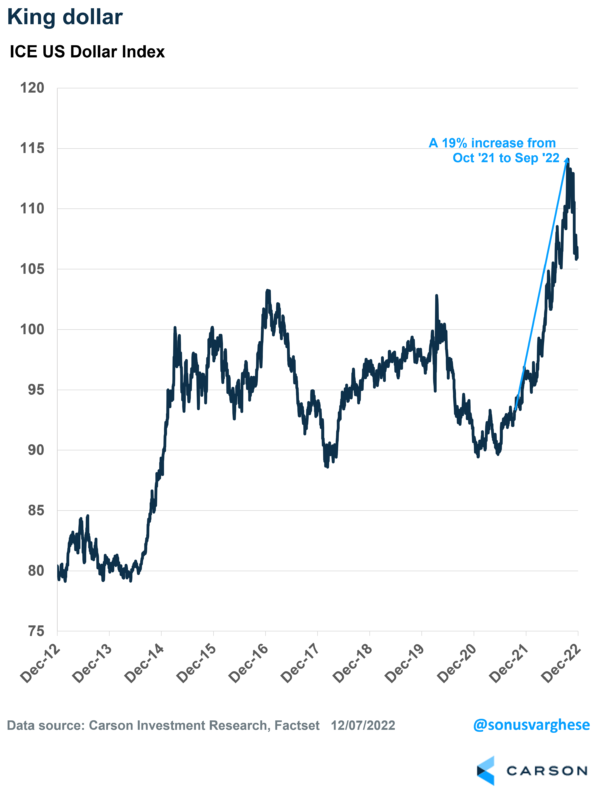

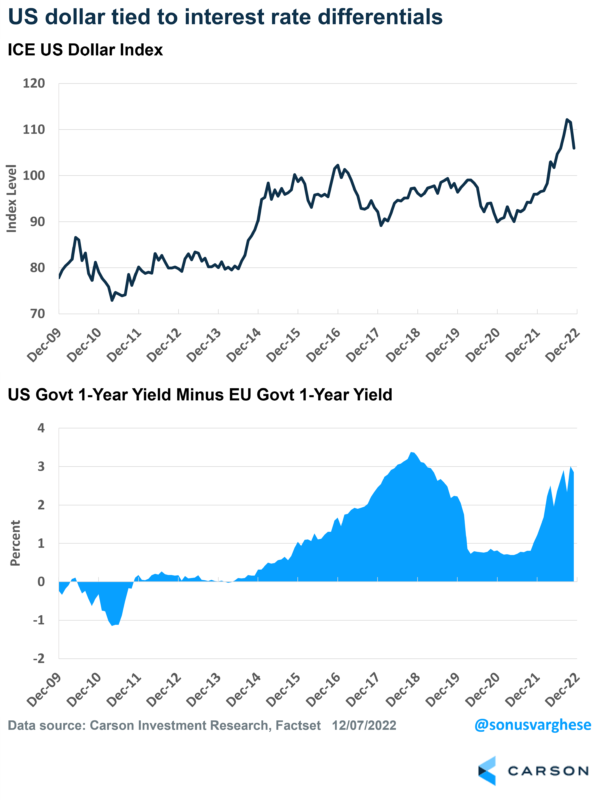

A big story this year has been the US dollar, which has surged. The chart below shows the sharp rise of the ICE US dollar index, which measures changes in the US dollar against a basket of other currencies, including the euro, yen, British pound, and the Canadian dollar. However, it pulled back by just over 5% across October and November.

A stronger dollar matters for several reasons, both of which have played out this year.

A headwind for USD-based international equity investors

When an investor in the US uses dollars to buy a basket of international stocks, the interim step is first converting those dollars to the local currency, which introduces currency risk. Note that when you see quotes for international stock exchanges, like the Nikkei (Japan) or the FTSE (UK), those are in local currency terms. To buy Japanese stocks, you must first convert dollars to yen. Your returns are not just dependent on what the Japanese stocks do; it’s also dependent on what happens to the yen relative to the dollar. If the yen appreciates against the dollar, that’s a tailwind to your investment, whereas a stronger dollar acts as a headwind. Of course, you could hedge to mitigate the currency risk, but that gets more complicated and expensive – so the majority of international equity investments are unhedged (using ETFs and mutual funds).

