“If Santa should fail to call, bears may come to Broad and Wall.”

—Yale Hirsh

That Escalated Quickly; Putting Things In Perspective

My oh my, this week escalated quickly to quote the great philosopher Ron Burgundy (Anchorman). The S&P 500 sold off nearly 3% on Wednesday and we saw 97% of all stocks in the S&P 1500 fall as well. That is what we call a selling cascade and it has left many bulls bruised and battered. Be sure to read what Sonu Varghese, VP Global Macro Strategist, had to say about the Fed cut and market reaction in The Fed Pulls a Grinch.

Yes, worries spiked this week over fears about sticky inflation (which we don’t see) and fewer rate cuts next year (which wasn’t really surprise to us – just two weeks ago Sonu wrote about expecting just 2-3 cuts in 2025). But let’s take a step back and put things in context. The S&P 500 is only 3.6% away from the recent highs and it still up 23% for the year, something that most investors would have gladly taken this time a year ago.

Then what else did the Fed say on Wednesday? They upped their views of economic growth and said things looked pretty good on the economic front. That isn’t the worst news. In fact, third quarter GDP came in at a very strong 3.1% and it has now gained more than 3% four of the past five quarters. Additionally, initial jobless claims fell 22,000 to 220,000 and are at the low end of the range the second half of this year. Lastly, forward-looking profit margins and earnings for the S&P 500 are both at all-time highs, suggesting the backdrop for this bull market remains quite strong and healthy.

Let’s Talk About 🎅

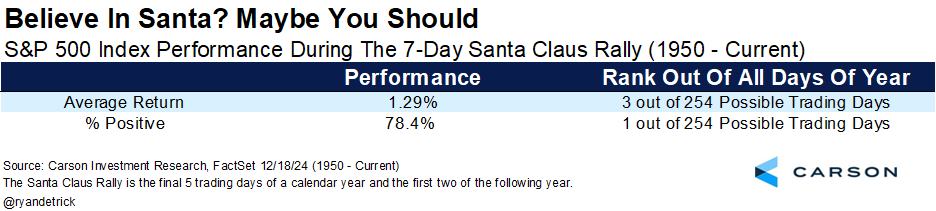

One of the little-known facts about the Santa Claus Rally (SCR) is that it isn’t the entire month of December; it’s actually only seven trading days. Discovered in 1972 by Yale Hirsch, creator of the Stock Trader’s Almanac (carried on now by his son Jeff Hirsch), the real SCR is the final five trading days of the year and first two trading days of the following year. In other words, the official SCR is set to begin next week on Tuesday, December 24, 2024.

Historically, it turns out these seven days indeed have been quite jolly, as no seven-day combo is more likely to be higher (up 78.4% of the time), and only two combos have a better average return for the S&P 500 than the 1.29% average return during the official Santa Claus Rally period.

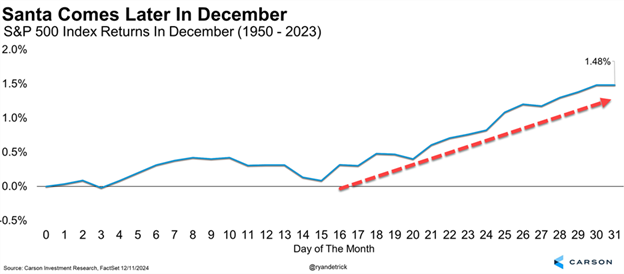

Here’s a chart we shared last week, showing that the latter half of December is when most of the seasonally strong gains occur.

These seven days tend to be in the green, so that is expected. Take note, Santa didn’t come last year and clearly stocks did just fine in 2024, but be aware these seven days had been higher the previous seven years before 2023. Here are all the returns since the tech bubble imploded 25 years ago.

The bottom line that really matters to investors is when Santa doesn’t come, as Mr. Hirsch noted in the quote at the start of this blog.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Although things worked out this year, other recent times investors were given coal after these seven days when Santa didn’t come. Not including this year, the previous five times (going back 25 years) that the SCR was negative saw January down as well. Notably, there was no SCR in 2000 and 2008, not the best times for investors, and potentially some major warnings that something wasn’t right. Lastly, the full year was negative in 1994 and 2015 after no Santa. We like to say in the Carson Investment Research team that hope isn’t a strategy, but I’m hoping for some green during the SCR!

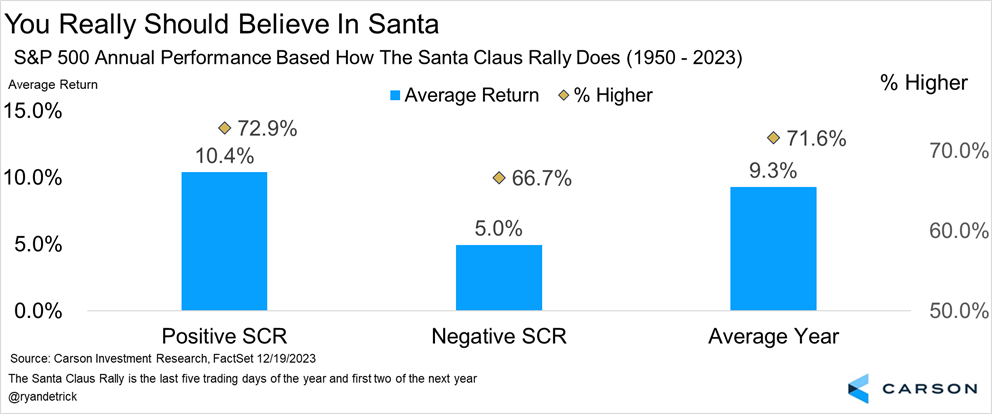

Finally, the average gain each year for the S&P 500 is 9.3% and the index is higher 71.6% of the time. But when there is an SCR, those numbers jump to 10.4% and 72.9%, falling to only 5.0% and 66.7% when there is no Santa (but note these numbers may improve once this year is in the books). Sure, this is only one indicator, and we suggest following many more indicators to base your investment decisions, but this is clearly something we wouldn’t ignore either.

With stocks extremely oversold going into this historically strong time of year, we’d expect to see a bounce to close out a solid year for investors in 2024. For more of our thoughts on why inflation isn’t sticky, China’s issues, the recent volatility, and a still strong and healthy US consumer, please watch our latest Facts vs Feelings podcast as we break it all down.

For more content by Ryan Detrick, Chief Market Strategist click here.

02562048-1224-A