Almost every outlook you open this season has forecasters predicting that 2023 will see a recession. In contrast, we here on the Carson Investment Research Team believe the economy can avoid a recession this year.

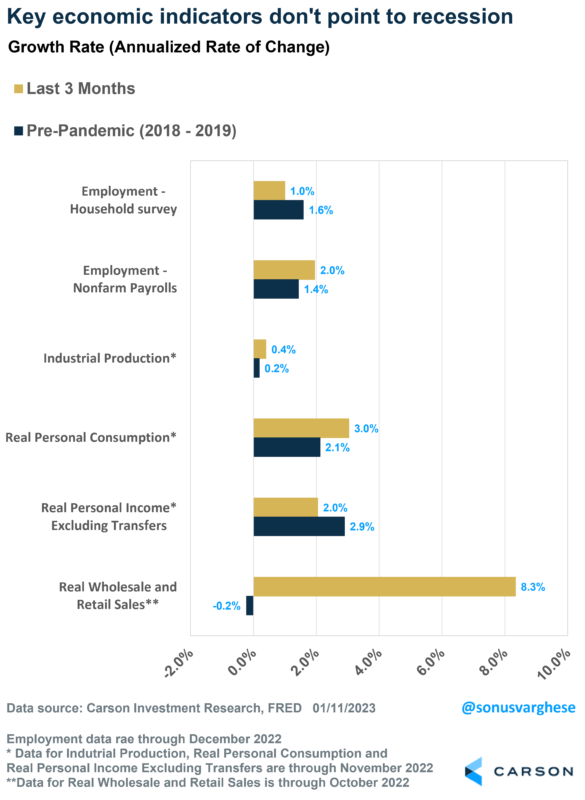

Note that the recession calls are all forecasts and clearly do not reflect where the economy is right now. For example, looking at the NBER’s preferred list of economic indicators, which they use for determining recession, every single one grew over the past three months and year-to-date (2022). Moreover, four of the six indicators exceeded their pre-pandemic growth rates over the past three months (comparing the yellow bars against the dark blue bars).

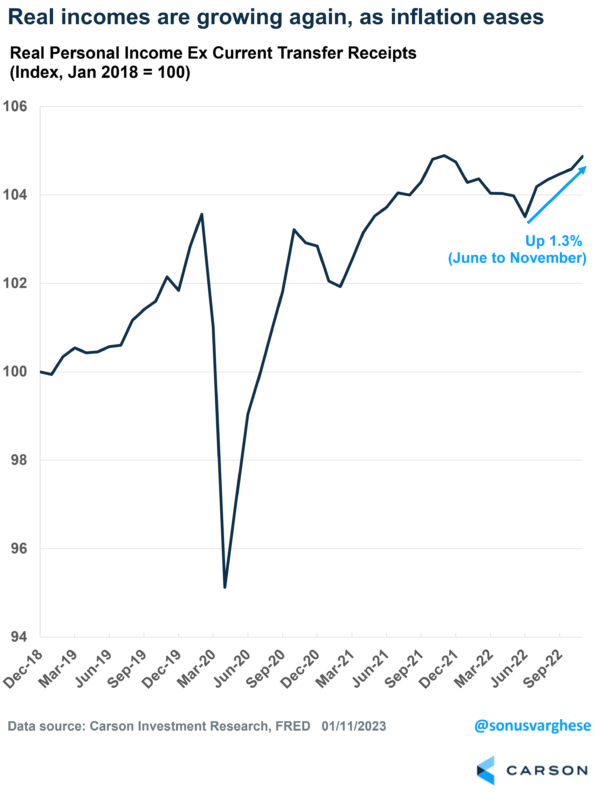

Obviously, the above is data for 2022, and the question is what happens in 2023. For one thing, inflation looks to be falling – and with wage growth remaining strong, real incomes will be higher. In addition, lower gas prices, lower energy prices (utilities), and lower food prices mean consumers should have more money in their pockets. Just as higher inflation is effectively an income tax, falling prices are akin to a tax cut. And unless households choose to save this excess income, this will likely keep consumption up.

Concerning tax cuts, thirty-eight states have significant tax changes that took effect on January 1st. As the Tax Foundation notes, most of these represent net tax reductions, which result from a wave of tax cuts we saw over the past two years as state revenues surged and governors/legislatures looked to ease the impact of higher prices on residents.

Also, social security recipients are slated to receive a cost-of-living adjustment of 8.7% to their incomes in 2023, a function of the high inflation we saw last year but coming just as inflation starts to pull back. Seniors will get another break from Medicare premiums, slated to fall this year.

All tailwinds for consumption, which make up 70% of the economy.

So, Why the Recession Calls?