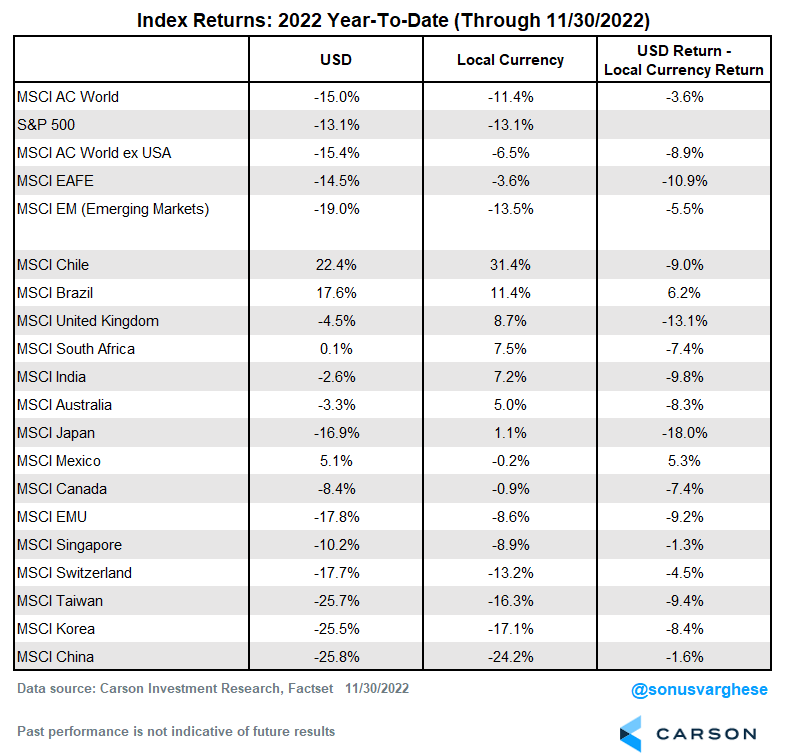

Through November 30th, the S&P 500 index has fallen 13.1%. A basket of international stocks, represented by the MSCI World ex US Index, performed worse, falling by 15.4%. However, those are returns denominated in US dollars. In local currency terms, the international basket looked better, down 6.5%. The table below compares US dollar-based returns versus local currency returns for several international baskets, including individual country baskets. You can see the impact of the stronger dollar, most notably in the case of Japan. The MSCI Japan Index was up 1.1% in local currency terms but fell 16.9% once it was converted back to the dollar – thanks to a big fall in the value of the Japanese yen against the dollar this year.

So, a stronger dollar directly impacts your international equity investments (unless hedged for currency risk). But there’s another indirect impact too.

A headwind for earnings

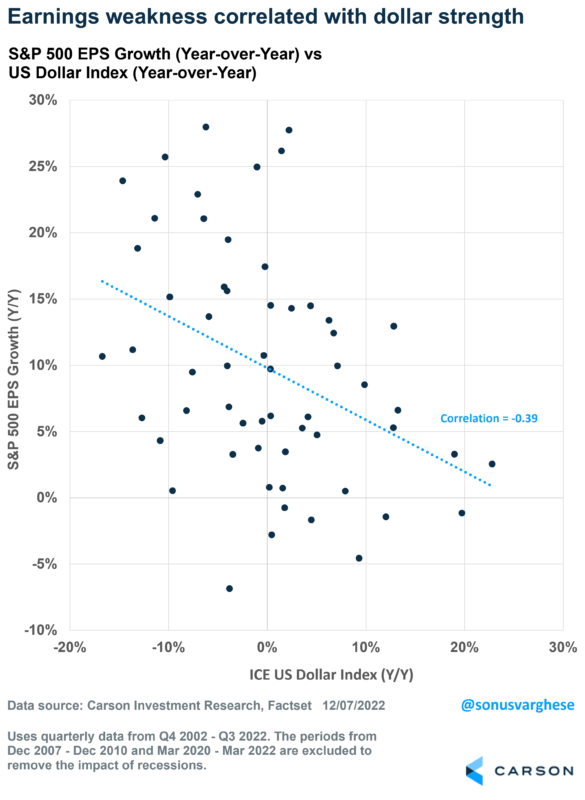

Over the past few decades, movements in the US dollar have negatively correlated with S&P 500 earnings changes. Excluding recessions and post-recession recoveries (since those skew the numbers significantly in either direction), earnings weakness for the S&P 500 has coincided with dollar strength over the past 20 years. At the same time, a weaker US dollar has correlated with stronger earnings growth.

This makes some intuitive sense once you realize that 40% of S&P 500 revenues come from outside the US. The logic here is that if a company used to sell a machine abroad that generated the equivalent of $1,000 in the past, now that would be about $900 because the local currency fell 10% against the US dollar.

So while the US economy is very relevant for S&P 500 company earnings, much of it also hinges on what happens outside the US and what happens with the US dollar.

