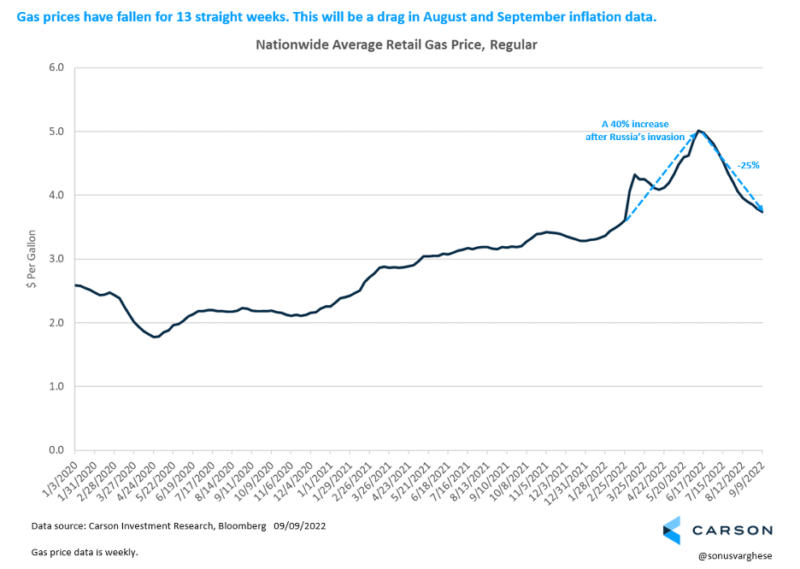

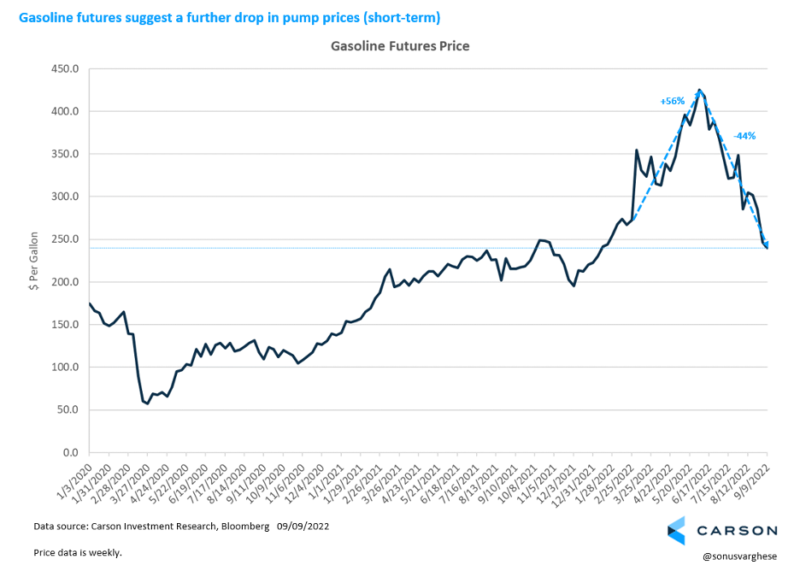

I wrote last week that consumer confidence is rising on the back of falling gas prices. Gas prices have dropped for 13 consecutive weeks, from a peak over $5 a gallon to about $3.75 per gallon. The good news is that it will have a deflationary impact on headline inflation data for August (released this week), and probably September too (released in October).

But the obvious question is, what next?

