“So you’re telling me there’s a chance.” -Lloyd Christmas in Dumb and Dumber

What a run it has been, with the S&P 500 up about 15 percent for the year as of Father’s Day. We came into this year expecting stocks to gain a total return of between 12-15%, which at the time was far and away one of the most bullish calls out there. Now here we are nearing the halfway point of the year and new highs aren’t very far away and we think there’s a chance they could happen.

Or as Lloyd Christmas told us many years ago, you’re telling me there’s a chance.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Think about these recent market feats.

- The S&P 500 was up 15 percent year-to-date in the month of June, something last seen in 2019 and 2013 before that, two years that eventually gained close to 30% when all was said and done. You have to go back to 1998 the other recent time it happened and stocks gained 27% that year.

- The S&P 500 just had a six-day win streak, the longest since an eight-day win streak in November 2021.

- The S&P 500 is in the midst of a five-week win streak, the longest since five weeks in October/November 2021.

- Lastly, the S&P 500 is up 5.5 percent in June, which would be the best month of June for stocks since 2019, but 1955 before that. June usually isn’t a great month for stocks, but as we noted in The June Swoon?, the odds favored a rally in 2023 and boy has that happened.

As we laid out in Outlook ‘23: The Edge of Normal, we said “..we believe the market is actually primed for a robust return in 2023 – perhaps to new highs.” As crazy as that sounded when everyone else was talking about an immediate recession and a collapse back to the October lows being a virtual certainty, we took the road less traveled and anticipated a much better environment for investors. We started the year overweight equities, added more exposure in mid-March when everyone else was lowering their targets during the regional banking crisis, and we remain overweight as of today.

Yes, we will likely increase our overall target for stocks when we release our Midyear Outlook in a few weeks, but the bottom line is we remain overweight stocks and underweight bonds, with new highs this year not very far away for stocks. With some more good news, stocks could absolutely add the 8% that is needed to get back to new highs. As noted above, 1998, 2013, and 2019 were other years that were up nicely as of the end of June and those years added 8.4 percent, 15.1 percent, and 9.8 percent, respectively, the final six months of the year.

I was on CNBC’s Closing Bell on Thursday and Scott Wapner asked me if I thought new highs were possible this year. He knew we were one of the few bulls out there to start the year, so it made sense he’d ask that, as most of the other guests they’ve had on the past few months are still talking about inverted yield curves, recessions, and bear markets. I’ll admit, I didn’t see that question coming, but I quickly answered yes (you can watch the interview at the bottom of this blog).

