“To be an investor is to be an optimist.” Jason Zweig, writer for the Wall Street Journal

I touched a lot on why more strength is expected in December in Five Things To Know About December, but I wanted to add a few more things today.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

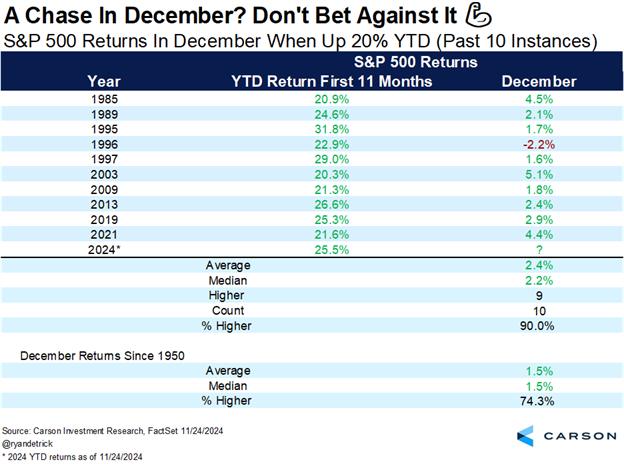

As I noted last week, when the S&P 500 was up 20% or more for the year heading into the final month, December has been up nine of the past 10 times.

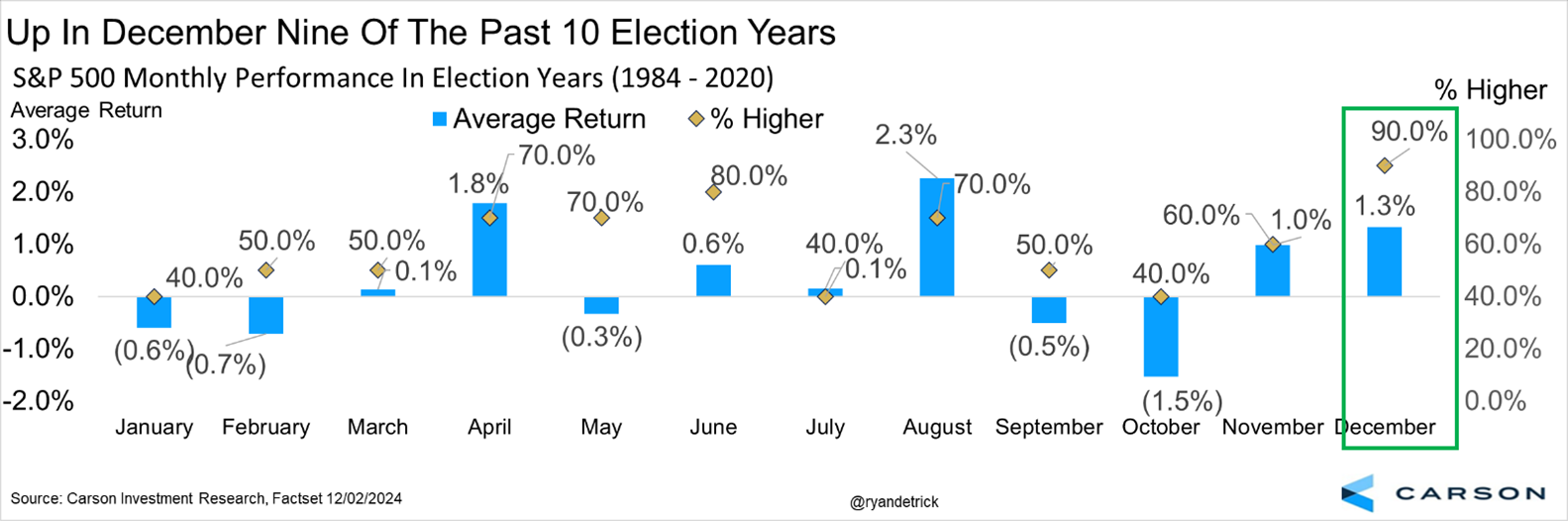

Taking this a step further, in an election year stocks have closed green nine of the past 10 times as well!

