“It’s a smile, it’s a kiss, it’s a sip of wine… it’s summertime!” – Kenny Chesney “Summertime”

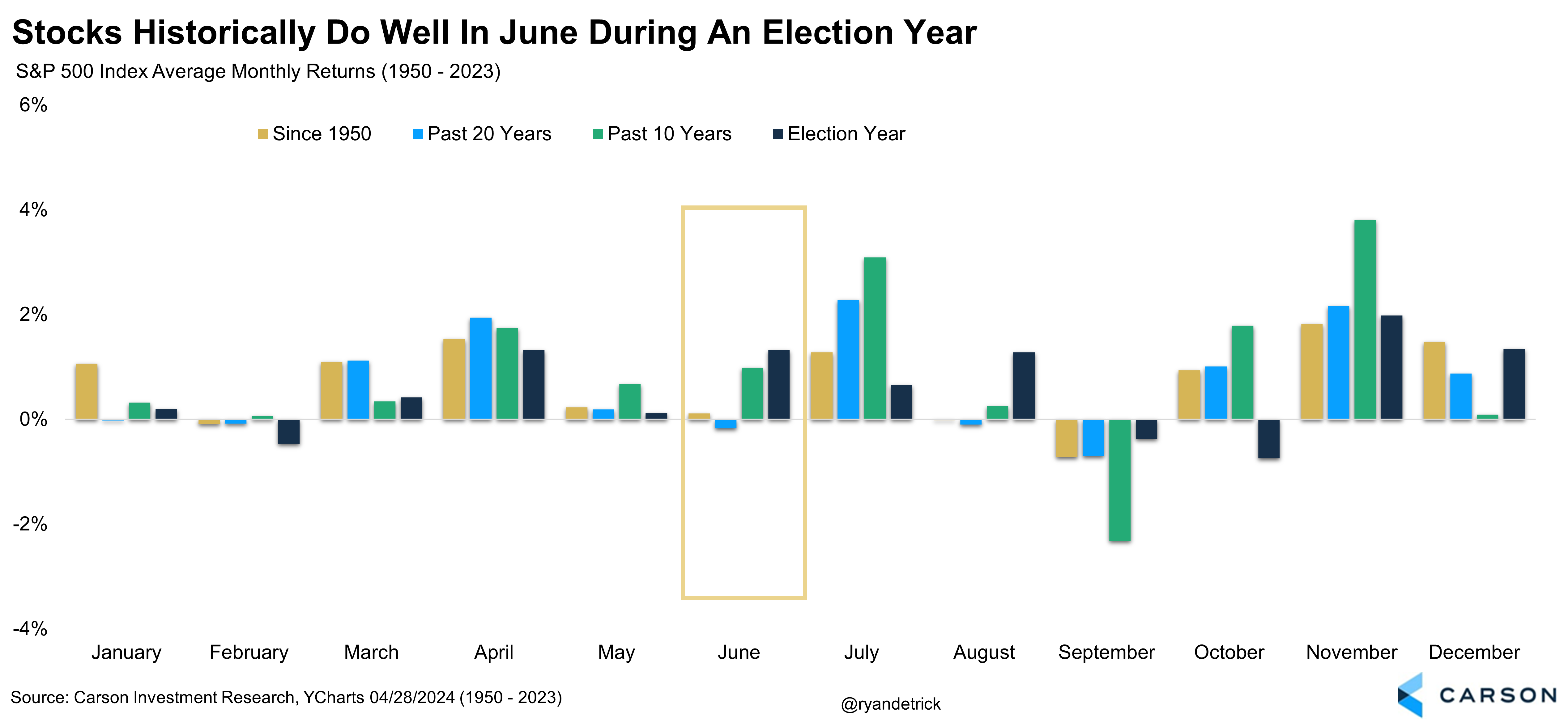

June historically isn’t a very good month for stocks, with the old saying ‘June Swoon’ quite common. Heck, the past 20 years only September has been worse, so could we see a swoon this year? We don’t think so and in todays’ blog I’ll explain why.

One of the main reasons we don’t think we’ll see a June Swoon? June tends to do quite well in election years. In fact, the usually weak June and August months both tend to do quite well, with both up a very solid 1.3% on average. Meanwhile, the normally strong month of July is actually a tad weaker than normal in an election year. June has been the 11th worst month the past 20 years with only September worse, but the past 10 years it is the 5th best month and during an election year it is the 3rd best month. Something for everyone indeed.

