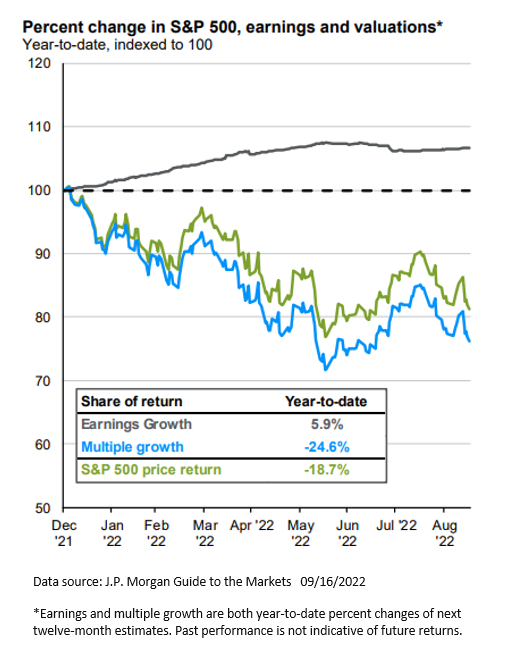

The change in the price of a security (or index) can be broken down into contributions from earnings growth and valuation changes. The S&P 500 is down 19% this year (through September 16th) and as this chart from J.P. Morgan illustrates, that is entirely due to falling valuation multiples. Earnings growth has been a positive contributor to the price return.

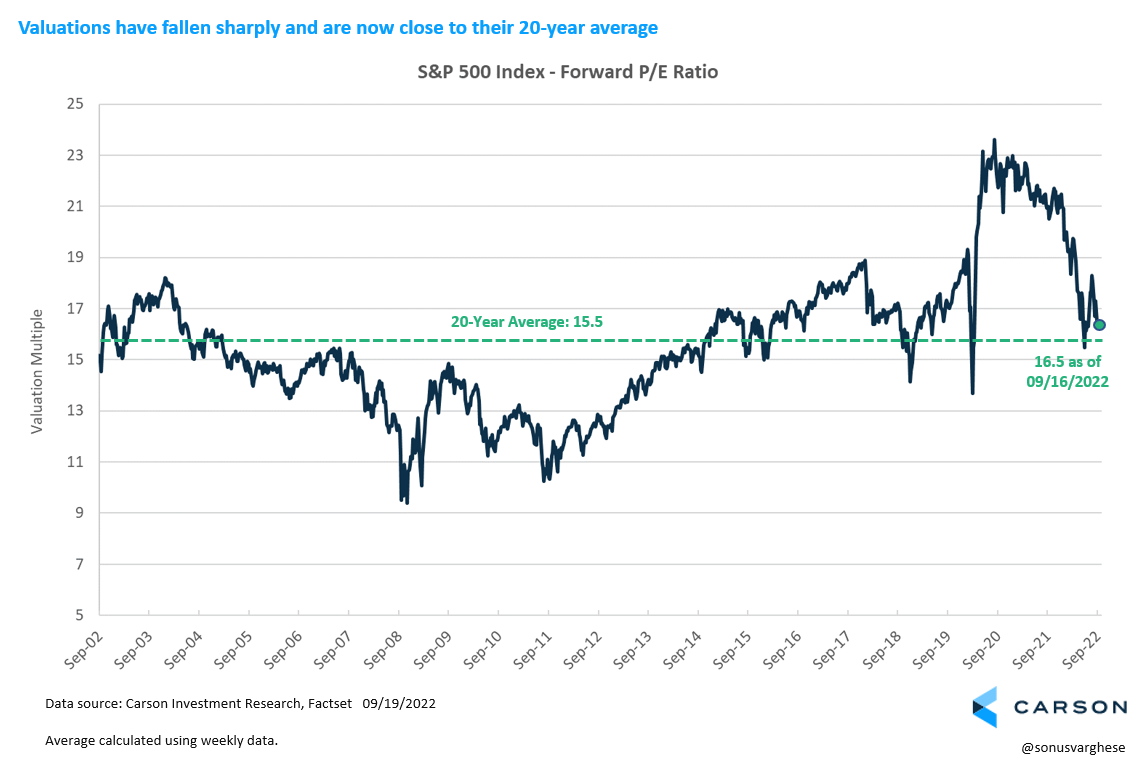

The forward P/E ratio for the S&P 500 has fallen from about 21.5 at the end of last year to about 16.5 now, which is not far from its 20-year average of 15.5.