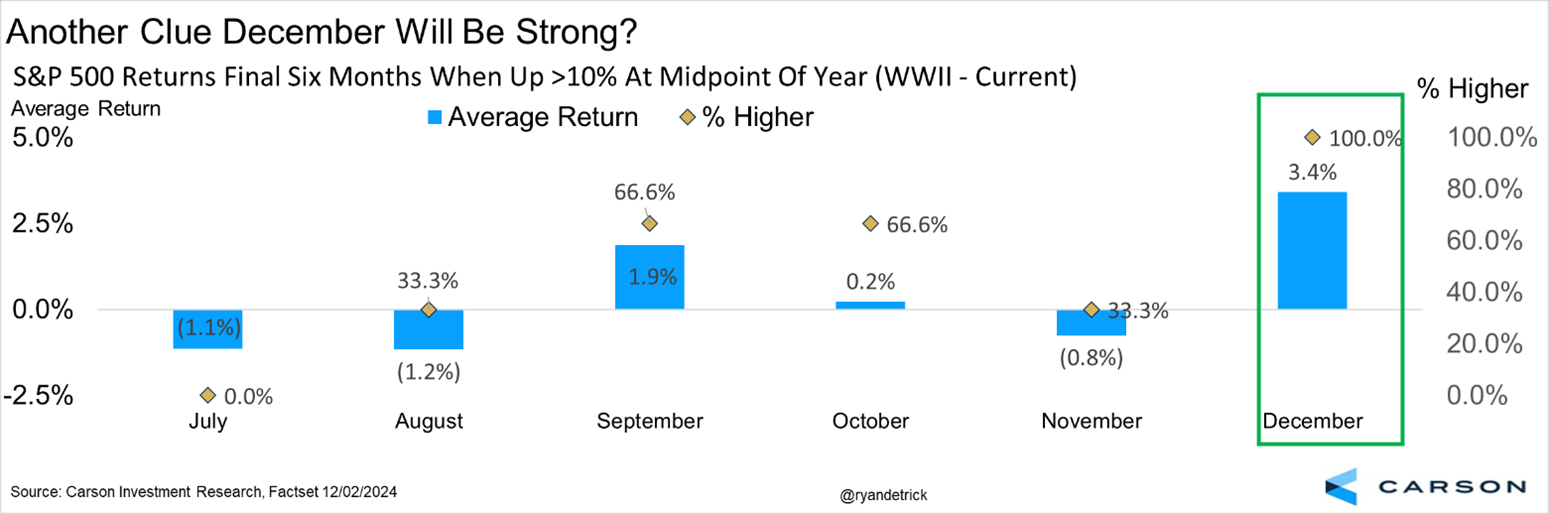

Good friend Tom Lee, Founder of Fundstrat, mentioned on CNBC on Monday morning that when the S&P 500 was up at least 10% at the midpoint of an election year, December has never been lower. Sure enough, that is true.