In short, forecasters expect the Fed’s aggressive rate hikes of 2022 to hit the economy in mid-2023 and beyond. The idea is that monetary policy impacts the economy with “long and variable lags.” Even Fed Chair Powell and other Fed officials have cited the uncertainty around the lagged impact of their rate hikes as a reason for stepping down the pace of rate hikes in December. Instead, they want to wait to see the impact of the 425 bps of rate hikes they did last year.

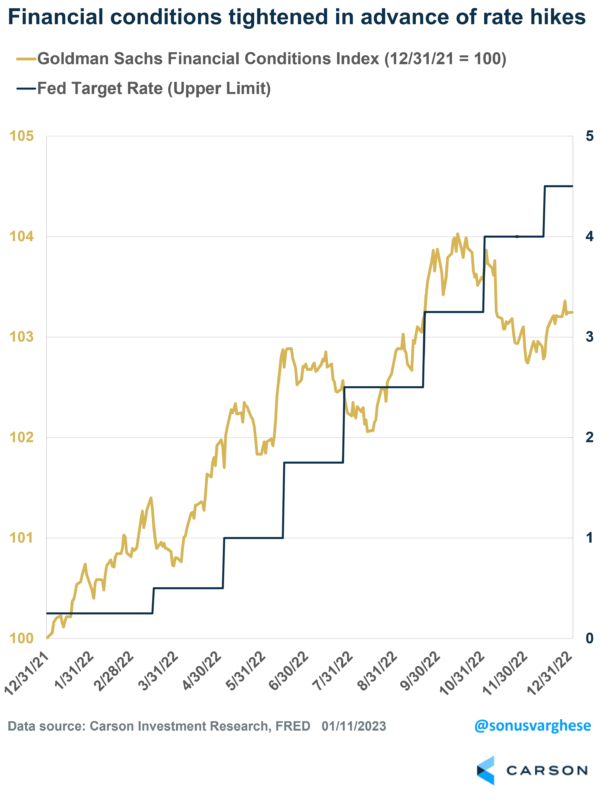

However, the reality is that monetary policy impacts the economy through financial conditions. For example, higher interest rates can crimp household demand for mortgages, and tighter credit conditions can crimp business spending, including hiring, CAPEX, and M&A.

In fact, because of the Fed’s forward guidance and other commentaries (including leaks to the press), financial conditions can tighten well before actual rate hikes as investors anticipate future Fed actions. You can see this in the chart below – across 2022, financial conditions tightened well ahead of the Fed’s rate hikes.

This means financial conditions can impact the economy sooner than most expect. The steep falloff in housing activity is a good example of how tighter financial conditions make an impact almost immediately – residential investment was a significant drag on GDP growth since the second quarter of 2022, which is when financial conditions started to really tighten in anticipation of the Fed’s aggressive turn. On an annualized basis, residential investment fell 18% in Q2 2022 and 27% in Q3.

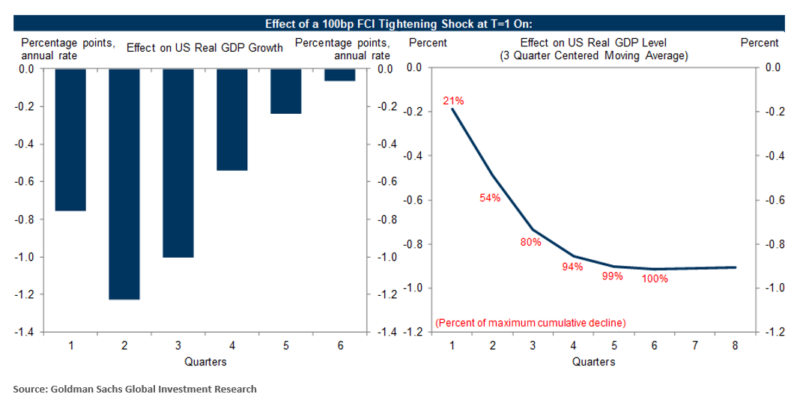

Goldman Sachs had a research note pointing out that tighter financial conditions impact the economy as soon as rate moves are expected, as opposed to when rate hikes are actually delivered (see chart below). Also, they pointed out that the lags from monetary policy apply to GDP levels as opposed to GDP growth.

Unexpected policy changes have a peak impact on GDP growth within 1-2 quarters. After that, it starts to wear off, though there is still a negative impact on GDP growth six quarters down. This means there is still a drag on the level of GDP 6 quarters down – it’s just less than what it was in the immediate aftermath of rate moves.

The confusion between the lagged impact of rate hikes on GDP growth vs. GDP level is perhaps why the consensus view amongst forecasters is a recession in 2023.

However, we may be beyond the point of peak negative impact of rate hikes on the economy. Most of the tightening in financial conditions occurred during the first three quarters of 2022. Financial conditions have eased since October (coinciding with a stock market rally), which is even more favorable for economic growth as the drag from tight financial conditions declines. The other side of stronger economic growth is that we’re more likely to see the Fed keep rates at a higher level for longer.