Last week I wrote about how economic growth is set to accelerate in the fourth quarter on the back of solid consumer spending. But the big question is whether consumer spending will remain strong in 2023. This is important because consumption, or lack thereof, will determine whether or not the US will experience a recession over the next 12 months. Consumer spending accounts for 70% of GDP, and so that’s pretty much the ballgame. We believe the consumer is in a strong position, but let’s walk through some reasons.

Income growth is strong

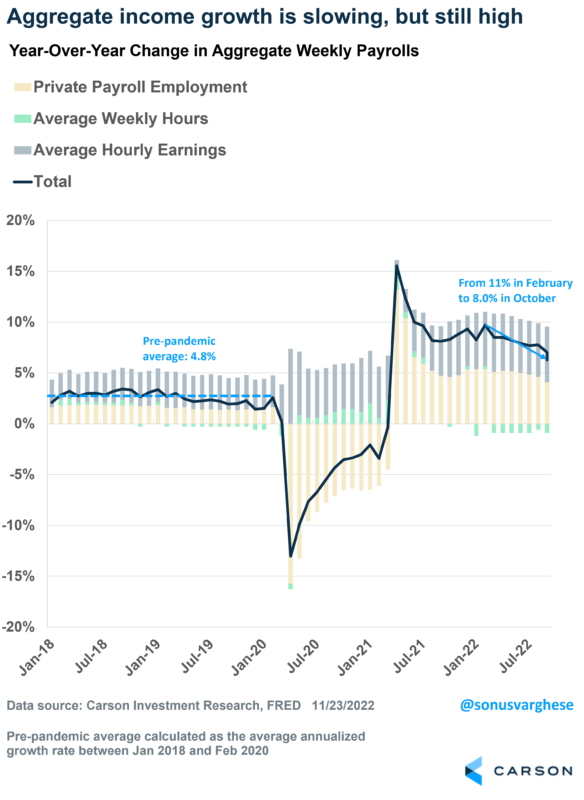

Most consumers spend out of their wages, so it helps to look at overall income in the economy. The chart below shows the year-over-year growth in aggregate weekly earnings, i.e., weekly earnings across all workers, which can be attributed to 3 sources:

- Employment growth: As more people get employed, overall income in the economy increases, driving more spending. Employment growth has been strong recently.

- Hours worked: as people work more, they earn more, and overall incomes go up. Hours worked have been falling in recent months, but that’s mostly a reversal from the significant jump we saw amid the pandemic.

- Average hourly earnings: as workers earn more, overall incomes go up. Average hourly earnings have been hot over the past year, but it’s been slowing recently.

You can see how aggregate earnings have slowed this year, from 11% to 8%. However, this is still higher than the pre-crisis pace of just under 5%, and we still have some ways to get there. Employment growth will likely slow in 2023. Payroll gains have averaged about 289,000 over the past three months, but even if it halves to about 125,000-150,000 net jobs a month, we’d still be looking at solid income growth comparable to pre-pandemic levels. The Fed is looking for a slowdown in income growth which could very well happen without employment reversing, i.e., the yellow bars going negative in the chart.

Consumers still have excess savings

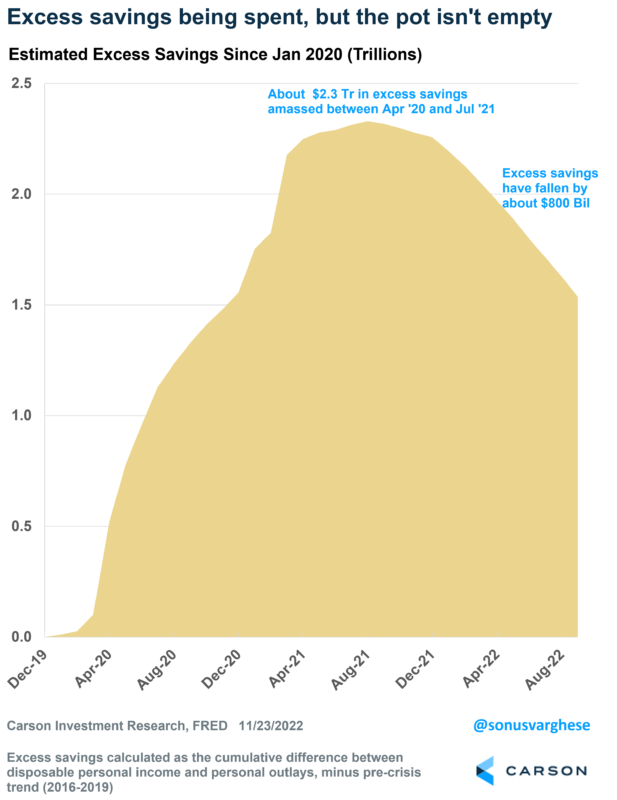

In the year and a half after the pandemic, consumers saved an estimated $2.3 trillion over and above what you would have expected based on the pre-crisis trend. A lot of this was due to fiscal policy (like checks and expanded unemployment benefits). However, for the top 25% of earners, it was almost entirely due to reduced spending amid the pandemic.

