“The simplest solution is almost always the best.” -William of Ockham, better known as Occam’s Razor

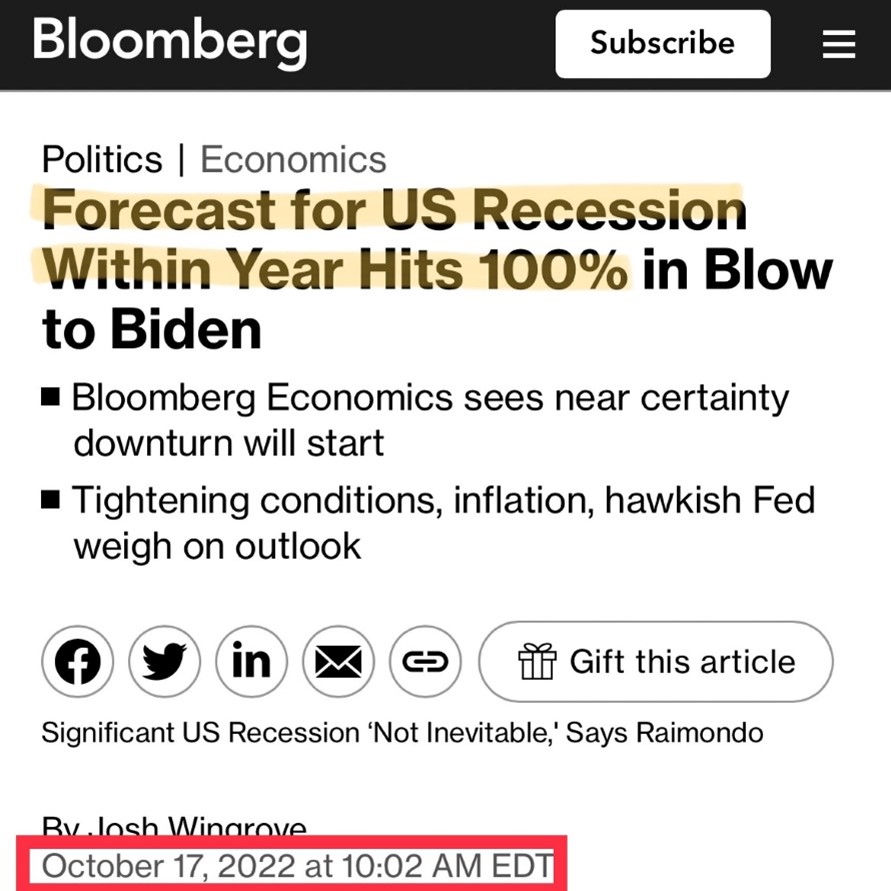

One year ago, right now nearly all the economists on tv told us a recession was coming. Who can forget this headline from last October?

In many cases it wasn’t a question of ‘if’, but how bad it would be. The usual worries were tossed out. Things like M2, inverted yield curves, weak manufacturing survey data, and negative Leading Economic Indicators (LEI) all took the headlines. We’ve dispelled all of these worries the past year and fortunately, here we are a year later, and the economy is still humming along.

The other big worry was higher rates would crimple the consumer, which hasn’t happened yet and is what I want to discuss more today.

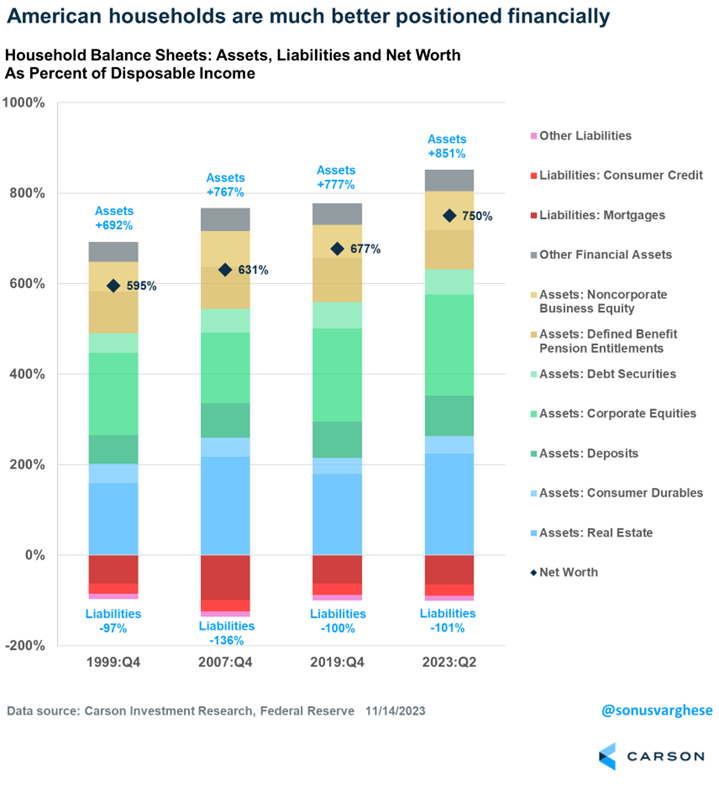

In the face of the most aggressive Fed in a generation, with yields soaring and mortgage rates exploding higher, the consumer’s situation in many cases improved. We’ve discussed before that a lot of this is because balance sheets for consumers are quite strong, thanks in part to record net wealth growth due to higher stock prices and home price.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Here’s a great chart from Carson’s VP, Global Macro Strategist Sonu Varghese showing just this. Overall liabilities are near where they’ve been the past few decades, yet assets and net worth have considerably improved. In other words, household balance sheets are in very good shape in many cases. This might surprise many investors given all we hear about are the negatives.

