“Never put off till tomorrow what you can do the day after tomorrow.” — Mark Twain

The S&P 500 was up 14.5% in the first half of the year, with the Dow up only 3.8%, but the tech-heavy NASDAQ up 18%. Be aware that none of these important indexes topped the first six months from last year. Digging in more, the Russell 2000 small cap index was up less than 2%, while many of the “Magnificent 7” large cap tech-oriented names continued to sport impressive gains. More on the return environment from the second quarter below.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

According to Howard Silverblatt at S&P, if you removed NVIDIA’s gains the S&P 500 would be up 10.7% and if you removed all of the Magnificent 7, it would still be up 6.3%. Take note, the average return for first six months for the S&P 500 is 4.2%, so even taking out the big winners, this is still a really solid year.

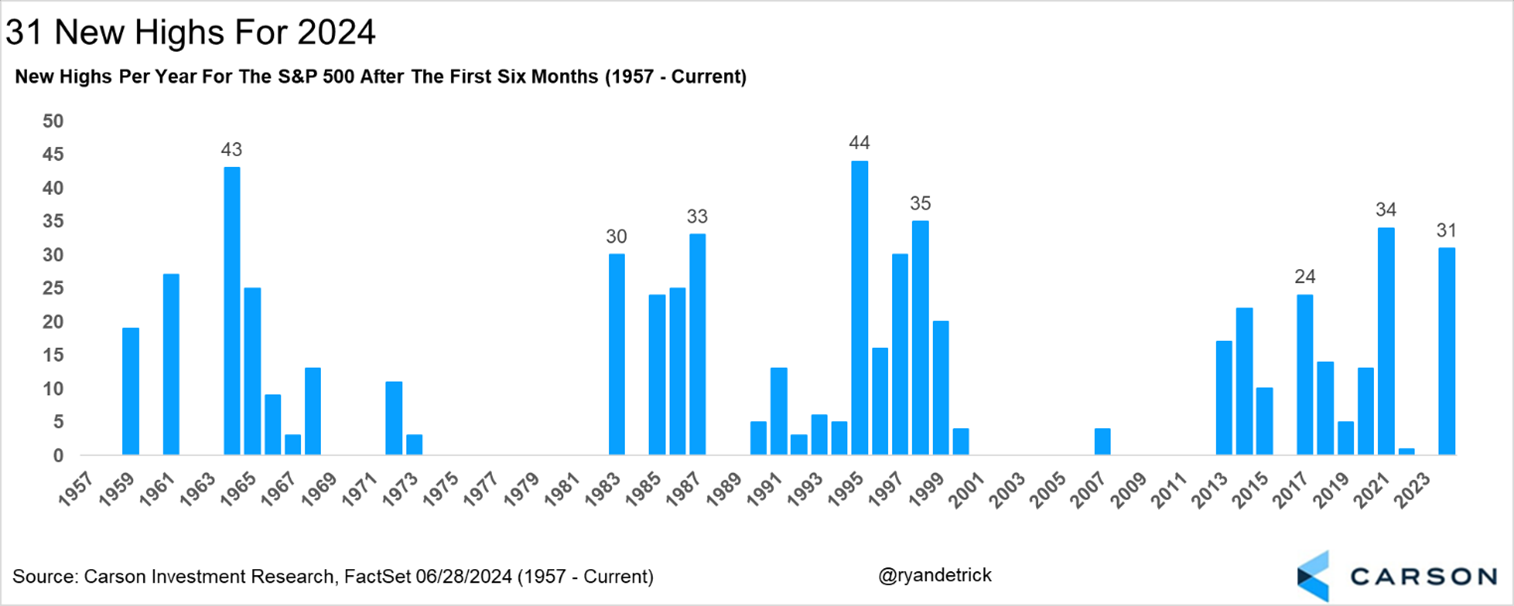

What stands out? The persistent number of new highs for starters. Remember, all of 2022 and 2023 the S&P 500 made a grand total of one new all-time high. It has 31 the first six months of this year, which is second only to 2021 this millennium.

What does a lot of new highs mean? When the S&P 500 had 20 or more all-time highs at the midpoint, the rest of the year has always had at least one more new high and it averaged another 20 new highs the second half of the year. Turning to returns, the median rest-of-year return was a very impressive 9.6%, well above the median return for all years of 5.6%. To put a bow on it, a lot of new highs so far in 2024 could mean more fun for the bulls.

