“No man ever steps in the same river twice, for it’s not the same river and he’s not the same man.” — Heraclitus, ancient Greek philosopher

First things first, no one knows how much longer this bull market might last, but as we’ve been saying for a long time now, we see no reasons to expect the economy to sink into a recession, nor do we see any major warning signs the bull market is over. The good news is once bull markets make it past their second birthday, they tend to last multiple more years. 🎂

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

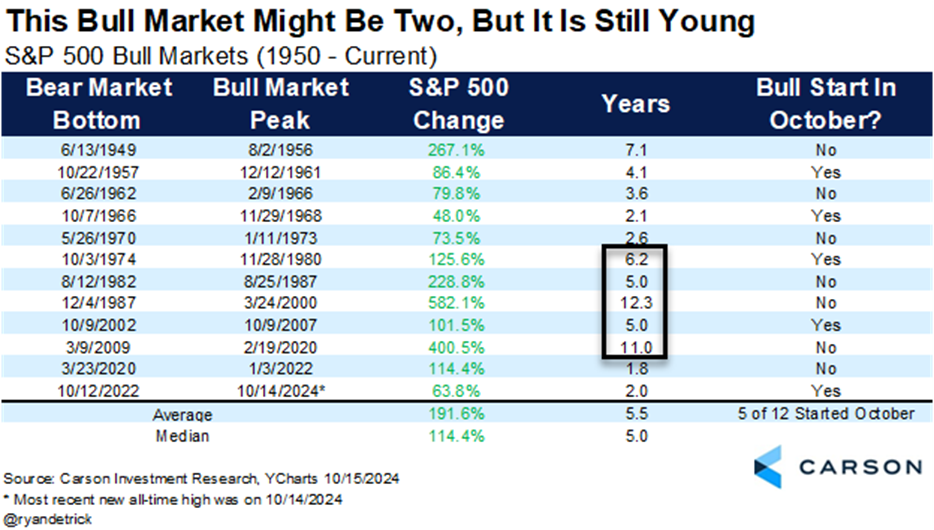

Here’s a table we shared in Happy Second Birthday to the Bull Market last week, but we wanted to take a closer look at how long recent bull markets have lasted. The 114% rally after the pandemic didn’t quite make it to two years, but looking back fifty years, every other bull market has had a lot more left in the tank after its second birthday. There were five bull markets over that time span that made it to the start of their third year, and the shortest one lasted was 5.0 years (which actually happened twice). I like to think of this like a cruise ship — once it gets moving it is hard to stop or slow down. 🛳🚢

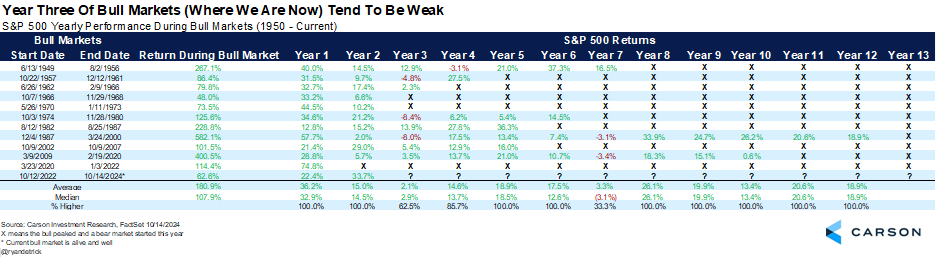

Here’s another look at things. I’ll say this, this table took me a long time to put together, but I like the way it turned out and I think we can learn a lot from it. The bottom line is year three of bull markets tend to be rather weak, up only 2.1% on average. I guess this shouldn’t be a huge surprise, as usually years one and two tend to see huge gains, so some type of choppy action or consolidation the third year would be normal.

Now take a look at how often bull markets made it to years four and five once they get to their third birthday. Should this bull market make it another year (as we expect), the returns in years four and five are extremely strong, up 14.6% in year four and nearly 19% in year five. That should have bulls smiling indeed.

Go read the quote above by Heraclitus again. I think it relates quite well to bull markets, as no two bull markets are ever the same. We like to look at the past to get a picture for what could happen in the future, but the truth is all bull markets are different. All we can do is look at the data as we get it and make an honest assessment of what could happen next. And not to beat a dead horse, but we simply see no reason to change the overweight we’ve held on stocks since December 2022, nor do we see enough cracks in the economy to call for a recession. So how much longer could this bull market last? Maybe many more years, which might surprise many, but history says it is possible.

Lastly, I was honored to join Kristen Scholer yesterday on her new show from the NYSE called LIVE on NYSE TV to discuss many of these ideas.

For more content by Ryan Detrick, Chief Market Strategist click here.

02464028-1001-A