I just wrapped up four weeks of a sabbatical leave, which Carson allows after five years on the job. Strange as it may sound, taking four weeks off is not easy, but summer is usually a fairly quiet time (or so I thought). My family and I headed to Europe for a couple of weeks. Two things really stood out there:

- How much cheaper things were in Europe. Some of it may be a function of living in Chicago (not a cheap city by any means), but it made me appreciate how much the dollar has strengthened over the past decade — the dollar index is up more than 20%.

- No air-conditioning. I know this is me being spoiled in America, but it does take some getting used to.

My time away got a little upended, because in early August we got a mini-market panic, with the VIX spiking to over 50. But the market’s recovered quite solidly since then. Over the past month (July 25th – Aug 21st – my sabbatical period), the S&P 500 was up 3.6%. There’s some perspective for you, albeit just across four weeks, but instructive nonetheless: markets usually power through if the macroeconomic backdrop is in a healthy place. If I had just completely ignored markets (I didn’t), I’d have come back and thought “that was a pretty normal 4 weeks for the market. I didn’t miss anything.”

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Anyway, I was also able to catch some tennis at the Cincinnati Open during the rest of my break. If you’re into tennis (or if you just like sports or a good time), I highly recommend this tournament — most of the top players are usually there as part of their US Open warm-up, and you can get up close to see them in matches or even on the practice courts. Carson’s Chief Market Strategist Ryan Detrick and I recorded a Facts vs Feelings Take 5 video while the world’s best player (in my humble opinion), Carlos Alcaraz, was hitting balls just 20 feet away.

Unfortunately, Alcaraz didn’t win, losing out in a rain-delayed second round match. Instead, the number one seed, Janick Sinner (another awesome up and coming player), won the tournament. But that hid all the upsets the tournament saw. On the women’s side, the number 1 seed, Iga Swiatek, lost in the semi-finals, and then Aryna Sabalenka won the tournament (she was the third seed).

This did get me thinking about investing, and how the best tennis players’ edge works.

The best tennis players, as good as they are, don’t have a massive edge on each point they play. Roger Federer talked about this recently in a wonderful commencement address at Dartmouth’s graduation (Ben Carlson wrote a great piece on this):

“In tennis, perfection is impossible… In the 1,526 singles matches I played in my career, I won almost 80% of those matches… Now, I have a question for all of you… what percentage of the POINTS do you think I won in those matches?

Only 54%.

In other words, even top-ranked tennis players win barely more than half of the points they play.”

That is not a big edge on the face of it, but that’s all there is for even the best players of all time, barely above 50%. Even in investing, edges are barely above 50%. But the question is, how to make it count?

Simple: Play longer. As many points, as many games, as many sets as you can.

The Cincinnati Open (and others like it) are best of 3-set matches for men and women, in contrast to the Grand Slams (Australian Open, French Open, Wimbledon, US Open) where the men compete in best of 5 sets. A typical set can consist of about 9 games on average (assuming 6-3 for the winner), and a typical game can average about 6 points (assuming a win at 40-30). So, for a 3-set match, you’re typically looking at an average of about 162 points (= 6 x 9 x 3). A 54% edge can help you win a lot of 3-set matches, but that edge manifests itself even more in a 5-set match, where the average number of points is 270 (= 6 x 9 x 5).

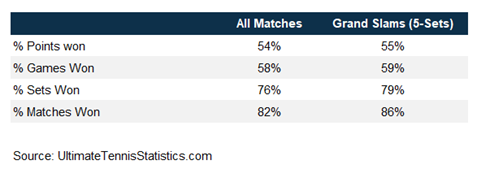

This is why Federer’s match-winning stats look better in grand slams (which are 5-set matches). Here’s his overall record, across all matches he played. He clearly stepped it up a notch in the slams, with 55% of points won (versus 54% across all matches). But the percent of sets won rises from 76% to 79%, and percent of matches won jumps from 82% to 86%. His edge worked better when he had more time to literally, play it out.