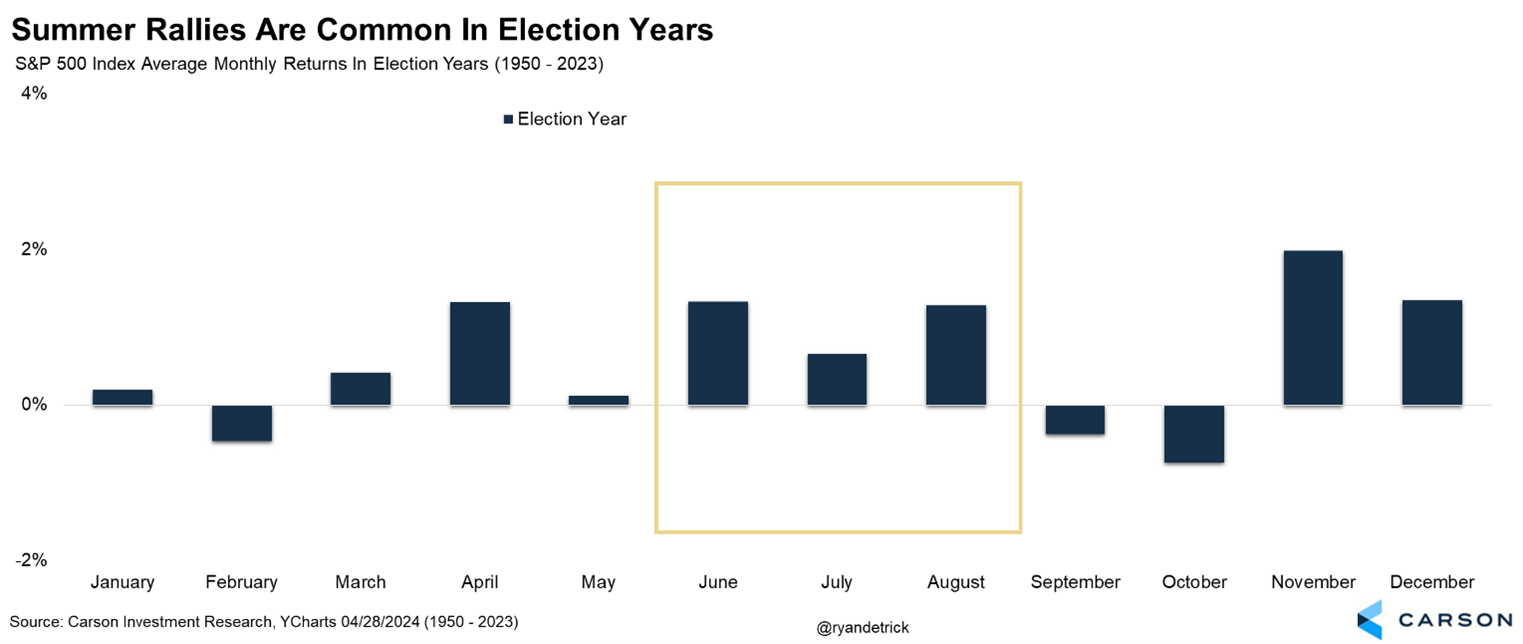

Here’s the same data, but focusing specifically on an election year. As you can see, a summer rally is quite normal.

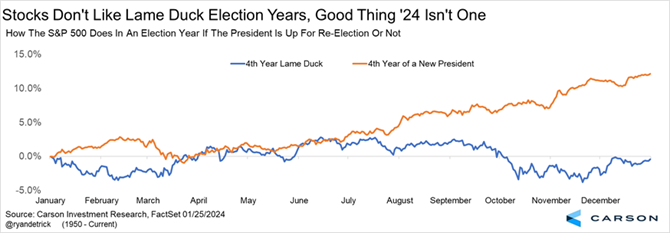

Here’s a chart we’ve shared many times this year. It shows that when a president is in their first term the second half of the year does quite well, compared with a lame duck president, which typically means rough seas are coming.

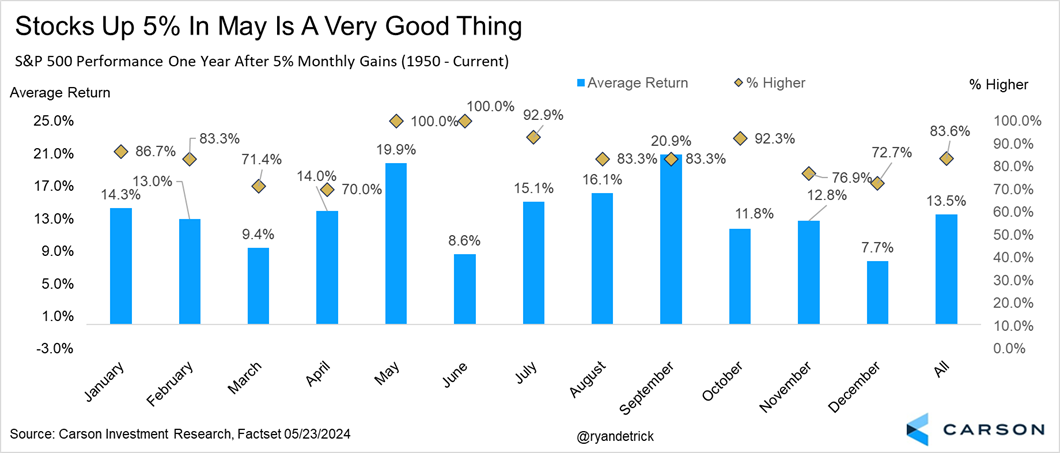

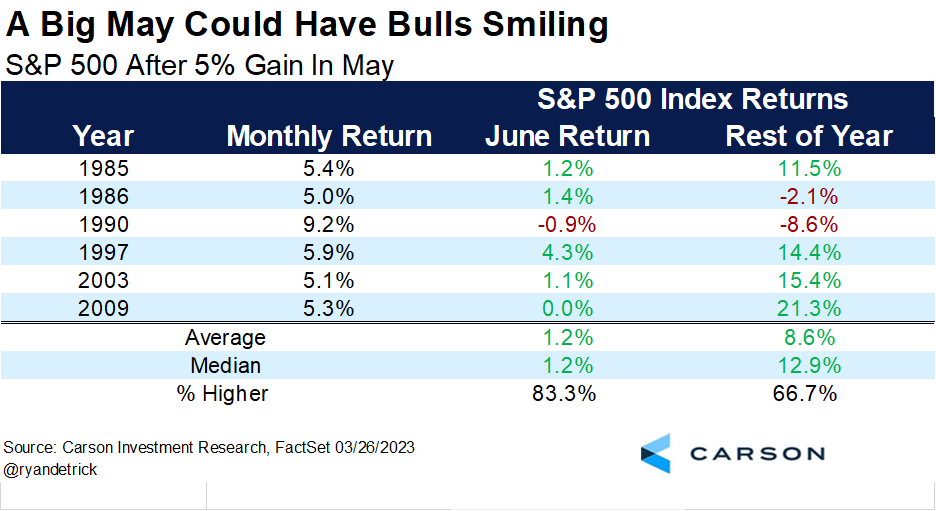

At the time I’m writing this, the S&P 500 is up right about 5% in the month of May. Yes, there is still time left and this could change, but let’s say stocks gain 5% in this normally not-all-that-great month. What happens next?

It turns out no month tends to see more likely higher prices a year after a 5% monthly gain than May. The year after a strong May averages nearly 20% and is higher six out of six times. If you are a bull, you are cheering for a rally in the month’s final two trading days.

Looking a little more at 5% gains in May, it turns out June has been higher five out of six times, with the rest of the year median return a very impressive 12.9%. In fact, the past three times May gained at least 5% the rest of year added 14.4% (1997), 15.4% (2003), and 21.3% (2009). Imagine how mad the bears would be if that happened again this year.

For more of our thoughts on today’s markets and economy, we were honored to be joined by Jeremey Schwartz, Global Chief Investment Officer at WisdomTree, on our latest Facts vs Feelings. You can watch it all below.

For more content by Ryan Detrick, Chief Market Strategist click here.

02258283-0524-A