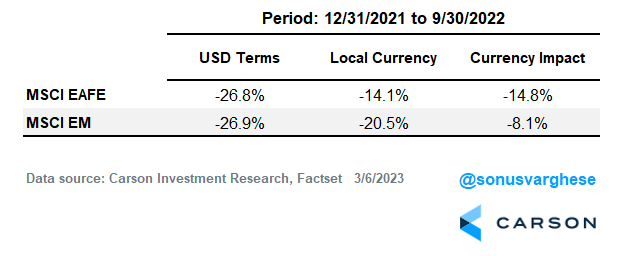

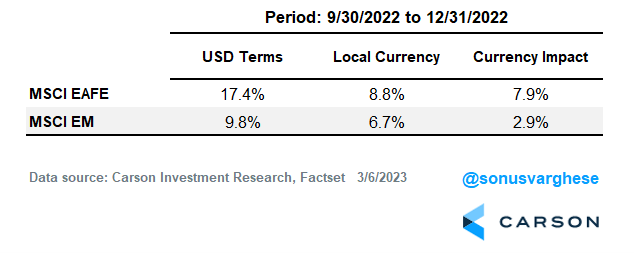

Last year the MSCI EAFE Index, which represents a basket of developed market stocks, fell 14.5%. Meanwhile, the MSCI Emerging Markets (EM) Index lost 20.1%. It turns out the returns for these baskets were higher in local currency terms, and there was a big drag from a stronger dollar. In local currency terms, the MSCI EAFE index lost “only” 6.5%, while the MSCI EM Index lost 15.2%.