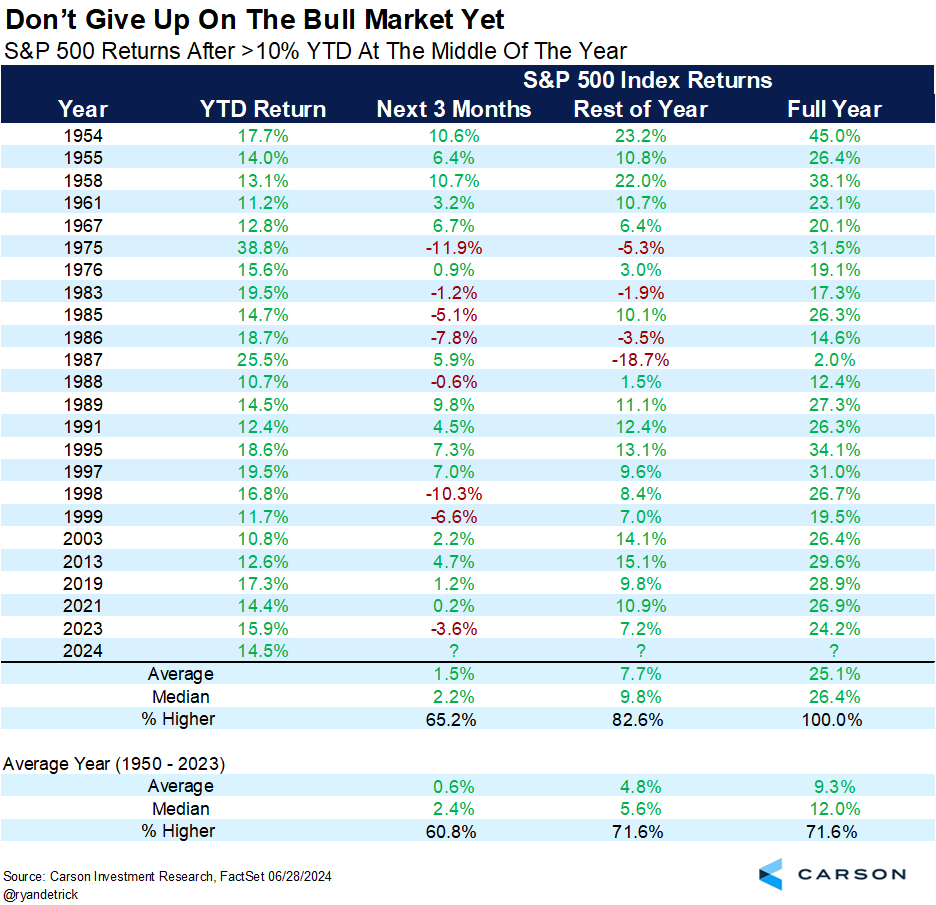

Lastly, turning to price returns, when the S&P 500 was up double digits at the midpoint of the year, the second half of the year again does better than most years. In fact, the full year has never been lower, with an average gain of 25% for the entire year, but given most of these years had huge head starts, that isn’t all that surprising. Still, the final six months have had a very impressive median gain of 9.8%, well above the returns from all years, and have been higher nearly 83% of the time.

Notable From the Second Quarter

- Large-cap growth stocks led for the quarter in addition to the first half of the year as discussed above.

- This is the 6th consecutive quarter the Russell 1000 Growth outperformed the Russell 1000 Value. The longest streak going back to 1979 is seven quarters.

- Only one top 3 sector (of 11) from the first quarter was also a top 3 sector in the second quarter—Communication Services.

- No bottom 3 sectors in Q1 were also bottom three sectors in Q2.

- The Bloomberg US Aggregate Bond Index eked out a small gain (+0.7%) and is up 2.6% over the last four quarters, which still trails short-term Treasuries.

- The Bloomberg Gold Index gained for the third consecutive quarter and is up more than 20% over the trailing four quarters. That’s not as good as the S&P 500, but it’s much better than core bonds.

Here’s to a happy and safe July 4th to everyone and we thank you for following us!

For more content by Ryan Detrick, Chief Market Strategist click here.

02306764-0724-A