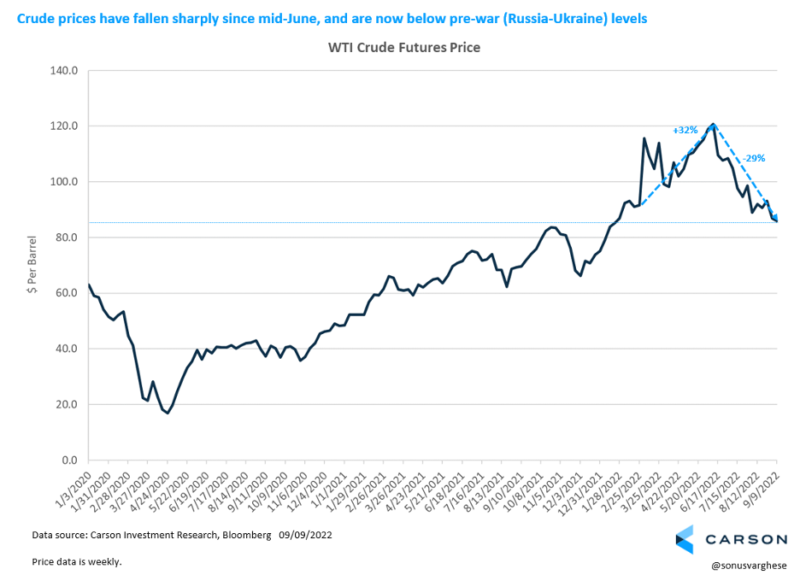

The good news is that gas prices may move even lower over the very short-term. For one thing, crude prices have more than retraced their upward move after Russia invaded Ukraine at the end of February. Oil prices are currently around $88 a barrel (WTI), a tad lower than the $90+ level we saw before the war.

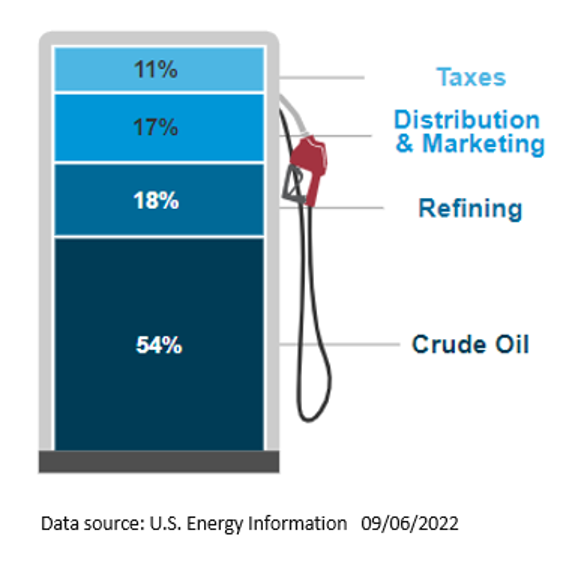

But more than oil prices go into the prices we pay at the pump, as this handy chart from the US Energy Information Administration illustrates. About 55% of it is dependent on crude oil prices, while another 18% is dependent on refining costs and profits.

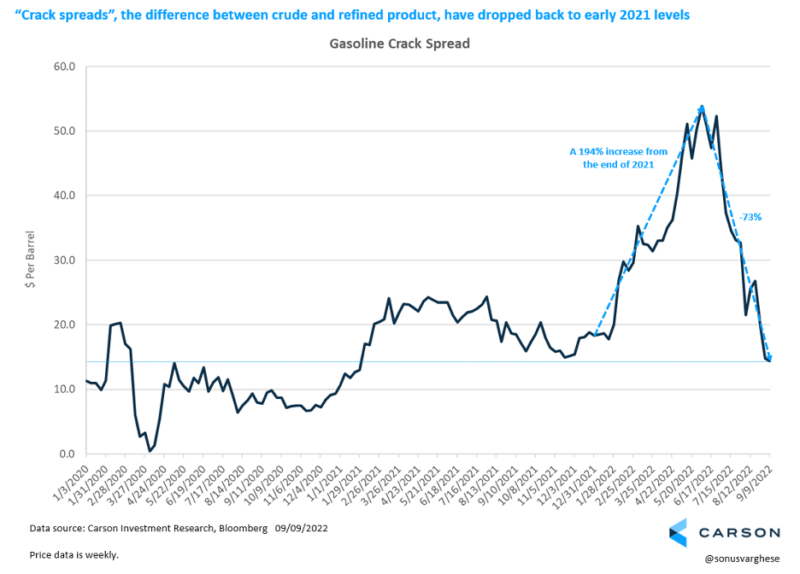

Refining costs surged in April and was the major reason behind the early summer spike in gas prices, beyond what would normally have been expected given higher crude prices. This is best illustrated by something called the “crack spread”, which is the price difference between crude and refined product. And crack spreads surged in April and May to almost 3 times what they were at the end of last year.