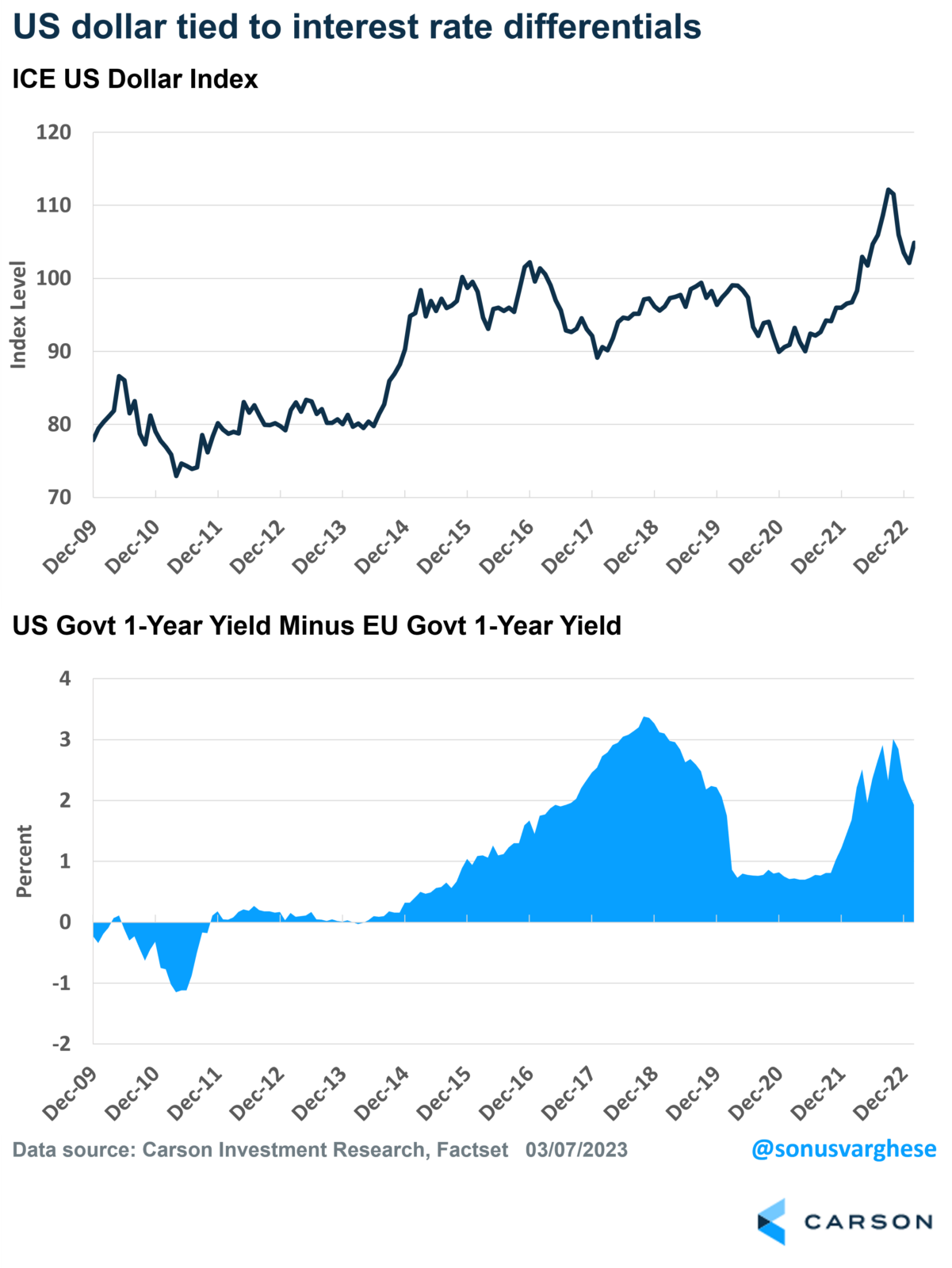

2022 was really a tale of two periods when it came to the dollar. Over the first three quarters, the US dollar (USD) appreciated significantly against other currencies. This came on the back of the Federal Reserve surprising investors by taking an aggressive approach to get on top of inflation. This contrasted with other central banks around the world, including in Europe and Japan, who weren’t quite so aggressive – mostly because their economies were weaker than the US, and being overly aggressive ran the risk of tipping things into an immediate recession. As a result, interest rate differentials between the US and other countries grew, and to a first approximation, rising interest rate differentials should boost the currency.

The following chart illustrates how the dollar has typically strengthened when interest rate differentials climb. We saw this is 2014 and again in 2022.

The strong dollar was a big headwind for international equities over the first 3 quarters of 2022.

However, as the Fed started to step back on the size of the rate increases by the end of the year, the dollar started to ease. Which was a tailwind for international equities.

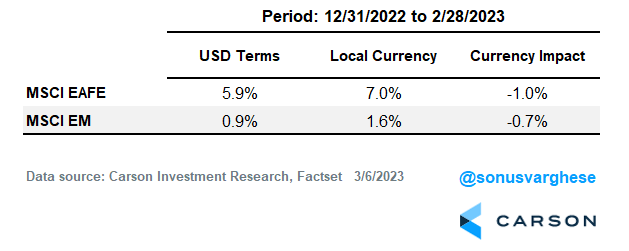

Then we saw another switch this year. As the economic data came in hot, especially the January employment data, investor expectations for Fed rate hikes increased. Which sent the dollar higher once again, yet again creating a headwind for international equities.

All this is a reminder of the currency hurdle that international equities must overcome to offer better performance relative to US equities.

The math for international equities is hard

But let’s try to simplify it a bit.

Consider two investments: stock A with returns of 20% in year 1 and 20% in year 2. Stock B with returns of 50% in year 1 and -10% in year 2. Both assets have an average return of 20%. But the compounded returns are quite different:

- Stock A: (1 + 0.20) x (1 + 0.20) – 1 = 44%

- Stock B: (1 + 0.50) x (1 – 0.10) – 1 = 35%

The compounded return for stock B is lower because of the “volatility drag”. This also gets to the reason why you always want to reduce portfolio volatility.

The currency impact works similarly.

Say an international equity basket appreciates 30% in local currency terms. But the currency depreciates 15% against the USD. The USD return is not 30 – 15 = 15%

Instead, the USD return = (1 + 30%) x (1 – 0.15) = 10.5%

There are 3 pieces to understand here:

- The investor made 30% on their actual international equity investment

- They lost 15% on the currency

- But, they also lost 15% of the 30% equity gain = 4.5% (the “geometric piece”)

Combing the three pieces, we get 30% – 15% – 4.5% = 10.5%

All this to say, you need to get two pieces right when investing in international equities