Over the past year, consumers have drawn down these excess savings by an estimated $800 billion. But what’s important here is that it’s not down to zero, and it’s going to take a while to get to zero.

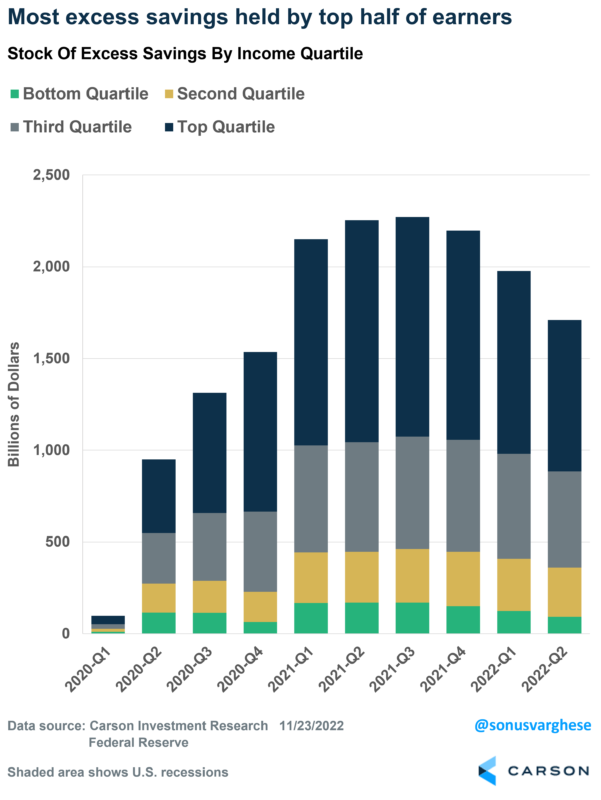

One thing is that most of these excess savings are held by the top 50% of income earners. And that’s because inflation tends to hit lower-income workers harder, which meant they probably had to draw on more of their excess savings to fund purchases.

But we’ve got a big break recently in the form of retreating gas prices. Gas prices are now almost back to where they were on the eve of Russia’s invasion of Ukraine. In a sense, just like higher gas prices were effectively a tax on incomes, falling gas prices are akin to a tax cut.

Consumers still have a lot of borrowing capacity

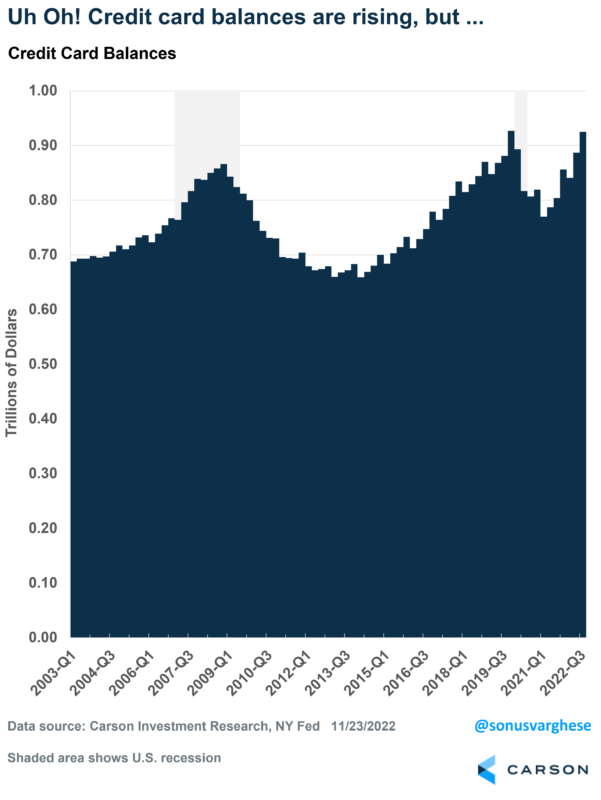

I’ve seen different versions of the following chart going around, showing a sharp and “scary” rise in credit card spending. But if you think about it, it’s not surprising, let alone scary. For one thing, prices are higher, and two, consumers are spending more (even adjusted for prices).