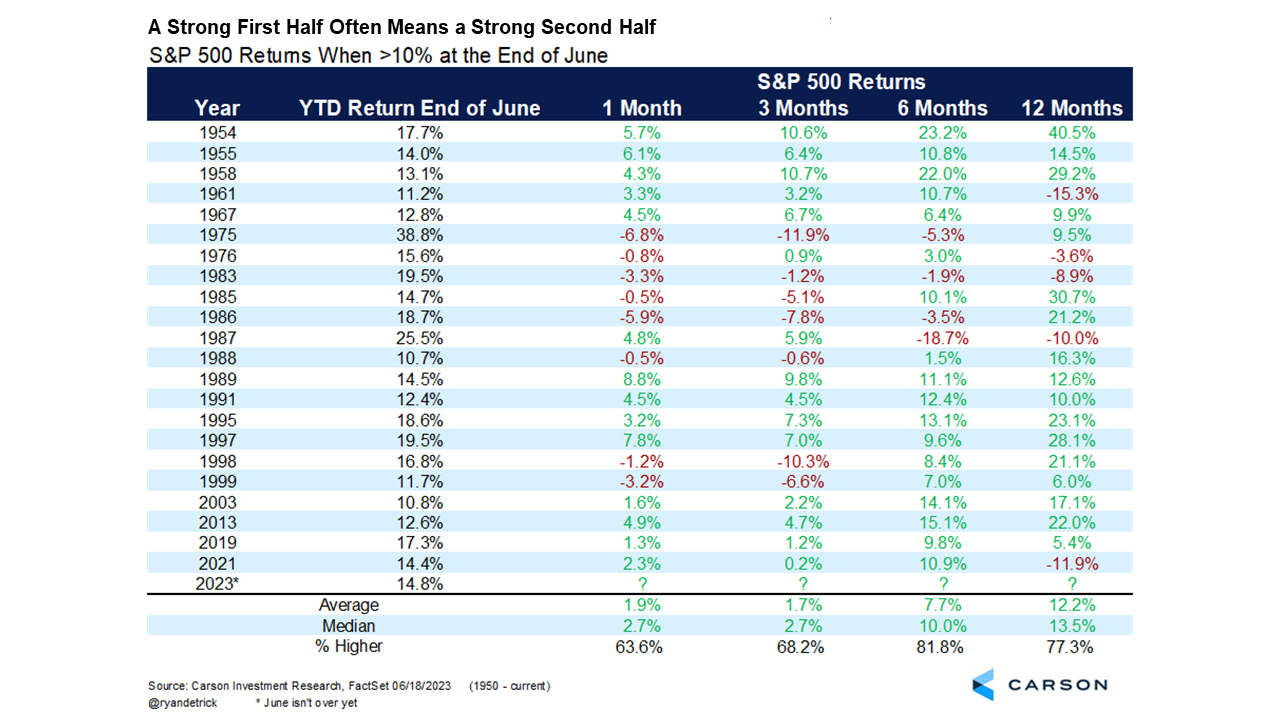

A good start to a year usually means a good second half. Sure, it isn’t always that simple, and 1987 is in here, but looking at the 22 times the S&P 500 was up at least 10 percent as of the end of June, the next six months added an average of 7.7 percent, a median of 10.0%, and were higher close to 82 percent of the time six months later. That eight percent needed now for new highs puts that right in line to potentially happen. Lastly, the final six months have been higher the past 11 times the S&P 500 was up at least 10% as of the end of June.

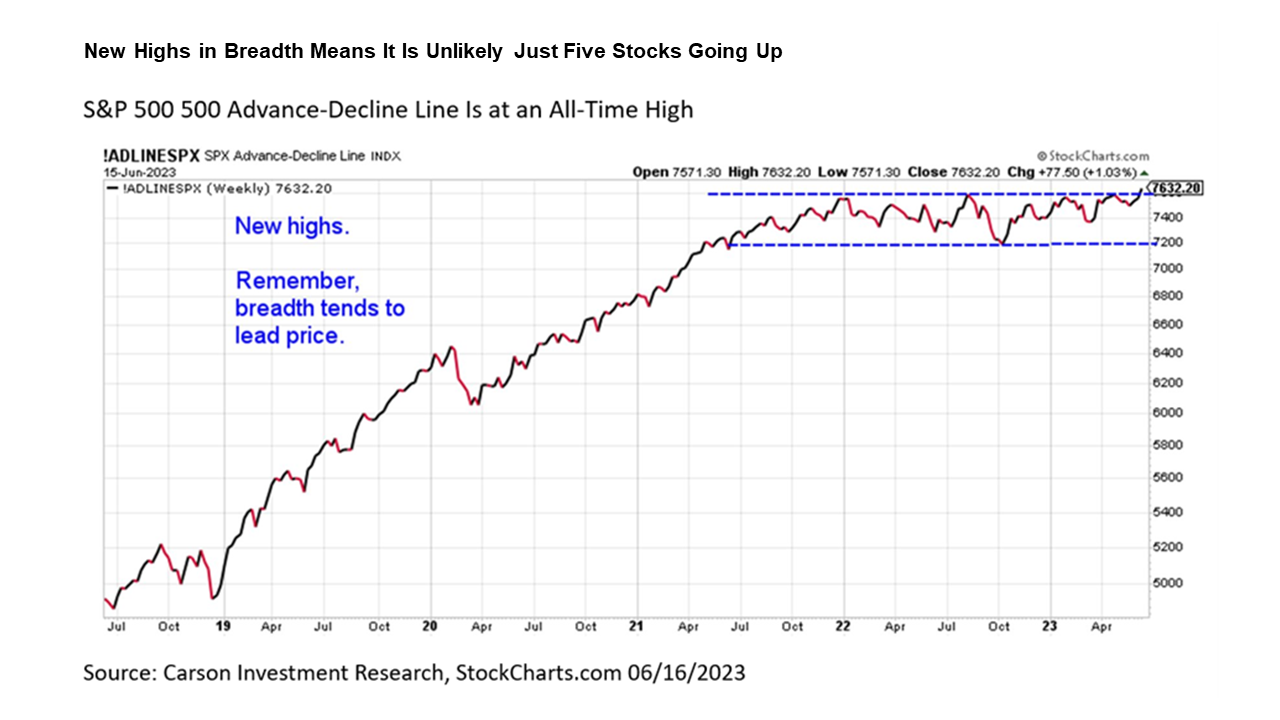

We’ve heard so much this year how ‘only five stocks’ are going up and that is the only reason the market is higher. I already talked about why this simply wasn’t true in Why This Stocks Market is Like The Michael Jordan Chicago Bulls, but there have been many other clues many other stocks have been going higher and this bull market was on firm footing. Well, the S&P 500 Advance-Decline line just closed at a new all-time high last week, another bullish signal that the trend higher is indeed higher. All you need to know is an advance-decline line is a cumulative daily tally of all the stocks that go up versus down each day. When it makes a new high, it is a sign that overall market breadth is quite strong. In other words, our opinion is that it is borderline ridiculous to say that only five stocks are going up.

The way I learned it many years ago was breadth leads price. At major market peaks, we tend to see stocks making new highs, but breadth weakening. Well, today we see breadth making hew highs and price hasn’t yet. The key word being yet, as we expect price to eventually make new highs along with breadth, just as it has done many times throughout history, and there’s a good chance it’ll happen this year.

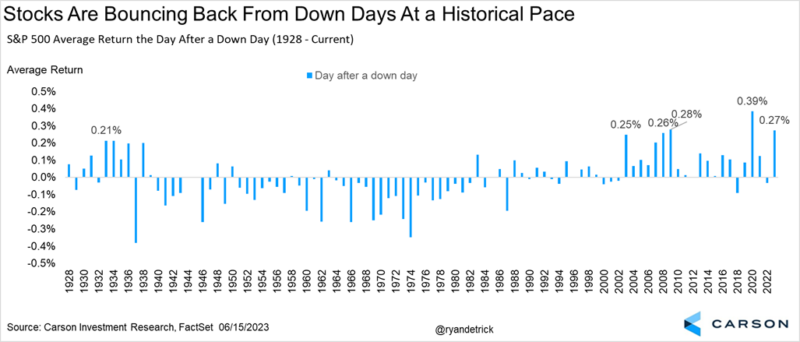

The last reason stocks could go ahead and make new highs in 2023 is they just don’t want to go down. This year so far is one of the best ever in terms of how stocks do the day after a down day. Or should I say, how strong stocks are the day after a down day. Up 0.27% the day after a down day would come in as one of the best ever percentage moves as the chart below shows. Yes, I’ll be the first to admit some of the best years ever have nearly all taken place the past 20 years and this could be because of algorithms and computer trading. Still, I’d chalk this up as another reason to remain bullish in 2023.

Will we get there? It’ll take some more good news, but I don’t think it is as crazy as it sounds. It likely was way more crazy when we were saying it was possible five months ago, but now, it just might happen and there’s a chance it’ll happen, like the always looking at the bright side Lloyd Christmas told us many years ago.

Here’s the fun interview I did with Scott on CNBC last week.