- One, the direction of the equity basket

- Two, USD vs. local currency

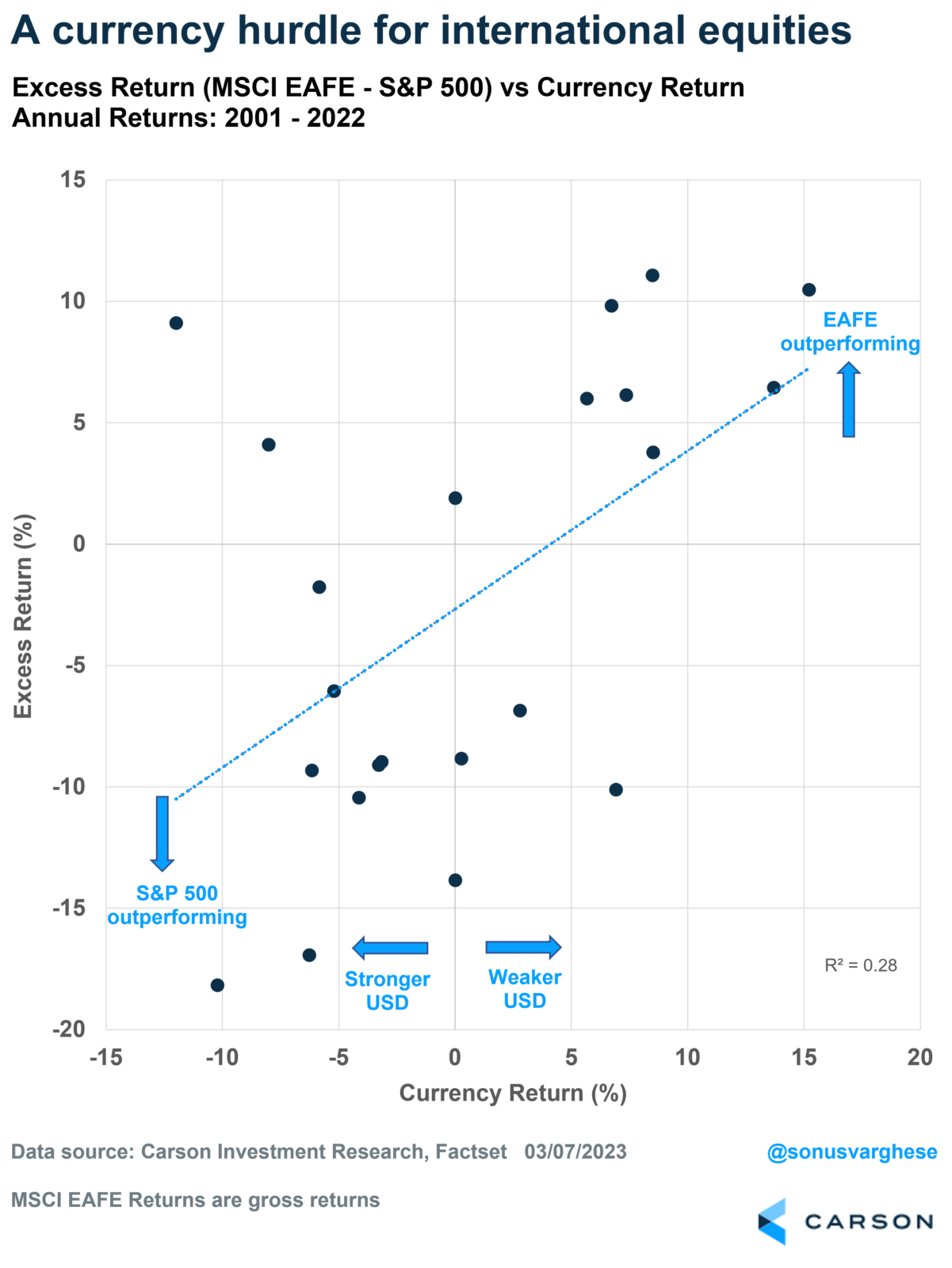

The data bears this out as well. The chart below shows the past 22 years of excess returns for the MSCI EAFE Index against the S&P 500, versus currency returns. You can see that international developed market excess returns are typically negative, i.e., US equities outperform when the USD appreciates. And vice versa.