Why did the dollar rise

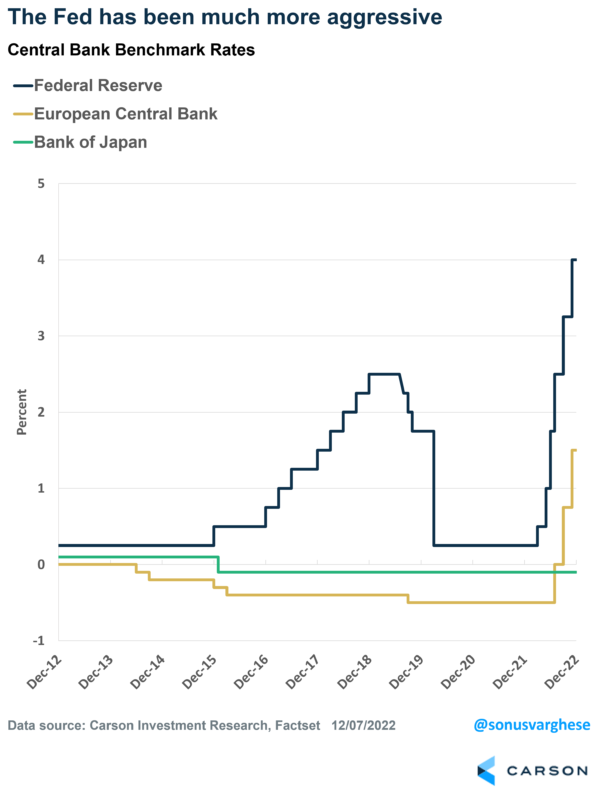

It’ll help first to understand why the dollar strengthened in the first place this year. The simplest explanation is that interest rate differentials between the US and other countries rose – the idea is that if interest rates are much higher in country A rather than country B, money will flow into country A, thus raising the value of that country’s currency.

This came about because the Federal Reserve (Fed) raised rates much faster than its counterparts abroad. The chart below shows the Fed’s target rate against those of the European Central Bank (ECB) and the Bank of Japan (BoJ).

And this chart illustrates how the dollar has typically climbed when interest rate differentials climb, most notably after 2014 and in 2022.

What next for the dollar

To get to the question as to where the dollar goes from here, the question is what happens to interest rate differentials. And that’s made up of two pieces: US monetary policy and monetary policy abroad.

The Federal Reserve is not entirely done with interest rate hikes yet, but markets are already accounting for this. 1-year US treasury yields are currently about 4.7%, while the Fed’s target rate is about 4% (though it’ll get to about 4.5% next week after the Fed’s December meeting). Of course, if inflation persists, the Fed could raise rates even more than currently expected, perhaps to 5.2-5.5%. But that’s not significantly higher than current expectations. And given what we’re seeing with goods prices and rental inflation, we should have softer inflation data a year from now. This means, barring another shock (like the Russia-Ukraine war), we’re probably not looking at interest rate differentials increasing on the back of higher US yields.

A more significant driver of interest rate differentials will probably be foreign central bank policies – which will be governed by what happens with inflation and their respective economies. Inflation is at multi-decade highs in Europe due to the energy crisis sparked by the Russia-Ukraine war. The ECB has responded, but nowhere to the extent the Fed has, and that’s because they’re working with an economy much weaker than the US right now. Even in Japan, the Bank of Japan has held firm, keeping benchmark rates below zero despite inflation hitting its highest level in more than 30 years.

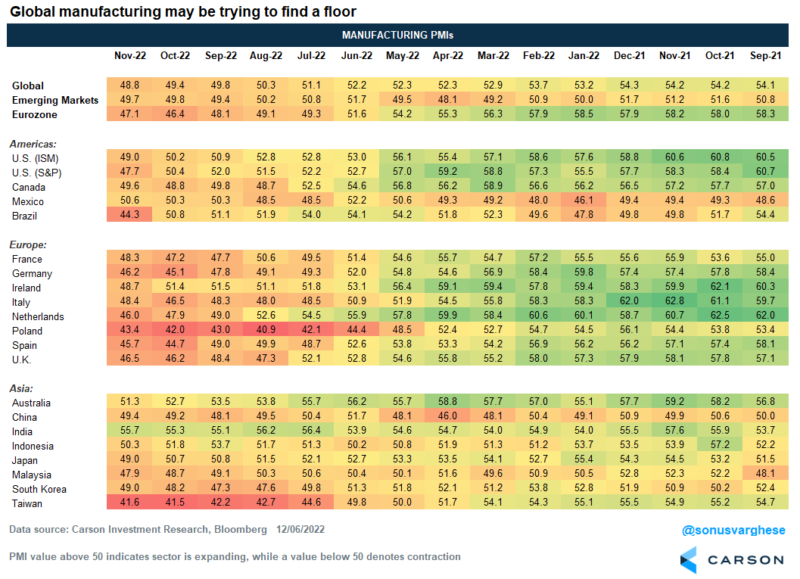

Ultimately, it depends on whether the rest of the world will be in a recession or not. Growth outside the US has been significantly weaker this year, but there are some signs that things may be shifting ever so slightly. November manufacturing PMIs reversed direction in 11 of the 20 major countries we track across Europe and Asia. The PMIs are still below 50 in 17 out of 20 countries, indicating the manufacturing sector is contracting (and manufacturing matters more outside the US).

However, things may be close to hitting a bottom, and we could start seeing a reversal in global economic growth in the second half of 2023. If the relative “economic growth differential” between the US and the rest of the world starts to shrink, we could start to see downward pressure on the dollar.

Investors may already be recognizing all of this, which is why the dollar index fell 5% in November, its largest monthly drop since September 2010. If that continues, a potentially weaker US dollar could be a tailwind for USD-based international equities and multi-national earnings.

Listen to the latest episode of Carson’s Facts vs Feelings Podcast here: