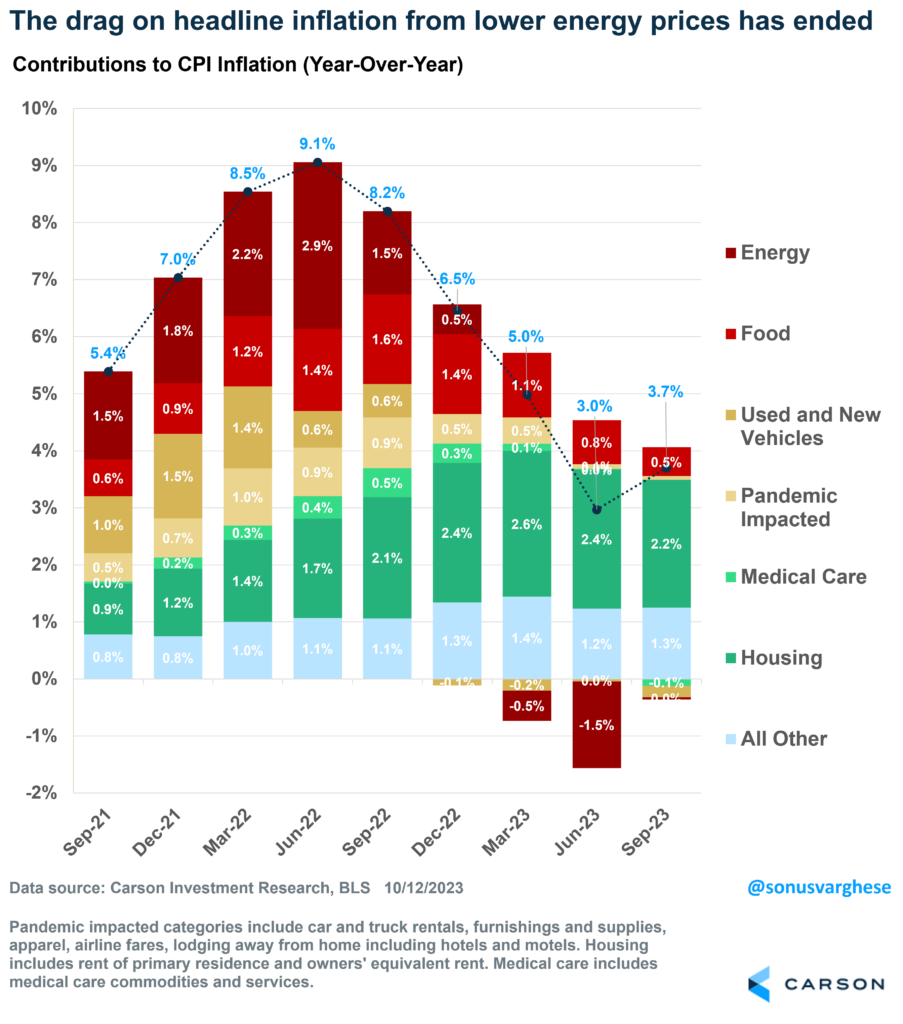

Headline inflation as measured by the consumer price index (CPI) ran hotter than expected in September, rising 0.4% over the month and 3.7% over the past year. The culprit was rising energy prices. Gas prices at the pump increased 2.1% in September, following on from the almost 11% gain in August. Long story short, inflation pulled back from 9% last year to 3% in June mostly on the back of falling energy prices. Over the last 3 months, energy prices have risen, stalling the downtrend. However, there’s more than meets the eye once you look under the hood.

Sticking with energy for a moment, the good news is that gas prices are falling and that’s going to drive the October CPI data lower. Gas prices are falling despite a recent run-up in oil prices because refining margins are crashing (I wrote about this earlier this month).

The other big category that matters for consumers is food prices. Grocery store inflation has eased from an annualized pace of 6% last December to 1.7% in September. That’s going to be key in keeping inflation lower as we move forward, not to mention providing a boost to households.