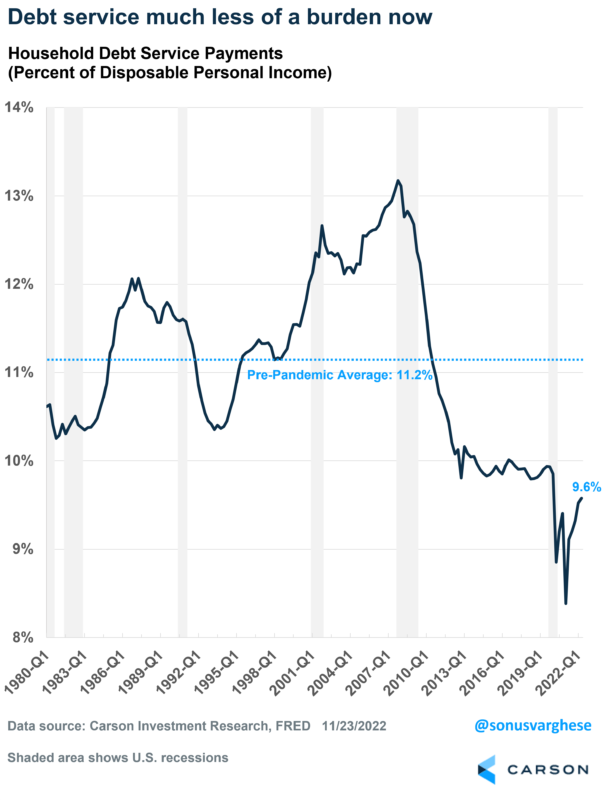

Instead of the total credit card debt, what’s important is that the debt service burden for households is close to record lows. The chart below shows households’ debt service as a percent of disposable income. As of the end of the second quarter, this metric was at 9.6%, well below the pre-pandemic average of 11.2%.

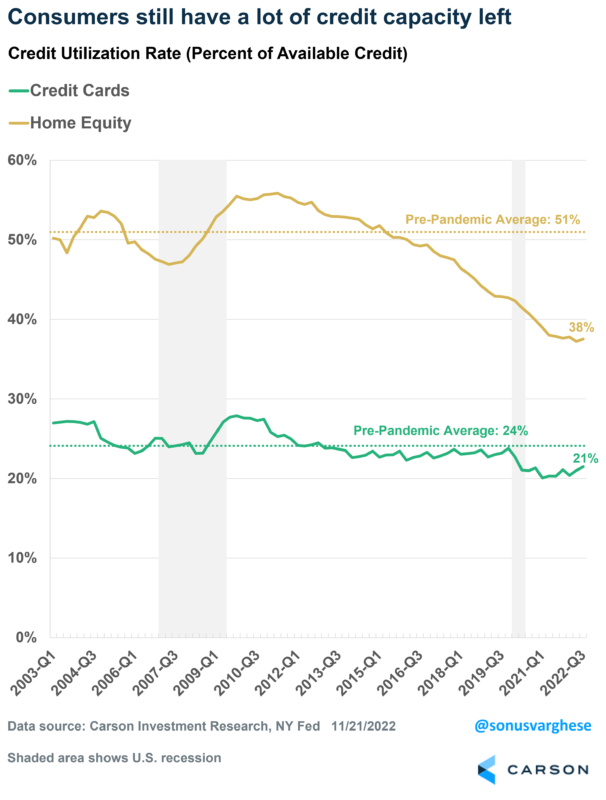

Also, credit utilization rates are still really low. Consumers are yet to tap into their credit cards and home equity lines of credit to the same extent as before the pandemic hit. And the utilization rates are well below the average levels we saw over the past few decades.

Easing inflation will also be a big positive for consumers

Excess savings were drawn down this year because consumers were dipping into that pot to fund their consumption since income gains were not keeping up with prices. But as inflation eases, real incomes will likely start rising again, and the rate at which that excess savings pot gets depleted should slow down.

Of course, the other side of more robust real incomes is that demand will be strong, which could keep inflation on the higher side. However, we at the Carson Investment Research Team believe that inflation will ease due to idiosyncratic downward pressure, as the same forces that boosted inflation reverse.

Energy was the first domino to fall, which is why inflation has eased since the summer – though there’s always the risk that energy (and even food) prices could start going up again due to geopolitics. However, as I wrote after the last CPI report, the deflationary baton seems to have passed from energy to goods, which is seeing prices fall finally. And by mid-2023, official rental inflation will also be decelerating. Check out the blog my colleague, Ryan Detrick, recently wrote about these phenomena.

All in all, the consumer looks to be in a good position as we go into 2023, raising the likelihood that consumption will remain strong over the next year. Which should help avoid a recession.