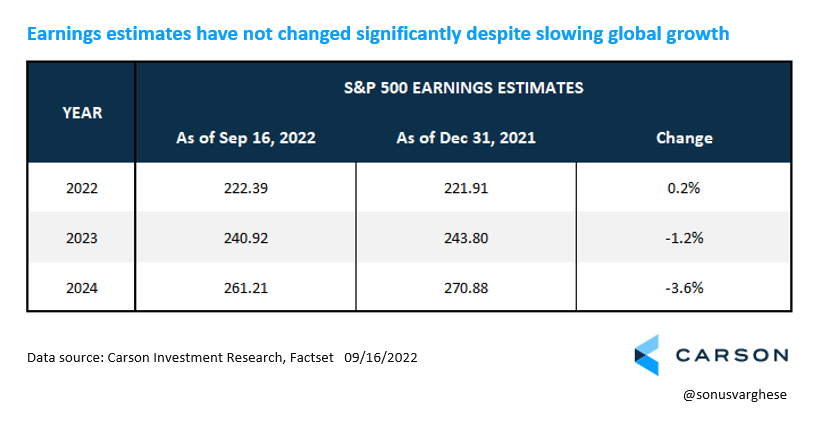

Looking ahead, analysts continue to hold S&P 500 earnings estimates steady. Earnings estimates for 2022 are up from the beginning of the year, while 2023 and 2024 estimates are down a bit. Unless we the economic outlook turns really bleak, we don’t foresee these changing significantly over the next few months.

Which leaves us with the question as to what happens with valuations. And for that we need to look at real interest rates.

As go real yields, so go valuations (in the opposite direction)

Quite often the S&P 500 earnings yield, which is the inverse of the price-to-earnings ratio, i.e. E/P, gets compared to nominal treasury yields. The idea is that when E/P is greater than treasury yields, stocks yield more than bonds and thus they are “cheap”. And vice versa. The logic is extended to argue that low interest rates “allow” for a lower E/P, and thus higher P/Es or richer valuations.

However, the P/E ratio is a real quantity and its inverse (E/P) should be compared to real yields. P/E ratios don’t have to rise and fall with inflation – instead, corporate earnings do that. Also, the usual (and correct) understanding is that as the discount rate falls, the price goes up. However, if nominal yields are falling, it’s likely that inflation is also falling, which means the nominal cash flow from equities will also fall. So lower expected cash flows offset lower discount rates.