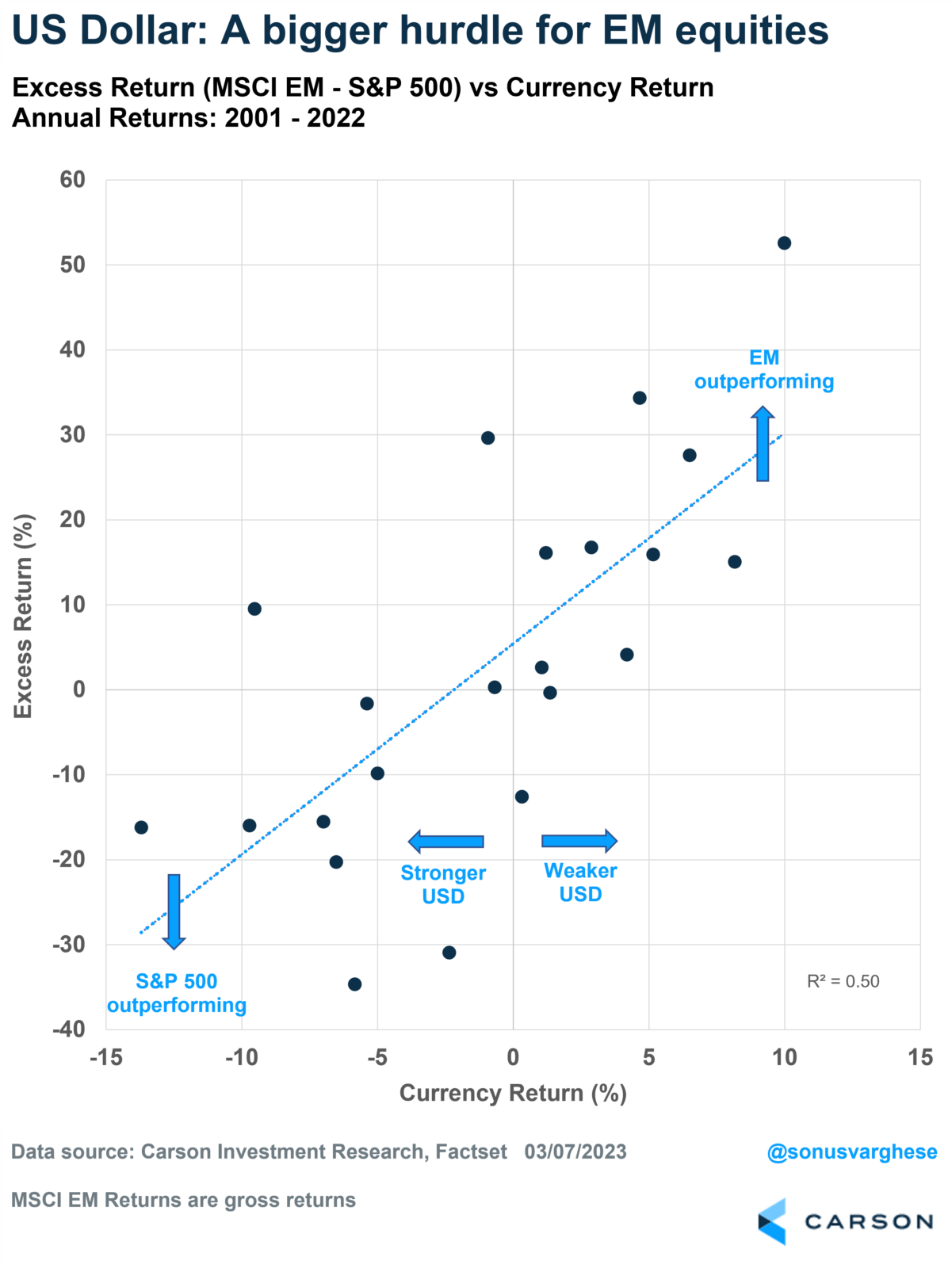

A similar dynamic exists for EM. A stronger dollar leads to US equities outperforming EM equities and vice versa. In fact, the relationship is even stronger than what we saw above with developed markets.

Part of the reason is that EM local returns are also disadvantaged by a stronger dollar. Normally, you would expect emerging countries to be advantaged by a weaker currency – which makes their exports cheap in international markets, boosting demand for those goods and stimulating domestic activity.

However, it turns out there’s a financial channel that offsets the trade impact. A weaker currency can lead to tighter domestic financial conditions. A lot of EM companies borrow in US dollars (since it’s cheaper to do so), but their revenues tend to be in local currency. So when the dollar appreciates, it increases their debt service costs relative to revenue, thus creating a tougher domestic economic environment.

The currency hurdle is one reason why we are underweighting international equities from a long-term strategic perspective.

However, our near-term tactical view is neutral on developed market equities.

This is because we believe the dollar will see downward pressure as interest rate differentials continue to shrink, and that will provide a tailwind.

In my next post, I’ll discuss why we believe interest rate differentials will shrink or at least not expand as they did in 2022. Including relative central bank policies, inflation, and economic growth.

Stay tuned.