What a week it has been — days that feel like weeks, weeks that feel like months. The last two weeks have seen the largest intraday market moves we have experienced since the depths of the COVID pandemic in March of 2020 and 2008 before that, periods marked with enormous uncertainty. Even though we saw large declines in stocks and bonds in 2022, the selloff was much more ‘orderly’ in terms of overall volatility, with the VIX index never eclipsing 40. In contrast, this last week we’ve touched the 60 level and remained above 40 for four consecutive days. Just as volatile as stocks and bonds are investor emotions, individuals and professionals alike. Optimists jump into the market only to be caught offsides; pessimists jump out of the market only to have fears of missing out!

In times like these, it’s best to return to one of the most basic (and boring) tenets of investing: diversification.

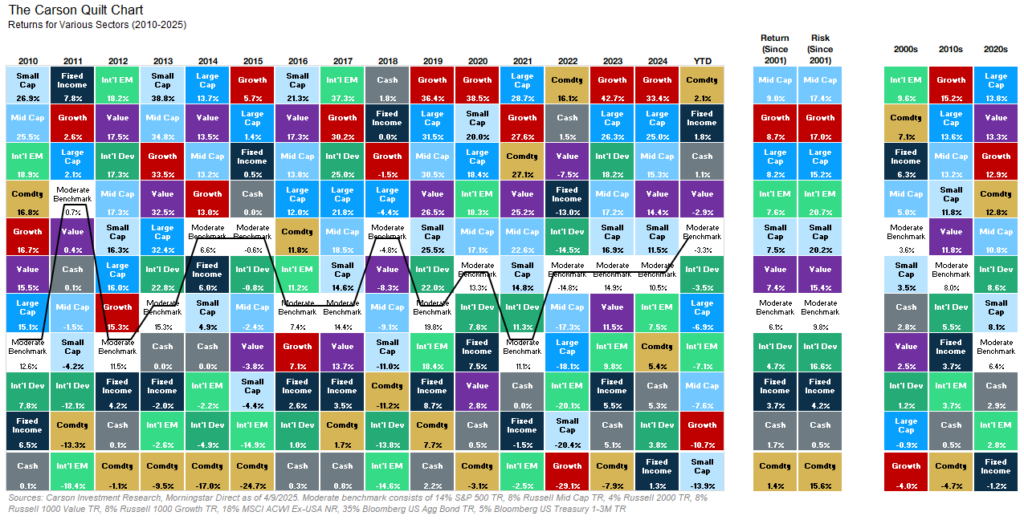

From the rebound off the 2022 lows, US large cap growth has been the place to invest — no questions asked. Outperforming the next major asset class by nearly double-digits, investor portfolios naturally drifted more and more into large growth, either by chasing performance or not rebalancing. As we saw following past runs, this can quickly reverse for areas of the market that have seen strong momentum. We’ve seen that play out this year, even before the recent bout of extreme volatility. A falling dollar and constructive policy abroad led to a hot start for international markets, particularly Europe. Domestic value stocks, which have taken a backseat to nearly every other major domestic equity style, have risen to the top. Defensive sectors such as staples, utilities, and parts of healthcare have held up well this year — all of which make up a component of most value indices. However, even more cyclical value sectors like financials and industrials have only experienced about half of the decline in the S&P 500 year to date.

In addition to the relative performance in US value and developed international, diversifiers are back in action. In certain ways, fixed income has been just as volatile as equities through this stretch, but despite all of volatility diversified bonds have outperformed the safety of cash this year, from short to intermediate term. On the more alternative side, broad commodities are still positive this year. Given the large drop in crude oil prices this seems hard to believe, but commodities are a broad and diversified asset class with many different return drivers. Gold and other precious metals have been strong this year, as have more defensive commodities like agriculture. And even with the drop in oil prices, natural gas — enormously volatile by itself — has maintained a positive return this year, helping support the index return.

Taken together, a well-diversified portfolio (as expressed in the chart by our ‘Moderate Benchmark’) has outperformed all major equity categories with the exception of value and done so with much less risk. Year to date, the max drawdown in the moderate benchmark has been almost exactly half that of the S&P 500, better than the 60% you would expect based on the equity allocation of the benchmark. Don’t get me wrong. In a volatile and down market, you would expect a diversified lower-risk portfolio to behave as such, but that can often be forgotten when times are good.

A diversified portfolio will never be the best performer, but conversely it should never be the worst performer either. We build our internal portfolios around the concept of broad global diversification as we feel that starting point gets us off on the best risk-adjusted foot (so to speak). And while diversification and risk minimization can be a boring concept, I think we could all use a little boring after this week.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Grant Engelbart, VP, Investment Strategist click here.

7849806.1-0325-A