But now let’s tackle the question of how higher rates haven’t impacted the consumer more. Even the most bullish bull would likely expect 30% credit card rates, 8% mortgages, and other areas of huge jumps in rates to slow the consumer or even corporate America.

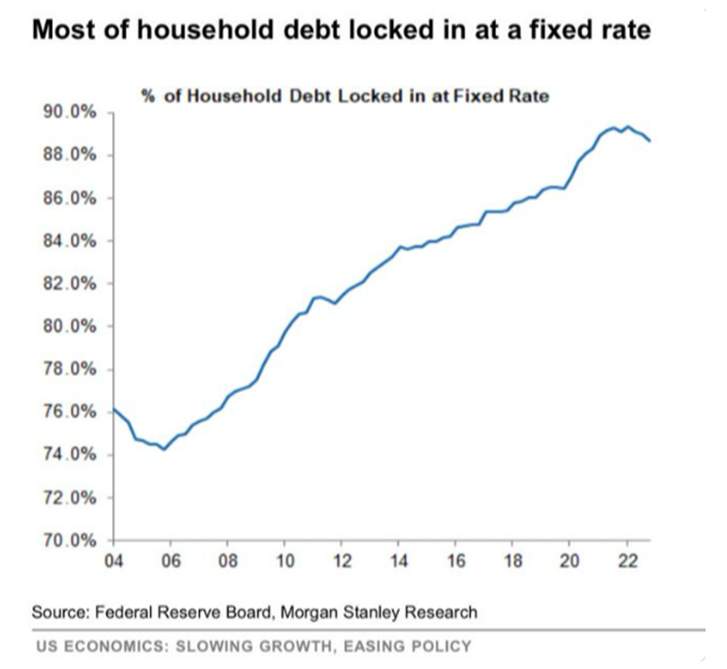

How was it possible that the consumer hasn’t slowed down at all? Go back and read the quote up top one more time. The simplest answer is likely the right answer according to Occam’s Razor. The simplest answer is consumers locked in debt at much lower rates and higher rates didn’t impact them nearly as much as many expected.

Here’s a great chart that was first shared by Michael Batnick on the Animal Spirits podcast last week. Side note, this is hands down one of my favorite podcasts and if you aren’t listening, then you should be. This chart showed that nearly 90% of all household debt was locked in heading into ’22, implying the huge jump in yields didn’t impact consumers as much.

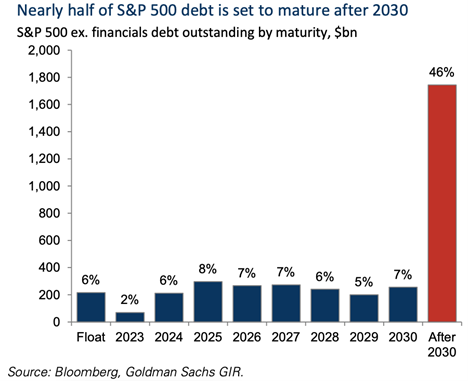

Let’s now look at corporate America. It might have been dumb luck, but many large companies locked in debt at historically low rates back in ’21 and early ’22. So, the jump we’ve seen in yields did little to impact their overall businesses. This chart below was shared by Sam Ro, Founder of TKer, a while back and it showed that nearly half of all debt (ex financials) in the S&P 500 is locked in till after 2030. Wow. Maybe this is why the largest tech and communications names did so well this year?

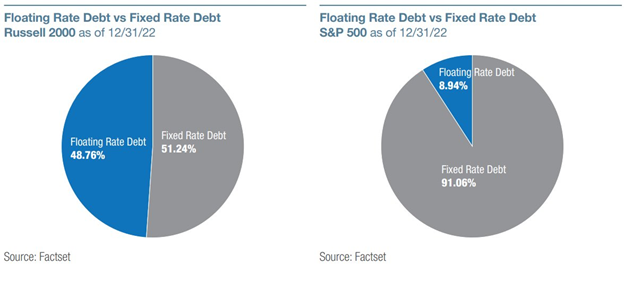

Lastly, Blake Millard, Director of Investments, Sandbox Financial Partners, shared this chart recently and it showed how larger companies wouldn’t nearly be as impacted by higher rates, as 91% of debt for S&P 500 companies was a fixed rate at the end of last year. The flipside to this is smaller companies (using the Russell 2000) had only 51% of their debt at a fixed rate. Given small caps struggled mightily this year, it isn’t a surprise, as higher rates hampered them greatly. The good news though is we think the Fed is likely done hiking and this should mean yields could begin to trend lower, potentially a huge tailwind for small and midcaps stocks as the economy continues to grow.

For more on why the consumer has been so strong, you have to listen (or watch below) our latest Facts vs Feelings podcast. Sonu and I were honored to be joined by Claudia Sahm, a former Federal Reserve economist and a leading expert on macroeconomic policy. She brought her A game for this one and you will love her unique takes on the economy and policy.

For more of Ryan’s thoughts click here.

01999630-1123-A