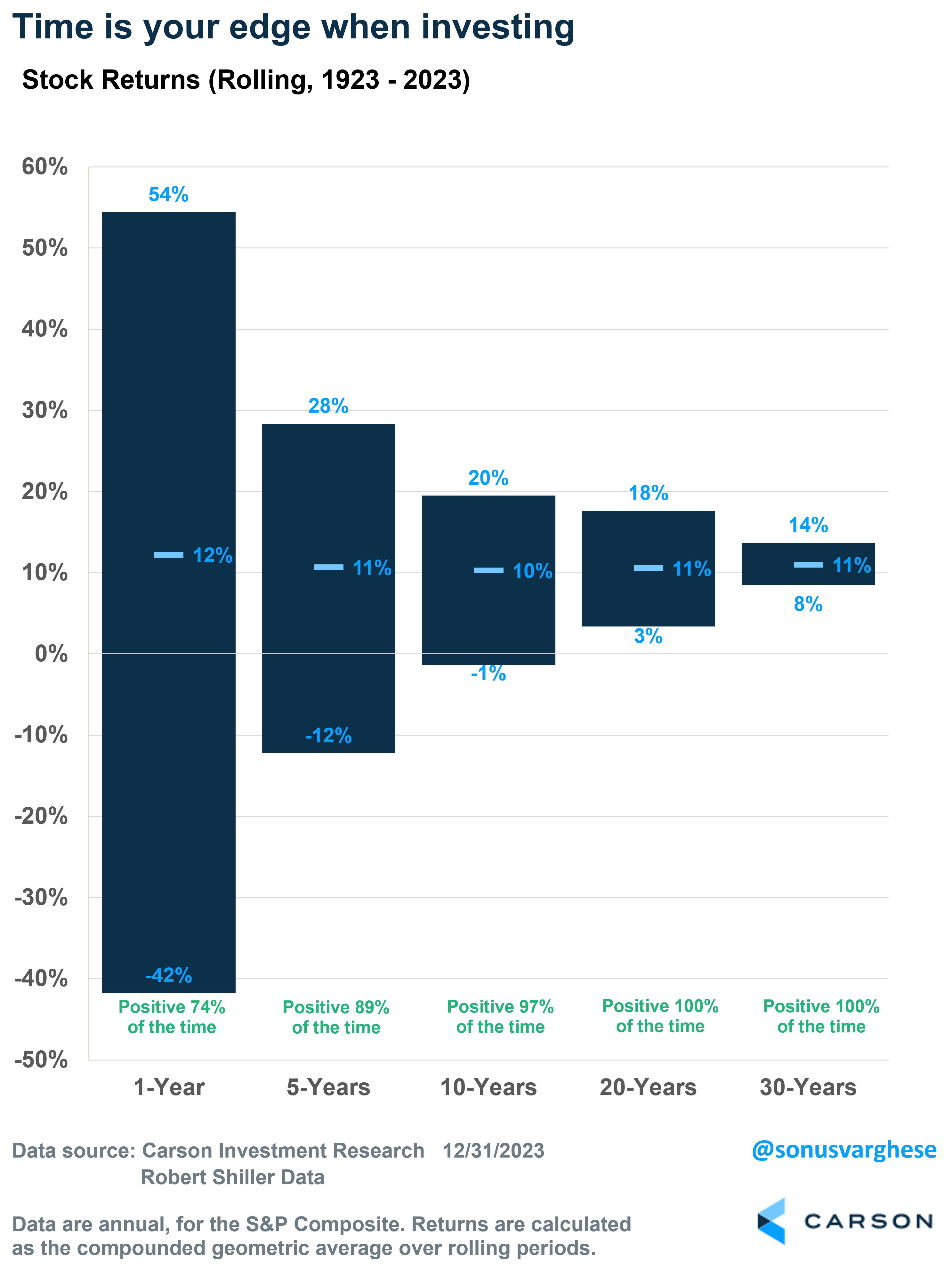

There’s an analogy here with investing. If you looked at daily returns for the S&P 500 from 1928 through 2023, returns are positive 54% of the time. That’s better than 50% but only slightly – which is why if you stare at markets day in/day out, it kind of looks random. But, allow time to let that short-term edge play itself out, and things look very different.

As you can see below, if the holding period was a full year, S&P 500 returns were positive 74% of the time. The average return was about 12%, but there’s still a lot of variance – there was a -42% return in 1931 and -39% in 2008. Extend that holding period to 5 years, and markets were positive 89% of the time. The average annualized return over the rolling 5-year periods was 11%, but the variance decreases. Same story as you extend the holding period further, and over 20- and 30-year rolling periods, the market was positive 100% of the time. The average annualized return over these periods was still around 11%, but the variance drops significantly. The “worst” 30-year rolling period had an annualized return of 8%.

In short, time is your edge when investing and you are more likely to win if you let it play out.

Final note on tennis, and how the edge manifests over longer matches (5 sets versus 3 sets). Even in the grand slams, women’s matches are just 3-set affairs, and those are harder to win consistently. Which is likely why there’s more turnover at the top amongst women’s players. But that’s also why what Serena Williams did in her career is truly remarkable, winning 23 grand slam titles (she won 55.5% of her points, 85% of all her matches, and 87% at the grand slams).

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02379534-0824-A