There were several reasons for this, including the fact that it was regular maintenance season for refineries. Also, over the last 3-4 years, the US closed down a lot of refineries – part of this because of moth-balling (several shut in 2020 and never re-opened), and some shut to move the energy transition forward. Coinciding with this was China putting caps on exports. China imports a lot of crude oil, but at the same time, they export a lot of refined products. However, amid shortages and climate goals, they capped exports – with exports of refined product more or less heading to zero.

The good news is that crack spreads have pulled back significantly and are currently close to levels we last saw more than a year and half ago in January 2021.

All of this is being reflected in wholesale gasoline prices, which are now below pre-war levels, and suggests we should see pump prices follow sooner rather than later.

What’s Causing Oil Prices to Drop as Much as They Have?

It’s always hard to pinpoint any one reason for what happens in markets. There may be various technical, market-related reasons for one thing.

But let’s take a look at supply and demand.

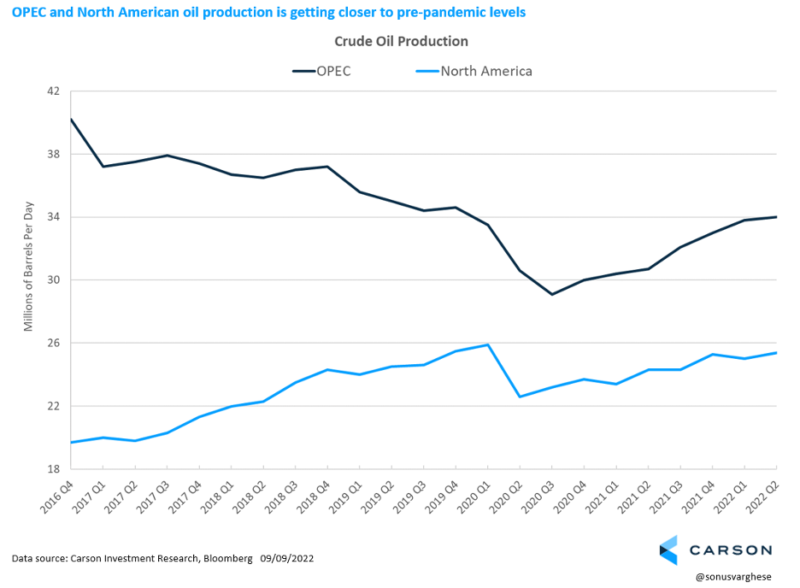

Production in the U.S. has been ramping up recently and getting close to pre-pandemic levels. OPEC production is also getting closer to pre-crisis levels, though it’s been on a longer-term decline.