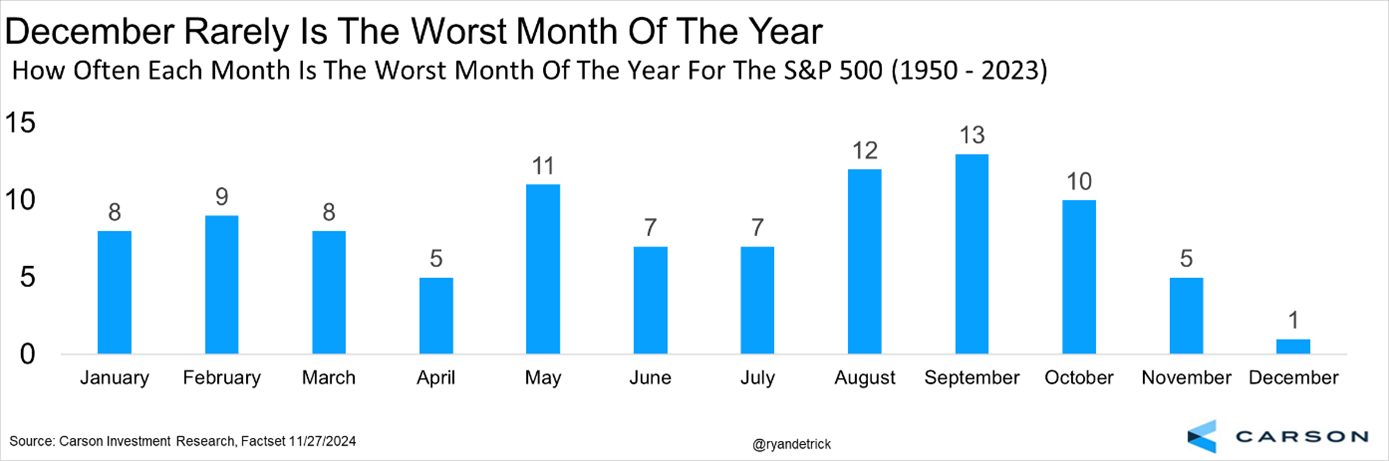

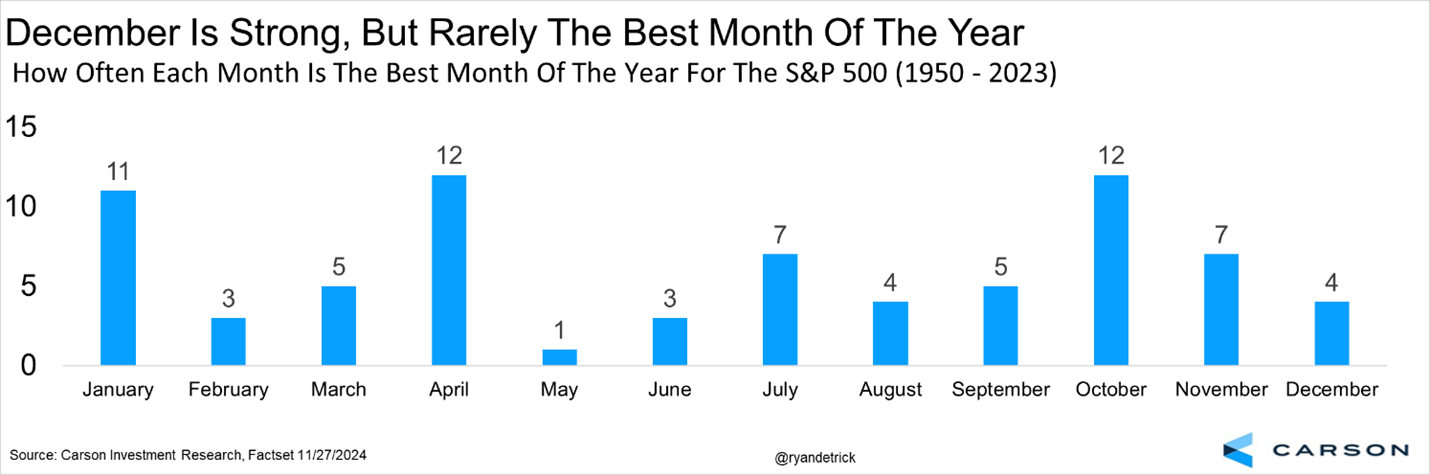

The worst month this year was about a 4% drop in April. Here’s the good news … It is quite rare for December to be the worst month of the year, as that has happened only once in history. By the way, that was in December 2018 when the market threw a big fit after the Fed didn’t cut rates. Bottom line, now isn’t the time to be expecting a big drop.

Here’s the flipside to this. December has been the best month of the year four times, but months like April and October have the most at 12.

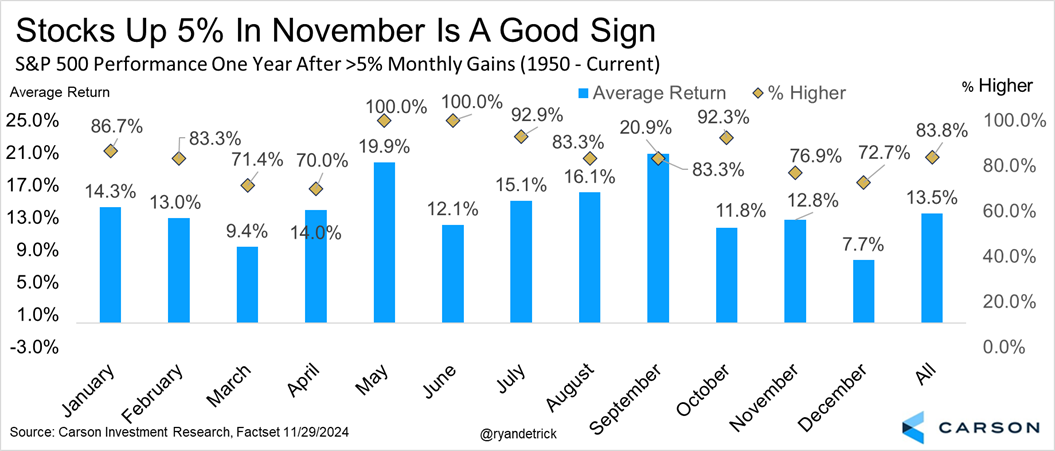

November just had a huge gain, up more than 5% in fact, for the best monthly return since November 2023. Do big monthly gains matter? We’d say yes, as the S&P 500 is up an average of 13.5% a year later and higher nearly 84% of the time after a calendar month gain of more than 5%. Breaking it down by month, after a 5% or gain in November, the next year is up almost 13% on average and higher nearly 77% of the time, both better than your average yearly return.

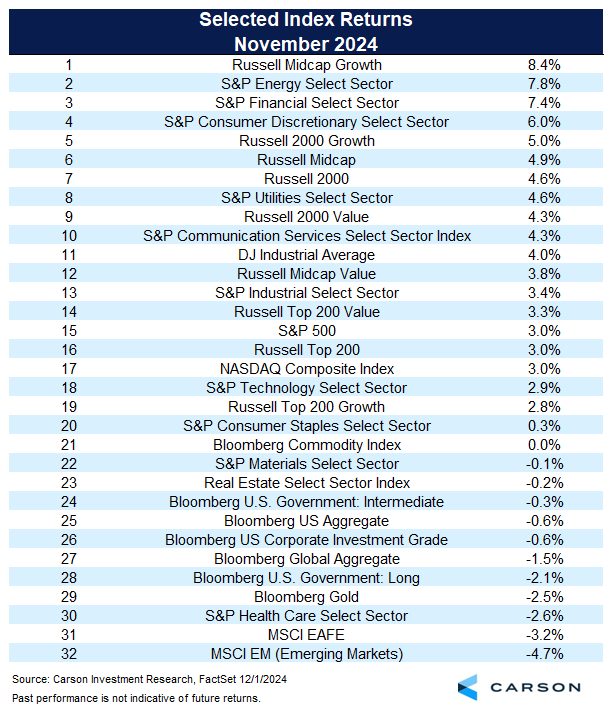

November was a huge month, but it was also very broad-based strength. The big winner though? It was small caps. The table below we share with our Carson Partners and shows just how strong last month indeed was.

Thanks for reading and stay warm out there!

For more content by Ryan Detrick, Chief Market Strategist click here.

02534018-1224-A