There’s Good News Even Within Core Inflation

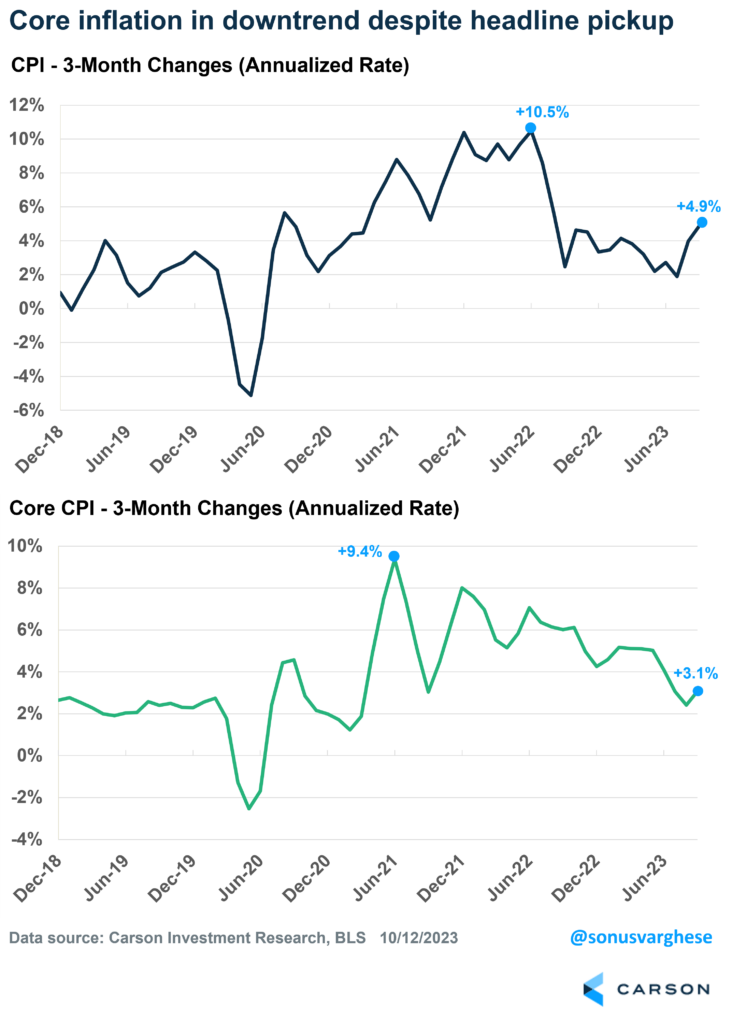

Core inflation, which excludes food and energy prices (since they’re more volatile), rose 0.3% in September and is running at a 3.1% annualized pace over the last three months. That’s slightly hotter than in August but as you can see below, it’s still in an encouraging downtrend.

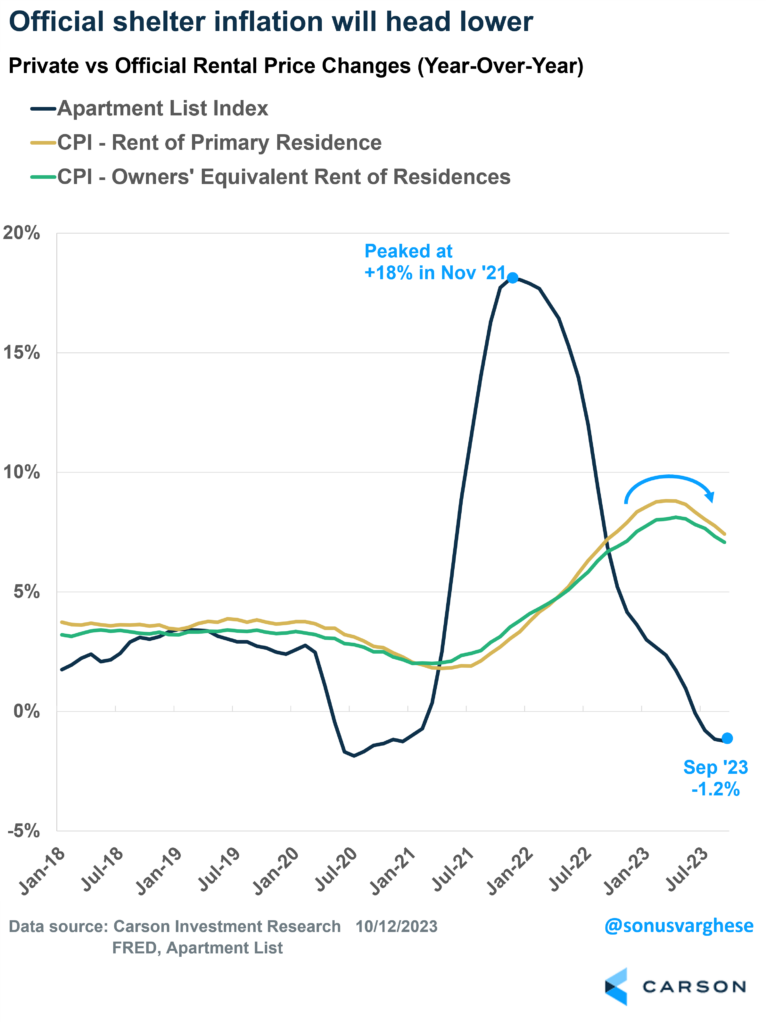

The rebound in September was because of a surprise jump in housing inflation. Housing makes up about 42% of the core CPI “basket” and is almost entirely based on rents. It has nothing to do with home prices, as even homeowners are assumed to rent to themselves at prevailing rental prices. Housing inflation ran at an average annual pace of 5.9% from February through August. That jumped to 6.9% in September. This is likely to be a blip in an otherwise strong downtrend, and we’ll probably see it reverse over the next month or two. Data from Apartment List shows that market rents have been falling for a few months now. Official data has a long lag to market data, but it does eventually follow it. So, we should see continued disinflation in the housing inflation data.