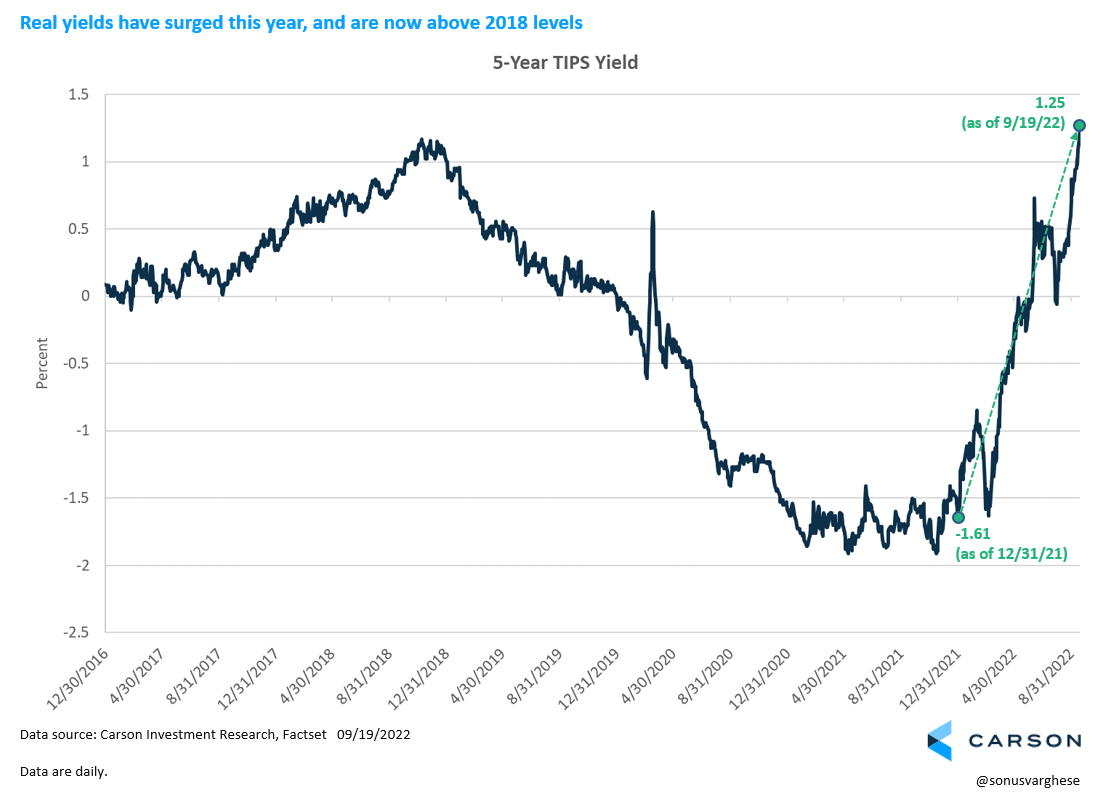

Over the last 5+ years, real yields (or yields on treasury inflation-indexed securities) have seen quite the roller-coaster ride. 5-year real yields rose from close to zero at the end of 2016 to above 1% by the end of 2018 (when the Fed hit the peak of their last hiking cycle). They turned negative pre-pandemic and went deeper into negative territory in 2021. But this year the 5-year TIPS yield has surged almost 275 basis points to 1.25%, their highest level since 2009 – thanks to a hawkish Fed.

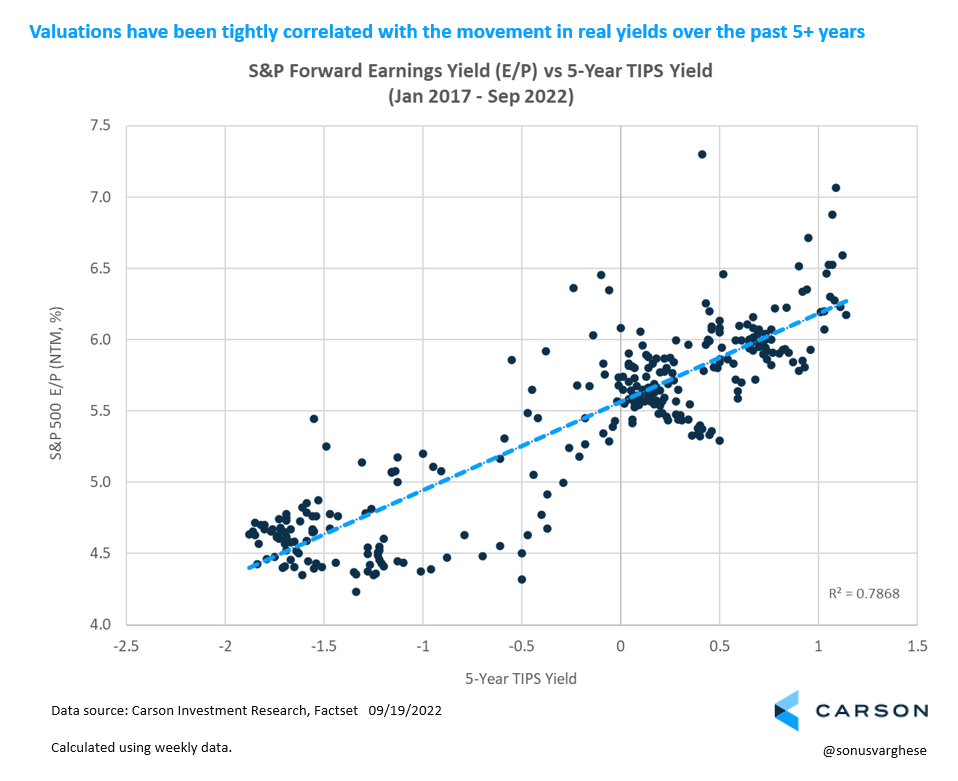

What is interesting is that over the last 5+ years, real yields have been very correlated with valuation changes, as the chart below shows (it plots E/P against 5-year real yields). Higher real yields have coincided with higher earnings yields, i.e. cheaper valuation multiples. And vice versa.

So, will real yields continue rising?

This is ultimately what the question about where valuations go from here boils down to. In other words, where do real yields go.

For that, recent comments by the Head of the Federal Reserve Bank of New York, John Williams, are pertinent. While saying the “terminal rate” (where the peak of the hiking cycle is) depends on the data, he believes real interest rates need to go substantially above zero to slow demand (and inflation). He doesn’t believe they are there yet. He expects inflation to fall between 2.5-3% in 2023 and thinks interest rates should be “well above that”.

Nominal interest rates minus expected inflation gives you the real interest rate. Assuming the Fed raises interest rates to a peak of 4.25%, that means we would be looking at real rates between 1.25-1.75%.

The good news is that 2-year real yields are now past the middle of that range (around 1.61%), though 5-year real yields are just about at the bottom of that range at 1.25%. Which means there could still be some room for yields to rise further, but the bulk of the increase is probably behind us at this point.

Of course, that is assuming inflation doesn’t accelerate from here. However, that is not our base case.