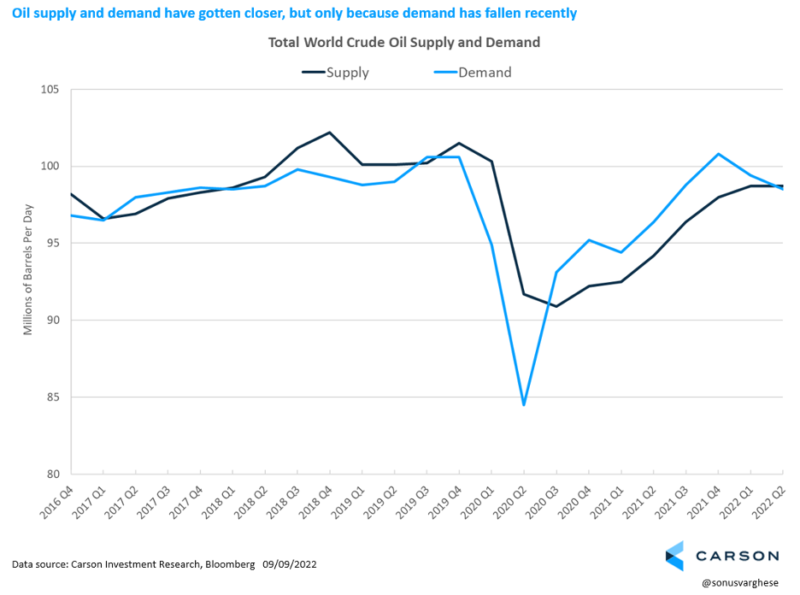

Overall oil production across the world was about 98.7 million barrels per day (bpd) in the second quarter of 2022, which is several million short of pre-pandemic levels of 101.5 million bpd. At the same time, global demand was back to pre-pandemic levels of about 100.6 million bpd by the end of 2021. Which is why there was upward pressure on oil prices, with supply running below demand. But recently, demand has fallen closer toward supply.

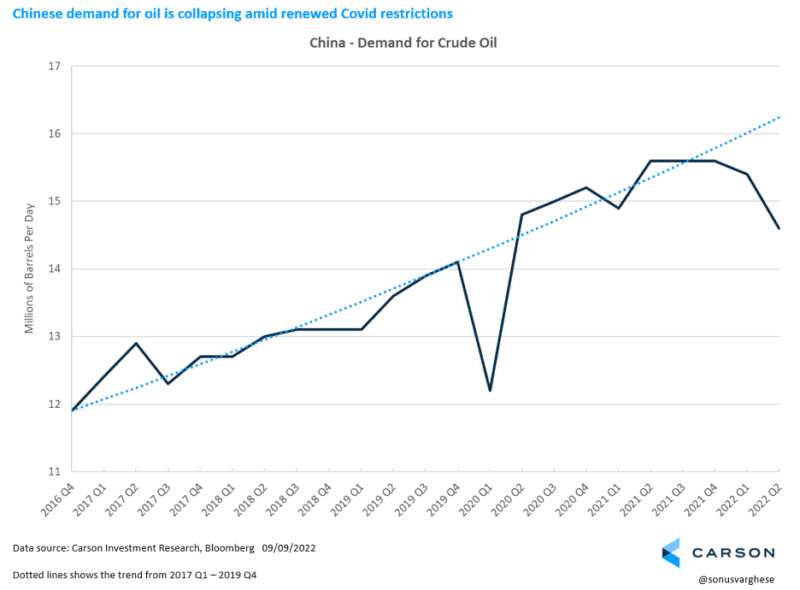

The big reason is China. China’s Covid-zero policies have resulted in major shutdowns once again. Chengdu province, home to 21-million residents, is now locked down indefinitely. Altogether, about 65 million residents are locked down across the country and China is discouraging domestic travel during upcoming national holidays.

Which means China needs less oil.

At some point, we would expect Chinese demand to come back. However, it is highly dependent on how long China continues with its Covid-zero policies. It’s clearly exacting a big cost on its economy – GDP growth is expected to slow quite sharply in 2022, rising just 4.3% compared to 8% in 2021. However, we believe President xi Jinping is unlikely to pull back on their goal of zero Covid, at least any time soon.

The Carson investment research team is watching the situation closely, because Chinese demand is going to be a big factor in determining what direction gas prices go. This goes hand in hand with keeping our eye on the supply picture as well. There is still considerable uncertainty around the availability of Russian crude oil barrels amid sanctions, as well as the possibility that falling prices may inhibit US producers from ramping up production – factors which will keep supply tight.