jake Bleicher for his contributions to this article.