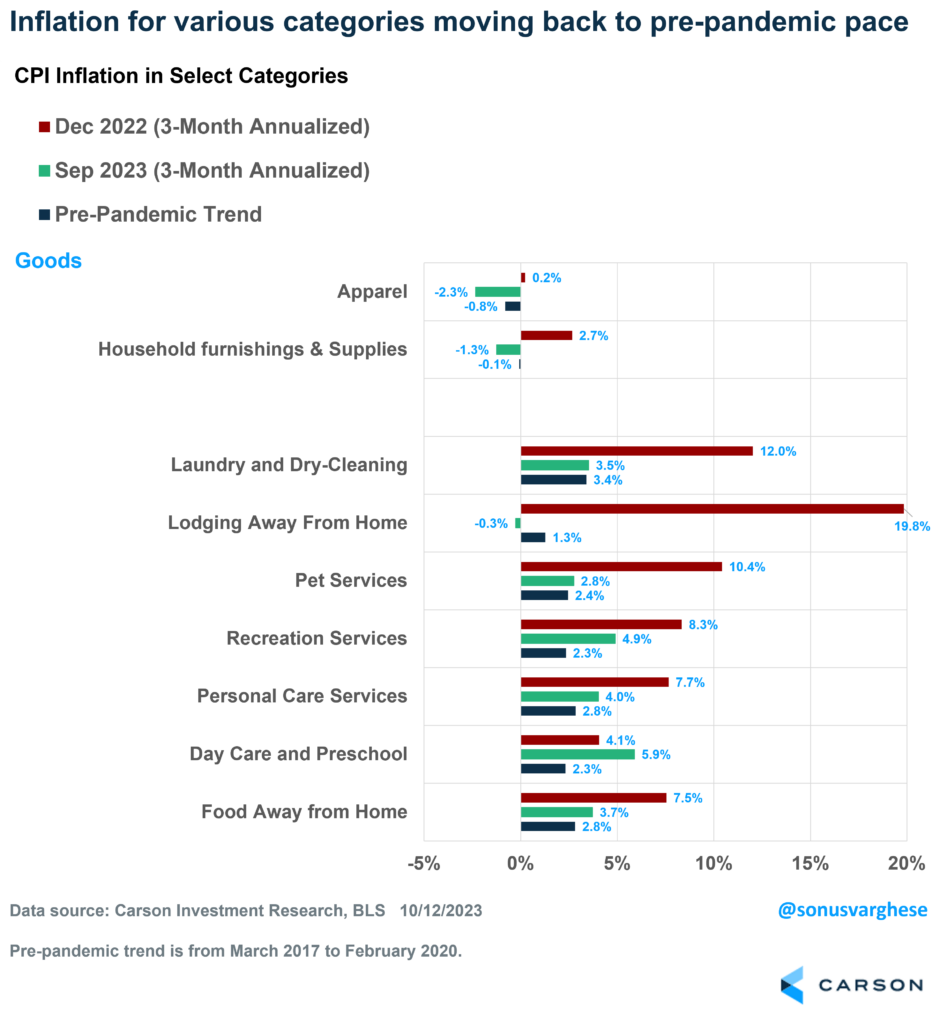

The most encouraging part of the CPI report was the fact that everything outside of housing offset the pickup there. Prices for commodities outside of food and energy fell for the 4th straight month, including

- Used cars and trucks: -2.5% month-over-month

- Apparel: -0.8%

- Household furnishings and supplies: -0.3%

Even several services categories are seeing disinflation. The Fed is especially focused on services outside of housing because they believe strong wage growth can lead to people spending more on services and driving those prices higher. The good news is that we’re not seeing that happening. For one thing, wage growth has eased to the pre-pandemic pace of about 3.4% – make no mistake, that’s still strong but consistent with 2% inflation as was the case before the pandemic. And we’re seeing evidence in the inflation data.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The chart below shows inflation for a few select categories, which together make up just over a fifth of the core CPI basket – comparing the 3-month annualized pace in September to the pace last December, and the pre-pandemic trend. You can see how the latest bars in green are much closer to the pre-pandemic trend (in blue), and well below the red-hot pace we saw last December.

The big takeaway from the CPI data is that there is no structural reason for inflation to surprise higher, or even remain elevated, for much longer. Despite the headlines, this was a good report because it showed continued normalization of inflation under the hood. Certain categories offset others and in a very good way. Unlike last year, we know that the following dynamics are in place and should remain so for the next several months:

- The reversal in vehicle inflation

- Housing disinflation

- Normalization of wage growth to the pre-pandemic pace, which eases pressure on services inflation

As a result, we believe the Federal Reserve is done with interest rate hikes for this cycle. They’ve already done more than enough. That could be a potential tailwind for equities as the bull market that started a year ago begins its second year, which Ryan just wrote about. Also check out our latest Take 5 video where we talk about markets, energy prices, and the Fed.